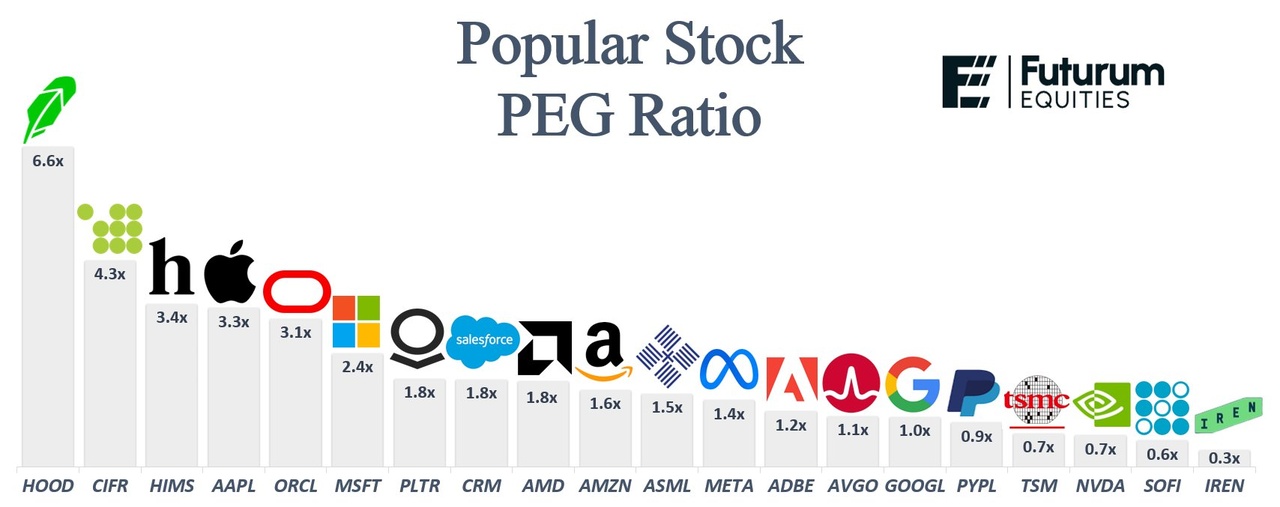

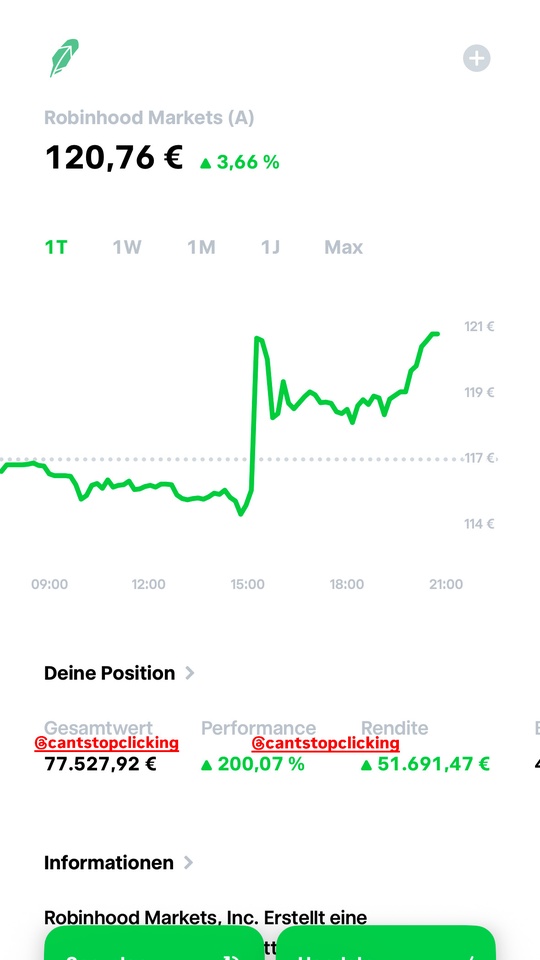

$HOOD (-3,53 %)

I see potential here, but would wait for a correction.

