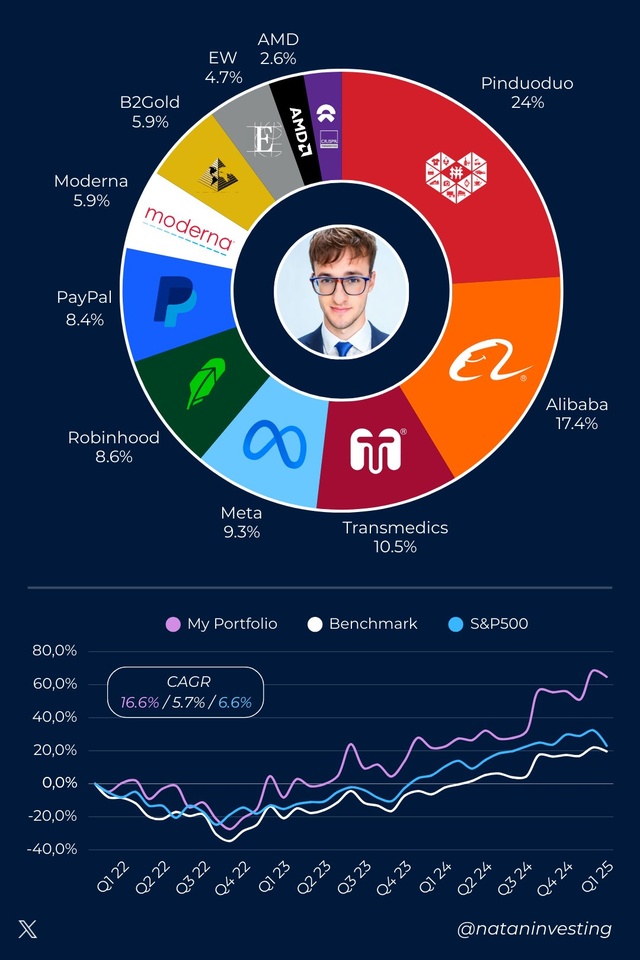

I have recently been on the lookout for exciting new investments and came across TransMedics ($TMDX (+1.58%) ). After thorough research, I was so convinced that I have now opened my first major position. Here is a brief summary of the most important points and my thoughts on them:

🔍 Why I got in

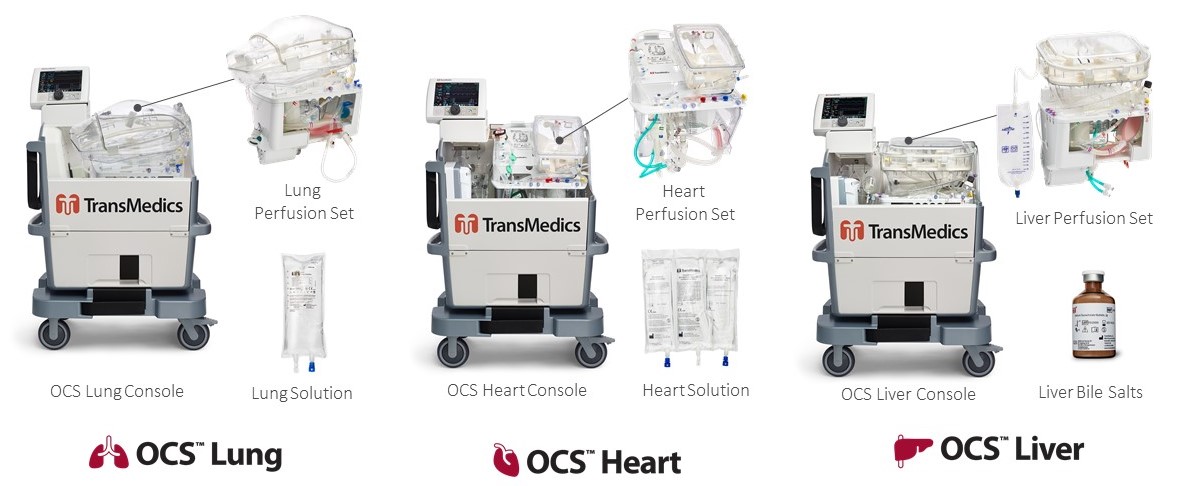

TransMedics has revolutionized the way organ donations are transported and received. The company is growing rapidly and is already showing stable profits. Annual sales in 2024 increased by 83% to USD 441.5 million, and the company posted its first annual net profit of USD 35.5 million. TransMedics improved again in the second quarter of 2025, with sales climbing to USD 157.4 million and profits to USD 34.9 million. The gross margin remains consistently high at around 61% .

The company is also investing in its own logistics fleet and aims to facilitate 10,000 NOP transplants by 2028 as part of the National OCS Program. There are also exciting developments such as the Next-Gen OCS Lung System and a possible expansion into the kidney segment.

💸 Evaluation and comparison

Despite the strong growth, the share is currently only valued at a P/S ratio of around 7.35 . By way of comparison, the Japanese Terumo Group recently acquired its competitor OrganOx for around USD 1.5 billion. OrganOx generated sales of around USD 74 million in 2024, which corresponds to an acquisition multiple of around 20× sales. TransMedics is much more broadly positioned (heart, lung, liver). So while OrganOx is being acquired at 20x sales, it is currently trading at $TMDX (+1.58%) is currently trading at only 6-9x sales, despite its larger market position, stronger portfolio and higher growth.

🧠 Conclusion

At the end of the day, I simply see a company with really strong tech, strong growth and still plenty of room for improvement in terms of margins. If you compare that with the takeovers that are currently going through the roof for completely different multiples, TMDX looks like a huge opportunity to me. I honestly believe that we will see the share at 200+ euros in the next few years.

What do you say? Am I missing something? 🙂

This is of course just my personal opinion and not investment advice. Please do your own research and act according to your own risk tolerance.