🇺🇸 USA

$SPX500 — Opening in a slight decline, pulling back from all-time highs due to profit-taking.

$DJ30 — Generalized weakness, with cyclical and financial sectors weighing on the index.

💻 Tech Snapshot

$NVDA (-6,14 %) — Remains in positive territory, driven by the AI narrative.

$AVGO (-7,17 %) — In a slight downturn, the semiconductor sector is mixed.

$AMZN (-5,92 %) — Stable, as investors await clearer signals on cloud growth.

$META (-5,02 %) — Net increase, supported by positive sentiment regarding advertising spending. $MSFT (-3,3 %) — In moderate decline, affected by the general market weakness.

$SHOP (-9,54 %) — Falling, giving up some of the recent gains.

$QBTS (-7,49 %) — Registers a major spike, benefiting from renewed focus on quantum computing.

🇪🇺 Europe

STOXX 600 — Registers a sharp setback, weighed down by luxury car and banking stocks.

GER40 futures — Moves in slight contraction, awaiting economic data from Germany.

🏦 European & Italian Banks

$UCG (-2,56 %) — Decisive drop, in line with the strong pressure on the sector.

$ISP (-1,98 %) — Moves into the negative, limited by yield volatility.

$BAMI (-2,13 %)

$CE (-0,74 %) , $BPE (-3,13 %) — Weak tone for Italian mid-cap banks.

$BBVA (-2,87 %) — Under pressure, due to its international exposures.

🌏 Asia

$JPN225 — Slight upward push, with the Yen remaining stable.

$KOSPI — Progressing, thanks to the strength of the technology sector.

$HK50 — Sharp decline, due to sales in Chinese tech stocks.

$BABA (-8,67 %) — Under strong pressure, reflecting ongoing regulatory uncertainty and growth concerns.

$CHINA50 — Stable, balanced between government support and weak data.

💱 Forex

$EURUSD — Moves in slight contraction, with the Dollar recovering.

$GBPUSD — Flat, awaiting the BoE's next move.

$USDJPY — Stable, as investors assess the yield differential.

$DXY — Recovering, showing a cautious return to strength.

🥇 Gold

$GLD (+0,53 %) — In solid increase, gold continues to attract safe-haven investment flows, maintaining high levels.

🛢 Oil

$BRENT — Falling, due to signs of slowing global demand.

$WTI — Losing ground, affected by recent increases in US inventories.

💰 Crypto

$BTC (-1,15 %) — Slight pullback, in a phase of technical consolidation.

$ETH (-1,86 %) — Following Bitcoin, showing a cautious tone. The sector remains awaiting new catalysts.

