Earnings

- Markets

- Stocks

- Westinghouse Air

- Forum Discussion

Discussion about WAB

Posts

6Westinghouse Air Brake beats earnings estimates; updates EPS outlook for fiscal year 2025

Press release from Westinghouse Air Brake (NYSE:WAB):

First quarter non-GAAP earnings per share (EPS) of $2.28 beat by $0.25. Revenue of $2.61 billion (+4.4% Y/Y) is in line.

The company's multi-year order backlog continues to provide good visibility.

As at March 31, 2025, the order backlog for the first twelve months was USD 486 million higher than in the previous year.

As of March 31, 2025, the multi-year backlog was $219 million higher than the prior year, and excluding foreign currency, the multi-year backlog was $460 million higher, an increase of 2.1%. In the first quarter, operating cash flow amounted to USD 191 million compared to USD 334 million in the same period of the previous year, which is attributable to higher receivables.

At the end of the quarter, the company had cash, cash equivalents and restricted cash of USD 698 million and total debt of USD 4.01 billion.

2025 financial guidance Wabtec increased its 2025 adjusted earnings per share (EPS) guidance by USD 0.10 and widened the range to USD 8.35 to USD 8.95 (compared to the consensus of USD 8.54 (previously USD 8.35 to USD 8.75)). The reason for this is the economic volatility and uncertainty over the rest of the year.

Wabtec's revenue forecast remains unchanged at USD 10.725 billion to USD 11.025 billion (compared to the consensus of USD 10.96 billion).

For the full year 2025, Wabtec expects an operating cash flow conversion of over 90 percent.

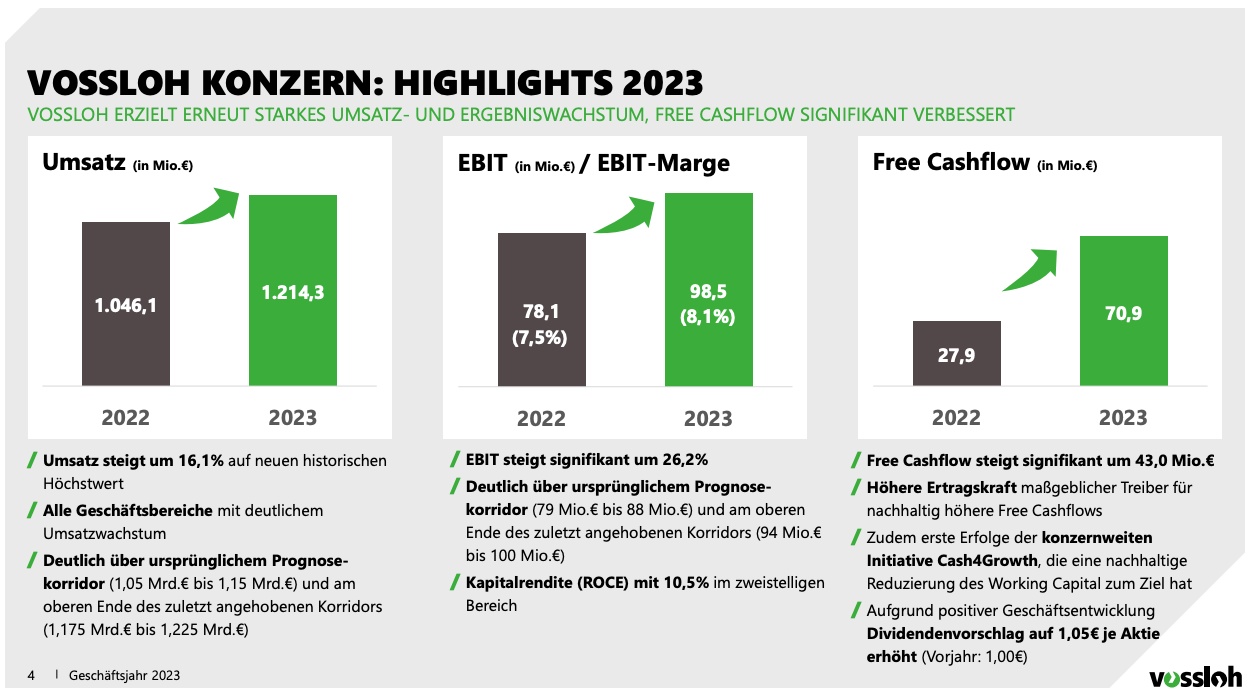

Vossloh achieves record sales and significant increase in EBIT in the 2023 financial year

The industrial stocks in my portfolio are gradually reporting excellent figures for 2023. $VOS (-0.83%) Strong project business in Mexico and the long-awaited higher demand in the USA. There is also a slightly higher dividend.

In addition to Vossloh, a few WABTEC $WAB (+0.27%) shares. Because where there are rails, something has to roll. Perhaps with the next setback.

Trending Securities

Top creators this week