Netflix impresses with quarterly figures

Netflix $NFLX (+0,37 %) broke through the 1,000 dollar mark per share in after-hours trading in a remarkable first quarter. The streaming giant exceeded expectations in almost all areas and achieved a turnover of 10.54 billion euros, an increase of 13 percent compared to the previous year. Particularly noteworthy is the net profit of 2.89 billion euros, which shows an impressive increase of 24%. Earnings per share of EUR 6.61 also exceeded Wall Street's expectations and grew by more than 25 percent year-on-year. The operating margin rose to 31.7 percent, indicating increasing efficiency. Netflix appears to be well positioned in a challenging economic environment as its business model is less dependent on physical goods and is instead based on intellectual property. This resilience gives the company a strategic advantage in the fast-paced streaming world.

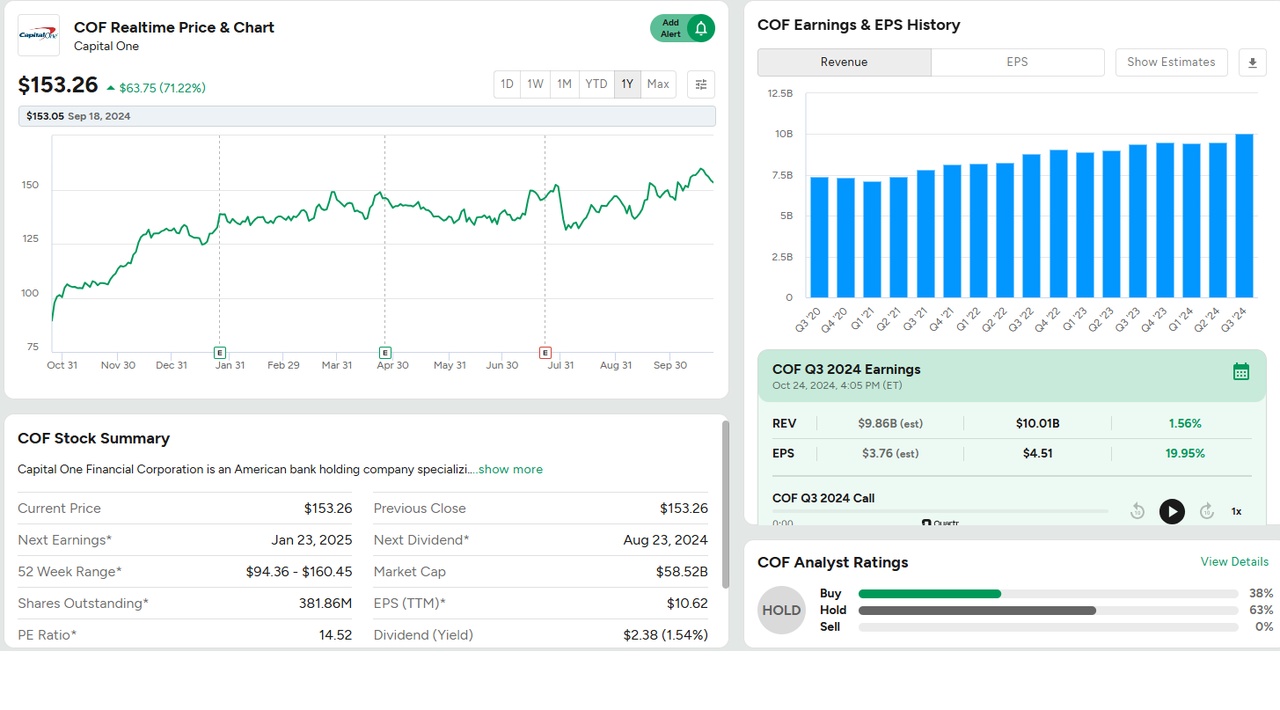

Capital One buys Discover Financial for 35 billion dollars

The merger between Capital One and Discover Financial $D1FS34 received the green light from several regulators on Friday, bringing the €35 billion merger closer to completion. Following the announcement of the acquisition in February 2024, the Federal Reserve and the Office of the Comptroller of the Currency have given their approval. The Federal Reserve also fined Discover €100 million for overcharging interchange fees. Capital One plans to complete the acquisition on May 18 after all necessary approvals have been obtained. This merger will bring together two of the largest credit card providers and could help Discover regain relevance in competition with the top dogs Visa and Mastercard. The synergies from this acquisition could significantly strengthen Capital One's portfolio and open up new market opportunities.

Sources:

https://finance.yahoo.com/news/netflix-crushes-earnings-safe-haven-160904929.html

https://finance.yahoo.com/news/capital-one-35-billion-purchase-162516083.html