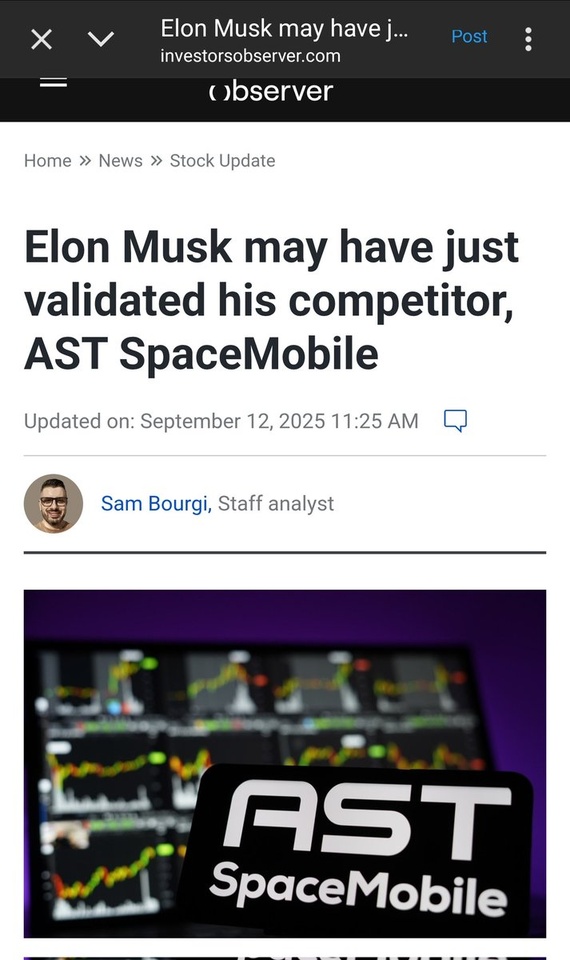

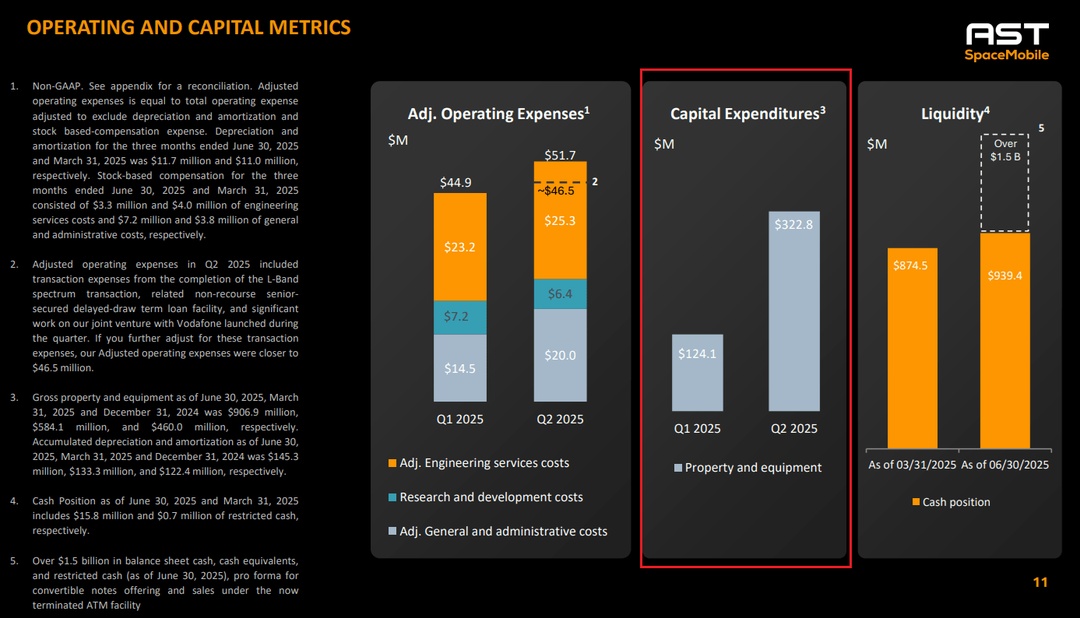

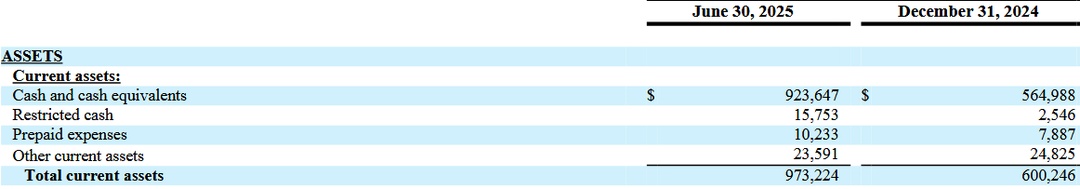

🚀 Insight: $ASTS (-6,02 %) (AST SpaceMobile) - The Analysis

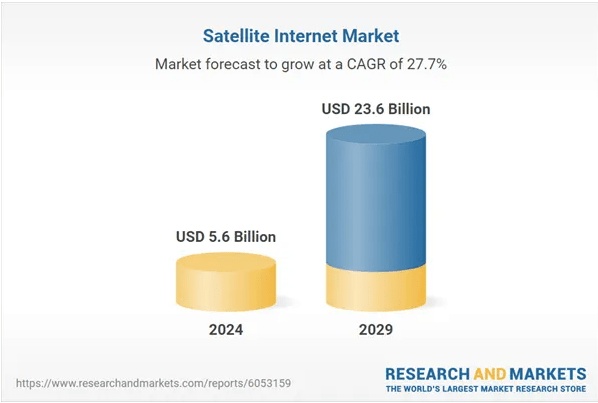

$ASTS is an innovative satellite telecommunications company with an ambitious mission: to create the first global cellular broadband network in space, capable of connecting directly with standard mobile phones.

