$BNTX (-0.82%)

$KSPI (+0.31%)

$HIMS (+2.1%)

$MELI (+0.67%)

$PLTR (+0.08%)

$DRO (+3.42%)

$IFX (-1.99%)

$9434 (+1.36%)

$FR0010108928

$DHL (-0.65%)

$BOSS (+0.07%)

$CONTININS

$DOCN (-0.59%)

$LMND (+1.7%)

$BP. (+1.96%)

$FRA (+0.34%)

$PFIZER

$SNAP (+0.25%)

$AMD (+0.13%)

$SMCI (+1.05%)

$OPEN (+0.95%)

$CPNG (+0.32%)

$LCID (+0%)

$CBK (+1.03%)

$ZAL (+0.27%)

$NOVO B (-0.87%)

$VNA (-1.51%)

$BAYN (+0.14%)

$UBER (+0.69%)

$SHOP (+0.46%)

$MCD (+0.06%)

$DIS (-0.11%)

$ROK (+0.58%)

$ABNB (-0.15%)

$RUN (+1.65%)

$FTNT (+0.38%)

$O (+0.22%)

$DASH (+0.03%)

$DUOL

$S92 (-1.08%)

$DDOG (+0.75%)

$SEDG (+2%)

$QBTS (+11.63%)

$RHM (-0.73%)

$DTE (+0.12%)

$ALV (+0.11%)

$LLY (-0.57%)

$CYBR (+0.1%)

$PTON (+0.81%)

$DKNG (+0.73%)

$RL (+1.64%)

$PINS

$TTWO (-0.07%)

$TWLO (+0.39%)

$MNST (-0.02%)

$STNE (+0.51%)

$MUV2 (+0.55%)

$WEED (+2.19%)

$GOOS (+0.07%)

$PETR3T

$ANET (+0.59%)

- Markets

- Stocks

- Solaredge Tech

- Forum Discussion

Discussion about SEDG

Posts

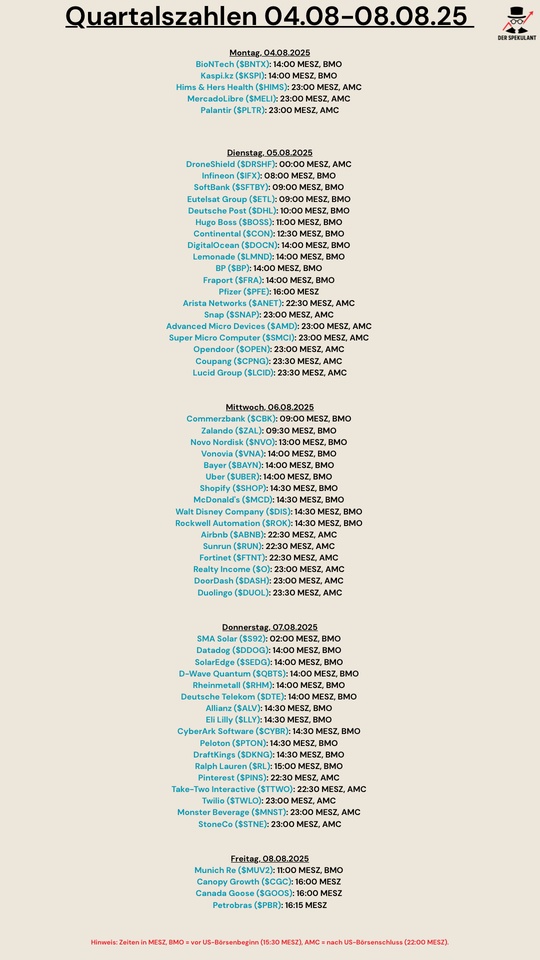

40Quartalszahlen 04.08-08.08.2025

Top top

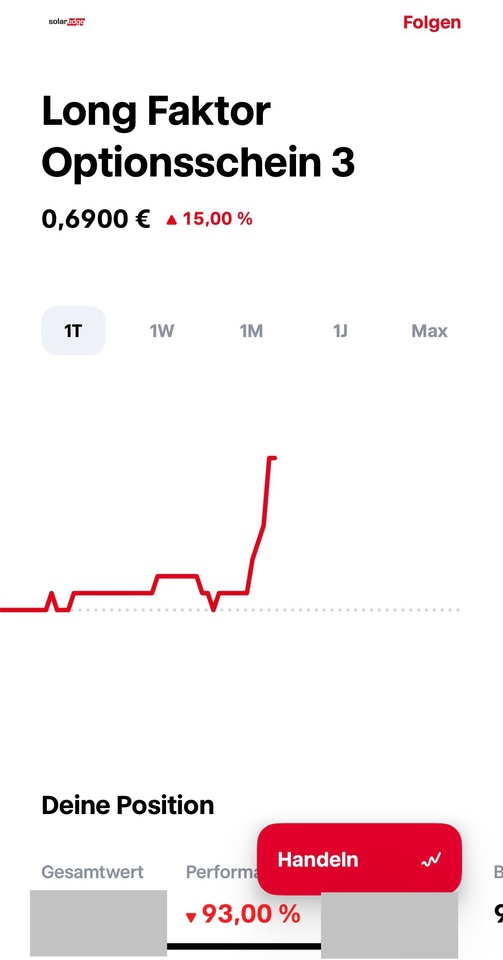

$SEDG (+2%) ohhh my god 🤣🤣🤣🤣

Solaredge pullback

$SEDG (+2%) Does anyone know why Solaredge is down so much today?

