$ASTS (-6,02 %) could be the future of mobile communications as the entire terrestrial infrastructure such as masts and the like could become irrelevant with only 200 satellites in space.

That is the mission and the business model at its core.

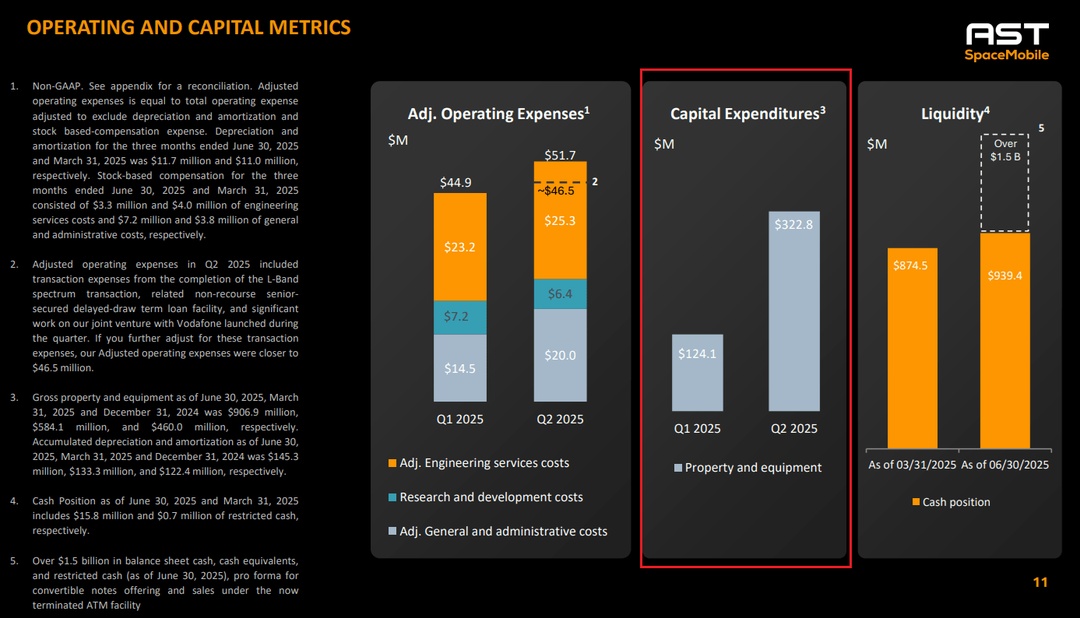

They currently have two factories for their satellites and one launch per month, which results in enormous CAPEX costs (see photo)

The company is clearly a bet a version and that is to handle the three billion customers of Verizon, Telekom and Co. via a satellite. If this works, it would save costs and they would get paid for the service. Now someone might come up with Starlink (yes, but they are focusing on other services).

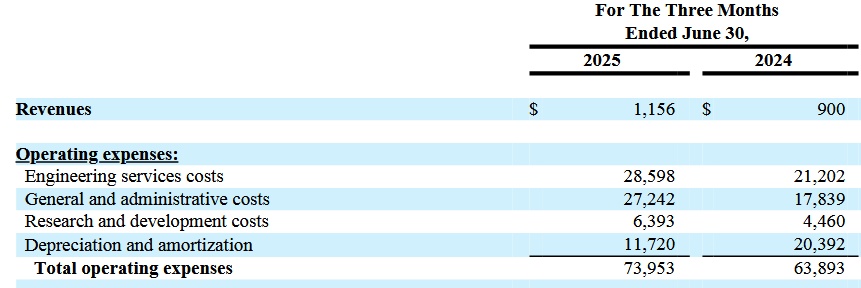

The company currently has hardly any turnover, but has secured orders from B2B and governments, plus they have patents and the factories.

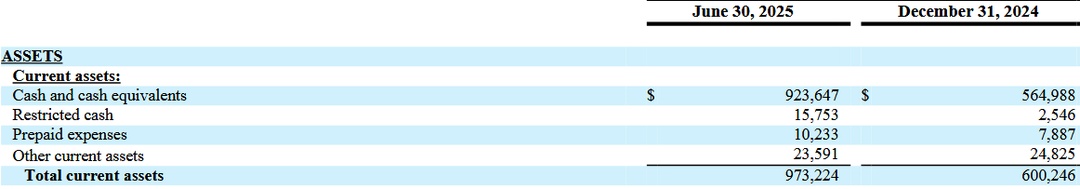

The revenue is also irrelevant for now as they have to build the infrastructure and they have already raised $900 million for that.

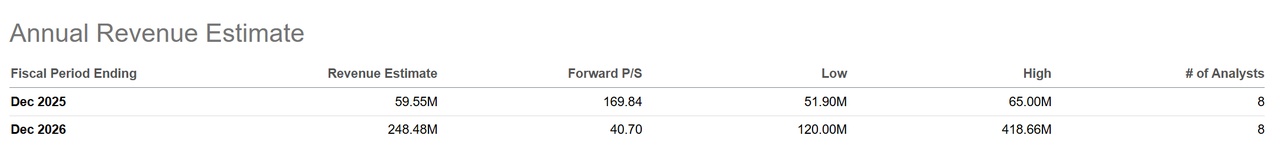

They are currently launching 6 satellites into orbit per launch, so at the current rate it could take another 1-2 years before the service could be offered globally, which is why they are concentrating on the USA as their first market, and this could soon really take off, as can be seen from the 2026 forecast.

An investment is currently still very speculative and the valuation is high compared to the status quo, but I find the future development exciting and am keeping an eye on the share.