1. Executive Summary ($CRM (-0.54%) )

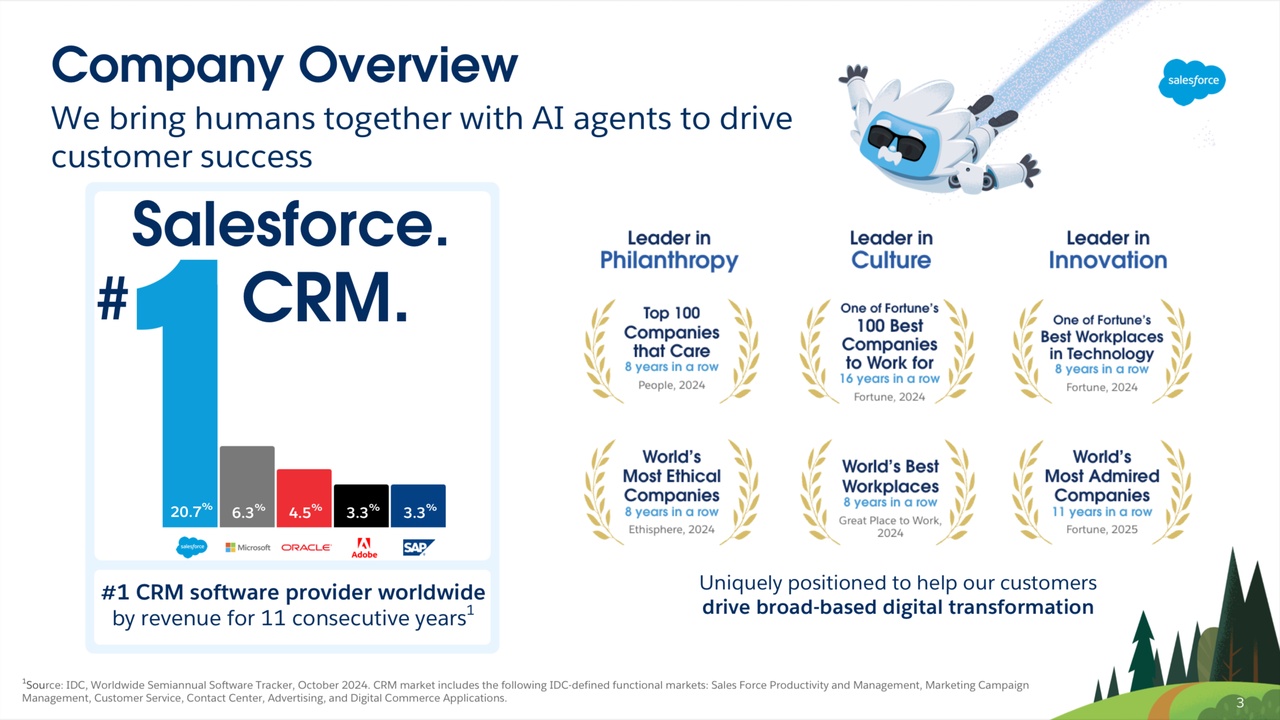

Salesforce is far more than the CRM pioneer it once was. It has grown into the global leader in customer management and enterprise platforms, with a market share of more than 20% in CRM and a presence that touches nearly every industry. Its suite spans sales, service, marketing, commerce, data, integrations, and now AI-driven automation. That breadth matters: it creates sticky recurring revenue, vast up-sell opportunities, and a platform effect that embeds Salesforce deeply in its customers’ operations. For many enterprises, Salesforce is not a tool but infrastructure.

