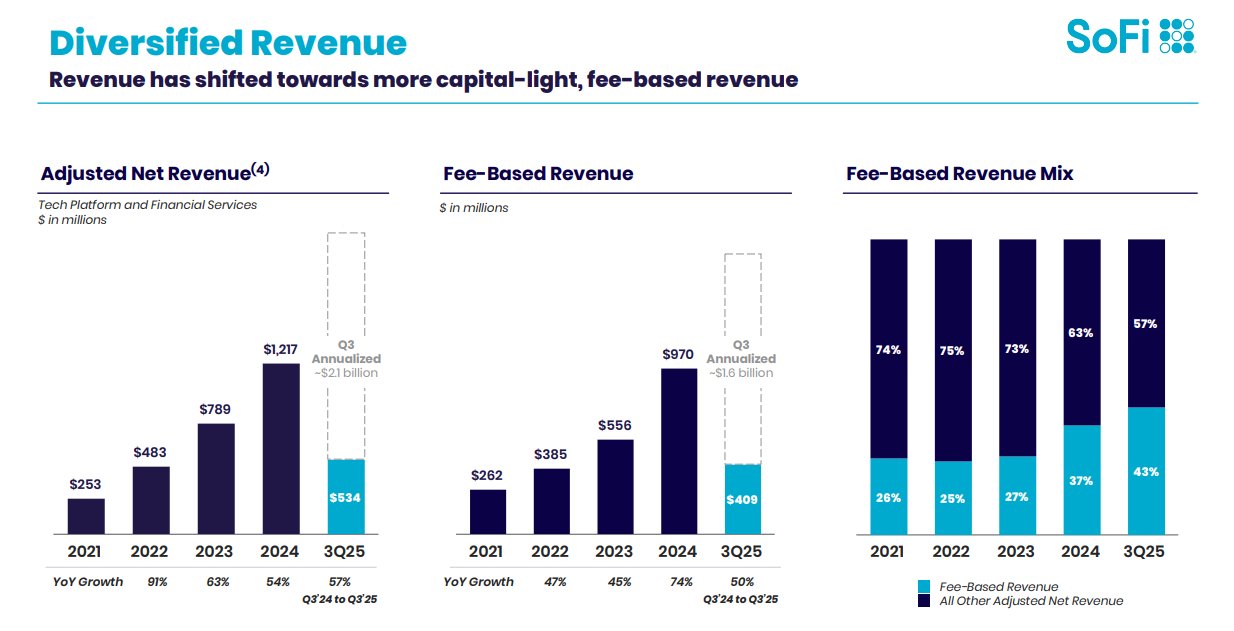

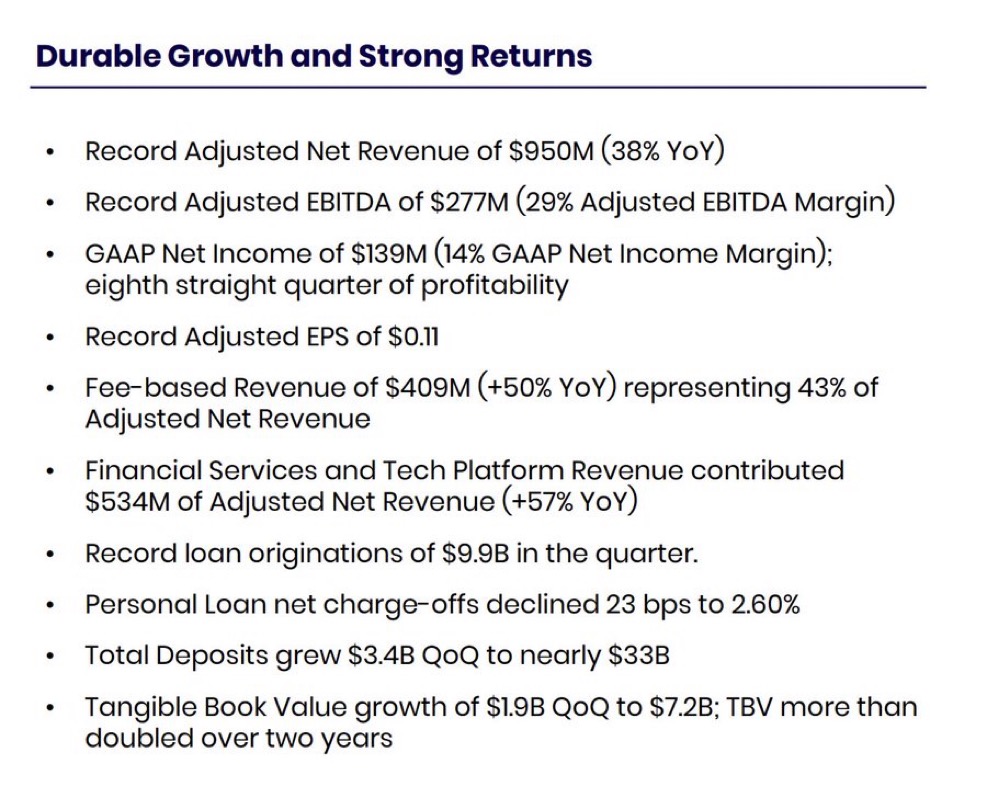

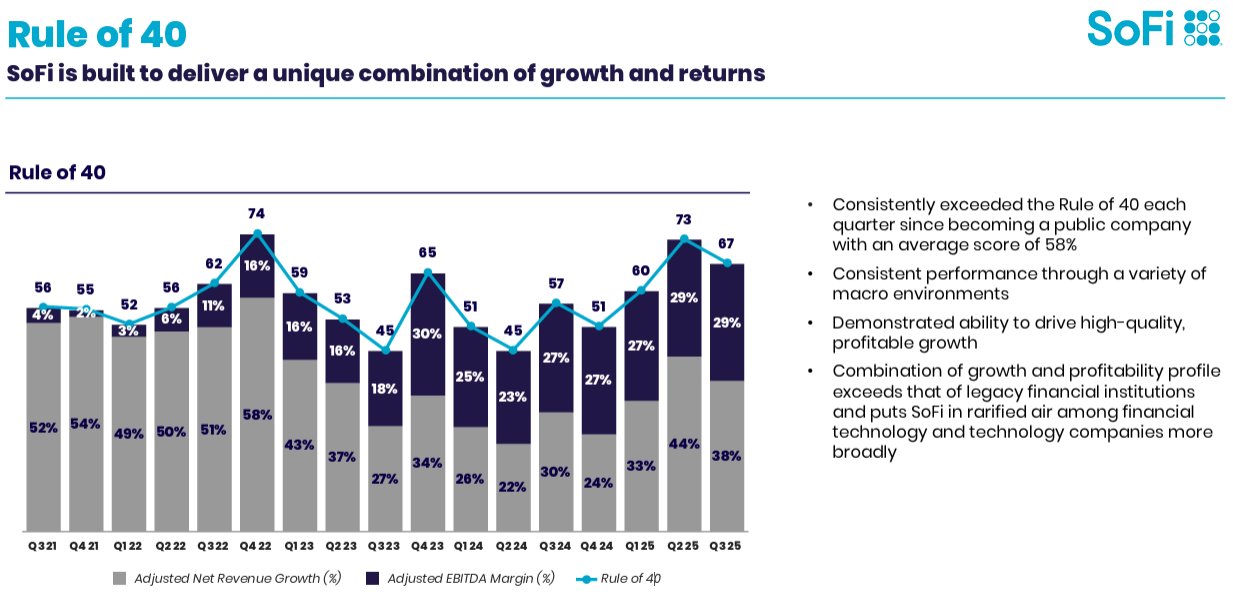

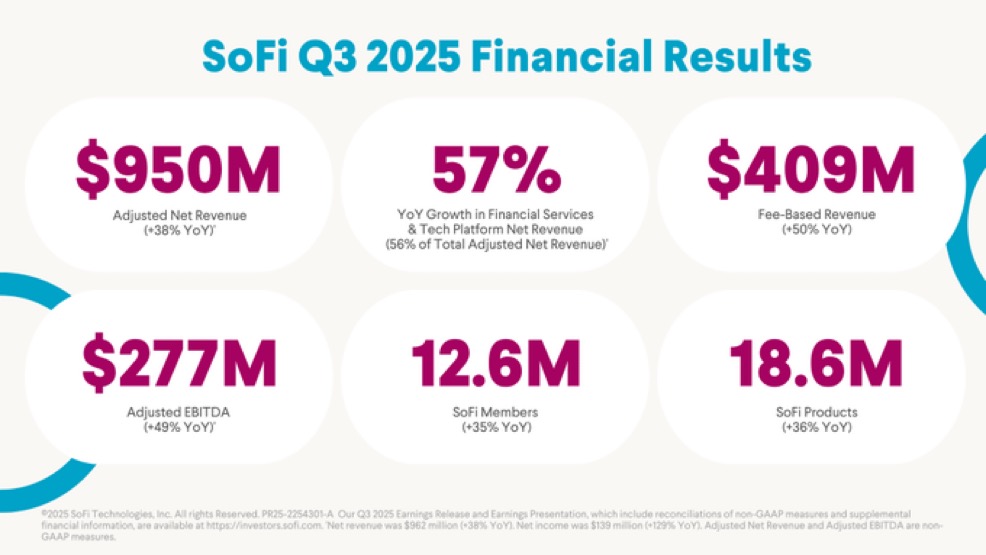

- Revenue: $961.6M (Est. $887.24M) ✅; UP +38% YoY

