Annual review 2023 - +147% in the portfolio. Every stock analysis in 2023 a bull's eye?

Here you can find the complete article in a well-formatted web view: Jahresrückblick 2023

Happy Birthday: 1 year Investorsapiens

As the first full year draws to a close, the time has come for me to do my first annual review and celebrate the first birthday of investorsapiens.de.

I am also reviewing all previous stock analyses and articles.

With what goal was investorsapiens.de created?

With the start of the technology stock crash at the end of 2021 / beginning of 2022, the irrational behavior of many investors, which I already knew from my distant past during the financial crash (early 2000s), was repeated.

Solidly undervalued shares were sold at huge losses and the remaining money was invested in leveraged warrants in the hope of recouping the losses, just like in a casino. As in a casino, however, the bank usually wins with warrants and the gambler comes away empty-handed in the long term.

Even worse: some people sold everything in a panic and left the stock market for good.

In 2023, a new trend emerged: people sold all their individual shares at a loss and put the money into an ETF.

The first two options are not a solution. Leveraged warrants and KO certificates lead to a total loss for 99% of investors in the long term. An experience that I also had when I started with warrants 16 years ago.

Leaving the stock market is also not a rational solution. In times of historically high inflation, money loses purchasing power very quickly. In addition, it is relatively difficult to build up assets without the stock market.

What about the 1-2 ETFs investment strategy that is currently being hyped?

Is it really the best investment strategy that nothing can match?

Many investors do not seem to be aware of what the ETF actually consists of. After all, the shares that are exchanged for the ETF in a crash make up almost 1/3 of the ETF and have actually been the ETF's performance drivers over the last 10-15 years. The remaining 2/3 of the ETF are thousands of fractional shares of companies that 99% of investors don't even know and would never buy themselves.

There is no question that ETFs are good and important as a passive investment optionIn my investment strategy, I also recommend that absolute beginners who have no experience of the stock market (or no time / no interest) start with a FTSE All World / MSCI World. I also buy the FTSE All World, into which I gradually transfer profits from the shares.

However, the 1 ETF strategy is by far not the best performer. An ETF that consists of 5% Apple can never match the performance of Apple. We are talking about 10x to 20x performance differences in favor of quality stocks. Of course, a single stock has a higher default risk, but that is a matter of risk management and diversification. Before the ETF supporters go into white heat and gasp, please just finish reading.

In addition, with the development of artificial intelligence long before the release of ChatGPT, I saw a new technological disruptive upheaval coming, a so-called Kondratieff cycle with a unique opportunity for investors to profit from the new megatrend. The technology crash was a perfect fit, as it provided a historically favorable entry point (or opportunity to buy more) into existing quality companies such as NVIDIA, Microsoft, Google and others.

We are all currently witnessing the emergence of a new disruptive innovation and, as investors, can be there from the start. The last time investors had a similar opportunity was in the early 2000s with the spread of the internet and Web 2.0.

With the publication of the stock analyses, I wanted to show for the reasons mentioned above that the stock market has much more to offer than the "1-2 ETF strategies". Because with an ETF you cannot invest "smart/targeted" and participate in the developments of the economy and the world in a targeted manner. (But you can certainly profit from general economic growth with a world ETF without having to actively engage with the stock market).

