Two Titans, Two Continents, Similar Playbook

Sometimes, if you want to invest in a certain business model, you can find multiple similar companies. And yes, Amazon and MercadoLibre have a closely related core business. However, they are so much more — in different ways. Both are ecosystem builders, not just online shops. Two conglomerates of commerce, logistics, payments, and data. Both dominate their respective continents. And, right now, both are under pressure, exactly the kind of pressure that tests conviction and might open opportunities.

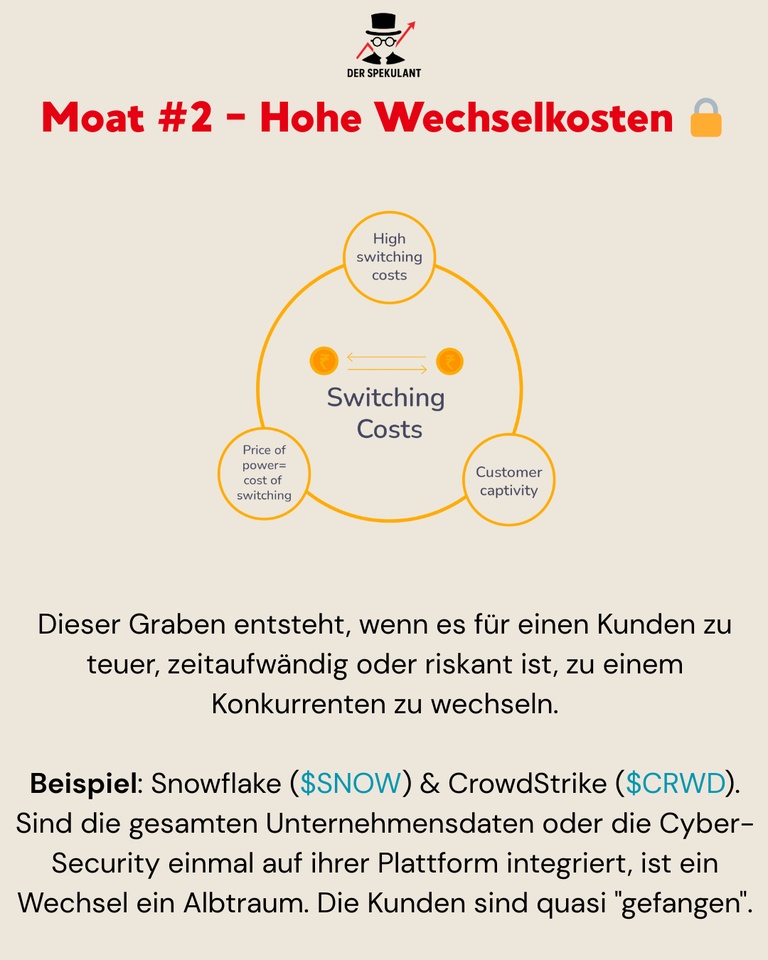

Amazon’s issues aren’t new. AWS growth has slowed to the high teens, the retail segment has lost much of its appeal (to investors, at least), and AI expectations haven’t all been fulfilled. All these reasons led to a lack of performance for Amazon. The company is down this year, while the rest of the Mag7, and quite frankly, the market is running away. When you’ve built one of the most profitable infrastructure businesses in the world, markets suddenly expect miracles every quarter. That’s the curse of scale. Jeff Bezos constantly selling shares doesn’t help either. But even with that, you still have the world’s most sophisticated e-commerce and logistics network, one of the fastest-growing ad businesses on the planet, and a cloud empire that will keep compounding as AI usage expands. While Google Cloud and Azure are growing faster, investors should keep in mind that AWS is still the indisputable leader.