- Adj EPS: $0.11 (Est. $0.08) ✅; UP +120% YoY

- Fee-Based Revenue: $408.7M; UP +50% YoY

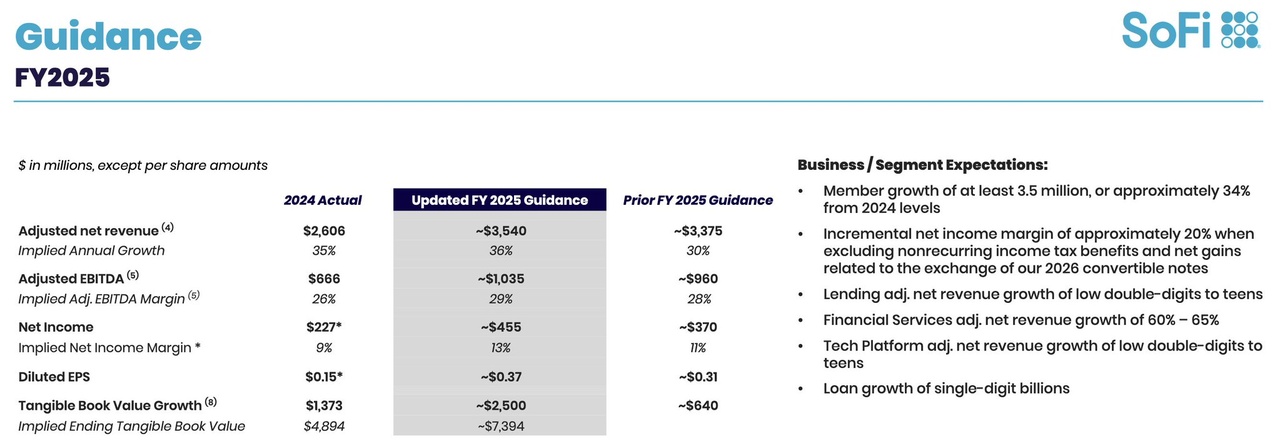

FY25 Guidance (Raised):

- Adj EPS: ~$0.37 (Est. $0.32) ✅

- Net Revenue: ~$3.54B (Est. $3.458B) ✅; UP ~+36% YoY

- Adj EBITDA: ~$1.04B (~29% margin)

- Net Income: ~$455M (~13% margin)

- New Members: ≥ 3.5M; UP +34% YoY

- Tangible Book Value: ~$7.39B (↑ ~$2.5B vs 2024)