Stock analyses 2023

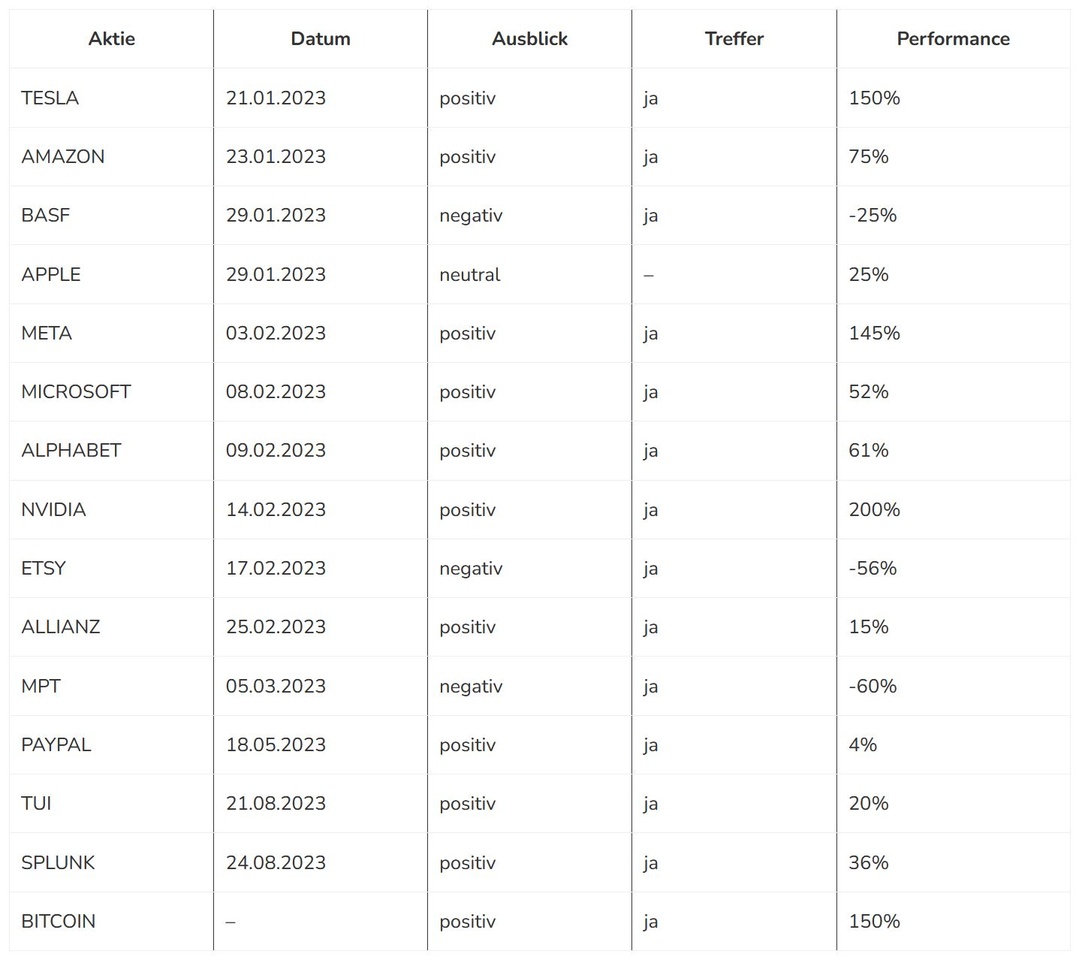

14 stock analyses 14 direct hits

Since January 2023, I have been publishing detailed stock analyses consisting of four parts here and on my website:

- Research on the company and the business segment

- current news and figures

- current overview of analysts' opinions

- Detailed chart analysis

100% hit rate with an average performance of 83%

At this point, I would like to explicitly point out once again that my stock analyses only represent my personal view and, despite the high hit rate and positive performance, do not constitute investment advice. no investment advice and not a recommendation to buy constitute investment advice or a buy recommendation. I make no claim to the accuracy or completeness of the information provided. Many shares are in my portfolio.

Supplementary information to the table below:

The stocks with the negative performance (BASF, ETSY and MPT) were community wish analyses in which I pointed out risks and negative developments. The performance of the shares is not included in the performance because I advise against trading in warrants and leverage certificates. However, if this were added as "capital preservation", the performance would be even higher.

As of today, PAYPAL has only developed very weakly and, with a performance of + 4 percent, is minimally on the positive side. However, as I continue to assume a positive trend and expect prices to rise further, I still count this analysis as a hit and expect prices to rise further. PAYPAL is still in my portfolio.

At the end of the list I have the position "BITCOIN" without a date. In the sections "Investment strategy" and "Bitcoin", I explain why I think a crypto share of 5 to 10 percent in the portfolio makes sense. Since the end of 2022 / beginning of 2023, Bitcoin has also performed positively with a gain of around +150%.

I could not insert a proper table here, so here as a screenshot or as a table on my site.

