Hi guys,

Which stocks are you buying this week?

I took advantage of the dip to do a little shopping, here are my buys:

If it goes under 180$ I'll laso considering buying $WING (-0.89%)

Posts

9Hi guys,

Which stocks are you buying this week?

I took advantage of the dip to do a little shopping, here are my buys:

If it goes under 180$ I'll laso considering buying $WING (-0.89%)

🧠 "If you're in a hurry, walk slowly." - Confucius

Many investors dream of early retirement - financed by regular dividend payouts. But which strategy will get you there faster? A high dividend yield or a consistent dividend increase? The answer depends heavily on individual goals, the investment horizon and personal circumstances.

🔹 Dividend yield

The dividend yield indicates what percentage of the current share price is paid out as a dividend. Companies with a high dividend yield often pay out a large proportion of their profits and cash flow to their shareholders. This is particularly common for large companies and in sectors such as utilities, telecommunications or REITs.

🚨 Attention:

A high payout may mean that the company has hardly any growth opportunities or does not know how to use the capital efficiently. There is also a risk of dividend cuts in difficult economic times.

🔹 Dividend increase

Dividend growth measures how strongly a company's distributions grow over the years. Companies with a high dividend growth rate often start with a lower initial yield, but offer a higher personal dividend yield in the long term.

✅ Advantages:

These companies are usually smaller, grow faster and only pay out a moderate proportion of their profits. This leaves more capital for expansion and future dividend increases. In the long term, investors benefit not only from rising dividends, but often also from a better share price performance.

Which strategy is better for early retirement?

There is no one-size-fits-all answer - the choice depends on the individual situation:

✅ Short-term income strategy:

Those who already want to live off dividends today are more likely to focus on companies with high dividend yields.

✅ Long-term wealth accumulation:

If you have the time, you can focus on dividend growth to generate a strong passive income in the long term.

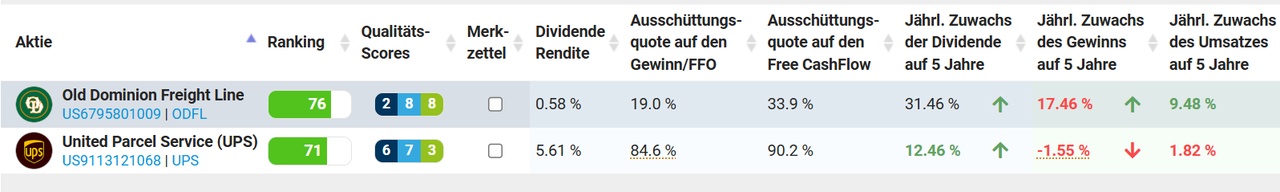

My personal approach

I pay attention not only to the dividend yield and increase, but also to sustainable growth in profits and sales. It is also crucial that the dividend is covered by free cash flow. For investment-intensive sectors, I use the operating cash flow as a benchmark, for REITs the funds from operations (FFO).

Practical example: $UPS (+0.01%)

vs. $ODFL (+0.75%)