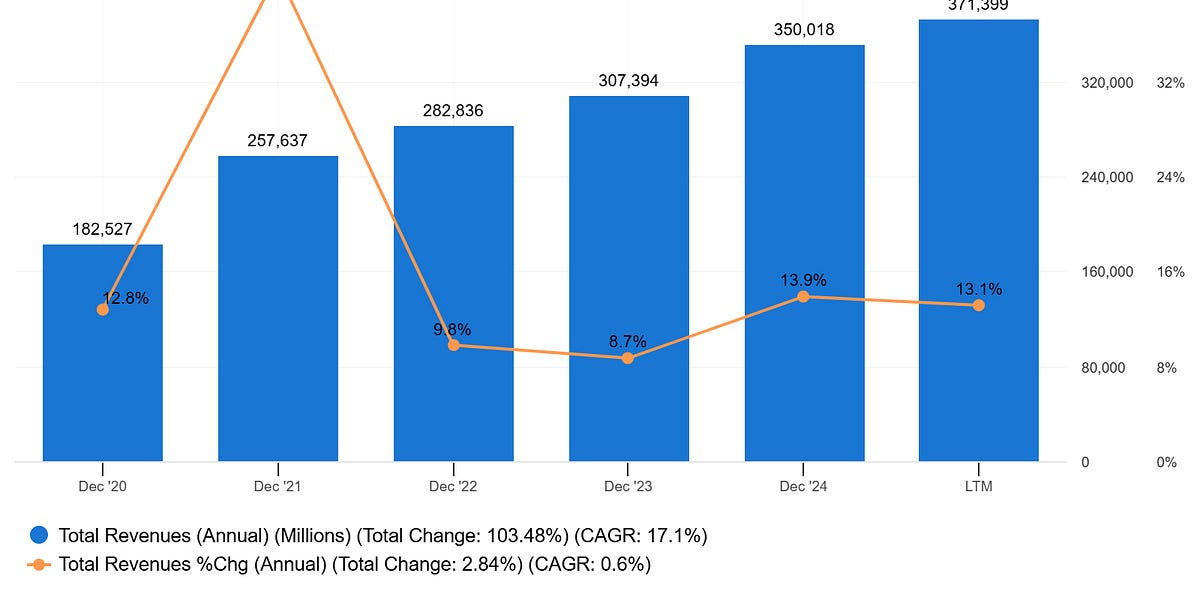

Growth has slowed from its hyper-scale days — that is well known — but the company remains highly profitable and free-cash-flow generative, with margins expanding year after year. Despite skepticism, AI traction is building: Data Cloud and Agentforce have already reached over $1.2 billion ARR, growing triple digits. While Agentforce has not yet delivered the full investor expectations, adoption is happening — just more gradually. Combined with relentless buybacks, margin expansion, and M&A optionality like Informatica, Salesforce is positioned as both a defensive anchor and a growth story.

2. Macro Environment

- Enterprise digitization continues. Companies still need CRM, automation, observability, and integrations — even in weaker macro environments. Digital transformation budgets shift but do not disappear. And AI is not negatively impacting the business, as many predicted.

- AI is changing buying behavior. Firms that can deliver useful AI agents (automation that actually reduces headcount or materially improves conversion) get prioritized spend. That is why Salesforce’s Agentforce matters.

- Regulation and data policy are rising risks. Data residency, privacy, and AI governance are now procurement checkboxes — vendors must prove security, explainability, and compliance. Salesforce has built an excellent reputation and loyal customer base.

Capital returns matter to investors. With M&A and buybacks active across tech, capital allocation signals competence; Salesforce has been aggressive on repurchases, which shapes market sentiment.

3. Company Overview & Segmentation

Salesforce is a collection of franchise products combined into one commercial conglomerate. Keep this in mind: it is not one product getting bigger — it is multiple monetizable pillars that cross-sell. Salesforce is highly diversified and all sectors continue to grow.

