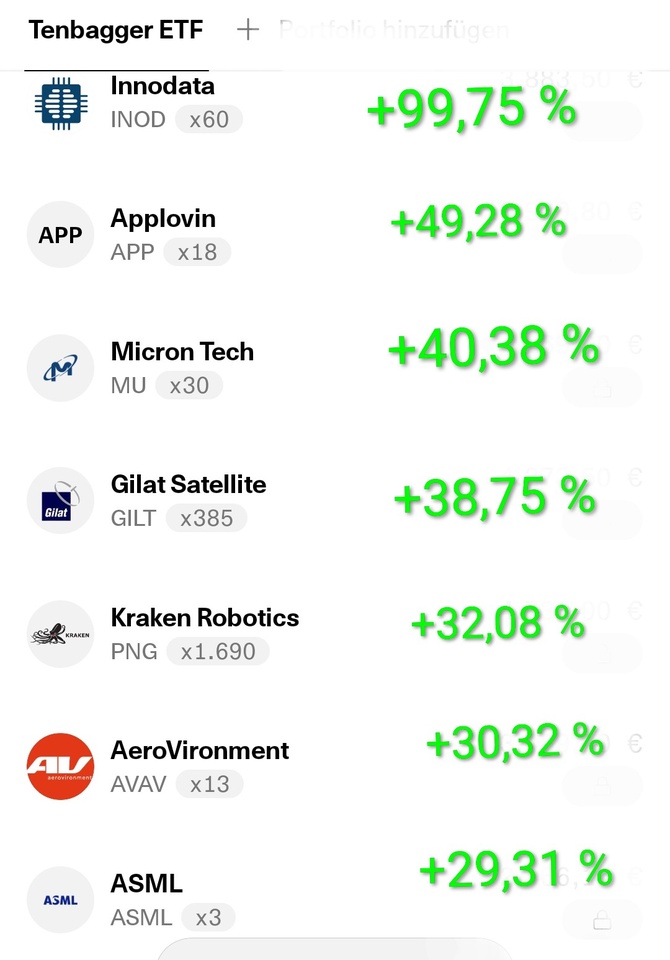

$IREN (+11.25%)

$CIFR (+17.08%)

$BTC (+0.13%)

Maybe some exciting companies for you ✌️

I am currently only in $IREN (+11.25%) and $CIFR (+17.08%) which are the most promising for me in terms of the opportunity/return ratio. In the event of a further setback, I would $CIFR (+17.08%) probably add a little more and perhaps pick up one or two other companies.

