$HOOD (-3,16 %) IS NOW AT $126 billion MARKET CAPITALIZATION

Exactly one year ago $HOOD still at a paltry 24$.

At the beginning of this year $HOOD at just under 40$.

Today it stands $HOOD at an incredible 142 $ per share. So we have a performance of 240% YTD!!!

👉🏻 At the end of the day, a lot depends on your own conviction in a company and the understanding of the business model.

🚨 If you enter somewhere "blindly" without really understanding what the company does and how it earns money, then there is a great danger, soft knees in difficult phases to get soft and to sell too early at the slightest correction.

🤝 One example: Robinhood. The business model is relatively simpleit's really quite simply put a "custodian broker" that almost all of us understand and use on a daily basis (TradeRepublic, Scalable, Interactive Brokers $ co,). As a result, you automatically develop more loyalty and trust in what the company does.

👉🏻 The idea behind it: The better you understand the business model, the more connected you are to your investment. This helps enormously to withstand price fluctuations (whether up or down) because you don't just see the chart,

but also the company behind it.

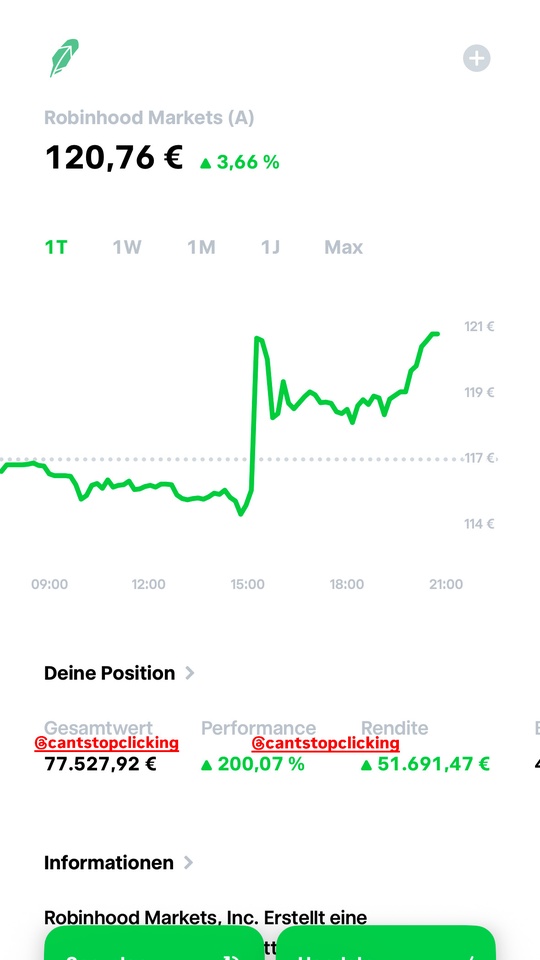

📈Today my purchase of the Robinhood share at the beginning of the customs dispute in April of this year 200% return.

Let the stocks be with us. I wish you a good return as well. Which trades have gone well for you recently? I look forward to the exchange! #aktien

#börse

#investieren

#finanzen

#aktientipps

#depot

#broker