Hi guys,

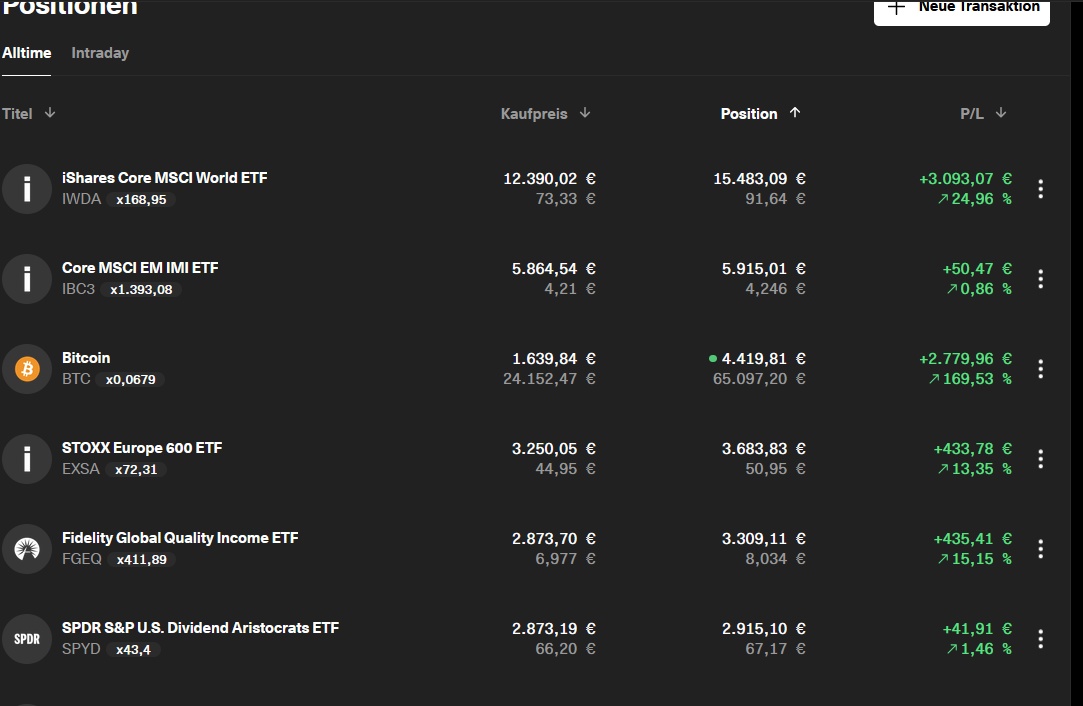

After careful consideration I have come to the conclusion to sell my position in $WSM (-4.63%) which is currently one of my biggest positions in the portoflio.

Williams Sonoma is a USA high-end retailer of various products for the home (and the stores look really cool).

I hold this company since 2021 and it is one of my best performer with an unrealized gain of +253 %.

What i liked about this company and the stock?

- Consistent ROIC of over 20% every year

- Consistent double digit dividend growth with a very low payout ratio (under 30%).

- When I bought the stock it was trading only at 8 p/fcf

- High and consistent share buyback program

- Williams Sonoma website is constantly in the top 30 most searched website in the USA

- They own also Pottery Barn and other different store brands.

- They also provide furniture for B2B customers like: big cruise ships, hotels and government buildings

Reason I am selling:

- I think that at this valuation the company is correctly priced/slightly overvalued and there are better opportunities in the market.

- P/FCF is a lot higher compared to 3 years ago, now sitting at 25.

- Selling furniture is a cyclical business and I think we are not heading into years of economic growth even if the FED cut rates.

- 3/4 of the products $WSM (-4.63%) sell are imported from Vietnam, China, Brazil or some other country impacted by tariffs, only 1/4 is produced in the USA and tariff + uncertanty could really affect this company. Management can increase prices passing the cost to the consumer knowing that sales will slow down or eating up this costs and reducing their margins.

A famous investor once said "Don't cut your flowers and water your weeds" but I really think it's time to cut this flower and take profit before it withers.

Despite knowing i have good reasons to sell I feel kinda bad, because I become attached to this company after all the reports I read and all the research I made.

Am I the only one who feel this way for selling a good performer? What's your experience?