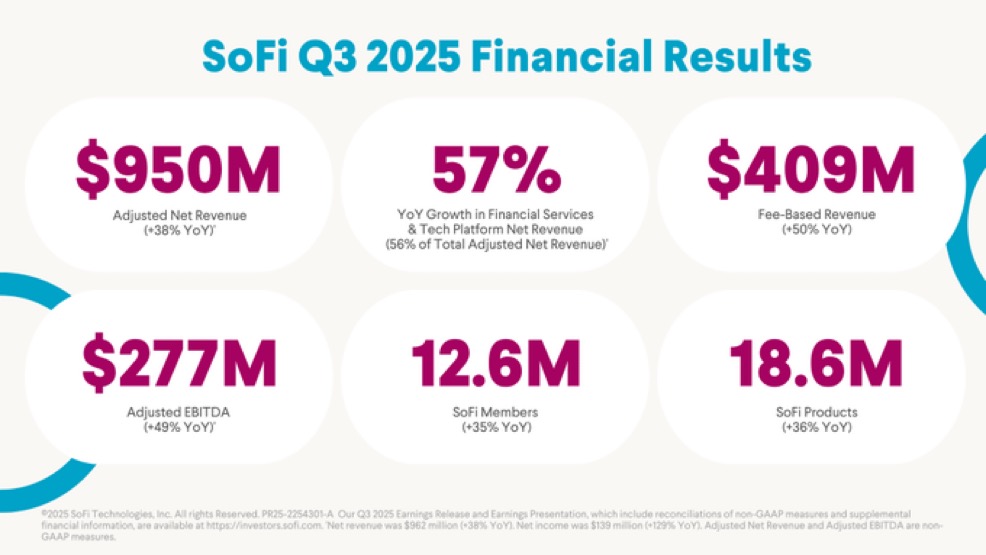

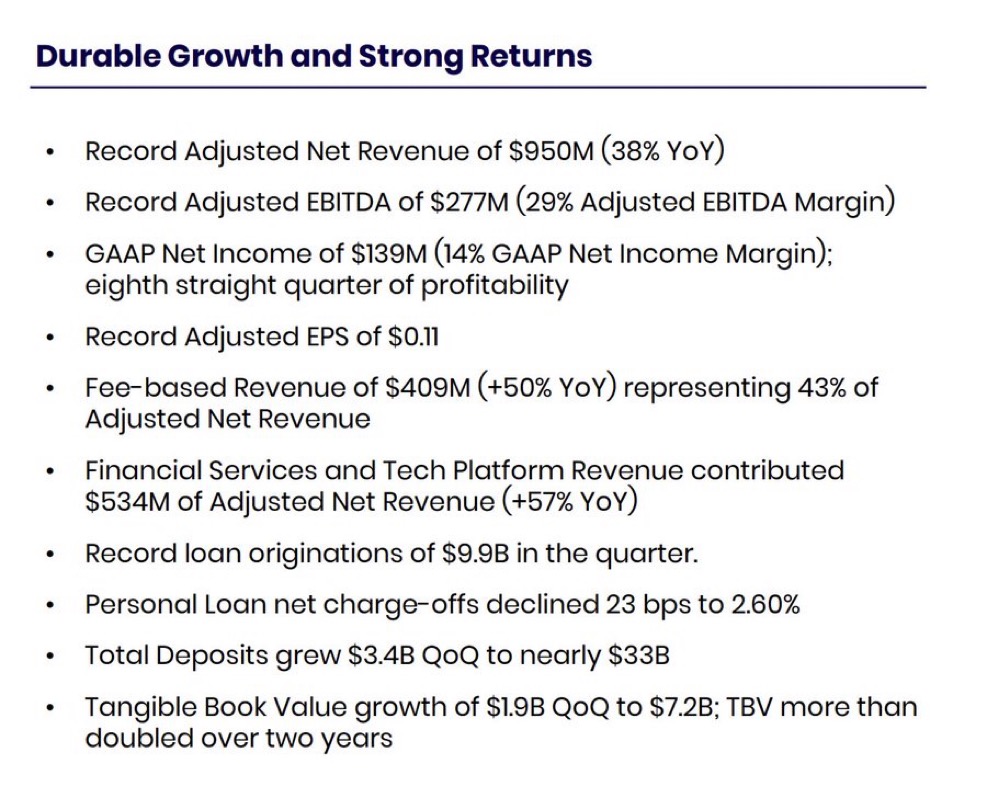

$SOFI (-3,65 %) reported an outstanding third quarter (Q3) in 2025, surpassing Wall Street expectations and demonstrating strong growth across multiple dimensions. The company achieved record adjusted net revenues of approximately $961.6 million, marking a year-over-year increase of 38%. This figure exceeded analyst estimates of around $904 million, representing a significant beat and consistent with SoFi’s trajectory of rapid expansion in the digital financial services sector.