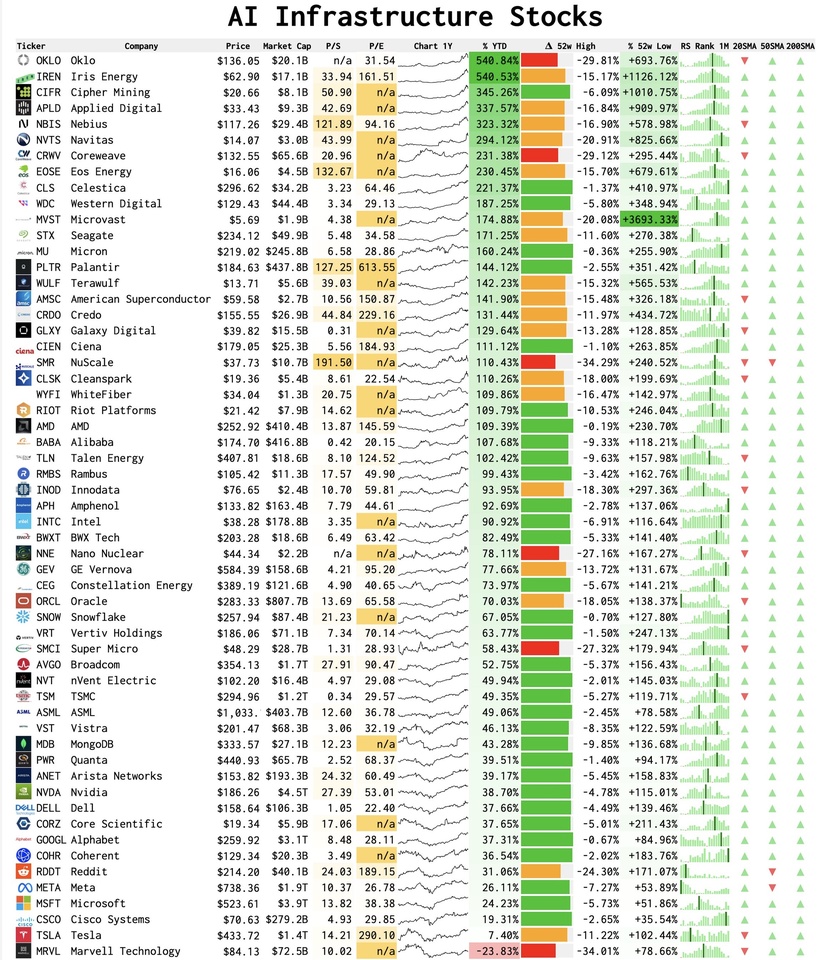

AI stocks, sorted by YTD performance:

Hyperscalers: $GOOGL (+1.8%)

$MSFT (+0.63%)

$AMZN (+1.56%)

$ORCL (+1.12%)

$BABA (+1.49%)

Neocloud: $NBIS (+9.49%)

$IREN (+11.25%)

$CRWV (+6.79%)

$APLD (-1.37%)

$GLXY (+3%)

$WYFI

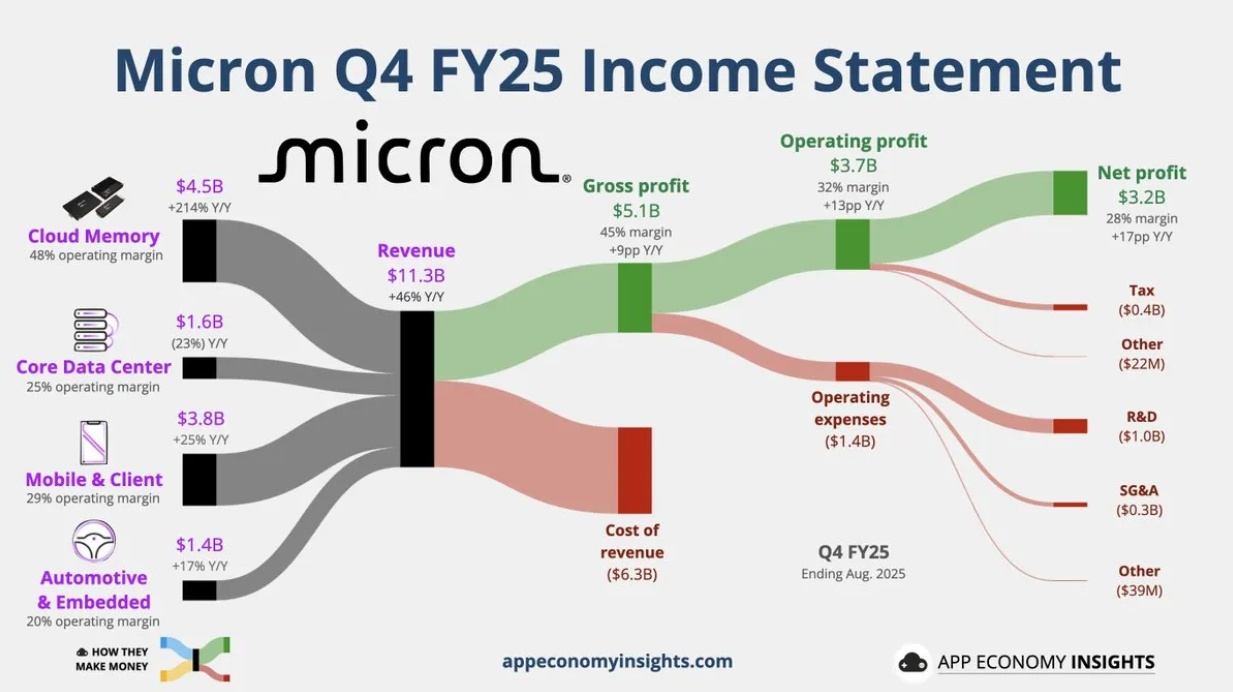

Memory: $SNDK

$STX (+4.07%)