Share

Share Date

Outlook

Hit

Performance

$TSLA (-3.07%) 21.01.2023 positive yes 150%

$AMZN (+1.56%) 23.01.2023 positive yes 75%

$BAS (-0.06%) 29.01.2023 negative yes -25%

$AAPL (+1.23%) 29.01.2023 neutral - 25%

$META (+0.46%) 03.02.2023 positive yes 145%

$MSFT (+0.63%) 08.02.2023 positive yes 52%

$GOOGL (+1.8%) 09.02.2023 positive yes 61%

$NVDA (+2.31%) 14.02.2023 positive yes 200%

$ETSY (+0.17%) 17.02.2023 negative yes -56%

$ALV (+0.33%) 25.02.2023 positive yes 15%

$MPW (+1.49%) 05.03.2023 negative yes -60

$PYPL (+0.12%) 18.05.2023 positive yes 4%

$TUI1 (+0.27%) 21.08.2023 positive yes 20%

$SPLK 24.08.2023 positive yes 36%

$BTC (+0.5%) - positive yes 150%

Individual shares Performance 83 percent

If you put together a portfolio from the 11 shares analyzed above + Bitcoin and weight everything notionally with, for example, 1000 euros. At the end of the year, 11,000 euros invested would have become 20,080 euros. A performance of + 83 percent. I have not included Apple (neutral), BASF (negative), ETSY (negative) and MPT (negative) in the performance. Theoretically, you could add the stocks that I warned about and which then fell sharply as a positive return as "capital preservation", but I have not done this, I have only included the positive outlooks in the analysis.

The two ETFs: FTSE All World and MSCI World will achieve a performance of around 20 percent in 2023. Here, too, the performance is largely attributable to the same stocks. The top 10 of MSCI consists of: Apple, Microsoft, Amazon, NVIDIA, Alphabet, Meta and Tesla.

Portfolio performance 2023

A plus of 147 percent

The performance of the investorsapiens.de portfolio in 2023 (01.01.2023 to 26.12.2023) was +147 percent in total, based on the absolute portfolio value on 31.12.2022.

The overall performance is made up of the performance of the investment and the monthly payments (savings installments) together. For the sake of completeness, I must of course mention that 2023 was a particularly good year. How much we will achieve in 2024 is completely open.

Investments in AI and technology stocks in particular have performed very well. By way of comparison, the portfolio performance in 2022 was +78% (performance + savings rate).

investorsapiens.de - The website

Finally, I would also like to highlight the development of the investorsapiens.de website/project itself in 2023. Because this is directly related to the content that I will make available here in the future.

The attentive reader has probably noticed. In January 2023, I launched an interactive "Stock analysis of the week" format. I gave the community a choice of around 10 stocks. I then analyzed the stock with the most votes for you. In February, I sometimes even published 2 analyses per week:

- 4 stock analyses in January

- 6 stock analyses in February

But then the "stock analysis of the week" format disappeared and the stock analyses were published only rarely

- In the months from March to December, there were only 3 stock analyses in 10 months in total

Why is that?

Even though stock analyses are exactly the kind of content that I enjoy very much, the effort involved in preparing the analyses, both in terms of content and appearance, is disproportionate to the feedback that I received. In fact, none at all. Despite high four-digit access figures, there were hardly any social media follows or social media shares and hardly any newsletter subscriptions.

A stock analysis alone takes me half an hour: I skim the latest news, look at the key figures and quickly run a chart analysis on Tradingview and I have everything I need to make an informed decision. After 16 years on the stock market, this is an automatic process that hardly requires any time or effort.

A proper article/post, on the other hand, takes me many hours. If there are also graphics that have to be created or selected in a decent quality in compliance with copyright law, an analysis can easily take 1-2-3 days. As I work a lot in my main job, after two months I had to ask myself whether I was still prepared to sacrifice 100% of my free time for stock analyses that ultimately bring me nothing. At the latest after the "worried" call from the tax office asking whether it was true that the website had actually generated a four-figure loss and no income at all, I realized that I would have to think about something in the long term. Never before had the tax office been so touchingly concerned about me :D

So I invested more time in informative articles and organic reach. In the period from March to December 2023, I published 12 articles / posts aimed at organic reach. The feedback was immediately noticeable. Growing organic visitor numbers, cooperation requests from companies, universities and other financial blogs and organizations were a welcome change. The long-term minimum goal must be to cover the ongoing fixed costs, as I am currently financing this project from my own deposit, which is definitely not healthy and is a very expensive hobby.

To put the above into figures as an example: The stock analysis for NVIDIA, with over 200 percent performance was shared a whole 0 times. Neither on Facebook, nor on Twitter, nor on any other social media networks. The response was a whopping 0, despite four-digit read accesses.

But as I'm not a person who gives up quickly, I'll give it some more time. Perhaps the share analyses will be more popular after all, or the feedback will at least come close to the number of hits. If so, I will of course be prepared to devote more time and energy to the analysis. So please let me know if you would like to see more stock analyses in 2024:

Subscribe to the newsletter, follow me on social media and on Getquin. For you it's just a click, for me it's a sure sign that the work wasn't in vain.

Until then, Happy New Year 2024, have a good start to a no less successful and profitable 2024 🙂 🥂