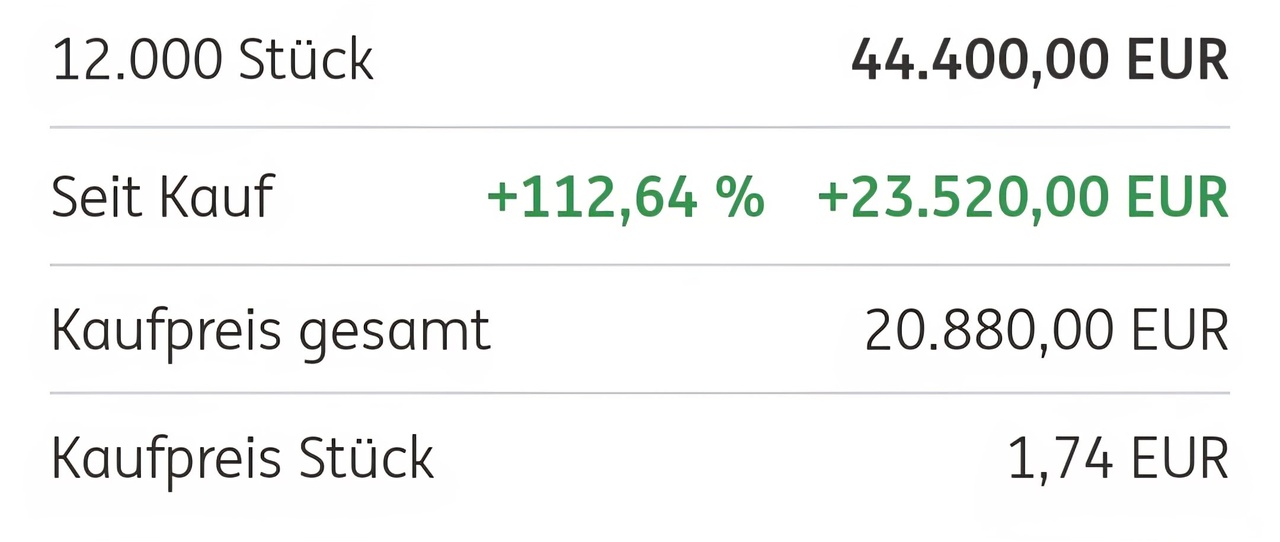

On the subject of event betting, I am invested in $LTMC (-0,43 %) invested.

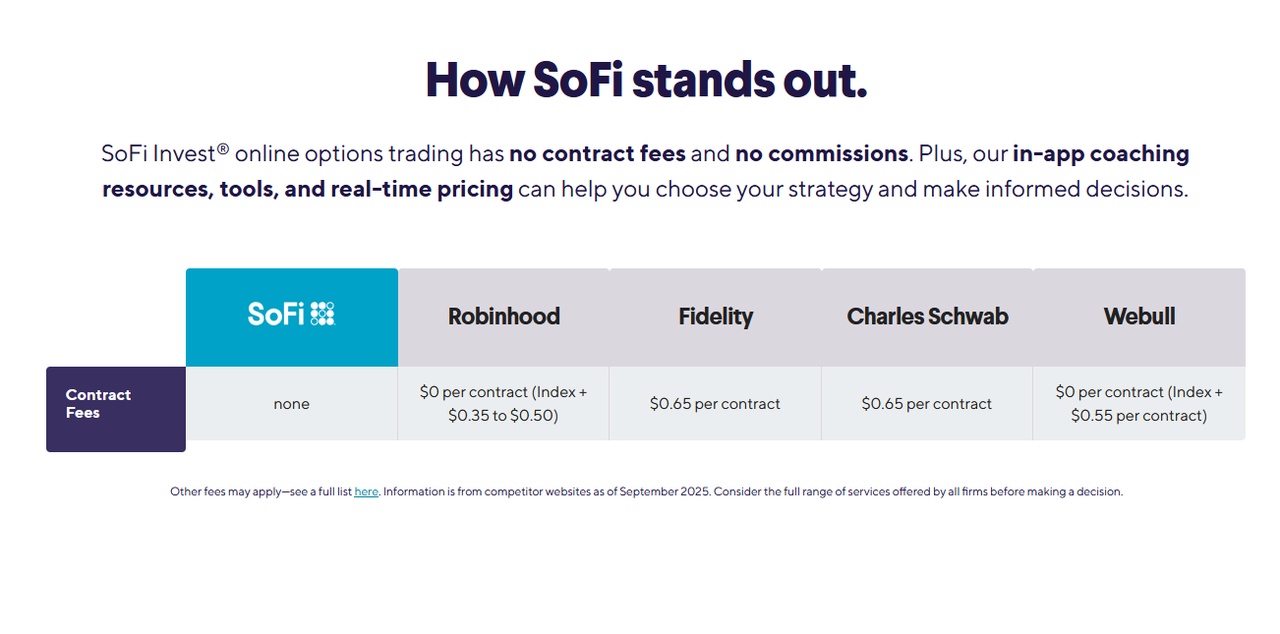

On the subject of brokers with a super app, I am in

$COIN (-1,77 %) and $SOFI (+0,08 %)

Robinhood's share price jumped by around 12% to a new all-time high yesterday. This was triggered by news of rapid growth in the event betting business - a segment that is developing into a key growth driver in record time.

Volume in the billions surprises investors

Robinhood announced that over 2 billion event betting contracts were concluded in the 3rd quarter alone. Since its launch, the trading volume now totals more than 4 billion contracts. This dimension has made many investors sit up and take notice: Betting is no longer an exotic niche product, but is developing into a market suitable for the masses.

Fantasy beyond shares and crypto

For investors, this means that Robinhood is creating a second strong pillar alongside traditional trading. While trading volumes in shares and cryptocurrencies can fluctuate greatly, the boom in event betting is opening up additional, steady sources of income. This gives the business model more stability and awakens the prospect of further growth.

Additional tailwind

Other news is also boosting momentum: premium customers are to be able to use banking services such as wealth planning and tax advice in future, which means Robinhood is clearly heading in the direction of a financial super app. In addition, the inclusion in the S&P 500 is generating capital inflows from index funds.

Outlook: From broker to all-in-one app

With the boom in the new segment and the expansion into banking, Robinhood is sharpening its profile as an all-in-one app for finance and betting. Investors are rewarding the new growth story - and believe the company is well on the way to permanently moving away from its past as a pure neo-broker.

- Updated on 30.09.25 08:35 D. Bußmann

https://aktienmagazin.de/nachrichten/hot-news/robinhood-kursrally-dank-milliarden-boom-bei-ereigniswetten-155203.html