Signing of safe harbor agreements with leading US providers of solar systems and financing solutions

At the end of December, the company signed safe harbor agreements with Sunrun

with Sunrun (Nasdaq: RUN) and one of the largest solar

financing companies for solar installations in the USA. Under the terms of these

agreements, SolarEdge will supply inverters, power optimizers and batteries

inverters, power optimizers and batteries, which will be manufactured

manufacturing facilities. In combination with other components manufactured in the USA

components, these products will enable SolarEdge's partners to qualify for

partners to qualify for tax credits for domestic content.

content tax credits. Deliveries under the

safe harbor agreements are expected to continue throughout 2025.

year.

By providing inverters produced in the USA,

power optimizers and batteries, SolarEdge's installation and financing

SolarEdge's installation and financing partners plan to secure the applicable investment and tax

tax credits for domestic content. This

provides better predictability for their business activities and

creates more certainty regarding the profitability of their

projects.

$SYM

FILES TO DELAY 10-K DUE TO REVENUE RECOGNITION ERRORS

Symbotic has delayed its FY2024 10-K filing, citing the need to address errors in revenue recognition related to cost overruns on deployments that won’t be billable. These issues impact system revenue, gross margin, and net income across Q2-Q4 of FY2024, with previously reported results deemed unreliable.

Revised estimates for FY2024 include revenue growth of $605M-$615M (vs. $645M initially reported) and a narrowed net loss of $117M-$127M (reflecting a $30M-$40M adjustment). Symbotic expects to file the corrected 10-K within the 15-day extension period.

__

$SEDG (+2%) TO CUT 500 JOBS, EXIT ENERGY STORAGE BUSINESS

SolarEdge is cutting 500 jobs, about 12% of its workforce, as it shuts down its energy storage division to focus on its core solar operations. Most layoffs will affect manufacturing roles in South Korea, with nearly all set to occur in the first half of 2025.

The pivot will result in $81M-$99M in charges from asset impairments, inventory write-offs, and severance. SolarEdge plans to partially offset these costs by selling off the energy storage unit's assets.

$SEDG (+2%) | SolarEdge Technologies Q3 Earnings Highlights:

🔹 Revenue: $260.9M (Est. $272.8M) 🔴; DOWN -64% YoY

🔹 GAAP EPS: -$21.13; Non-GAAP EPS: -$15.33 (Est. -$1.65) 🔴

🔹 GAAP Net Loss: $1.21B vs. $61.2M loss YoY

🔹 Adjusted EBITDA: Not provided due to large write-downs and impairments

🔹 GAAP Gross Margin: -269.2%, down significantly from 19.7% YoY

Q4 Guidance

🔹 Revenue: $180M - $200M (Est. $309.2M) 🔴

🔹 Non-GAAP Gross Margin: -4% to 0%, inclusive of ~1000 basis points from IRA manufacturing tax credit

🔹 Solar Segment Revenue: $170M - $190M

🔹 Solar Segment Gross Margin: 0% to 3%, inclusive of ~1050 basis points from IRA manufacturing tax credit

🔹 Non-GAAP Operating Expenses: $103M - $108M

Segment Revenue

🔹 Solar Segment: $247.5M, DOWN -63% YoY

🔹 Non-Solar Revenue: Not specifically detailed

Operational Metrics

🔹 Inverters Shipped: 850 MW (AC)

🔹 Battery Shipments: 189 MWh for PV applications

Impairments and Write-Downs

🔸 Total impairments and write-downs of $1.03B, contributing heavily to net loss

CEO Commentary

🔸 "We are diligently focused on three main priorities: financial stability, recapturing market share, and refocusing on our core solar and storage opportunities. Despite the current challenges, I am confident in our path to restoring profitability." – Ronen Faier, Interim CEO

Other Financial Metrics

🔹 Cash Used in Operating Activities: $63.9M, compared to $40.6M generated in the same quarter last year

🔹 Cash, Equivalents, and Marketable Securities: $53.3M, down from $165.3M in Q2

INITIAL MARKET REACTION TO TRUMP VICTORY:

- U.S. Stocks: Broadly higher across sectors

- $XLF: Big banks higher on expectations of regulatory relief, M&A growth

- Cannabis Stocks: $WEED (+2.19%), $MSOS, $TLRY (+0.34%) down as Florida votes against legalization

- $CVS (-0.76%), $UNH (-1.58%) : Health insurers rally on potential easing of Medicare Advantage pressures

- $XLE (+1.76%) , $XOM (+2.04%): Energy stocks higher, anticipating fossil fuel support and less regulation

- Solar/Renewables: Pressure on $FSLR (-0.18%), $SEDG (+2%), EV, hydrogen, and battery stocks as clean energy subsidies could be rolled back

- Crypto: Higher as Trump holds a favorable stance, $BTC (+2.44%) strong

- $TSLA (-3.2%): Higher after Trump Win as Musk was all-in on support

- Bonds: Weaker, with yields rising on fiscal concerns

- China Stocks: Weak as tariff pressures and anti-China policy concerns grow

- Peso/Mexican Equities: Weaker on aggressive trade policies and tariffs fear

- FinTech: Higher with $HOOD (+1.32%), $AFRM (+1.48%) , $SQ (+0.76%), $SOFI (+1.02%) responding positively

- Dollar: Stronger due to pro-business policies

- $META (-0.12%), $SNAP (+0.25%): Mixed as TikTok ban concerns ease

- Overall: Dollar, crypto, energy, banks, and U.S. stocks higher; bonds, renewables, and cannabis under pressure.

If you are interested in renewables and hydrogen (shares), here is an extremely easy to understand podcast that deals with many airlock theories such as the resurgence of nuclear energy.

can be listened to on the side

https://www.youtube.com/watch?v=fbSEfu6g3c4

$NEL (-1.56%)

$VWS (+0.9%)

$UKW (-0.4%)$FSLR (-0.18%)

$SEDG (+2%) and for whom it might still be relevant

Trending Securities

Top creators this week