Morgan Stanley upgraded 3M (NYSE:MMM) from a previous investment rating of "underweight" to "equal weight" late Tuesday, saying the industrial conglomerate appears to be turning a corner after several years of sluggish performance.

Morgan Stanley now values the stock at 21 times 2026-27 earnings, a discount of around 10% to the S&P 500 and reflecting what the company sees as a more balanced risk/reward profile.

The company cited 3M's self-help initiatives - including product innovation, operational improvements and a focus on consumables - as drivers of more sustainable growth.

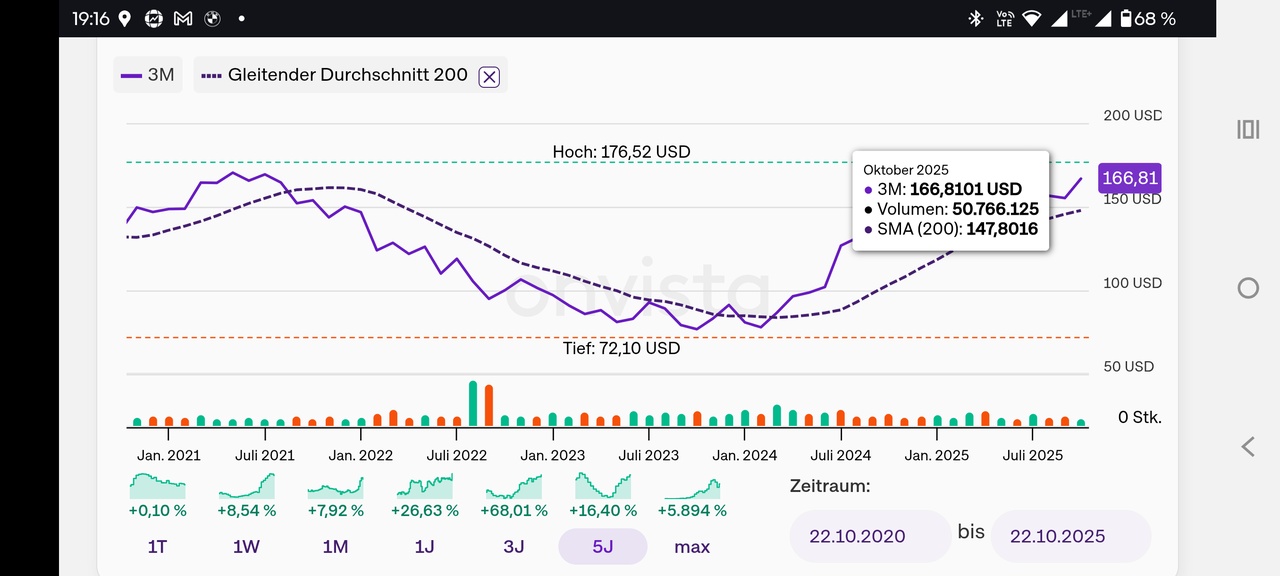

Morgan Stanley raised its price target for 3M (NYSE:MMM) to $160 per share from $130.

Although risks related to tariffs, litigation liabilities and potential channel destocking remain, Morgan Stanley said the outlook for 3M improved as the growth trend becomes more aligned with U.S. industrial production. "We now view 3M (MMM) as relatively well positioned from an audit perspective, which should obviate the need for underperformance," the report states.