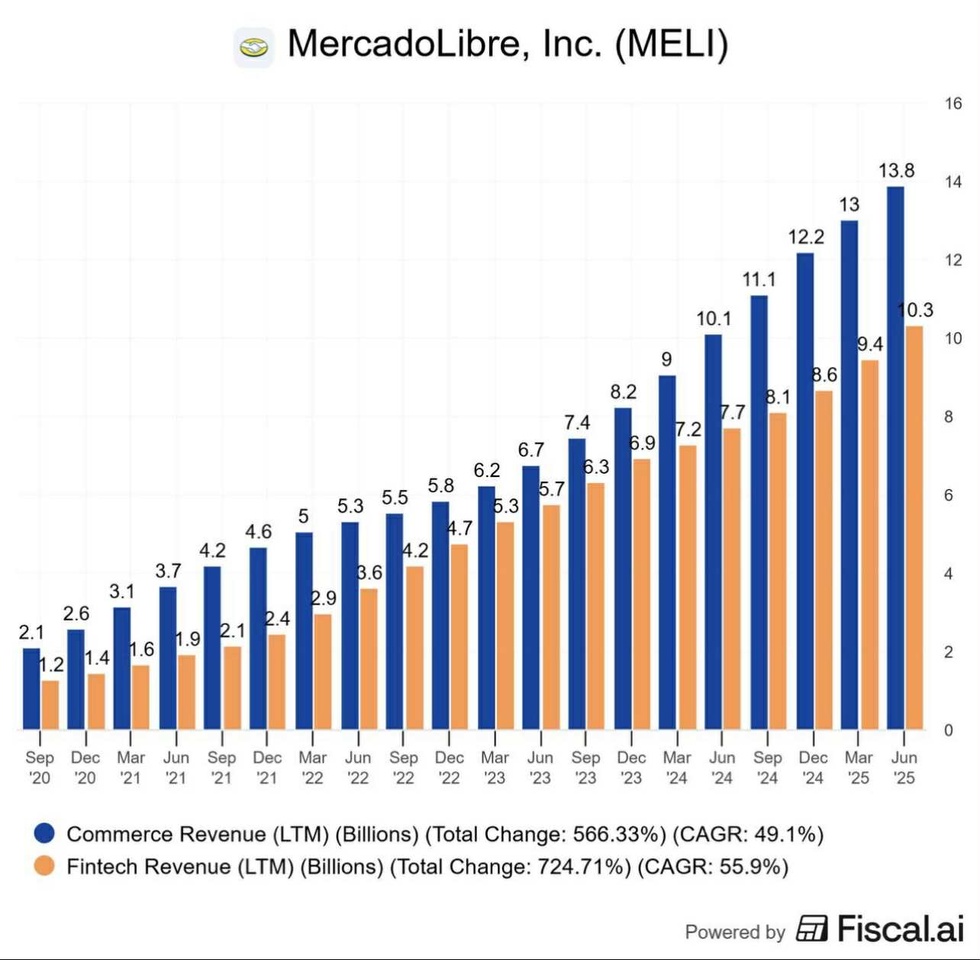

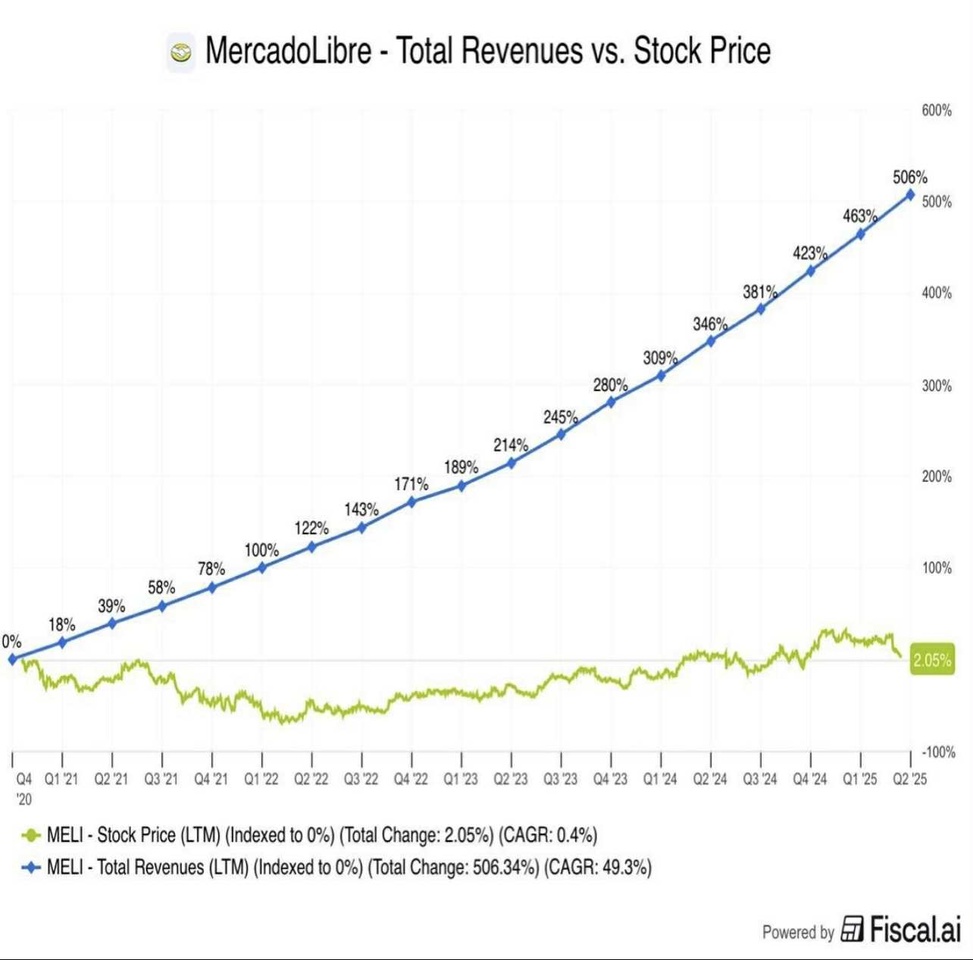

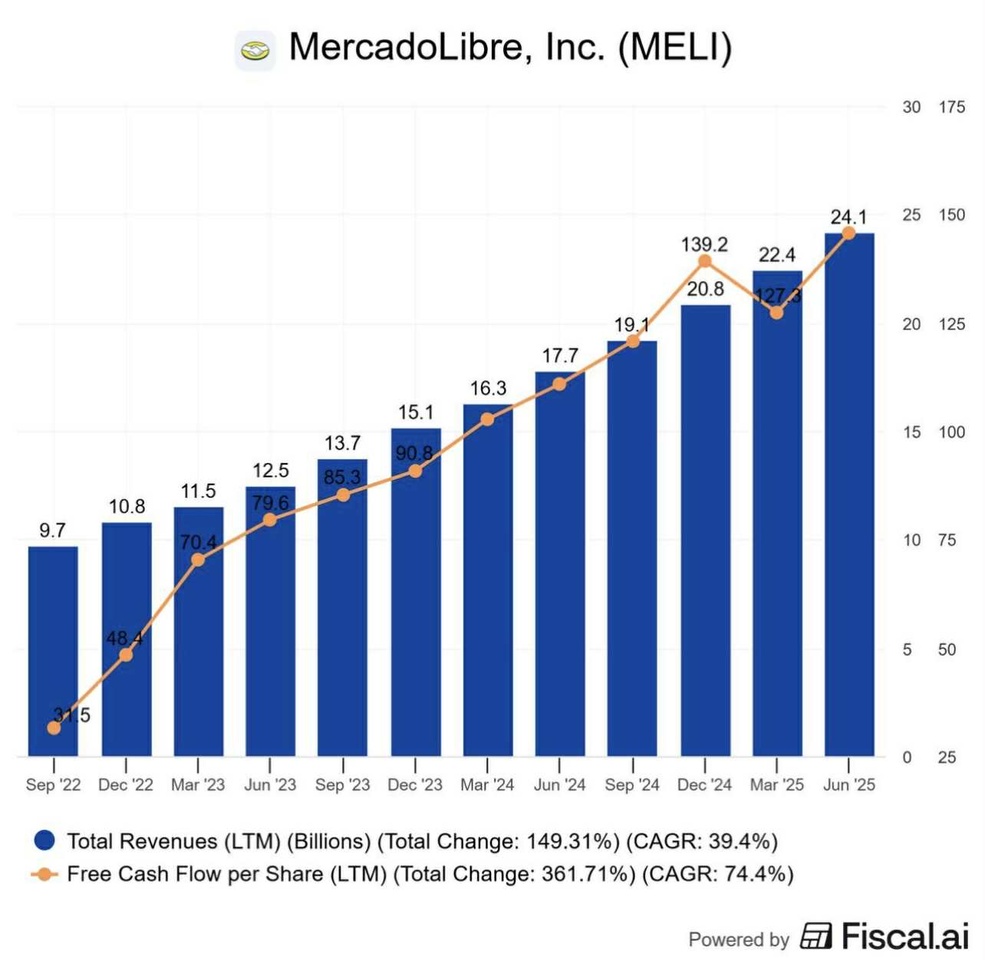

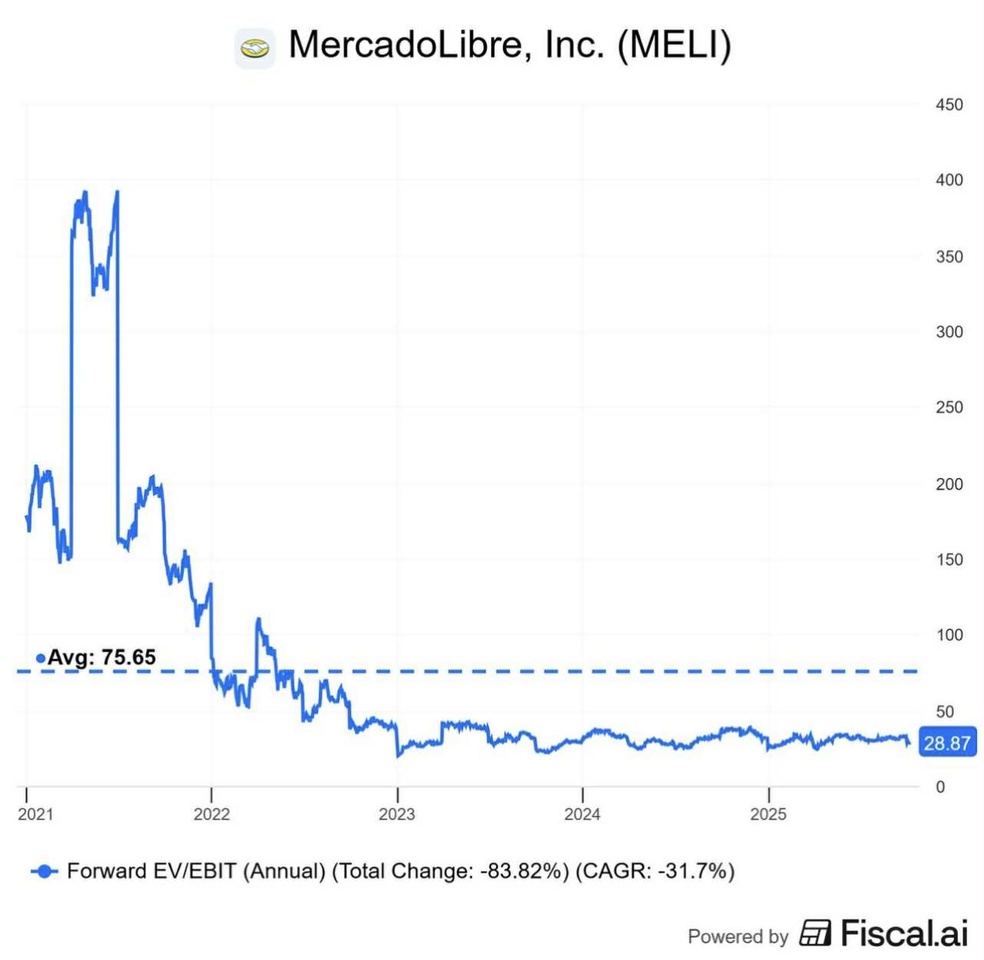

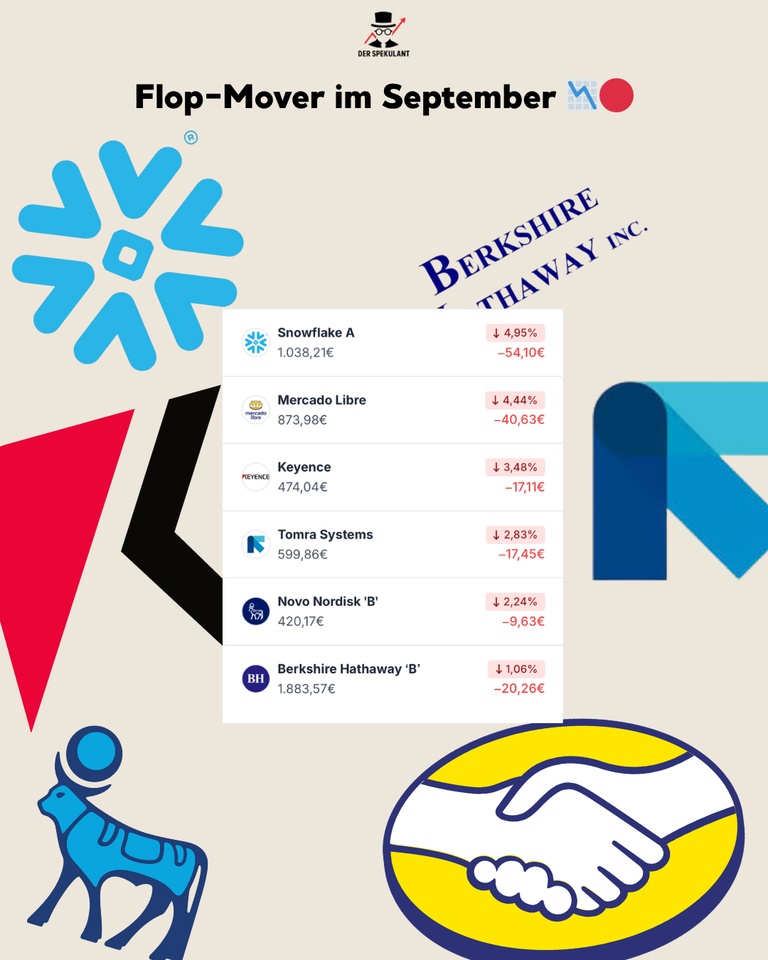

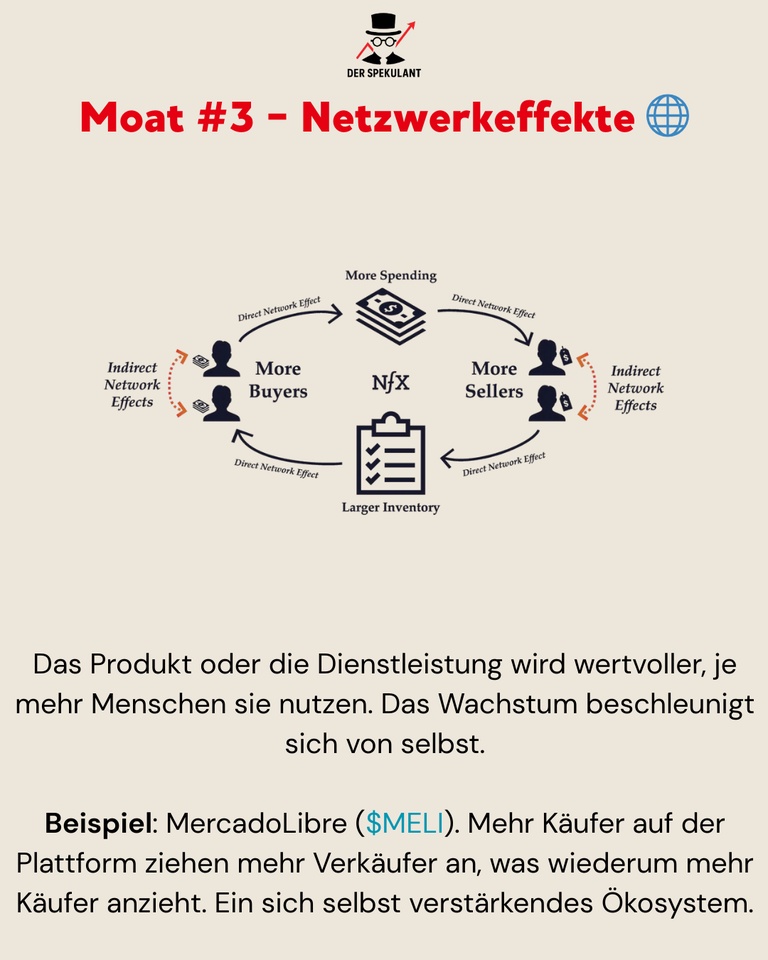

MercadoLibre (MELI), on the other hand, is what Amazon was a few years ago. Still smaller, but growing rapidly, and building up an unprecedented commerce ecosystem. MELI