The fintech firm continued to build on its profitable streak, announcing its eighth consecutive quarter of GAAP profitability. The GAAP net income for Q3 reached $139.4 million, with a diluted earnings per share (EPS) of $0.11, surpassing analysts’ expectations of $0.08 per share by a notable margin. This profitability reflects the company’s effective cost management and operational scalability as it expands its product offerings and member base.

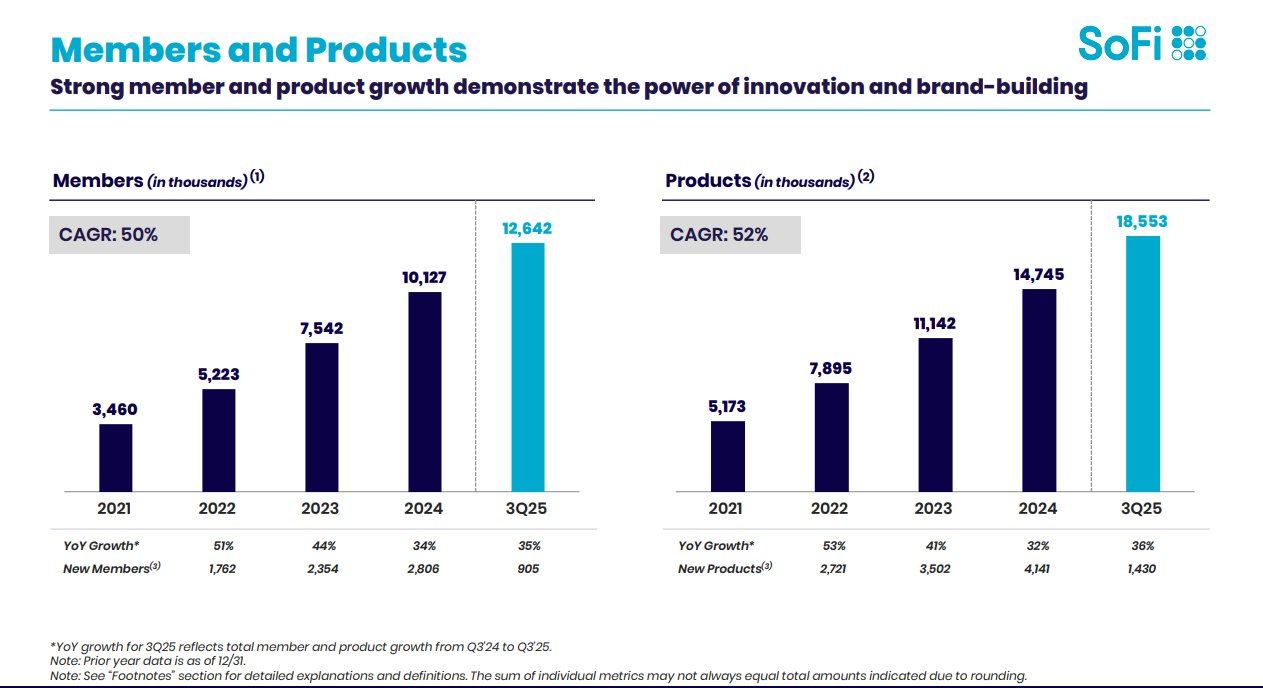

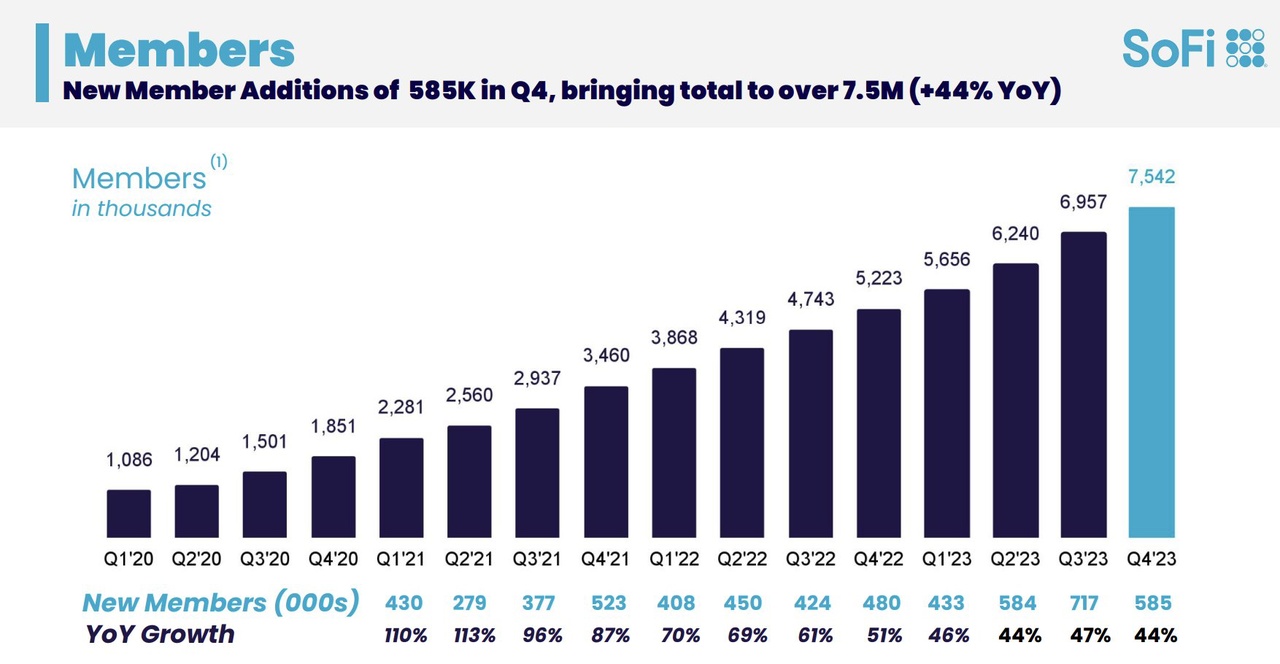

SoFi’s member growth remains exceptional, with a record addition of 905,000 new members in Q3 2025. This brings total membership to approximately 12.6 million, a 35% increase compared to the previous year. Alongside member growth, the company reported the addition of 1.4 million new products during the