🚚

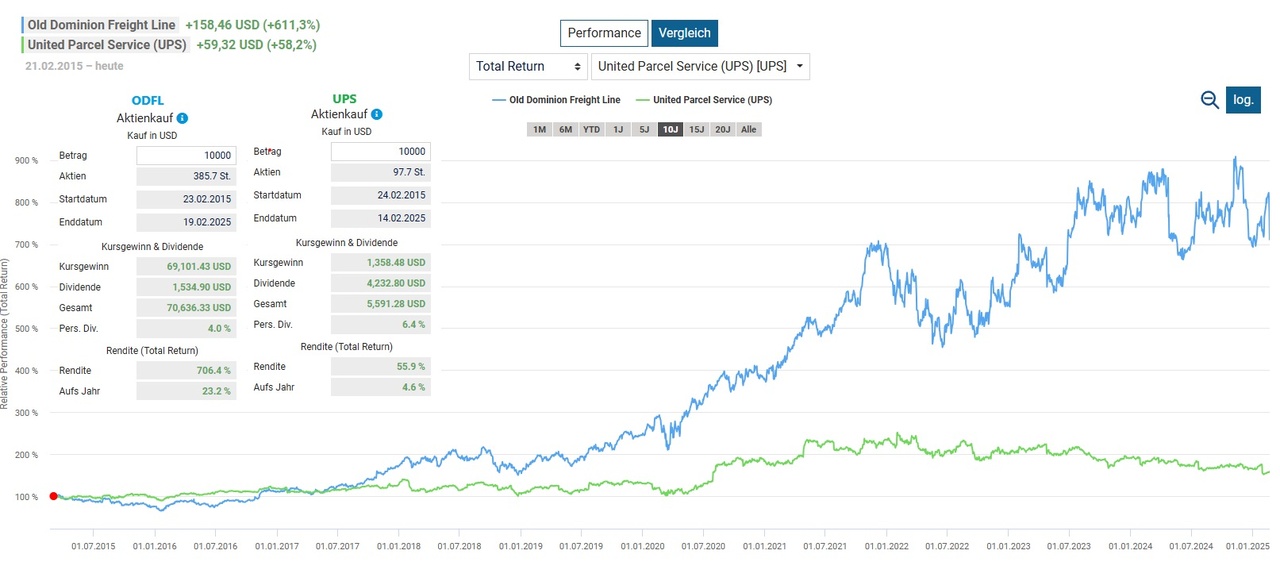

To compare theory with practice, I compare UPS and ODFL - two industry-related companies from the transportation sector.

📌 UPS stands for a company with a higher dividend yield.

📌ODFL on the other hand, stands for a company with a higher dividend increase.

As can be seen from the charts, the pattern described is confirmed:

📉 UPS offers an attractive dividend yield in the short term, but in view of the weak share price performance, this could be seen more as "pain and suffering".

📈 ODFL on the other hand, is growing more dynamically, continuously increasing its dividend and at the same time showing a significantly better and more stable share price performance.

➡️ Conclusion:

At first glance, the high dividend yield strategy may appear more tempting, as it generates higher payouts in the short term. However, a look at the long-term development shows a different picture.

Anyone who has invested in the last 10 years on $UPS (+0.01%) have actually been able to achieve a higher cumulative dividend yield.

But over a period of 20 years the ratio is reversed: Due to the steady increase in dividends, the payout grows at $ODFL (+0.75%) so strongly that the dividend yield calculated on the original investment is significantly higher than for $UPS (+0.01%) .

In addition to the higher dividend income, investors in $ODFL (+0.75%) also benefit from a significantly better and more stable share price performance, which further increases the overall return potential. This example shows that it pays off in the long term to invest in companies with solid dividend increases and sustainable growth.

💬 Which strategy do you prefer? High initial yield or long-term dividend growth? Let us know in the comments! 🚀💰

Disclaimer:

This analysis is for information purposes only and does not constitute investment advice or a recommendation to buy/sell financial instruments. It is not an invitation to trade in securities. Historical performance is not an indicator of future results. Investments in securities involve risks and should be carefully considered.

⚠️ Important note: The selected examples $UPS (+0.01%)

and $ODFL (+0.75%) serve to illustrate extreme contrasts between high dividend yields and high dividend growth. They are deliberately chosen to highlight the difference, but do not represent the entire market or every possible investment strategy.

$UNH (+1.21%) I understand today because of DoJ investigations etc. but what about $ODFL (+0.75%) the -8.6%, did something important happen? Does anyone know?

Announcements of dividends/distributions today

AIRPORTS OF THAILAND PCL

$AOT-F (+0.96%) TH0765010Z16 - 0.79 THB - 0.0219 EUR

ALIMENTATION COUCHE-TARD INC

$ATD (+2.03%) CA01626P1484 - 0.195 CAD - 0.1319 EUR

FUTUREFUEL CORP

$FF (+1.41%) US36116M1062 - 0.06 USD - 0.057 EUR

KIMBERLY-CLARK DE MEXICO SAB DE CV

$KIMBERA (-1.82%) MXP606941179 - 0.465 -MXN 0.0217 EUR

GLADSTONE CAPITAL CORPORATION

$GLAD (-0.18%) US3765358789 - 0.4 USD - 0.3806 EUR

OLD DOMINION FREIGHT LINE INC

$ODFL (+0.75%) US6795801009 - 0.26 USD - 0.2474 EUR

OLD POINT FINANCIAL CORPORATION

$OPOF US6801941070 - 0.14 USD - 0.1332 EUR

PACIFIC TEXTILES HOLDINGS LTD

$1382 (-1.25%) KYG686121032 - 0.07 HKD - 0.0085 EUR

I can add to this list if anyone else has an interesting company to add.

