I'm currently on vacation in Florida and I'm really looking forward to seeing all the different companies like CVS, Target, Chipotle etc. in real life. It feels like a bit of sightseeing for me 😅. One stock I've been keeping an eye on for a while is $TXRH (-0.91%) We had dinner here a few days ago during the week and I have to say, it was really great. The place was completely full, the atmosphere was good, the people were happy, the food was delicious and the staff were great. I have now bought a few shares here and will build up the position in the long term, as the future prospects for the chain are also optimal.

- Markets

- Stocks

- Texas Road

- Forum Discussion

Discussion about TXRH

Posts

19Further increase in weak phase

Texas Roadhouse is simply a great store. Me and my colleagues (service technicians) always go to the store at least once a week when we are in the USA.

It's just great value for money! And the store is always full no matter what day or state! 🍻

Unfortunately, I haven't been able to test the other two chains that they now also have...

Another 29 new restaurants will be added this year. According to management, net profit and dividends will also grow by double digits in the next few years 📈💪

I will continue to stock up here in the weak phase... a share to sit back and put your feet up.

Greetings Bubu 👋🍻

1.8.25

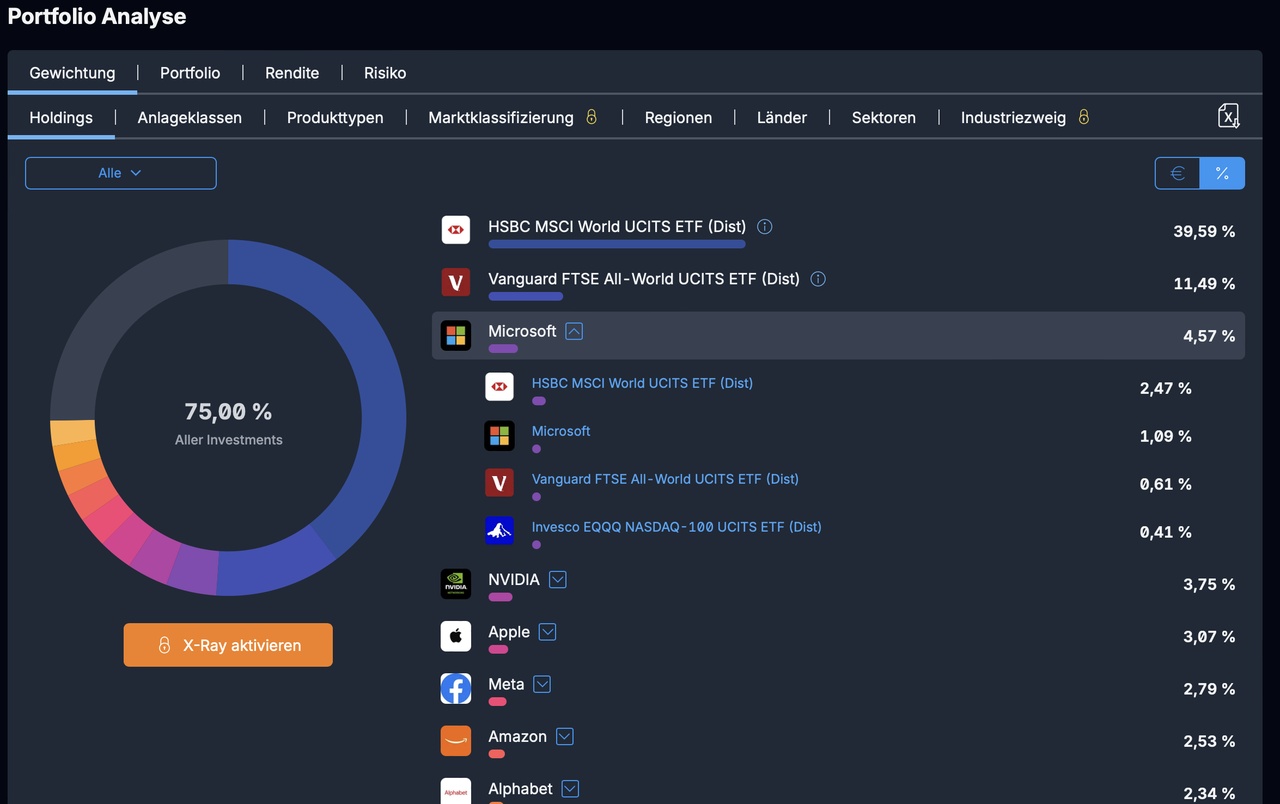

Today I got rid of some of my winners and shifted further into my ETFs.