Why is it interesting?

Disruptive Technology: The company aims to eliminate global "shadow zones" without requiring additional user hardware. The implementation of the BlueBird network represents a potential game changer for the wireless industry.

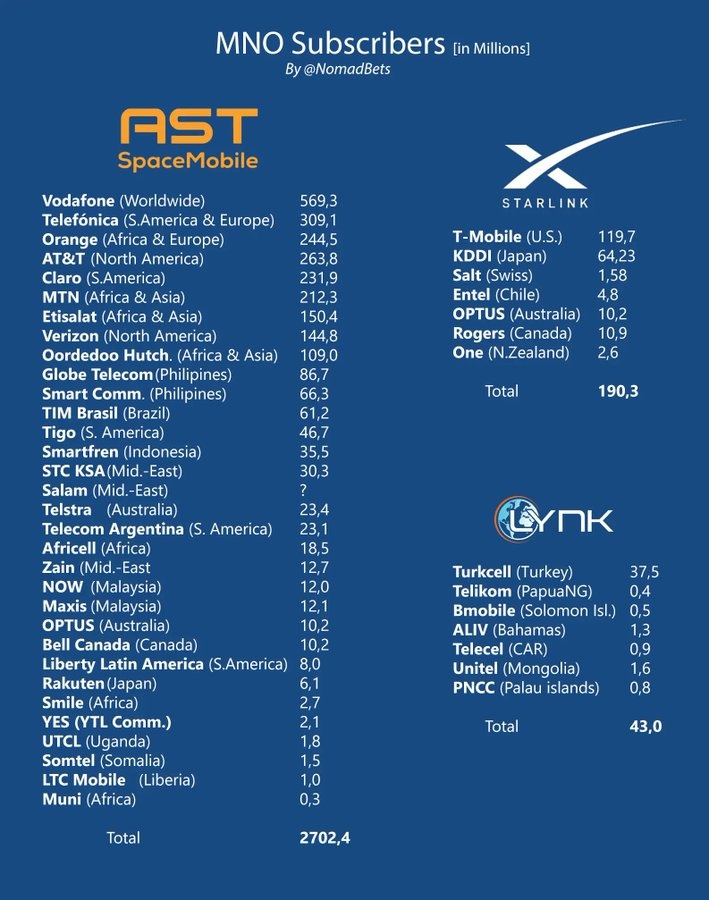

Strategic Partnerships: Agreements with top-tier operators, such as Vodafone and Rakuten, validate its market potential.

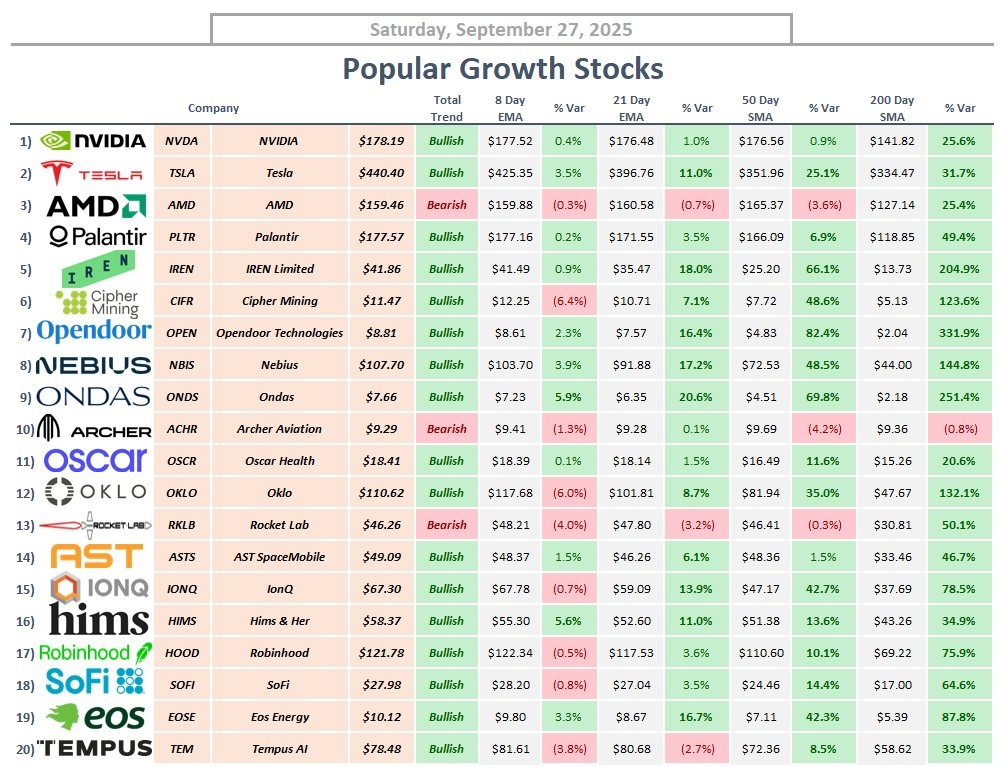

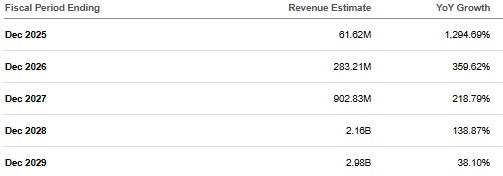

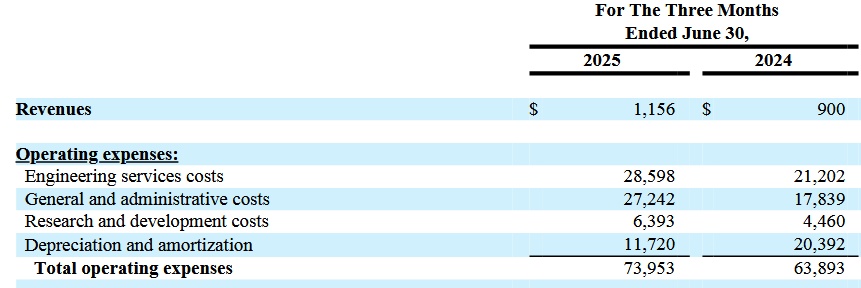

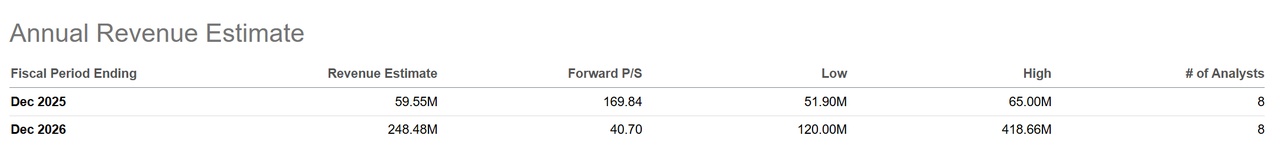

Market Performance: The stock has recently shown ** strong upward momentum**, with significant year-on-year growth.

Analyst Sentiment (TipRanks & eToro)

The general sentiment is one of cautious optimism with a "Moderate Buy" recommendation.

- Target Price: The 12-month target is considered high (around $53 $), although the current price ($86 $) exceeds the average projection, reflecting the enormous potential of the technology.

- Technical Analysis: In the medium term, the stock is in an upward trend channel. The high RSI indicates strong optimism, but suggests the stock may be technically "overbought" in the very short term, making a brief correction possible.

In summary, $ASTS is a high-risk/high-reward

growth stock, driven by space-to-cell technology and supported by solid partnerships.

PS: The strong run of $ASTS has attracted attention. I am considering entering a position at more attractive support levels (around $60 $ in case of a correction) to capitalize on the long-term trend in satellite connectivity.

⚠️ Disclaimer: Past performance is not indicative of future results. Investing involves risks, including the loss of capital.