I am currently looking for companies that are active in the industrial sector and came across $ODFL (+0.75%) I came across. It's a solid company with good figures and a moat. The share price is also tempting at the moment. What do you think?

Hello folks,

I have been wanting to buy a stock in the transportation sector for a long time.

But I am currently unsure between these 3 stocks.

$DPW (-0.13%)

$ODFL (+0.75%) and $DSV (-2.56%)

I find Deutsche Post interesting at the moment because they are a bit cheaper and have a reasonable dividend of 4.46%.

My investment goal is of course for a long time.

I would be very happy to hear your opinions. :)

𝗠𝗮𝗿𝗸𝗲𝘁 𝗡𝗲𝘄𝘀 🗞️

𝗚𝗲𝘁𝗾𝘂𝗶𝗻 𝟮.𝟬 𝗶𝘀 𝗼𝘂𝘁 / 𝗗𝗮𝘅 𝗶𝗺 𝗢𝗺𝗶𝗸𝗿𝗼𝗻-𝗦𝗼𝗴 / 𝗕𝗶𝗼𝗡𝗧𝗲𝗰𝗵 𝗹𝗶𝗲𝗳𝗲𝗿𝘁

𝗘𝘅-𝗗𝗮𝘁𝗲𝘀 📅

As of today, among others, The Coca-Cola Company ($KO (-0.37%)), Ball Corporation ($BLL (+0.19%)), eBay ($EBAY (+1.83%)), Lockheed Martin ($LMT (-0.76%)), Manulife Financial ($MFC (+1.15%)), McDonald's ($MCD (-0.54%)), McKesson ($MCK (+0.95%)), Old Dominion Freight Line ($ODFL (+0.75%)), Realty Income Corporation ($O (-0.39%)), Schlumberger ($SLB (-0.56%)) and Stanley Black & Decker ($SWK (+0.07%)) traded ex-dividend.

𝗤𝘂𝗮𝗿𝘁𝗮𝗹𝘀𝘇𝗮𝗵𝗹𝗲𝗻 📈

Today, among others, Scotiabank ($BNS (+0.43%)), Globalfoundries ($GFS (+1.19%)), Salesforce.com ($CRM (-0.22%)) and Zscaler ($ZS (+1.56%)) presented their figures.

𝗠𝗮𝗿𝗸𝗲𝘁𝘀 🏛️

Dax ($GDAXI) - The Dax is again in the wake of Omikron and the 15,000 mark is in sight. There is no recovery in sight for the German stock market as the Omikron mutation continues to unsettle investors. Asian markets had already reacted to the warning from Moderna ($MRNA (+1.86%)) chief, Stephane Bancel, and drove the stock markets into the red. According to Bancel, current vaccines are less effective against the new COVID-19 mutation.

BioNTech ($BNTX (+0.44%)) - Mainz-based vaccine manufacturer BioNTech is bringing forward a shipment of 2.9 million vaccine doses to Germany in response to strong demand for vaccines. This means that a total of 5.8 million vaccine doses will be delivered to the federal government. With this delivery, BioNTech is responding to the skyrocketing demand for booster vaccines. In Germany, more than 20 million booster vaccinations are targeted by the end of the year. The share price of the pharmaceutical company rose in the meantime to 323.95 euros.

𝗚𝗲𝘁𝗾𝘂𝗶𝗻 𝟮.𝟬 🚀

Today at 1pm, our new version of the getquin 2.0 app was released.

Due to a completely new native programming, the app now runs faster and smoother. This leads to a lightning fast and error free usage. Also, the long-awaited darkmode is now available, making it much more pleasant to use at night.

Take off your sunglasses and dive into the wonderful world of getquin 2.0.

Follow us for french content on @MarketNewsUpdateFR

Top creators this week