Congratulations to all investors of $AMD (+0.35%)

I have sell 20-25% of the stocks and I’ve bought $WM (+1.1%)

Posts

121Congratulations to all investors of $AMD (+0.35%)

I have sell 20-25% of the stocks and I’ve bought $WM (+1.1%)

👋 Introduction & background

Hey everyone!

I'm 33, married and dad to two small children (18 months and 2 months old). I've been working in the automotive industry since 2011 and in management consulting since 2019. ⚙️🚗💼

My wife is an engineer and also works in the automotive industry. 👩🔧🚗

I've been with getquin since 2022, but so far I've been reading along rather than actively posting. 👀

My wife is currently on parental leave and receives parental allowance. I will go on parental leave in Q2 2026 (also with parental allowance), then she will start working again. This means that only one of us will receive a full salary until the end of 2026 - but we'll still be sticking to our savings and investment quota. 👶💶

💰 Current status:

A good mid-six-figure amount has already been saved in our custody accounts. 📈

👶 Children & investments

For each child, we invested €10,000 in the Vanguard FTSE All World ($VWRL) (+0.68%) invested. In addition, each child receives €150 per month in the same ETF - via junior custody accounts at ING. 📊

💍 My wife's investments

She invests monthly:

- 🌎 500 € in the MSCI World ($XDWL) (+0.98%)

- 💸 500 € in the Vanguard FTSE All World High Dividend ($VHYL) (+1.04%)

📈 My investment strategy

Long-term, diversified and with a focus on cash flow & wealth accumulation.

🔹Core portfolio (ETF & Bitcoin)

900 € flow in monthly:

- 💵 €500 in SPDR S&P 500 ($SPY5) (+1%)

- 🌍 €200 in Vaneck Morningstar Developed Markets Dividend Leaders ($TDIV) (+0.48%)

- ₿ 200 € in Bitcoin ($BTC) (+0.38%)

🔹 Individual share savings plans (€25/ €600 each)

Target per company: €10,000 investment amount.

Currently participating:

$DB1 (+0.72%) , $UNP (+1.61%), $RACE (+1.47%) , $MRK (+1.46%) , $MUV2 (-1.18%) , $DGE (+1.21%) , $DE (+1.13%) , $TXN (+1.58%) , $AWR (+0.62%) , $ADP (+0.91%) , $PLD (+4.51%) , $HEN (+1.51%) , $ITW (+1.11%) , $UNH (+0.08%) , $LLY (+0.1%) , $BEI (+2.37%) , $MCD (+0.9%) , $DTE (+1.22%) , $WMT (+1.65%) , $COST (+1.17%) , $WM (+1.1%) , $JPM (-0.12%) , $BLK (-0.15%) , $SY1 (+2.38%)

🔹 Cash reserve

💰 Set aside at least €1,000 every month to be able to strike flexibly when opportunities arise.

🏘️ Real estate strategy

We live in our own home and own a rental apartment that pays for itself. ✅

Further real estate purchases are planned. 🏡📈

🎯 Target (15-20 years)

Financial freedom - with the option of part-time or complete independence from employment. Focus on more time for family, projects and quality of life. ✨

How do you structure your portfolios? What is your strategy and what are your long-term goals?

I look forward to the exchange!

... In my opinion, this is not the ideal time to buy, but some stocks, especially in the more defensive area, are comparatively attractive for me right now, especially as they can also be a defensive anchor if tech should correct again. As far as tech is concerned, I'm waiting for that.

Today I have:

$WM (+1.1%)

$RSG (+1.04%)

$PG (+1.4%)

$COKE (+1.81%)

$KO (+1.45%)

$LIN (+2.03%)

$CSL (+1.79%)

$NEE (-0.67%)

$DB1 (+0.72%)

$DTE (+1.22%)

$COST (+1.17%) bought

all about the same amount... Linde a little more, Carlisle a little less...

One position $VICI (+0.63%) in the 🚮

And from 🚮♻️ $WM (+1.1%) in the depot

have a nice evening ✌️

$VICI (+0.63%) from the depot for an initial purchase at $WM (+1.1%)

A lot has happened in my portfolio again in recent weeks. In addition to a few sales (including $GOOGL (+1.26%) and $NVDA (+1.31%)) from hot sectors, I have built up cash and diversified further ($CMG (+0.76%)

$SNPS, (+1.99%)

$BRO (-0.48%)

$AMGN (+1.09%)

$LSEG (+0.5%)). Further acquisitions and new entries (e.g. $INTU (+3.2%)

$ADP (+0.91%)

$WM (+1.1%)

$CTAS (+2.2%)

$RMS (+1.62%)) are planned. As short- to medium-term trades, I have invested in $Adobe (+1.97%) and $TTD (+0.8%) as short to medium-term trades. I mainly invest for the long term, but a correction (technology, cloud) including sector rotation (consumer, pharma, software) seems inevitable to me. I am therefore taking a wait-and-see approach and, if necessary, I will reenter $GOOGL (+1.26%) and $NVDA (+1.31%) again at the appropriate time.

Please let me know what you think.

I will probably share future updates with you every two months at the beginning of the month (November, January,...).

I wish you all a successful time.

Day Investors!

I mainly invest in dividend aristocrats and dividend kings.

I usually buy shares that have fallen due to weak economic phases or other stock market events and therefore have a high dividend yield at lower prices. The growth and accumulation of my dividends is important to me. I don't speculate on turnarounds, but make sure that the companies in my portfolio have a solid business model and continue to be profitable enough to increase their dividends annually.

Regular quarterly figures and annual reports are therefore very important to me.

Currently, my portfolio has a gross dividend yield of over 5% and annual dividend growth of over 8%.

I have recently started to invest more in growth stocks in order to compensate somewhat for the weak share price performance to date. These include, among others $HD (+1.78%) , $AMD (+0.35%) , $WM (+1.1%) , $GOOGL (+1.26%) etc. Also $UNH (+0.08%) I count as well. To be honest, $UNH is a small "trade". If it pans out, I would have secured a 3% dividend yield along with strong growth... which is pretty rare. FOMO.

Maybe it's also $NOVO B (+0.04%) to this. 😜

My dividends are taxed in accordance with the double taxation agreement.

So far, I've collected €9,000 in dividends and reinvested every cent of it.

I like to exchange ideas with other investors, especially dividend investors.

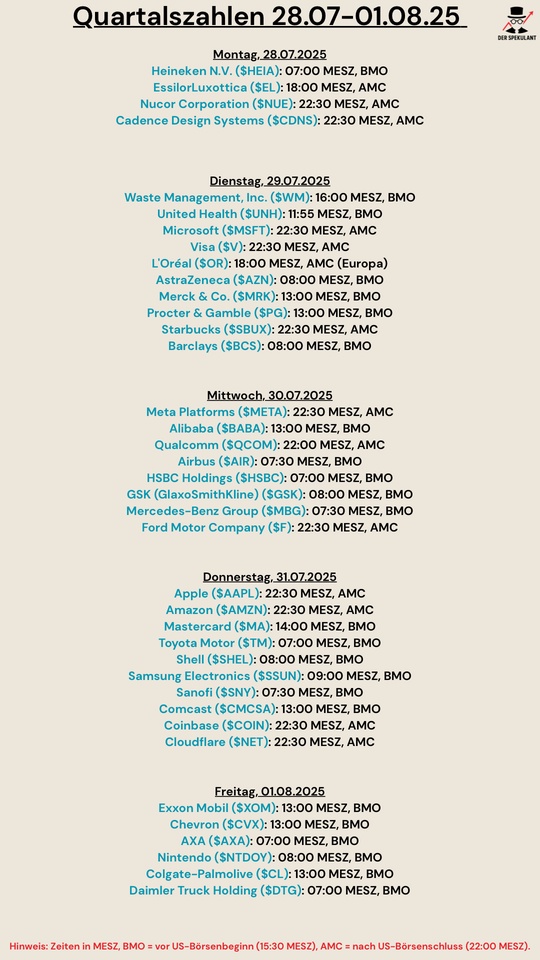

📊 Waste Management - Q2 2025 (short & sweet):

Turnover: USD 6.43 billion (+19% YoY) ✅

Adjusted earnings per share (EPS): USD 1.92 (USD +0.03 above expectations) ✅

GAAP EPS: USD 1.80 (previous year: USD 1.69)

Net profit: USD 726 million (previous year: USD 680 million) ✅

➡️ Conclusion: Expectations exceeded - strong sales growth, solid profit development.

$HEIA (+2.38%)

$EL (+11.49%)

$NUE (-0.26%)

$CDNS (+1.39%)

$WM (+1.1%)

$MSFT (+1%)

$V (+2.32%)

$OR (+2.78%)

$AZN (+0.63%)

$MRK (+1.46%)

$PG (+1.4%)

$SBUX (+1.82%)

$BCS (-2.64%)

$META (+1.13%)

$BABA (+1.78%)

$QCOM (+0.56%)

$AIR (-0.27%)

$HSBC (-0.88%)

$GSK (-0.24%)

$MBG (+2.48%)

$F (+2.1%)

$AAPL (+2.46%)

$AMZN (-0.07%)

$MA (+2.6%)

$7203 (+1.93%)

$SHEL (+1.39%)

$005930

$SNY (+1.41%)

$CMCSA (+1%)

$COIN (+2.4%)

$NET (+0.34%)

$XOM (+1.73%)

$CVX (+1.17%)

$CS (-1.45%)

$NTDOY (+4.07%)

$CL (+1.49%)

$DTG (-0.61%)

$UNH (+0.08%)

Top creators this week