I have sold:

$CL2 (+1.59%) +5% this fine ETF, also known as holy amumbo, will be rebuilt right next week via savings plan.

$TXRH (-0.91%) +13% whether this will not become a tenbagger in the long term and was therefore a stupid sale?

$JPM (+2.5%) +20%

$V (+0.34%) +25%

$CAT (+0.84%) +26% I suspect that we are at the end of the cycle here. But who knows for sure?

$LULU (+0.01%) -10% good numbers, very bad chat history, but at least it saved me some taxes.

$RKLB (+1.82%) +28% This stock always made me think of Peter Lynch's quote, "don't buy the stocks of rocket companies, buy the boring ones..."

Bought:

$VWRL (+0.64%) at €129.48 🥱

and

$EQQQ (+1.05%) at 481.75 € 😎

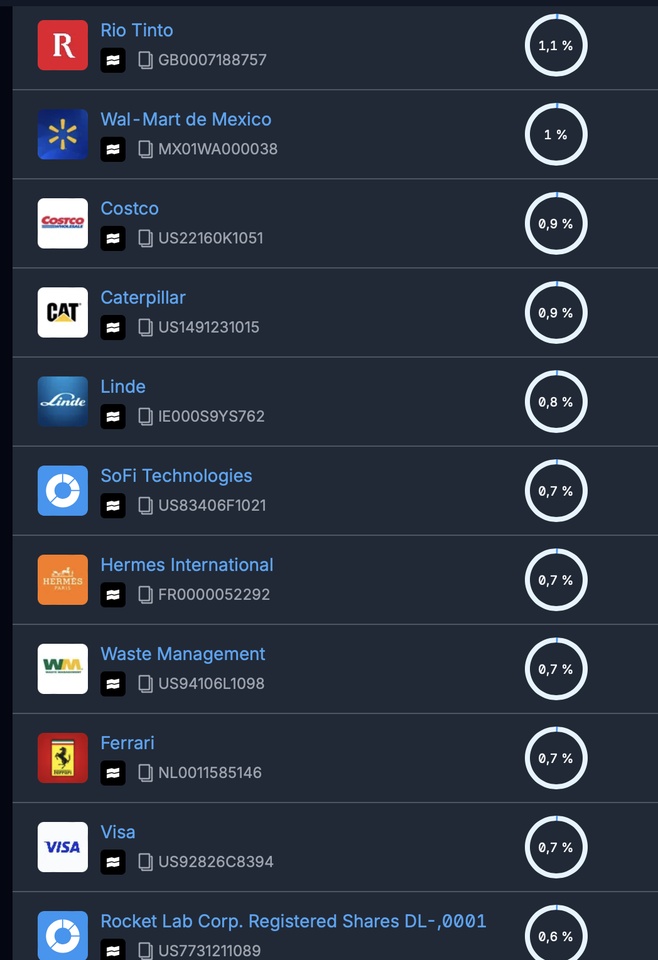

My securities account as of today - Update

Here in the link my previous portfolio (unfortunately can no longer be updated here at the moment) and the train of thought of the last months briefly summarized:

-----------------------------------------------------------------------------------------------------------

This is my portfolio as of today.

