The world's population is getting older and older, an irreversible demographic change with considerable economic consequences.

This article is intended to provide investment ideas and impetus. The stocks mentioned do not, of course, constitute investment advice, but merely serve as examples of potential beneficiaries of demographic change. Historical developments are no guarantee of future returns.

The main source is the short analysis "How to invest as the global population ages" by Goldman Sachs [1], which, however, does not name any specific stocks.

I have also added additional sources and charts.

__________

🌍 Demographic change: growth and ageing of the world's population

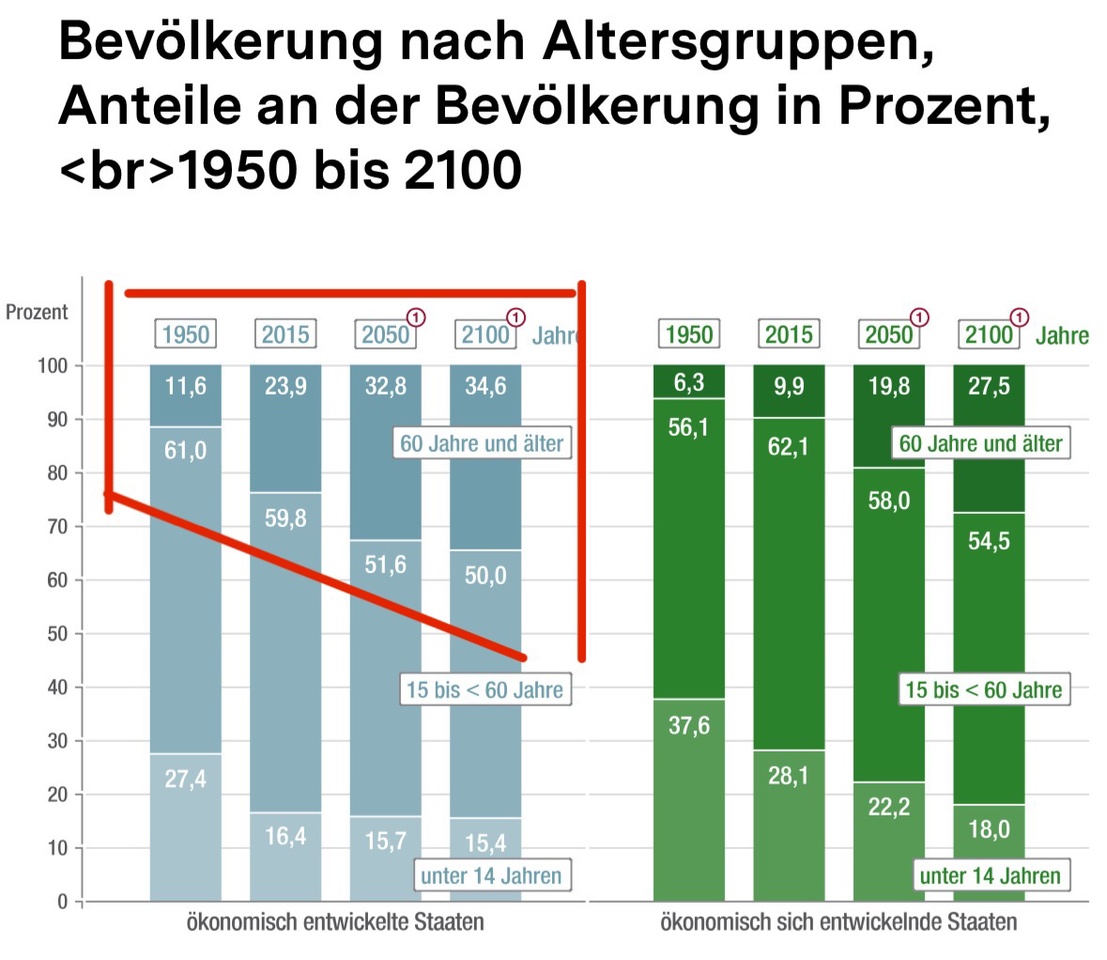

The world's population will grow to almost 10 billion people by 2050. But it is not just the number of people that is increasing, their age structure is also changing dramatically. [2]

Increase in the older population:

- The proportion of people aged 60 and over is rising from 8% (1950) to 21.5% (2050).

- In 2050, 2.1 billion people will belong to the over-60 age group.

Source: [2]

Regional differences:

Europe & North America have the oldest populations & remain the most affected demographically.

Latin America, the Caribbean & Asia: The proportion of over-60s will more than double between 2015 and 2050, reaching around 25 %.

Africa remains the youngest region: in 2015, there were 21 countries worldwide with a birth rate of 5 children per woman, 19 of which were in Africa. However, it should be noted that current statistics from 2024 show that the birth rate per woman in Africa was already just 4.07 in 2023 and could fall to 2.79 by 2050. [3]

While industrialized countries are struggling with an ageing society, Africa remains the most dynamic and youngest region in the world. This development can also have an economic impact and open up new investment opportunities. [2]

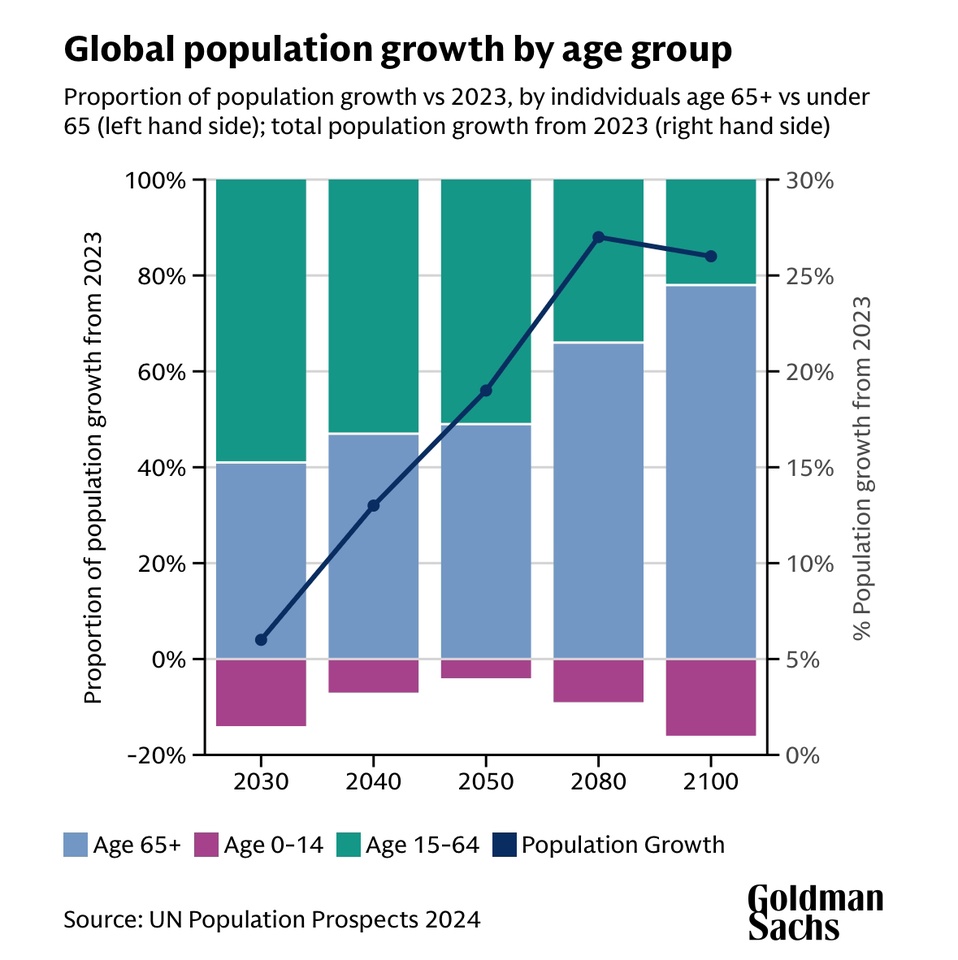

Goldman Sachs also comments in the article with similar figures, according to which the global population is expected to increase by around 20% by 2050 and senior citizens will make up a disproportionate share. The number of people over the age of 65 is expected to double from 800 million to 1.6 billion during this period. [1]

In view of this demographic development, there are opportunities to benefit from precisely this trend. Opportunities lie in targeted investments in sectors that could benefit from the growing proportion of older people.

🚑 Healthcare: A growing market worth billions

Facts:

- In the USA, people over the age of 65 already account for 36% of healthcare expenditure, although they only make up 18% of the population. Age-related diseases such as cardiovascular disease, diabetes and neurological disorders are driving up costs. [1]

- Alzheimer's cases are even expected to double worldwide by 2050.

Possible profiteers:

Medical technology

- Medtronic ($MDT (-1.23%) ) - (cardiac pacemakers, diabetes technology)

- Stryker ($SYK (-2.46%) ) - (orthopaedic implants, surgical devices)

- Siemens Healthineers ($SHL (-3.21%) ) - (imaging, diagnostics)

Pharmaceuticals

- Novo Nordisk ($NOVO B (-3.44%) ) - (Diabetes & Obesity)

- Eli Lilly ($LLY (-3.36%) ) - (Alzheimer's, Diabetes)

- Roche ($ROG (-0.98%) ) - (Oncology, Diagnostics)

🏡 Senior Living & Care: Bottlenecks in nursing homes worldwide

Facts:

The UK has a shortfall of over 30,000 senior units by 2028. [1]

In Germany, France and Italy there is a shortage of nursing home places due to the ageing population. [1]

In the US, only 2% of people over 65 live in nursing homes, leading to an increasing demand for home care and telemedicine. [1]

Potential beneficiaries:

Care providers

- Brookdale Senior Living ($BKD (-3.26%) ) - (senior living, care facilities)

Homecare

- ResMed ($RMD (-2.58%) ) - (sleep apnea, ventilators)

- Fresenius Medical Care ($FME (-2.3%) ) - (dialysis, home therapy)

- Coloplast ($COLO B (-3.29%) ) - (ostomy care, incontinence products)

Telemedicine

- Teladoc Health ($TDOC (-10.75%) ) - (virtual doctor visits, digital health solutions)

- Hims & Hers ($HIMS (-8.47%) ) - (telemedicine & e-health)

Anti-Aging

- L'Oréal ($OR (-1.55%) ) - (skin care, cosmetics)

- Estee Lauder ($EL (-7.14%) ) - (luxury cosmetics, skin rejuvenation)

- Revance Therapeutics ($RVNC ) - (Botox alternative, wrinkle treatment)

🚢 Leisure & consumption: The new "silver economy"

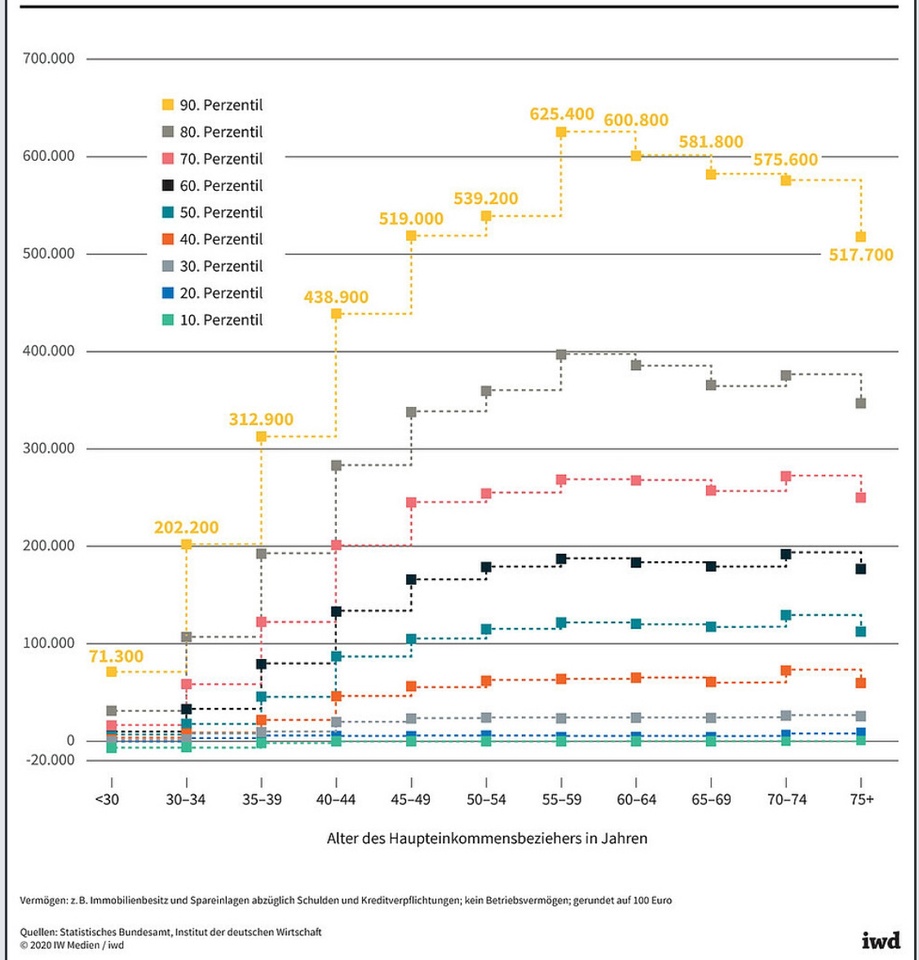

The following chart shows the distribution of wealth in Germany depending on the age of the main income earner. [4]

It is clear that older people tend to have higher wealth than younger age groups. This is reflected in the significantly higher values for the percentiles for age groups aged 50 and over. In particular, the groups aged between 50 and 74 have the highest assets.

The trends are also similar internationally:

- The wealth of older people is 3x that of millennials.

- Over-60s control more than 50% of consumer spending in many developed countries.

- The global silver economy could reach a volume of USD 15 trillion by 2030 (Oxford Economics).

This observation underlines the economic importance of the older generations and their central role in wealth distribution and consumer spending.

Possible beneficiaries:

Luxury

- LVMH ($MC (-2.5%) ) - (fashion, jewelry, wine & spirits)

- Hermès ($RMS (-3.96%) ) - (Exclusive Fashion & Accessories)

- Richemont ($CFR (-2.75%) ) - (Swiss luxury watches & jewelry)

Cruise (Over 60s book a third of all cruises worldwide [1])

- Royal Caribbean ($RCL (-1.72%) ) - (Cruises for seniors & families)

- Carnival ($CCL (-3.03%) ) - (mass market cruises)

- Norwegian Cruise Line ($NCLH (-4.12%) ) - (premium cruises)

Motorhome manufacturers/ recreational vehicles (47% of motorhome users are over 55 years old, In the UK, two thirds of over 55s have a motorcycle license, which may indicate a growing market for motorcycles and accessories. [1])

- Thor Industries ($THO (-3.39%) ) - (motorhomes, campers)

- Winnebago ($WGO (-5.9%) ) - (motorhomes & caravans)

- Harley-Davidson ($HOG (-2.18%) ) - (motorcycles and entry-level electric motorcycles)

🤖 Technology & automation: solution to the labor shortage

Facts:

The labor shortage caused by an aging society is becoming a global challenge. Automation, AI and robotics could help close the skills gap. [1]

Profiteers:

- ABB ($ABBNY (-0.8%) ) - (industrial robotics, automation)

- Fanuc ($6954 (-1.33%) ) - (robotics, factory automation)

- Intuitive Surgical ($ISRG (-4.16%) ) - (robot-assisted surgery)

- Siemens ($SIE (-2.34%) )- (automation & also medical technology)

🧠 Conclusion:

Demographic change offers long-term investment opportunities. Early investment in the right sectors can benefit from rising spending on health, care, leisure and technology.

I myself am still looking for one or two individual investments and am a little annoyed that I didn't get into Hims & Hers earlier, although I have been on the verge of doing so several times. Apart from the luxury segment with LVMH, the portfolio also includes Siemens as a conglomerate in the field of automation.

Do you explicitly take demographic change into account in your investments, e.g. in the form of individual shares?

Which shares do you have in your portfolio or do you still see them as an opportunity?

Thanks for reading!

_________

Sources:

[1] https://www.goldmansachs.com/insights/articles/how-to-invest-as-the-global-population-ages

[2] https://www.bpb.de/kurz-knapp/zahlen-und-fakten/globalisierung/52811/demografischer-wandel/

[4]

https://www.iwd.de/artikel/mit-dem-alter-waechst-das-vermoegen-489710/