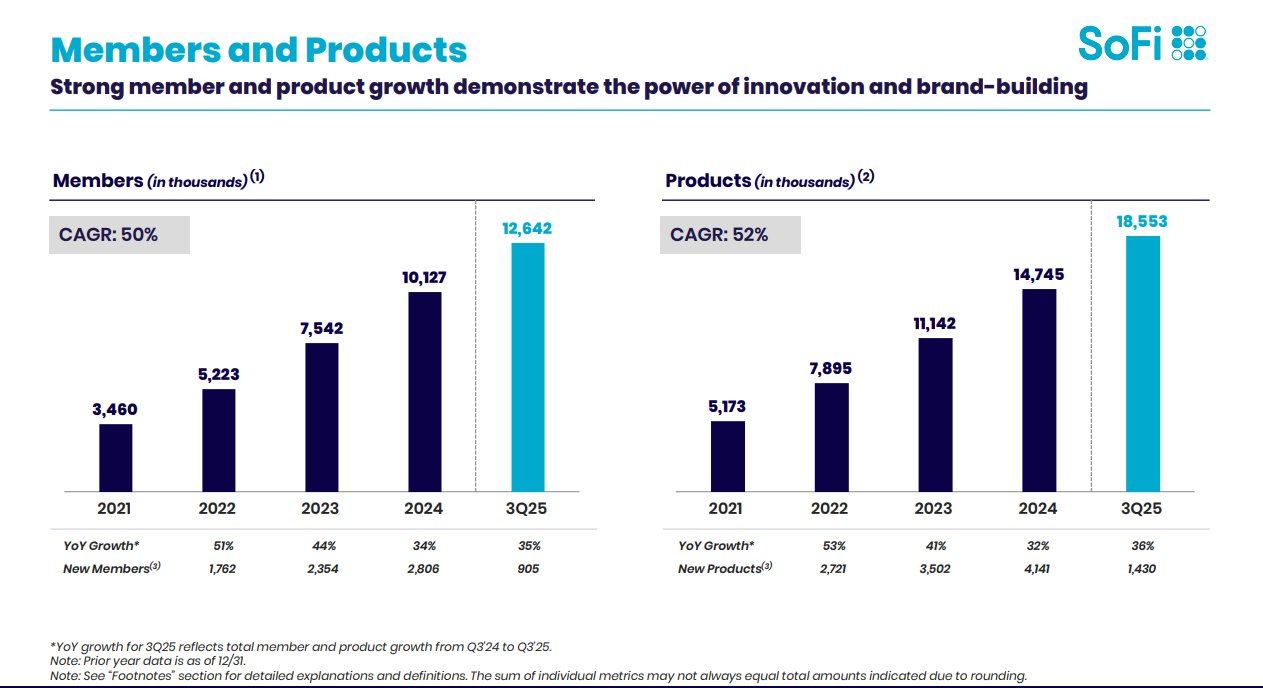

Q3 Members & Products:

- Members: 12.6M; UP +35% YoY (record +905k in Q3)

- Total Products: 18.6M; UP +36% YoY

- Financial Services Products: 16.1M; UP +37% YoY

- Lending Products: 2.46M; UP +30% YoY

Segment:

- Loan Originations: $9.9B; UP +57% YoY (Personal $7.5B; Student $1.5B; Home $945M)

- Loan Platform Business (third-party): $3.4B originations; $167.9M revenue

- Technology Platform Revenue: $114.6M; UP +12% YoY

Other Metrics

- Adj EBITDA: $276.9M; UP +49% YoY (29% margin)

- GAAP Net Income: $139.4M; UP +129% YoY

- Net Interest Income: $585.1M; UP +36% YoY

- Deposits: $32.9B (avg. deposit rate ~190 bps below warehouse facilities)

Kommentar des CEO:

⭐️ „Rekordumsatz, Rekordzuwachs bei Mitgliedern und Produkten – unsere One-Stop-Shop-Strategie sorgt weiterhin für nachhaltiges Wachstum und eine starke Kreditperformance.“