-----------------------------------------------------------------------------------------------------------

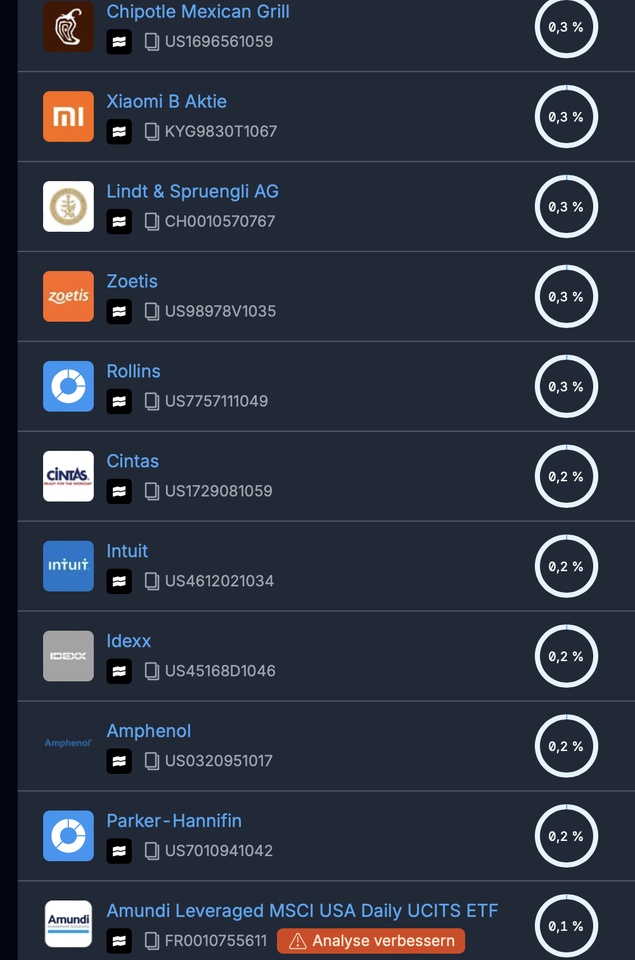

I probably won't manage to get rid of individual stocks completely.

But at least I could eliminate supposedly unnecessary overweightings and overlaps and focus more on second-tier stocks, such as $CALM (+0.56%)

$TXRH (-0.91%)

$SOFI (+3.9%)

In any case, I haven't reallocated much since the article linked above.

I'm taking it rather slowly, as it still feels wrong to me, although the opposite would be more accurate.

So far I have sold the following stocks:

Lotus $LOTB (-1.69%) -7,3 %

Hims $HIMS (+3.4%) +202 %

DE Telekom $DTE (-1.26%) +-0

Church&Dwight $CHD (-0.38%) -6 %

Ecolab $ECL (+0.44%) +1 %

-----------------------------------------------------------------------------------------------------------