$MU (+5.61%)

$WDC (+3.12%)

$PSTG (+0.71%)

Semiconductor: $NVDA (+2.31%)

$AVGO (+1.78%)

$AMD (+6.32%)

$TSM (+1.4%)

$ASML (-0.02%)

$ARM (+1.87%)

$KLAC (+1.14%)

$INTC (-7.3%)

Networking: $CIEN (+4.21%)

$CLS (+1.59%)

$CRDO

$RMBS (+3.57%)

$ANET (-0.02%)

$APH (-0.89%)

$COHR (+6.21%)

Servers: $VRT (+1.24%)

$DELL (+2.26%)

$HPE (+0.85%)

Data: $INOD (+2.8%)

$PLTR (+2.29%)

$SNOW (+2.02%)

$DDOG (-0.63%)

$MDB (+1.25%)

Energy: $LEU (+11.22%)

$CEG

$OKLO

$TLNE

$GEV (-1.56%)

$NXT (+0%)

Batteries: $EOSE

$QS

$TSLA (-3.07%)

$MVST (+2.85%)

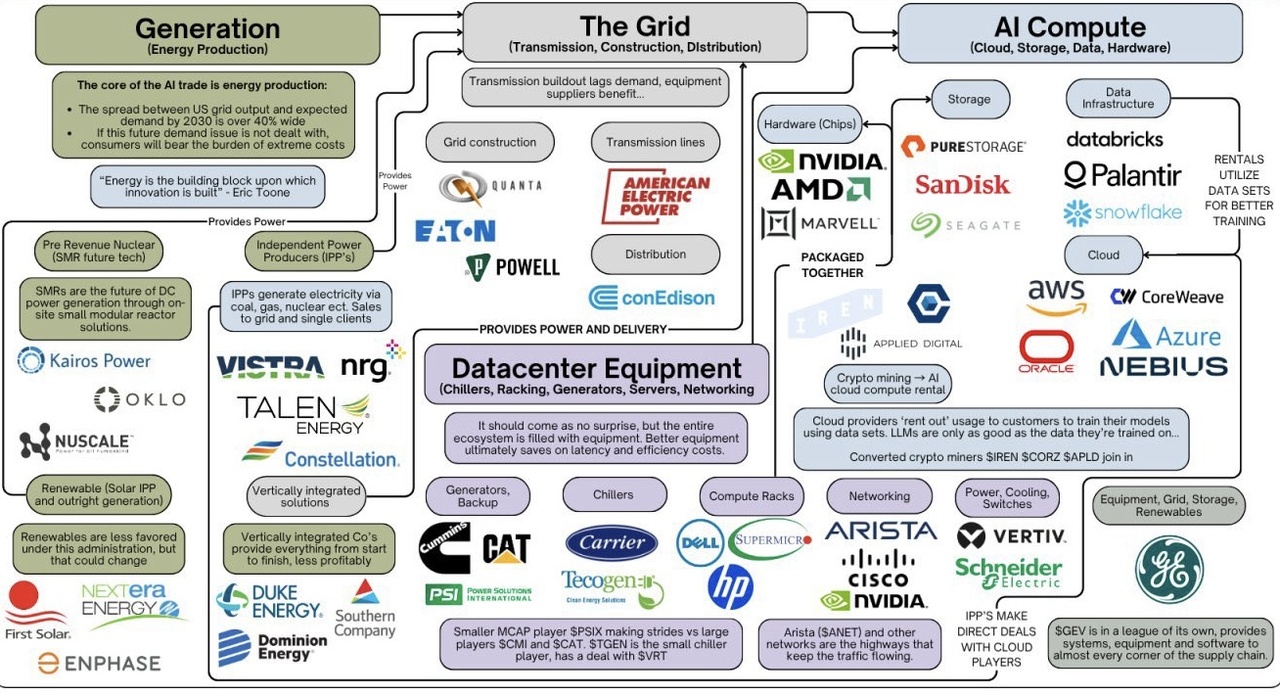

Every AI Value Chain explained: