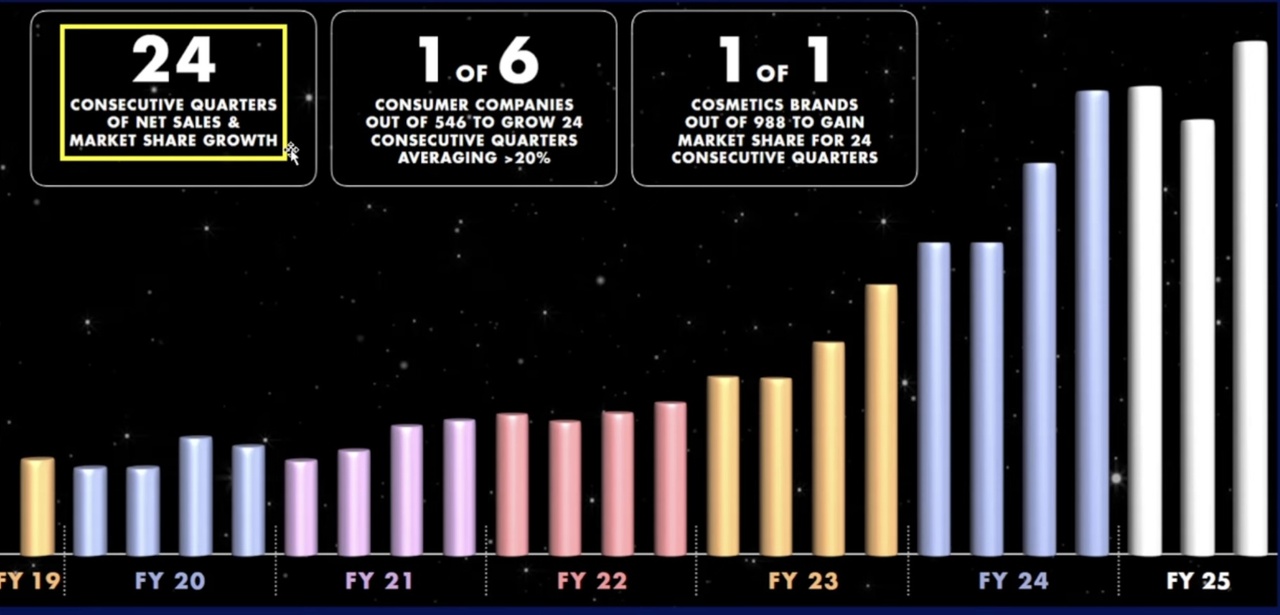

🔹 Revenue: $2.79B (Est. $2.66B) 🟢; UP +9.3% YoY

🔹 EPS: $5.78 (Est. $4.99) 🟢; UP +9.1% YoY

🔹 Comparable Sales: +6.7%

FY25 Guide (Raised):

🔹 Revenue: $12.0-$12.1B (Est. $11.72B) 🟢

🔹 EPS: $23.85-$24.30 (Est. $23.73) 🟢

🔹 Comparable Sales: +2.5% to +3.5% (Prev. 0% to +1.5%)🟢

🔹 Operating Margin: 11.9%-12.0%; Prev. 11.7%-11.8%

🔹 New Stores: ~63; Prev. ~60

Other Q2 Metrics:

🔹 Gross Profit Margin: 39.2%; UP +0.9 ppt YoY

🔹 Operating Income: $344.9M; Operating Margin 12.4%

🔹 Net Income: $260.9M; UP +3.3% YoY

Q2 Performance Drivers:

🔹 Transaction Growth: +3.7% YoY

🔹 Average Ticket: +2.9% YoY

🔹 Store Count: 1,473 Ulta Beauty stores (excluding 83 Space NK stores)

🔹 New Store Openings: 24 stores in Q2; 30 stores YTD

First Half FY25 Performance:

🔹 Revenue: $5.64B; UP +6.8% YoY

🔹 EPS: $12.49; UP +6.0% YoY

🔹 Comparable Sales: +4.7% YoY

🔹 Operating Margin: 13.2%

Other Key Metrics:

🔹 Cash and Cash Equivalents: $242.7M

🔹 Merchandise Inventories: $2.4B; UP +20.5% YoY

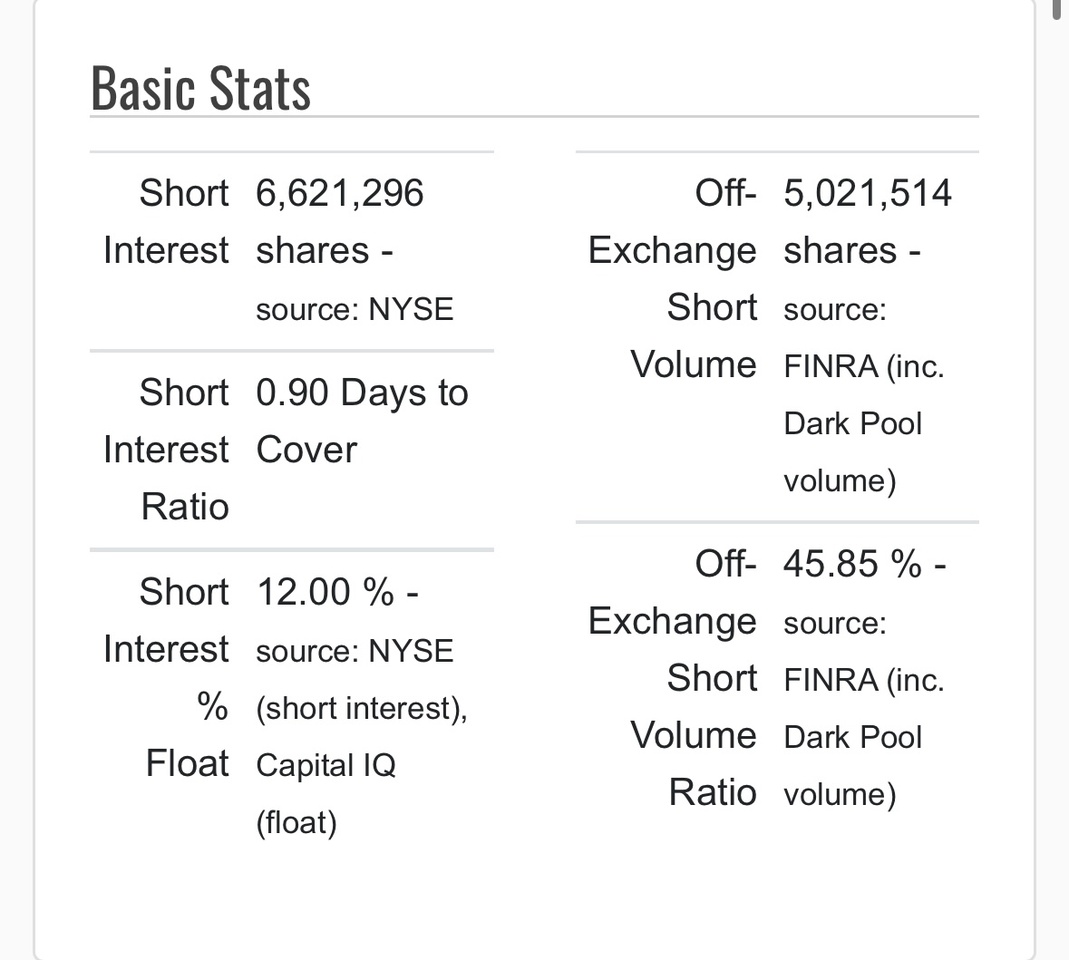

🔹 Share Repurchases Q2: $109.5M (244,559 shares)

🔹 Share Repurchases YTD: $468.3M (1.2M shares)

🔹 Share Repurchase Authorization Remaining: $2.2B

Operational Updates:

🔹 SG&A Expenses: $741.7M; UP +15.0% YoY

🔹 Tax Rate: 24.5%

🔹 Gross Profit: $1.1B; UP +11.6% YoY

🔹 Space NK Integration: Acquired July 10, 2025

CEO Kecia Steelman's Commentary:

🔸 "The Ulta Beauty team delivered strong results in the second quarter, including 6.7% comparable sales growth. Outstanding top line performance, fueled by growth across all major categories, drove market share growth and better-than-expected profitability."

🔸 "As we look to the future, we remain committed to executing our Ulta Beauty Unleashed strategy and strengthening our operating model."

🔸 "Our outlook for the remainder of the year reflects both the strength of our year-to-date performance and our caution around how consumer demand may evolve in the second half of the year."

🔸 "While near-term uncertainty persists, we're staying focused on what we can control and on executing with excellence to deliver our uniquely Ulta Beauty experience."