quarter, expanding its total products to 18.6 million—an impressive 36% increase year-over-year. This diversified product suite includes loans, investment options, banking services, and credit cards, offering members a comprehensive digital financial experience through SoFi’s one-stop shop platform.

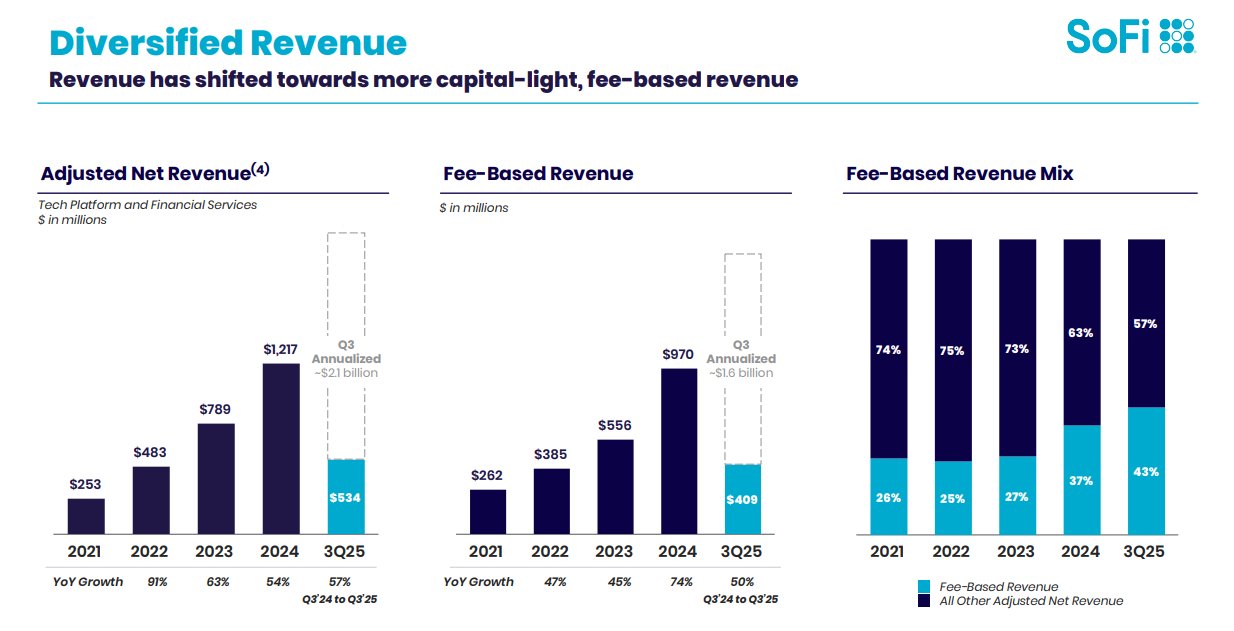

Loan originations hit new records, totaling $9.9 billion in the quarter, representing a 57% increase year-over-year. Personal loan originations led this growth with $7.5 billion, followed by student loan originations rising 58% to $1.5 billion, and home lending setting a new record with nearly $945 million originated. Fee-based revenue surged by 50% to an all-time high of $408.7 million, largely driven by the Loan Platform Business, which contributed significantly to both top-line growth and profitability.

