New Weekly Update with Purchase.

#dividend

#dividends

#dividende

#invest

#investing

#etf

#etfs

$NNN (-0.83%)

$O (-1.42%)

$ADC (+1.02%)

$MAA (-0.73%)

$WHA (-0.43%)

$ECMPA (-0.1%)

Posts

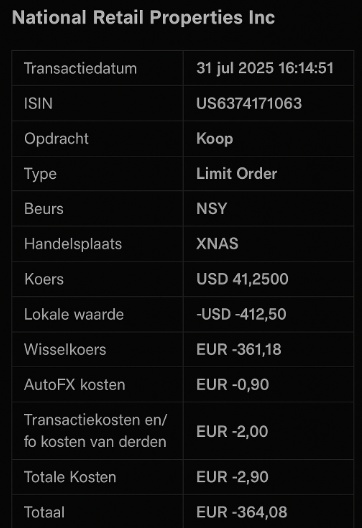

12Today I bought $NNN (-0.83%) reit, 8 shares at an average price of €35,955 each (including transaction costs).

I currently own 48 shares, which currently yields +- €98,99 per year in dividends.

#dividend

#dividends

#dividende

#invest

#investing

#etf

#etfs

$NNN (-0.83%)

$O (-1.42%)

$ADC (+1.02%)

$MAA (-0.73%)

$WHA (-0.43%)

$ECMPA (-0.1%)

Today I bought $NNN reit, 10 shares at an average price of €36,408 each (including transaction costs).

I currently own 40 shares, which currently yields +- €82,492 per year in dividends.

#dividend

#dividends

#dividende

#invest

#investing

#etf

#etfs

#nationalretailproperties

$NNN (-0.83%)

$O (-1.42%)

$ADC (+1.02%)

$MAA (-0.73%)

$WHA (-0.43%)

$ECMPA (-0.1%)

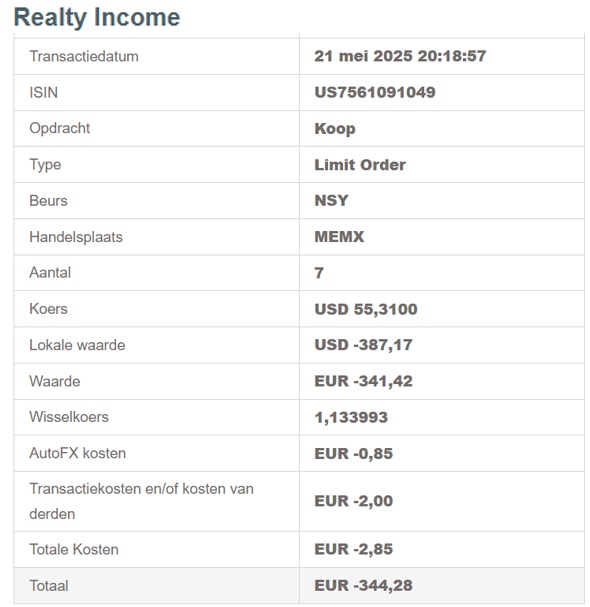

Bought 7 shares of Realty Income $O (-1.42%) today at an average price of €49,182 including transaction costs.

I currently own 73 shares.

This gives me an annual dividend of approximately €214 per year.

$O (-1.42%)

$ADC (+1.02%)

$NNN (-0.83%)

$MAA (-0.73%)

$WHA (-0.43%)

$ECMPA (-0.1%)

#dividend

#dividende

#dividends

#invest

#investing

#realestate

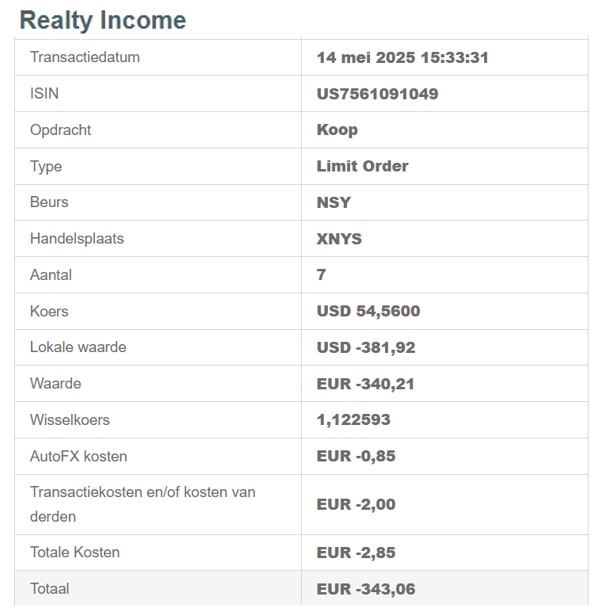

Bought 7 shares of Realty Income $O (-1.42%) today at an average price of €49,008 including transaction costs.

I currently own 66 shares.

This gives me an annual dividend of approximately €193 per year.

#dividends

#dividend

#dividende

#realtyincome

#realestate

#investing

$O (-1.42%)

$ADC (+1.02%)

$NNN (-0.83%)

$WHA (-0.43%)

$MAA (-0.73%)

$ECMPA (-0.1%)

I have looked at a large number of REITs, including $O (-1.42%) but also $CUBE (-1.6%) , $EGP (-3.05%) , $VICI (-0.75%) , $MAA (-0.73%) , $REXR (-4.78%) and many more. After a planned filtering (only USA, min. 3 % DIV, very high sales/earnings ratio and others), 4 buyable REITs remained, which I then analyzed with 2 tools. In the end, 2 buy stocks came out for me and I bought one directly; the buy limit for the other is just under 1.2% below the current price. I'm excited, this is my first investment in a REIT. Take a look at the portfolio or the video.

Note after comments: Stock Finder and Stock Guide. AF usually looks better, but I actually make more returns when I "trust" the company more.

Have a nice day and best regards,

Angelo

Residential REIT

I would like to add another residential REIT to my portfolio in the near future. The classics like Mid American Apartments $MAA (-0.73%) Camden $CPT (-0.85%) Essex Property $ESS (-1.7%) AvalonBay $AVB (-1.15%) and Sun Communities $SUI (+0%) have already been looked at and I also have a favorite. My question to you would therefore be whether you know of any other stocks in this area that tend to fly under the radar and can provide both positive and negative feedback.

Yes indeed too much noordusa always had a lot of interest in it, so I want to $NN (-0.3%) buy and $ASRNL (+0.17%)

add on and add to the euro div etf to spread something outside USA. Also $KPN (+0.63%)

and $WKL (-1.06%) seem interesting to me. I am indeed trying to keep under 10% by own money, but if by growth I get above that, I would be fine with that. (Let your runners run)

Growth indeed I am looking at: $SBUX (-2.43%) and $CMI

$DE (-3.27%)

$HSY (-0.19%)

$TRV (-2.09%)

$APD (-3.1%)

$MCO

$ADP (-0.57%)

But also for a little more dividend $MAA (-0.73%)

$TD (-2.41%)

$AFL (-0.73%)

$AVB (-1.15%)

Main I bought when it was very low and interest rates were also very low, so so the risk was much less. Only bought once. I may well stay away from this for a long time and use the dividend for the dividend snowball.

Otherwise quite difficult to stick with these boring and safe stocks, but this is what I like and sleep best with. (Slow but "sure")

Fantastic explanation everything was indeed correct how I think about it and this helps me tremendously to persevere, thank you Paul.

Thanks for your review: https://youtu.be/7-xomL4oDBM?si=v-JueJwSOVPHQeYZ

I'm curious what you guys think of this YouTube money tree show

Top creators this week