$UA (-3.19%) Do you see potential for the restructuring to go well or would you prefer to stay away now?

- Markets

- Stocks

- Under Armour

- Forum Discussion

Discussion about UA

Posts

9Under Armour Q4 Earnings Highlights

🔹 Adj. EPS: -$0.08 (Est. -$0.08) 🟡

🔹 Revenue: $1.2B (Est. $1.16B) 🟢; -11% YoY

🔹 Gross Margin: 46.7%; +170 bps YoY

🔹 Inventory: $946M; -1% YoY

FY26 Guidance

🔹 Revenue: -4% to -5% YoY

🔹 Gross Margin: +40 to +60 bps YoY

🔹 Adj. Operating Income: $20M–$30M

🔹 Adj. EPS: $0.01–$0.03

Q4 Segment Breakdown

🔹 North America: $689M; DOWN -11% YoY

🔹 International: $489M; DOWN -13% YoY

— EMEA: DOWN -2%

— APAC: DOWN -27%

🔹 Wholesale: $768M; DOWN -10% YoY

🔹 DTC: $386M; DOWN -15% YoY

🔹 Apparel: $780M; DOWN -11% YoY

🔹 Footwear: $282M; DOWN -17% YoY

🔹 Accessories: $92M; UP +2% YoY

CEO Kevin Plank’s Commentary

🔸 “We’re rebuilding Under Armour into a more focused and profitable brand.”

🔸 “Macro uncertainty and tariffs impact our outlook, but execution and alignment remain strong.”

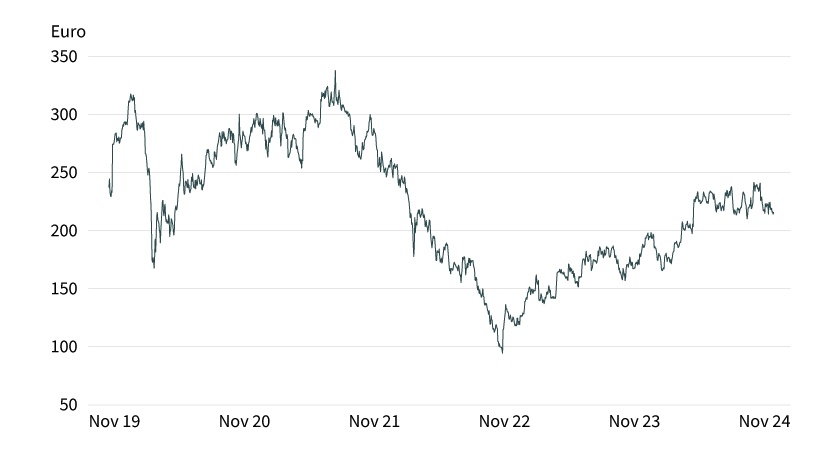

Detailed Adidas share analysis $ADS (-2.82%)

Company portrait

Long-term growth profile

Performance

Ukraine war

The economy

China

Yeezy / Kanye West

Management and strategy

Valuation & recovery

Quarterly figures & forecast

Adidas Originals has a real trump card up its sleeve. Here you can constantly draw on history and sell old things to young people as hip.

The Samba shoe was my absolute favorite in my youth and now young people are wearing it again.

No big development costs and so you can sell a cheap shoe with a high margin.

It is similar with the textiles - the logo with the three leaves stands for noble and high quality, which of course improves the margins.

For me personally, the revival of old was a smart move.

And it always reminds you of your youth.

$UA (-3.19%)

$UAA (-1.68%) | Under Armour Q3 '24 Earnings Highlights:

🔹 Adj EPS: $0.30 (Est. $0.19) 🟢

🔹 Revenue: $1.4B (Est. $1.38B) 🟢; DOWN -11% YoY

🔹 Gross Margin: 49.8%, UP 200 bps YoY

🔹 Adj Operating Income: $166M (excluding one-time items)

🔹 Inventory: DOWN -3% YoY to $1.1B

Raised FY25 Outlook:

🔹 Adj EPS: $0.24-$0.27 (Prev. $0.19-$0.21) 🟢

🔹 Adj Operating Income: $165M-$185M (Prev. $140M-$160M) 🟢

🔹 Revenue: Expected to decline at a low double-digit percentage

🔹 North America: -14% to -16%

🔹 International: Low single-digit percent decline

🔹 Gross Margin: Expected to increase by 125-150 bps

🔹 Adjusted SG&A Expenses: Expected to decrease low-to-mid single digits (excluding litigation and transformation expenses)