SoFi’s robust net interest income, totaling $585.1 million for Q3 (a 36% increase year-over-year), was fueled by a 29% rise in average interest-earning assets and a 76 basis point reduction in cost of funds. The company also recorded a net interest margin of 5.84%, improving by 27 basis points from the previous year. This strong interest margin reflects the company’s efficient funding strategy, including a growing deposit base approaching $33 billion, which has helped reduce funding costs substantially.

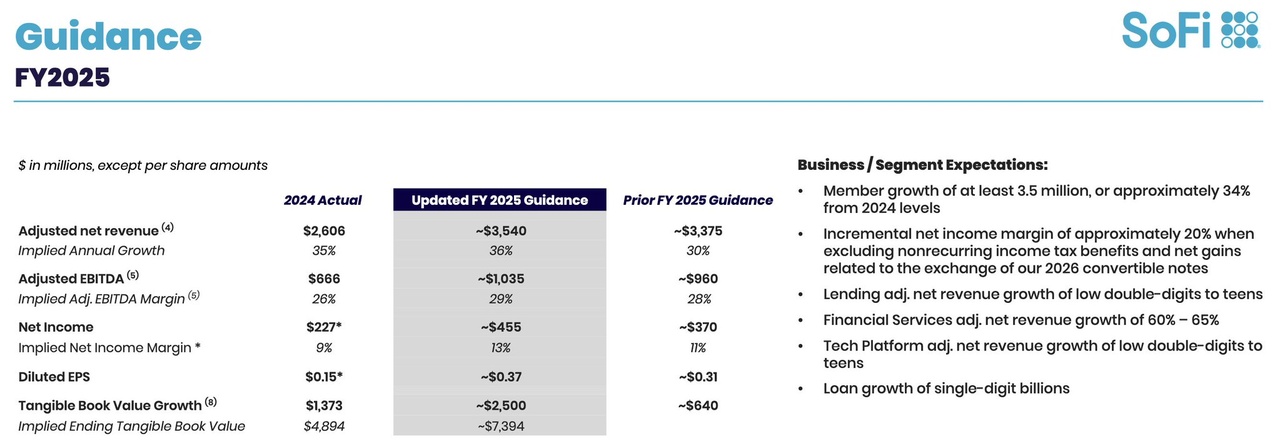

In line with its strong Q3 performance, SoFi raised its full-year 2025 guidance. The company now anticipates adjusted net revenues of about $3.54 billion, up from the prior estimate of $3.375 billion. Adjusted EBITDA guidance also increased to $1.035 billion, with an improved margin of 29%, up from a previous margin forecast of 28%. Additionally, the company expects adjusted EPS of $0.37 for the full year, beating the earlier forecast of $0.31. Tangible book value is expected to rise significantly as well, underscoring the company’s growing equity strength.

SoFi’s strategy of combining technology-driven innovation with a full-service financial platform continues to pay dividends. The company has launched new products incorporating artificial intelligence and cryptocurrency, such as SoFi Pay (a crypto-powered global remittance solution) and AI-driven financial coaching tools. These innovations not only enhance member engagement but also position SoFi at the forefront of fintech disruption, addressing evolving customer needs.

Overall, SoFi’s Q3 2025 results reflect a company that is not only scaling rapidly but doing so profitably, with a diversified revenue model and a strong balance sheet. Its ability to attract and retain members through a broad product ecosystem supports durable growth and robust financial returns. The raised guidance for 2025 indicates confidence in continued momentum, reinforcing SoFi’s status as a leading player in the fintech space.

In summary, the key highlights for SoFi Q3 2025 and outlook include:

- Record adjusted net revenue of ~$961.6 million (+38% YoY).

- GAAP net income of $139.4 million, EPS of $0.11.

- Record member additions of 905,000, totaling 12.6 million members.

- Record loan originations of $9.9 billion (+57% YoY).

- Fee-based revenue growth of 50% to $408.7 million.

- Increased full-year guidance: adjusted net revenue $3.54 billion, adjusted EPS $0.37, adjusted EBITDA margin 29%.

- Continued product diversification and technological innovation.

- Robust capital base with growing tangible book value and strong liquidity.

These results and initiatives underscore SoFi’s healthy financial position and growth prospects, making it a strong candidate for investors seeking exposure to innovative digital financial services

https://s27.q4cdn.com/749715820/files/doc_financials/2025/q3/3Q25-SoFi-Earnings-Presentation.pdf