$NDAQ (-0.14%)

$RTX (+0.1%)

$KO (-0.37%)

$MMM (-1.74%)

$NOC (-0.1%)

$LMTB34

$OR (-0.56%)

$TXN (-1.56%)

$NFLX (-1.61%)

$HEIA (-2.16%)

$SAAB B (+5.28%)

$UCG (-2%)

$BARC (+0.23%)

$GEV (-1.56%)

$TMO (+0.74%)

$T (+2.17%)

$MCO (+2.02%)

$IBM (+8.06%)

$SAP (-3.22%)

$TSLA (-3.07%)

$AAL (+8.03%)

$FCX (+0.06%)

$HON (-2.23%)

$DOW (+1.43%)

$NOKIA (+1.13%)

$TMUS (-1.05%)

$INTC (-7.3%)

$NEM (-4.95%)

$F (+6.36%)

$PG (-0.4%)

$GD (+2.31%)

- Markets

- Stocks

- Newmont Mining

- Forum Discussion

Discussion about NEM

Posts

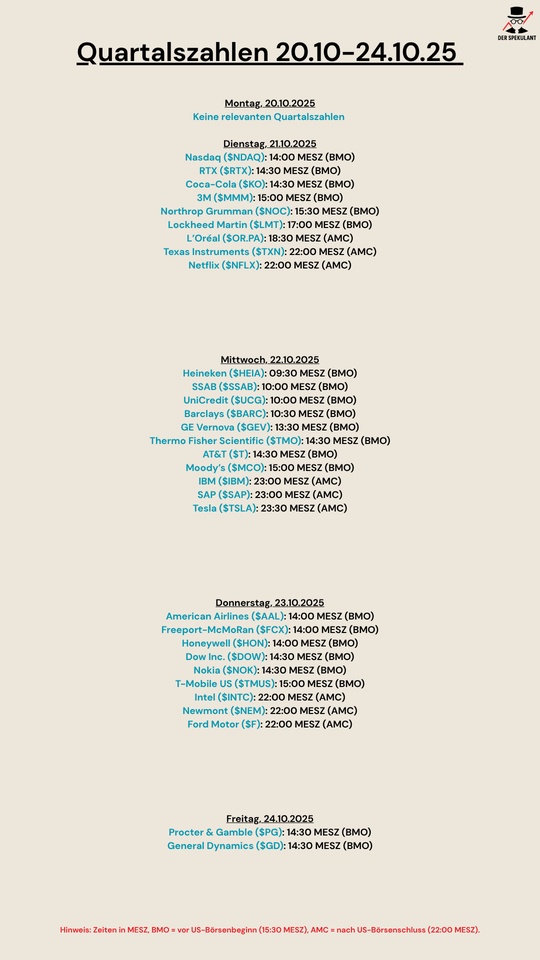

21Quartalsberichte 21.10-24.10.25

My best position this year

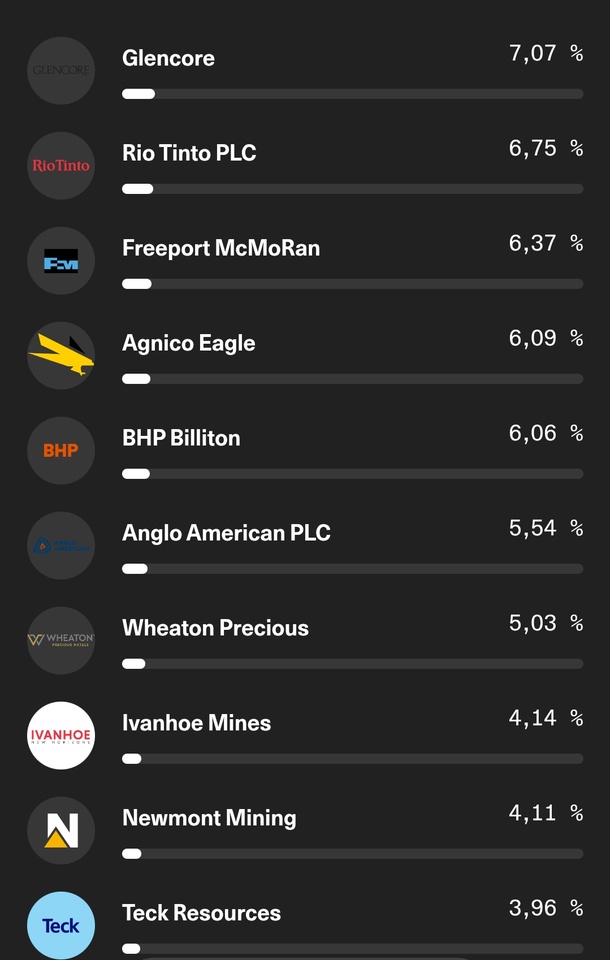

A fund in my pension plan

The absolute drivers should be the positions $NEM (-4.95%)

$AEM (-0.58%) as the big 3 have all lost yld.

Sometimes the haystack is better than just the needle even if it's in a fund shell.

Composition:

Golden times 🏅🥇

Sometimes it's worth taking a fresh look at the familiar - I'd like to share some new insights here and look forward to hearing your opinions on the subject:

Gold has been the subject of much discussion on the financial markets recently - and rightly so. In the current year 2025, the precious metal is one of the top performers: The spot price has risen by around 38-40% in USD terms since the start of the year, while global share indices have risen significantly less in the same period. According to the World Gold Council, gold was already up around +26% YTD by the middle of the year - a figure that had risen further to over +40% by September. By comparison, global equity ETFs were up ~+17% YTD (in USD) at mid-year. Gold marked new all-time highs around $3,700/oz.

What is driving this gold boom?

Several macroeconomic factors are at play. Firstly, a weaker US dollar in 2025 has boosted the price of gold, as gold is quoted in dollars. Secondly, there is still uncertainty in the geopolitical environment - from the ongoing war in Ukraine to trade conflicts - which is driving investors into safe havens. Added to this are concerns about inflation and recession, which are also increasing the attractiveness of gold as a store of value.

The demand from institutional investors is particularly noteworthy: central banks around the world are increasing their gold reserves more than they have for a long time. Since 2022, central banks have been buying over 1,000 tons of gold every year - around twice as much as the average in previous years. These record-high central bank purchases and continued inflows into gold ETFs are seen as the main drivers of the rally. At the same time, expectations of falling US interest rates (after the high interest rates of previous years) have reduced the opportunity cost of gold and sparked additional demand.

Gold in the portfolio: Diversification vs. "insurance"

Gold is a polarizing topic in many investor portfolios - often either not present at all or very highly weighted. Gold is traditionally seen as a "safe haven" and inflation protection. In fact, history shows that gold tends to rise, especially in times of crisis, when stock markets are weak. Gold recorded positive returns in 15 of the 20 worst quarters of the S&P 500 and outperformed equities in almost all other cases. This defensive characteristic makes it a stabilizer in many portfolios.

Even more important, however, is the diversification effect: gold has a relatively low or even negative correlation to traditional investments such as equities and bonds. In normal market phases, gold behaves independently and often in the opposite direction to share prices. This can help to reduce the fluctuation range of the overall portfolio - gold therefore does not "run" in step with the stock market indices.

Studies show that even a small addition of gold can measurably reduce portfolio risks: In one analysis, the Sharpe ratio (risk-return ratio) of an insurer's portfolio rose by around +12% when 2.5% gold was added. In other words, gold can improve the risk/return profile due to its low correlation. It is therefore no wonder that some asset managers recommend a gold allocation of ~10% in a balanced portfolio. Asset manager Sprott, for example, is of the opinion that ~10% physical gold (possibly supplemented by up to 5% in mining stocks) is a sensible component for risk diversification.

At the same time, gold should not be blindly idealized: Gold is not a perfect insurance policy for all eventualities. Like all investments, it is subject to fluctuations in value - sometimes considerable ones. For example, the price of gold lost around 29% of its value in 2013-2014 when the US Federal Reserve scaled back its ultra-loose monetary policy. Such drawdowns show that gold investors have to ride out lean periods.

In addition, gold does not generate any current income (no interest or dividends). In calm market phases, opportunity costs can therefore arise if, for example, bonds yield interest and gold is "only" unchanged. Some professionals - such as life insurers - argue that gold does not fit into the concept because no cash flow is generated.

Ultimately, it all comes down to perspective: Gold is less suitable for generating regular income, but more as a strategic asset component for extreme cases ("tail hedge") and for admixing with its own dynamic profile.

Personally, I take a middle course with gold.

Gold ETCs make up around 5-10% of my portfolio - not because I consider it to be the ultimate crash insurance, but as a deliberate counterbalance to equities and crypto. My aim is to have a share that develops independently of my equity investments and tends to be more stable or even positive in phases when equities and cryptocurrencies weaken. This strategy reflects what gold means for many investors: a diversifier and "crisis cushion", but not a sure-fire success.

It is interesting to note that gold and equities do not always move in opposite directions. The most recent example: In the first half of the 2020s, both gold and many stock markets recorded strong gains at the same time. Investors should therefore be aware that the correlation between gold and other assets can vary.

In phases of global booms (with simultaneously rising corporate profits and inflation), gold can certainly rise with equities. Conversely, in acute moments of panic, gold can also be sold off in the short term before it reasserts itself as a safe haven (as seen in March 2020, for example).

However, the overall picture remains: over longer periods, gold has its own price determination, driven by macro factors (inflation, real interest rates, USD exchange rate, geopolitical risks) and supply/demand (jewelry industry, investor demand, mining production). These factors are fundamentally different from equities and ensure that gold usually lives up to its reputation as a portfolio stabilizer.

Short-term fluctuation vs. long term: performance over time

What about long-term performance? Opinions are often divided here. In the long term - over many decades - gold has offered real value preservation plus a moderate increase in value, while equities (including dividends) have grown much more strongly.

An often-cited example: If one had invested $100 each in gold and the S&P 500 stock index since 1971 (the end of Bretton Woods and the freeing of the gold price), the gold investment would be around $7,000 today, but the stock investment would be over $26,000 (with dividend reinvestment). So over ~50 years, the stock market has delivered the higher growth.

But - and this is important - the answer depends heavily on the period under consideration. Anyone who started with gold and equities in 2000 has an advantage with gold today: $100 would have become ~$900 with gold, while $100 in the S&P 500 (well doubled despite the dotcom and financial crisis) grew to around $600.

The period 2000-2024 was characterized by two severe bear markets in equities and at the same time a major upswing in the price of gold. There were similar "catch-up runs" for gold in the 1970s: in the stagflation of that era, gold shot up massively while equities ran sideways.

What can we learn from this?

Timing and time horizon are crucial. Gold moves in long cycles. Phases of rapid rises (as recently since 2019) can follow longer lulls (think of the 1980s/90s, when gold barely moved for two decades).

- Over 10-20 years, gold can certainly keep pace with or outperform equities, especially if the starting period came from a low phase in the gold price.

- Since the turn of the millennium (1999-2024), for example, gold has returned an average of around +9.2% per year, outperforming global equities.

- Over 30+ years, on the other hand, broad equity indices are generally ahead, especially when dividends are taken into account.

Nevertheless, gold has also returned in real terms - since 1971 on average around +8 % p.a. in USD, which is well above inflation. This means that the often-heard criticism that gold "only preserves purchasing power but has no return" is not entirely fair - the real value of gold has also grown significantly over the decades.

It just depends on the chosen starting and end point. In terms of diversification, this means that gold can generate returns in certain phases and compensate for any losses in other asset classes, but you should not expect it to outperform equities on an ongoing basis.

The bottom line is that gold remains a special building block in the investment universe:

It is a commodity and currency substitute with its own supply/demand dynamics, not a productive investment in the traditional sense, but historically a reliable store of value over generations.

Particularly in an environment in which equities and bonds are again correlating positively at times (e.g. with simultaneous losses in 2022), gold is gaining in importance as an independent diversifier. Whether you hold 0%, 5% or 20% gold depends on your individual convictions, goals and risk preferences.

$4GLD (-0.68%)

$GLDA (+0.03%)

$EWG2 (+0.43%)

$DE000EWG0LD1 (-0.22%)

$IGLN (-0.64%)

$SGLD (-0.47%)

$GOLD (+0%)

$PHGP (-0.41%)

$GDX (-0.89%)

$SPGP (-2.6%)

$NEM

$NEM (-4.95%)

A few more precise figures and statistics for your statements would have been even better. I once did a detailed backtest on the different weightings in an equity portfolio in 2023. The best Sharpe ratio was 30% gold. At the time, this was far too high for most people. A maximum of 10% was possible. 🤷

I myself hold a little too much gold (>35%) due to the rise. But the plan was to significantly reduce the share at the end of the USD cycle in 2026/27 at USD 4500 (<10-15%). I like gold as an underestimated performance anchor, but the metal is slowly becoming too popular for me. The end of the boom is approaching.

PS: No GTAA without gold! 👌

Bulls Take Charge

Bulls Take Charge: Record Highs, Trade Deals & Standout Stocks

Markets surged into the weekend with the S&P 500 and Nasdaq hitting fresh record highs, driven by a US-China rare earth export deal and mounting Fed rate cut hopes. The Dow rallied over 500 points as bullish momentum swept across sectors.

Top performers included Nike (+15%), posting a blowout quarter, and Boeing (+4.6%) after an analyst upgrade. Cruise liners like Carnival, RCL, and NCLH jumped 3–4%, while Nvidia (+1.4%) extended its lead as the most valuable US company.

On the flip side, Coinbase (-6.2%) and Palantir (-3.4%) saw sharp pullbacks, and gold miners like Newmont fell with declining safe-haven demand.

Momentum remains firmly bullish heading into Q3. $NKE (-0.74%)

$BA (+1.5%)

$NVDA (+2.31%)

$CCL (-0.16%)

$COIN (+9.84%)

$PLTR (+2.29%)

$NEM (-4.95%)

Newmont Corporation reported earnings Q1 FY2025 results ended on Mar 31, 2025

- Revenue: $5.01B, +25% Y/Y

- Net Income: $1.89B, +1012% Y/Y

- Free Cash Flow: $1.21B, record Q1

CEO Tom Palmer: "Newmont has delivered 1.5 million attributable gold ounces and generated a record first quarter free cash flow of $1.2 billion... we remain firmly on track to meet our 2025 guidance."

🌱Revenue & Growth

- Total Revenue: $5.01B vs $4.02B, +25% Y/Y

- Gold Production: 1.54M oz vs 1.68M oz, -8% Y/Y

- Avg Realized Gold Price: $2,944/oz vs $2,090/oz, +41% Y/Y

- Copper Production: 35K tonnes

- Non-managed JV (Nevada Gold Mines): 216K oz, -23% Y/Y

💰Profits & Health

- Net Income: $1.89B vs $170M

- Adjusted Net Income: $1.40B, $1.25/share

- Adjusted EBITDA: $2.63B, -14% Q/Q

- Gold CAS: $1,227/oz, +16% Y/Y

- Gold AISC: $1,651/oz, +15% Y/Y

- Operating Cash Flow: $2.03B

- Cash & Equivalents: $4.70B

- Net Debt/EBITDA: 0.3x

- Dividends Paid: $0.25/share

- Debt reduced by $1.0B YTD

📌Business Highlights

- Completed sale of 5 non-core assets (e.g., Éléonore, Musselwhite, CC&V, Akyem, Porcupine)

- $2.5B in after-tax cash proceeds from asset sales YTD

- $1.0B returned to shareholders YTD (dividends + buybacks)

- Received $64M from Pueblo Viejo and $23M from Fruta del Norte JVs

- Spent $95M on reclamation (incl. $50M for Yanacocha water treatment)

🔮Future Outlook

- 2025 Gold Production Guidance: 5.9Moz

- 2025 Gold AISC: $1,630/oz

- Development Capex: $1.33B (H1 weighted)

- Reclamation Spend FY2025: $800M

- Q2 Production expected flat vs Q1; FCF expected to decline due to taxes and capex

- Remain on track for FY2025 guidance; long-term portfolio focus on Tier 1 assets

Stock Exchange Investor Day Munich

What did I take with me?

It is not a crisis because >\=20% down but a good entry into tranches.

Which stocks were discussed?

$P911 (+2.18%) Unfortunately I've been in Porsche since 2023, when luxury comes back, the Chinese will buy Porsche and not locally

$ABX and $NEM (-4.95%) Barrick and Newmont buy the shovels not the gold. Gold is for value preservation, not for speculation. I was invested in mines decades ago.

$MC (-1.81%) LVMH surprised me, I thought the air was out, will have a look.

$META (+0.46%) I finally understood how Facebook makes money. There's still a lot to come. First purchase?

$GOOGL (+1.8%) Yes, I've been adding to my portfolio since 25.

$H1PE34 Hewlett Packard Enterprise, I only knew it as a hardware manufacturer, here is the shovel for AI Ai chips.

$9988 (+1.45%) and $9888 (+1.67%) Chinese Baidu and Alibaba. I also had it 10 years ago, after the high it went down bloody. But will probably be seen again as a turnaround and cash flow for 2025.

$TTD (-3.92%) I was not aware of Trade Desk until today.

$22U Biontech became known as a corona profiteer, but is looking for the cancer vaccine.

These 10 stocks were discussed as stronger buys on the spot.

Which stocks are of interest to you, or where are you buying now?

At $MC it will be exciting to see whether they buy up a few more brands and whether they stick to luxury or add more consumer products to their portfolio (e.g. Birkenstocks)

Chinese equities are undervalued, China is on track to overtake the US by 2030

Was in China in April 2024, China is simply different. Europe, on the other hand, is a developing country

Newmont shares on the way up!

Have you heard of the Newmont share $NEM (-4.95%) heard? The mining group recently published its balance sheet for the fourth quarter of 2024 and the figures look promising.

Compared to the previous year, Newmont has achieved a turnaround: earnings per share rose from -3.22 US dollars to a pleasing 1.40 US dollars, exceeding analysts' expectations of 1.08 US dollars. Turnover was also impressive, at USD 5.63 billion, well above the previous year's USD 3.92 billion and estimates of USD 5.14 billion.

For the full year 2024, Newmont reports earnings per share of USD 3.47, compared to USD -3.0 in the previous year. Revenue climbed from USD 11.78 billion to USD 18.68 billion, which also exceeded analysts' forecasts of USD 18.21 billion.

Following this positive news, the Newmont share price rose by 1.95% to 49.03 US dollars after the close. A good reason to keep an eye on developments! What do you think of the latest figures? 📈

Detailed gold price analysis

Performance comparison

Trigger for the price increase

Gold purchases by central banks

Expectations of interest rate cuts

Gold demand in China and India

Gold ETFs

Link: shorturl.at/HHgOg

Hello,

I’d like to get your opinion about my portfolio.

I will make around 35k€ payment at the end of this year. This is why I keep this amount on cash side. I am open for investment suggest for 6-7 months on that part. All others are available for long term.

Thanks for contributions

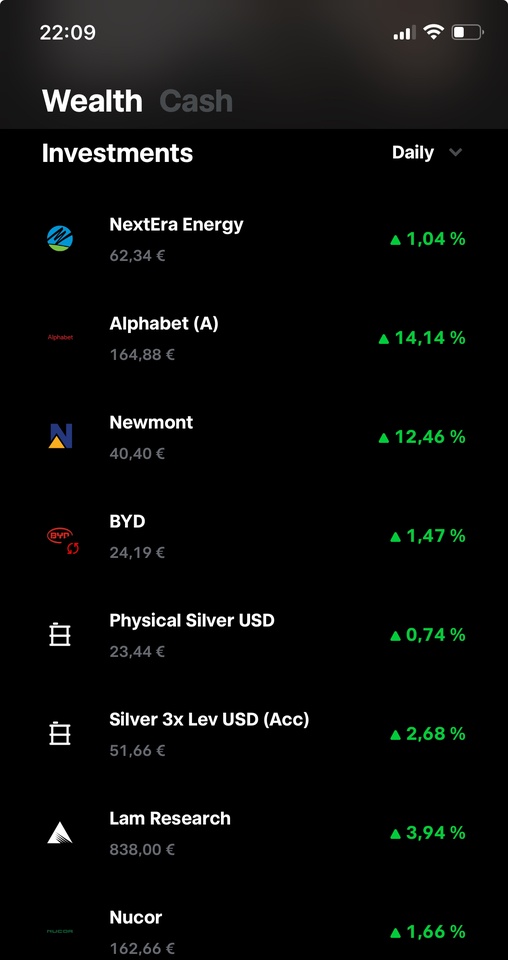

Daily Gain Rocks! 😀

It was the best day for me today. $GOOGL (+1.8%) and $NEM (-4.95%) , 2nd - 3rd biggest positions , made the highest daily increases. They stole the star role from my Silver positions on my portfolio :)

I wanted to share this situation because it is really exceptional day for me :)

Trending Securities

Top creators this week