$IREN (+2,35 %)

$SOFI (+3,29 %)

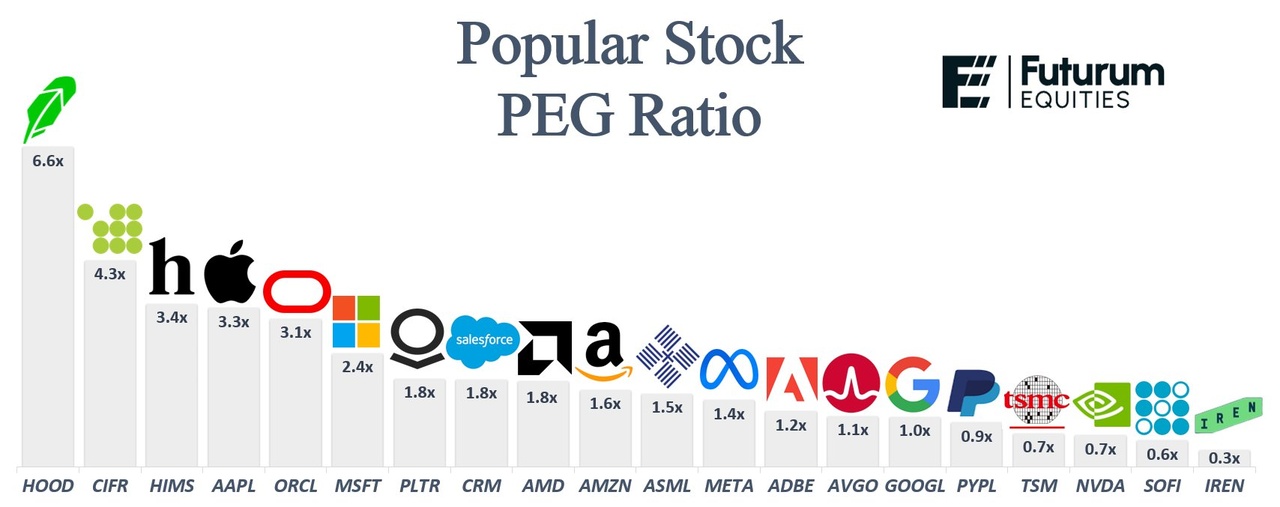

First of all, I have not checked these values exactly and do not know from which date they originate, but could mean even more upside for $IREN (+2,35 %) especially if more hype comes in here.

PEG < 1 usually means mispriced growth

PEG > 2 is where you start hitting the danger zone

PEG ratios right now:

- $HOOD (+5,39 %) ~6.6x

- $CIFR (-0,56 %) ~4.3x

- $HIMS (+0,11 %) ~3.4x

- $AAPL (+1,07 %) ~3.3x

- $ORCL (-0,96 %) ~3.1x

- $MSFT (+1,51 %) ~2.4x

- $PLTR (+3,07 %) ~1.8x

- $CRM (+0,29 %) ~1.8x

- $AMD (+0,95 %) ~1.8x

- $AMZN (+1,44 %) ~1.6x

-$ASML (+1,47 %) ~1.5x

- $META (+1,46 %) ~1.4x

- $ADBE (+0,54 %) ~1.2x

- $AVGO (+1,42 %) ~1.1x

- $GOOGL (+3,45 %) ~1.0x

- $PYPL (+2,07 %) ~0.9x

- $TSM (+0,59 %) ~0.7x

- $NVDA (+1,81 %) ~0.7x

- $SOFI (+3,29 %) ~0.6x

- $IREN (+2,35 %) ~0.3x

https://x.com/stocksavvyshay/status/1974838017815957797?s=46&t=5M46IuHFFx0VtfxNNuG8NA