🔹 Capital Expenditures: $190M-$210M

Q3 Demography Revenue:

🔹 North America: $863M; DOWN -13% YoY

🔹 International: $538M; DOWN -6% YoY

🔹 EMEA: DOWN -1%

🔹 Asia-Pacific: DOWN -11%

🔹 Latin America: DOWN -13%

Revenue Channels:

🔹 Wholesale Revenue: $826M; DOWN -12% YoY

🔹 Direct-to-Consumer (DTC) Revenue: $550M; DOWN -8% YoY

🔹 eCommerce Revenue: DOWN -21%; accounts for 30% of DTC

Product Categories:

🔹 Apparel: $947M; DOWN -12% YoY

🔹 Footwear: $313M; DOWN -11% YoY

🔹 Accessories: $116M; UP +2% YoY

CEO Kevin Plank's Commentary:

🔸 "Our strategy to elevate Under Armour’s brand positioning is gaining traction, as evidenced by better-than-expected profitability, allowing us to raise our full-year outlook while increasing brand investment for long-term growth."

Fiscal 2025 Restructuring Plan:

🔹 Total estimated charges of $140M-$160M, with up to $75M in cash-related expenses

Update analyst assessments:

$TSLA (-6.86%) | RBC raises target price for TESLA from USD 236 to USD 249. Outperform.

$KO (+0.18%) | JPMORGAN lowers the price target for COCA-COLA from USD 78 to USD 75. Overweight.

$TMUS (+0.17%) | UBS raises the price target for T-MOBILE US from USD 210 to USD 255. Buy.

$T (-1.52%) | UBS raises the price target for AT&T from USD 24 to USD 25. Buy.

$AOF (-5.6%) | WARBURG RESEARCH raises the price target for ATOSS SOFTWARE from EUR 142 to EUR 144. Buy.

$UA (-3.19%) | UBS raises the price target for UNDER ARMOUR from USD 11 to USD 12. Buy.

$JST (-3.56%) | WARBURG RESEARCH raises the price target for JOST WERKE from EUR 62 to EUR 77. Buy

$IBM (-4.51%) | UBS raises the price target for IBM from USD 145 to USD 150. Sell.

$FTK (-2.36%) | HAUCK AUFHÄUSER IB downgrades FLATEXDEGIRO from Buy to Hold and lowers target price from EUR 16 to EUR 15.

$ROG (-0.98%) | DEUTSCHE BANK RESEARCH raises the price target for ROCHE from CHF 235 to CHF 250. Sell.

$EBAY (-2.91%) | UBS raises the price target for EBAY from USD 59 to USD 72. Neutral.

$KER (-1.58%) | RBC lowers the price target for KERING from EUR 280 to EUR 230. Sector-Perform.

𝗴𝗲𝘁𝗾𝘂𝗶𝗻 𝗗𝗮𝗶𝗹𝘆 𝗦𝘂𝗺𝗺𝗮𝗿𝘆 𝟬𝟲.𝟬𝟱.𝟮𝟬𝟮𝟮

Hello getquinners!

Bitcoin to the moon?🚀 Last night’s drop might say otherwise*

(* we say nothing because we are not financial advisors, and our content is NOT financial advice)

𝗘𝘂𝗿𝗼𝗽𝗲🌍:

1. EU tweaks Russia oil sanctions plans

In a bid to win over reluctant states, the European Commission has proposed changes to its planned embargo on Russian oil. Following the EU’s announced plans earlier this week, Hungary and other member states expressed concerns of impact on their own economies, however this adjustment allows some countries to upgrade their oil infrastructure.

🟩 Oil (Brent Crude), $112.93/barrel (🔼+1.70%)

More on this: https://reut.rs/3LQfDFP

𝗔𝘀𝗶𝗮🌏:

2. Chinese EV NIO turns to Asian stock exchanges

The Chinese EV manufacturer NIO $NIO (-10.08%) is planning on listing its shares in Singapore, making it the third listing, following a secondary listing in Hong Kong earlier this year. This comes amid heightening geopolitical tensions between China and the USA. The US Securities Exchange Commission added over 80 companies to a list of (mostly Chinese) companies facing expulsion from US exchanges, and there has been a wave of “homecoming listings”, with giants such as Alibaba joining the HKSE.

