$ASTS (-6,02 %) I presented briefly the other day, and the thesis rises and falls with the launches of satellites.

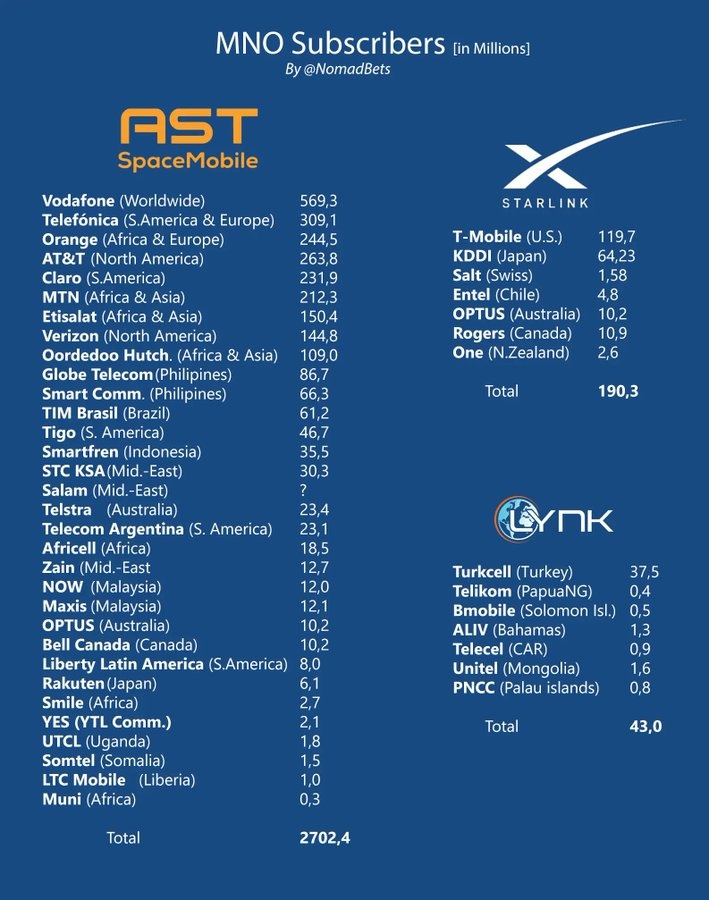

They currently have a very clear lead with partners (companies & countries), but the uncertainty is currently increasing as Elon Musk is catching up and investing in the market.

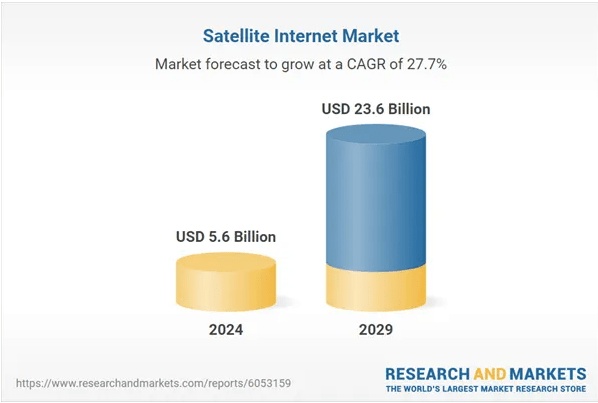

The market is growing enormously at 27.7% per year and there is hardly any competition or established players so far, it will be exciting to see whether AST Spacemobil will use the first mover advantage here, they don't have much time left. It remains to be seen whether the advantage of the current increase in military spending can initially increase the pace.

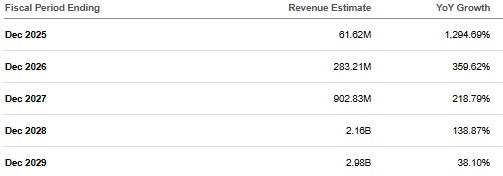

I will take another 1-2 weeks of research before I make a decision here, the currently expected sales increases are enormous - it's about 360% next year.

But you mustn't forget the valuation - we have an FWD P/S ratio of an incredible 174.99!!

A lot of growth has to happen to bring this to a fair level and Amazon is also investing in the business and they all have more money and the satellite infrastructure and that is the problem. AST has hardly any satellite and is 100% dependent on the internet business and it could become unattractive due to delays, making it a very risky player.