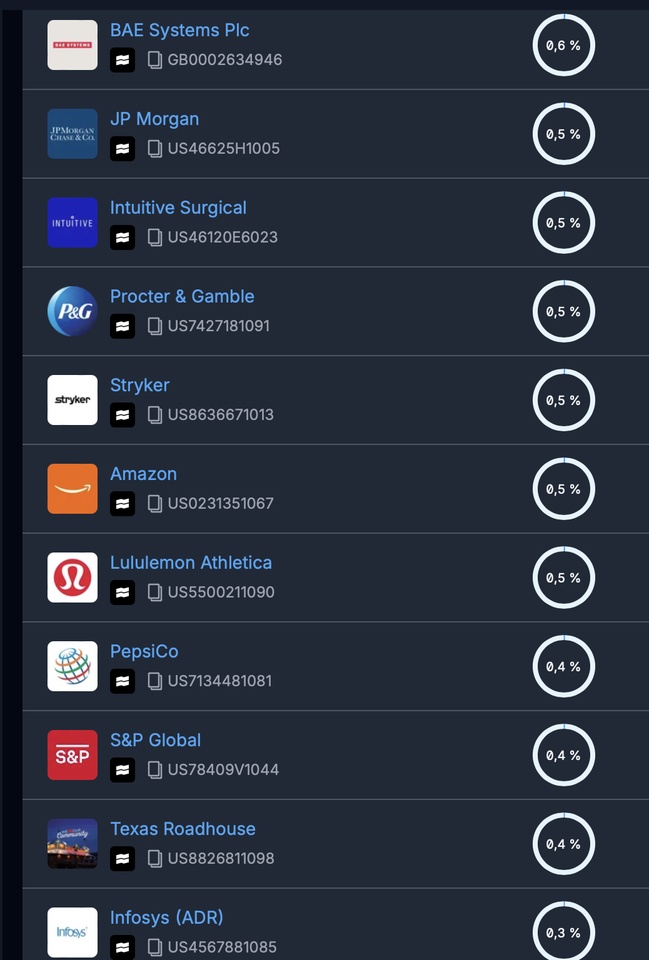

Below is the X-Ray, which illustrates overweightings and allocations. Nvidia and Apple are not in my portfolio as individual stocks, but are strongly represented due to the ETFs. However, I have $MSFT (+0.62%) and $GOOGL (+2.27%) shares in the portfolio, which leads to an overweighting. Alphabet convinces me in many ways, so the overweight could make sense here. But with Microsoft, the ETF share could actually be enough for me. I am therefore considering adding an SL to Microsoft, for example 7% below the current price level.

-----------------------------------------------------------------------------------------------------------

+ 1

Purchase 06/25

🥩 Texas Roadh $TXRH (-0.91%) - A juicy investment in June! 🥩

$TXRH is one of my absolute favorite stocks! Why? Stable dividend growth combined with a strong share price performance makes this share a real highlight in my portfolio.

Every quarter, new steakhouses open in the USA 🇺🇸, and the existing restaurants are recording continuously rising sales both in the take-away business and for in-house consumption. Demand remains robust - whether on weekdays or weekends. I have visited the restaurants myself in several states and was impressed by how crowded they are and how many guests enjoy their evening there.

A company with strong growth, loyal customers and a convincing success story!

Happy investing! 📈 What did you buy this month?

My favorites in the non-consumer goods sector 🏎️✨

Hermes $RMS (-0.95%) (very expensive 🤑 )

Ferrari $RACE (+1.41%)

Lululemon $LULU (+0.01%)

Just do it $NKE (-0.62%) (supposedly cheap at the moment, please do not reach into the falling knife)

Booking $BKNG (+0.89%)

Marriott $MAR (+0.92%)

Ulta Beaty $ULTA (-0.94%) and/or L'Oreal $OR (-0.44%) (much more expensive)

Mercadolibre $MELI (+0.23%)

Texas Roadhouse $TXRH (-0.91%)

Chipotle $CMG (-1.73%)

Fast Retailing $9983 (-0.3%)

(doesn't fit with the others on the list but I could imagine it as a speculative stock)

"Everything" very expensive, luxury.

I would be interested to know what your favorites are for a long-term investment?

Loose money for steaks

Bear market offensive has started. From now on, every spare euro will be invested. And what could be better than a $TXRH (-0.91%) steak 🥩 at falling prices 🍻

With this in mind... keep going 💪

A steak always works 🤤

With $TXRH (-0.91%)

$CMG (-1.73%)

$MCD (-0.53%)

$DRI (-1.04%)

$DPZ (-1.45%) I have a few restaurants in my savings plan portfolio 😁

Last earnings Texas Roadhouse

- Dividend will increase by 11 % to 0.68$ increased

- Share buyback program of 500 million$

4Q 2024 4Q2023

Turnover 1.437 bn.$ 1,164 billion dollars

Net profit 115 million dollars 72 million dollars

EPS 1.73$ 1.08$

Source

Are you in the industry and what do you have in your portfolio?

Fast (casual) food company wanted🍟

Hi folks,

I'm currently looking for a good fast (casual) food company that is a good place to start. I'm looking for small companies rather than big players like $MCD.

I have in mind especially $WING (-1.78%) and $TXRH (-0.91%)

what do you say?

Trending Securities

Top creators this week