🟥 $NIO (-10.08%) NIO In, $15.38 (🔽-0.13%)

Interested in electric vehicles? https://tcrn.ch/3w6Uocp

𝗪𝗼𝗿𝗹𝗱🌎🌏🌍:

3. Bitcoin falls sharply

Bitcoin $BTC (-0.84%) took a massive hit, as there was a major stock sell-off in the US, causing a subsequent shock to the cryptocurrency market. This morning, $BTC (-0.84%) was down 8.6% according to Coin Metrics. Other crypto, such as $ETH and $XRP were negatively affected, with $126 billion wiped off the cryptocurrency market. Tech-heavy index Nasdaq fell by nearly 5%, following the Fed’s interest rate hike, and crypto has remained positively correlated to the equity markets.

🟥 $BTC (-0.84%) Bitcoin, $36,103.20 (🔽-1.19%)

Want to read more about this? https://cnb.cx/3FqglYk

𝗦𝗽𝗲𝗰𝗶𝗮𝗹: 𝗜𝗻𝘁𝗲𝗿𝗲𝘀𝘁 𝗿𝗮𝘁𝗲 𝗵𝗶𝗸𝗲

The US Federal Reserve has announced the biggest interest rate hike in more than two decades to increase their fight against high inflation. The Fed said it is raising rates by half a percentage point, following a smaller increase in March. While inflation is at a 40 year high, further increases are expected. This push is the latest attempt to curb rising costs affecting households across the world.

Major stock indices rose after Fed Chairman Jerome Powell is “not actively considering” raising interest rates in three-quarter percent increments, with tech stocks posting the biggest initial gains. However, US stocks then fell sharply as investors assessed the impact of the Fed’ aggressive monetary tightening.

Source: https://on.wsj.com/3KP1jMM

𝗘𝗮𝗿𝗻𝗶𝗻𝗴𝘀 𝗰𝗮𝗹𝗹𝘀🔔:

1. Shopify $SHOP (-9.54%)

🟥 Revenue: €1.2bn vs €1.24bn expected (-0.38%)

*EPS data is not yet published

E-Commerce Shopify remains behind expectations with their earnings report, and joins Amazon, eBay, Zalando and Etsy. The platform is one of the post-pandemic losers.

Article: [https://bit.ly/3sg9ZFk](https://bit.ly/3sg9ZFk)

🟩 EPS: $0.92 vs $0.76 expected (+20.83%)

🟩 Revenue: $579.27bn vs $579.27 expected (+0.79%)

3. $ING (+0%)

🟩 EPS: €0.11 vs €0.08 expected (+45.99%)

🟩 Revenue: €4.6bn vs €4.58bn expected (+0.49%)

🟩 EPS: $1.05 vs $1.03 expected (+1.61%)

🟩 Revenue: $2.48bn vs $2.46bn expected (+0.87%)

𝗦𝘁𝗼𝗰𝗸𝘀 𝗼𝗳 𝘁𝗵𝗲 𝗱𝗮𝘆:

🟩 TOP, $NRG (-5.14%) NRG Energy Inc (🔼+7.74%)

🟥 FLOP, $UA (-3.19%) Under Armour Inc (🔽-23.48%)

🟥 Most searched, $ALV (-0.68%) Allianz (🔽-1.84%)

🟥 Most traded, $DPW (-1.89%) Deutsche Post (🔽-2.35%)

🟥 S&P500 (🔽-0.54%)

🟥 DAX (🔽-2.12%)

🟥 $BTC (-0.84%) Bitcoin ₿, $36,103.20 (🔽-1.19%)

Time: 17:00 CEST

An organisation in India has developed a pioneering model, which works together with local communities, in order to protect the snow leopards in 12 countries, including India, Pakistan and Afghanistan. Among other things, the association has introduced insurance schemes to compensate herders if they lose their livestock to snow leopards - a measure designed to reduce retaliatory killings.

More positive news to get your weekend off to a good start: https://bit.ly/3w8zmdw

Trending Securities

Top creators this week