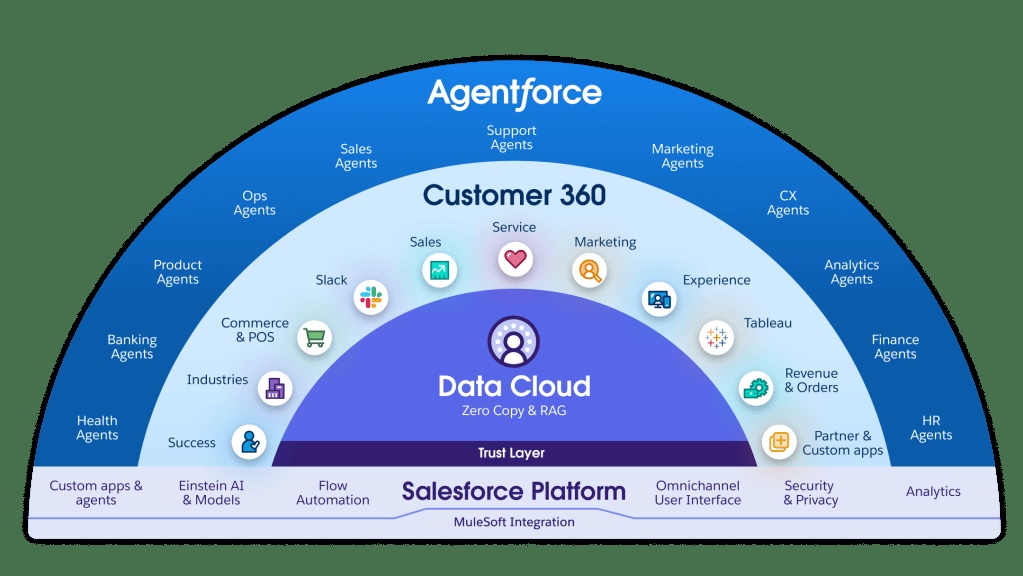

- Subscription & Support (core): The classic SaaS engine — Sales Cloud, Service Cloud, Marketing Cloud, Commerce. This is the revenue anchor and the reason customers stay. Subscription & support made up the overwhelming majority of the revenue base in the last reported quarter. This business is extremely sticky and embeds Salesforce products into clients’ systems, making disengagement costly and slow.

- Platform, Integration & Data (Data Cloud, MuleSoft, Tableau): Data Cloud sits at the center of the company’s AI play — it is where customer data is unified and prepared for AI agents and analytics. MuleSoft and Tableau are critical for integration and insight, respectively.

- AI & New Product Revenue (Agentforce, Data Cloud monetization): Agentforce is Salesforce’s attempt at “digital labor” — AI agents that automate workflows. Early signs show real traction: Data Cloud + AI reached a notable run-rate and is growing fast, suggesting AI is moving from demo to dollar. While not yet satisfying many investors, this section has incredible potential and keeps delivering quarter after quarter.

- Professional Services, Marketplace & Ecosystem: Slack, AppExchange, professional services, and partners round out the go-to-market. These are less about high margins and more about customer stickiness and expansion.

Put simply: subscription reliability + platform extensibility + AI optionality = the modern Salesforce investment case.

4. Financial & Operational Performance (latest, Q2 FY26 highlights)

- Revenue (Q2 FY26): $10.2 billion, +10% year-over-year.

- Subscription & Support: approximately $9.7 billion in the quarter, up approximately 11% YoY.

- CRPO (current remaining performance obligation): $29.4 billion, +11% YoY — solid forward visibility.

- Margins: GAAP operating margin approximately 22.8%; non-GAAP operating margin approximately 34.3% (margin expansion continues).

- Capital return (quarter): Returned $2.6 billion to shareholders (approximately $2.2 billion buybacks + $399 million dividends); board expanded the buyback authorization, bringing the total to $50 billion. This is a strong signal of management’s confidence in the company’s future and positioning. Leadership considers the stock cheap and continues to reduce share count.

- Data Cloud / AI traction: Data Cloud + Agentforce reached roughly $1.2 billion ARR and grew approximately 120% YoY — these “future” sections are showing strong traction, defying analysts’ expectations.

- Guidance (FY26): Revenue expected $41.1–41.3 billion; non-GAAP operating margin guidance nudged to approximately 34.1%; operating cash flow growth raised toward approximately 12–13% YoY.

Takeaway: the numbers show a company that is maturing (single-digit to low-double revenue growth), but with improving profitability and a growing, monetizable AI franchise. Margins are expanding every year with a free cash flow margin of more than 32%. The company is highly profitable and cash-generative. While Agentforce has not yet yielded the desired results, it continues to grow and is on an upward trajectory. The fundamentals do not show a move away from Salesforce, rather the opposite.

5. Growth Drivers

- Agentforce monetization: This is the single most important optionality. Most of Salesforce’s fall from grace can be credited to a perceived lack in AI integration and monetization. Agentforce has not delivered to investors’ expectations yet. However, while not at the desired pace, AI integration is ramping up, and customers are adapting to Agentforce. This is Salesforce’s future, and it works, though it could need a boost.

- Expansion within the installed base (upsell): Salesforce sells more to existing customers than to new ones. Industry cloud packs, analytics add-ons, and AI features drive high-margin expansion revenue. This drives Salesforce’s fundamentals from solid to exceptional. While growth has slowed, margins continue to increase substantially.

- Platform & integration demand: MuleSoft + Tableau + Slack = a full integration and collaboration stack. Customers that standardize on Salesforce for both data and apps create switching costs. The SaaS behemoth does a very good job in keeping customers and leading them to the full array of its products. Salesforce is on the path of becoming an all-in-one solution, which increases stickiness and attractiveness for potential customers.

- Verticalization: Industry-specific solutions (healthcare, financial services, public sector) allow premium pricing and deeper penetration. As top-line growth slows and Salesforce emphasizes margin expansion, customized solutions are more important than ever.

Capital returns & M&A optionality: Aggressive buybacks (and selective M&A like Informatica) can amplify EPS and add capabilities, making the investment thesis more compelling even in slower organic growth environments. Also, this adds a layer of internal confidence on the investment case, which could boost investors’ morale. The company is acquiring other companies as well as its own shares — one of the most reassuring combinations. Besides, with a continually increasing free cash flow and a margin north of 32%, management can afford these investments.

6. Competitive Landscape

- Salesforce is the global leader in CRM & enterprise cloud platforms, commanding a large share of the global CRM market (between 20–30%, depending on sources) and enterprise SaaS spend. Salesforce is the first choice for legacy companies driving digitalization. Because so many enterprises use its core clouds (Sales, Service, Marketing, Commerce), it sits deep in the workflow of its customers — not just as a tool, but as part of the operating backbone. The company is deeply embedded across the entire economy, which creates a wide moat, considering the stiff structures many corporations operate in. It is highly unlikely the CEO of BMW wakes up one day and decides that Microsoft offers a better package.

- Large incumbents: Microsoft (Dynamics + Azure), Oracle, SAP — all have cloud/CRM ambitions. Microsoft is notable because it bundles CRM with Office/Teams/Power Platform. However, all these competitors fall behind Salesforce in terms of sheer size and CRM-specific reputation.

- Data & AI rivals: Snowflake, Databricks, AWS/Azure ML services — Salesforce must defend the data/AI layer as much as CRM. Which it does, however not to the extent the markets would like to see at the moment.

- Nimble startups: Specialized automation and AI vendors can undercut on price or user experience; Salesforce must integrate or out-innovate. However, this is a risk accompanying practically every company on this planet and remains manageable, assuming industry understanding and surveillance, which should be a given for a company of Salesforce’s size.

- Regulatory & trust barriers: Increasingly, customers prefer vendors with strong compliance, which is a moat if Salesforce maintains good controls and data governance – as it always did in the past. The company has a trusted name, which is extremely valuable, especially for potential new customers weighing the best solutions against each other.

Bottom line: Salesforce’s scale and ecosystem are huge advantages, but the company must keep executing on product integration and AI monetization to stay ahead. The SaaS giant is in the prime spot to do so, with stellar, founder-led management, high cash flows, and an undervalued stock, which takes away pressure to meet short-term criteria.

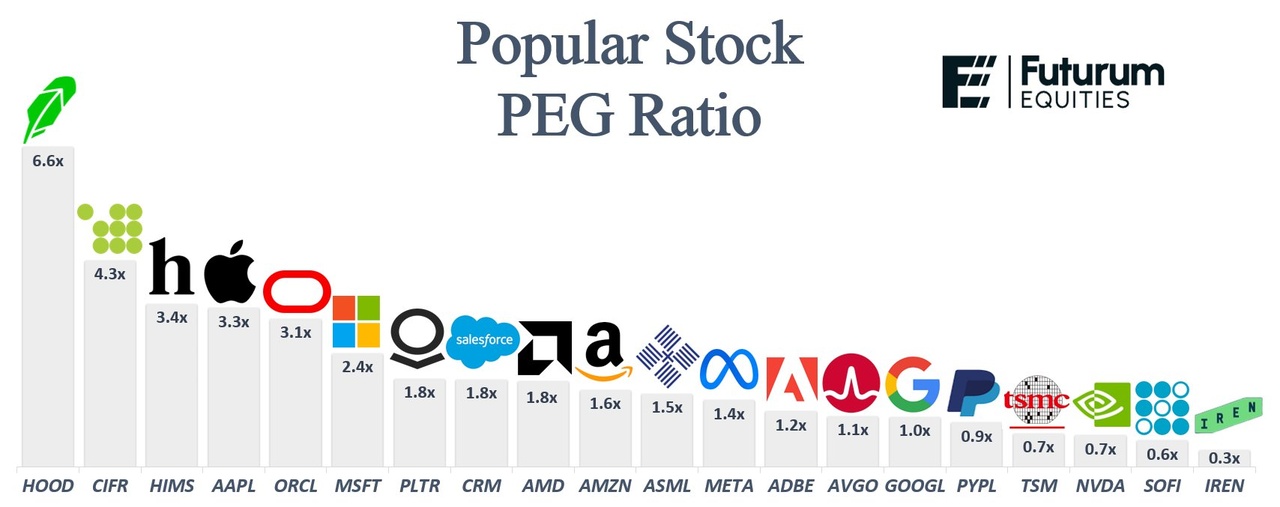

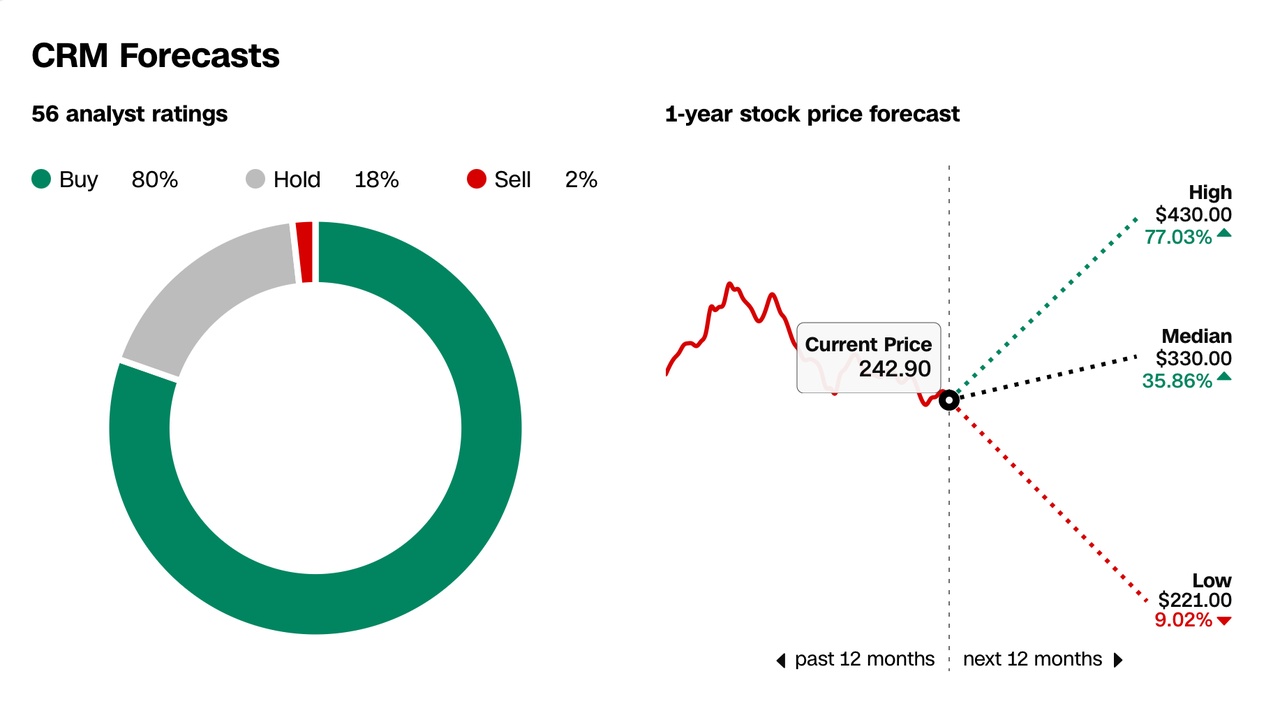

7. Valuation & Investor Sentiment

Valuation sits in the 30s on forward P/E and a forward EV/revenue of around 5, which reflects the expectation that growth will stabilize but margins and cash flow will keep improving. Both of these valuation metrics are at multi-year lows, due to investors’ concerns about AI disruption. However, none of this can be seen at this moment in time. The company is very high quality, with a strong moat and reputation.

Sentiment is mixed: investors like the margin and buybacks, but as pointed out before, others believe AI integration is not happening fast enough and Salesforce loses its position. The stock trades on a blend of defensive revenue and optional AI upside — comfortable, but not necessarily cheap relative to slower-growing software names. However, if some signs of AI reaccelerating growth appear, markets could be quick to re-rate the stock back to historic P/E ratios, which lie significantly above current levels.

Downside is limited, the earnings show solid quarters. The stock is priced for the current case: slow AI integration in a dying industry. Nevertheless, in my opinion, this is the most unlikely case, considering companies’ reliance on CRM services and Salesforce’s position in this market.

8. Risks & Challenges

- Growth complacency: If AI monetization stalls noticeably, the stock could re-rate lower because base business growth is slowing. However, as mentioned before, this has already happened drastically, which points at limited further downside potential.

- Execution risk on Agentforce/Data Cloud: Early ARR is encouraging, but conversion at scale and gross margin retention remain unproven long term.

- Large-tech competition: Microsoft/Azure and cloud providers can bundle solutions aggressively. If AI integration gains traction at Microsoft, Salesforce could face increased competition.

- Regulatory/data issues: Any misstep on privacy or AI bias could dent adoption and slow sales. Cyberattacks have been known to be able to cause major damage at software companies, and are becoming increasingly more common.

9. Catalysts & Timeline

- Short term (next 6–12 months): continued CRPO strength and Data Cloud/Agentforce deal announcements — if bookings show consistent, accelerating adoption, investor sentiment will improve. Q3 guidance and Dreamforce (annual event) messaging will be important. If Agentforce impresses, a rebound seems reasonable.

- Medium term (12–24 months): successful integration of Informatica and scaling of Agentforce into a high-margin business could materially change growth math.

Operational: margin expansion and operating cash flow growth (company pushed guidance higher) should steadily lift free cash flow per share — buybacks will amplify EPS if revenue growth stays stable.

10. Conclusion

Salesforce is not just another software company — it is the backbone of enterprise CRM and increasingly the fabric of enterprise data and AI integration. With more than 20% global CRM market share, a sticky subscription base, and a sprawling ecosystem, the company has a defensible moat. Margins are rising, free cash flow is strong, and management is aggressively buying back shares.

Markets have the stock priced as if Salesforce were losing share and stumbling on AI. The numbers paint a different picture: AI integration is happening, even if slower than some hoped, and management signals confidence through capital returns. The next 12 months will be decisive: either AI converts into faster growth and the multiple expands, or adoption stumbles and the company trades more like a mature software roll-up. This means either the stock will trade around the levels it is now or break out upwards.

For long-term investors who believe AI will be monetized at scale inside enterprises, Salesforce remains a core holding. The company is in a prime spot to integrate AI — and it has time, thanks to its reputation and large, loyal customer base.