has another tailwind Amazon never had: many people in Latin America are first-time users of digital services. With phone and internet adoption, MELI is able to basically create customers out of thin air. Customers that don’t know (and don’t need to know) anything else, because MELI’s services are convenient and universal. All business segments continue to grow at double-digit rates, its marketplace dominance is untouchable, and ventures like its FinTech are rounding out the investment case. If you believe in Latin America’s long-term digital adoption, you can’t not believe in MercadoLibre. I am already heavily betting on this trend with Nu, but I wouldn’t mind adding to my conviction if the opportunity arises.

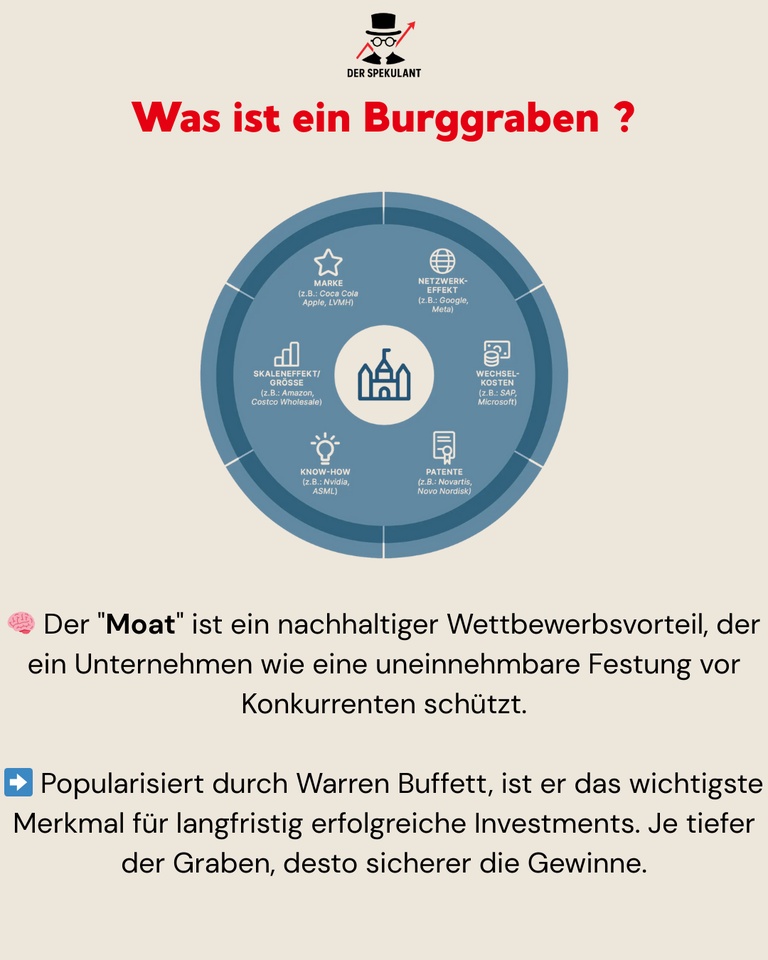

Both Amazon and MELI sit in that rare category of businesses where the short-term headwinds are simply the price of building something indestructible (which they have already done, to an extent). Their moats don’t just exist, they expand with every second they exist. While others chase the next AI narrative or speculative small caps, these two compound in silence, through infrastructure and habit.

I’m not pretending they’re cheap. I’m just saying they’re inevitable in the long run. Amazon below $200? I’ll buy. MercadoLibre below $1,800? Same story. Those are the levels where long-term investors make their best entries, not traders chasing momentum. We are only 10% away from my entry points, and I am excited.

For now, I don’t hold either yet. But these are the stocks you can buy, fall asleep, and wake up years later with a smile. They are the ultimate “peace of mind” growth plays.

$AMZN (+1.56%)

$MELI (+0.32%)