As every Sunday, the most important news from the past week, as well as the most important dates for the coming week.

Also as a video:

https://youtube.com/shorts/vgEC8AK9nrA?si=Luo_VSckLrkhrVLu

Monday:

Despite fairly high inflation, Bank of England central banker David Ramsden sees further interest rate cuts. The prime rate currently stands at 4.0%, with inflation at 3.8%. The BoE left the prime rate at 4.0% in the middle of the month, after 5 cuts in a row.

Tuesday:

Inflation in Germany rises to 2.4%, slightly above expectations. While energy prices are falling, services in particular are becoming more expensive.

Wednesday:

At 2.2%, the inflation rate in the eurozone as a whole is also above the ECB's target of 2.0%. The price driver of food costs in particular makes further interest rate cuts unlikely for the time being.

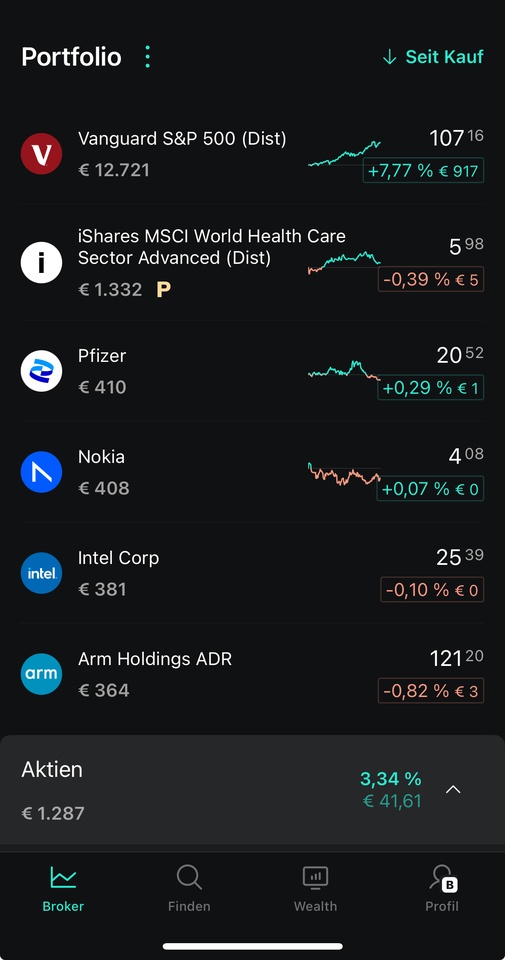

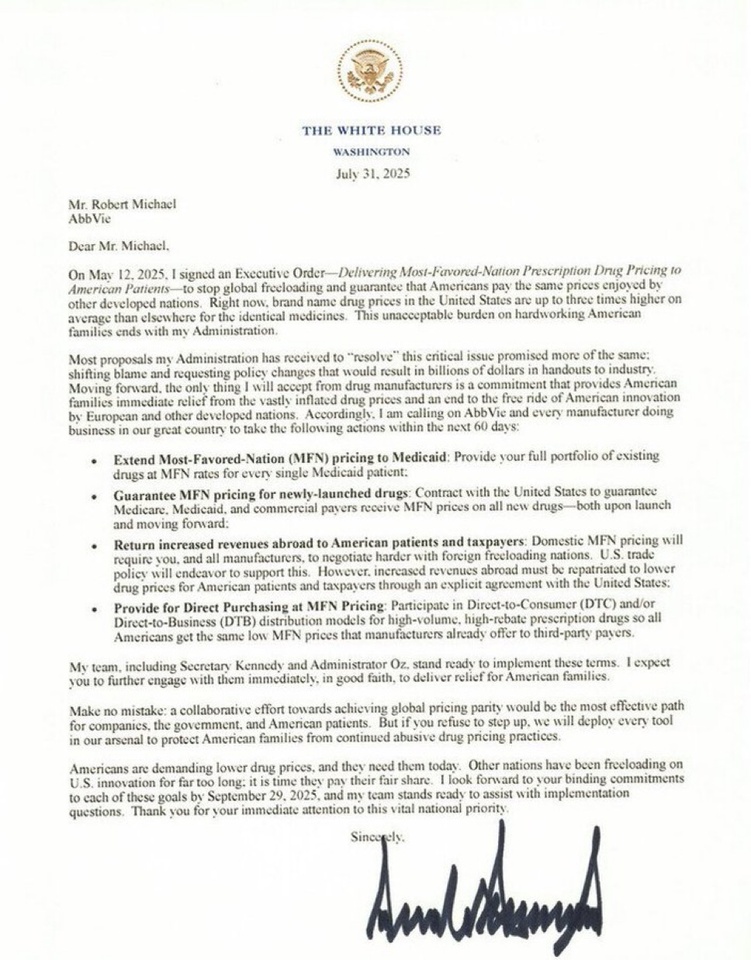

Pharmaceutical companies$BAYN (-0.5%) Bayer benefits from Trump's announcement of the new government platform TrumpRX. In future, US Americans will be able to buy medicines more cheaply via this platform. After an initial deal with $PFE (-0.34%) Pfizer, other pharmaceutical manufacturers are now hoping for deals and thus tariff relief. The threatened tariffs are 100%.

Donald Trump cannot dismiss Fed member Lisa Cook for the time being. The Supreme Court ruled that the council member can keep her position for the time being. However, there will be another decision in January. The markets initially reacted calmly, as it underscores the Fed's independence.

For the first time in 6 years, the USA is in shutdown again. Many employees of federal authorities are being sent on forced leave.

https://www.zeit.de/politik/ausland/2025-10/usa-shutdown-behoerden-haushalt-republikaner-demokraten

Friday:

While it was German Unity Day in Germany, it was business as usual in the USA. The labor market figures are of course interesting in this context. However, they were not available today because the Bureau of Labor Statistics was on forced leave due to the shutdown. Almost like the public holiday in Germany.

https://www.nbcnews.com/news/amp/rcna235298

These are the most important dates for the coming week:

Wednesday: 01:50 Current account (Japan)

Wednesday: 20:00 FOMC Minutes (USA)

Thursday: 08:00 Trade Balance (DE)

Can you think of any other dates?