The market continues to push toward new ATH and today it looks ready to recover from last Friday’s sharp drop following Trump’s threat of 100% tariffs on China.

While many investors keep chasing momentum, I’ve stayed calm and rotated my portfolio toward what I see as real value.

My focus has been on companies that are deeply undervalued yet essential to people’s daily lives, some to balance.

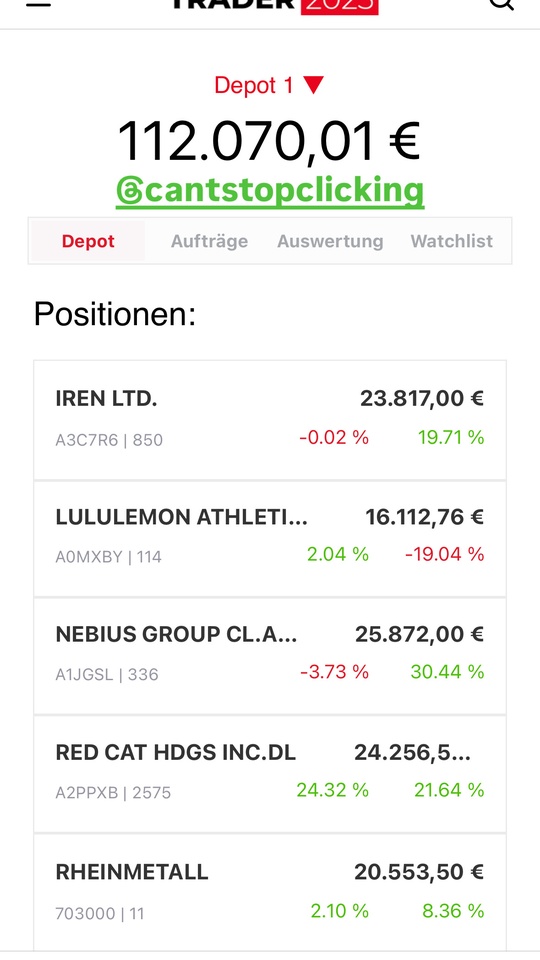

Here’s a glimpse of my current positions:

Pepsi $PEP (+1.97%) Cintas $CTAS (+0.65%) Bristol Myers ($BMY (+0.36%) ), TMF, Intuitive Surgical ($ISRG (+0.05%) ), General Mills $GIS (+0.47%) , Lululemon ($LULU (-0.21%) ), Campbell Soup (CPB), iShares MSCI India (INDA), American Water Works $AWK Airbnb (ABNB), and Novo Nordisk $NVO (-1.71%)

This rotation has kept my portfolio on a steady growth plateau — not chasing short-term rallies, but positioning for sustainable performance in the months ahead.

I’m focusing on strong fundamentals, stability, and pricing power in an environment where volatility and political headlines can change the mood overnight.

𝗧𝗵𝗶𝘀 𝗶𝘀 𝘁𝗵𝗲 𝗽𝗲𝗿𝗳𝗲𝗰𝘁 𝘁𝗶𝗺𝗲 𝘁𝗼 𝗰𝗼𝗽𝘆 𝗺𝗲 𝗼𝗻 𝗲𝗧𝗼𝗿𝗼—𝗱𝗼𝗻’𝘁 𝗺𝗶𝘀𝘀 𝘁𝗵𝗶𝘀 𝗼𝗽𝗽𝗼𝗿𝘁𝘂𝗻𝗶𝘁𝘆 𝘁𝗼 𝗴𝗿𝗼𝘄 𝗮𝗹𝗼𝗻𝗴𝘀𝗶𝗱𝗲 𝗺𝘆 𝘀𝘁𝗿𝗮𝘁𝗲𝗴𝘆.

😎 𝗗𝗶𝘀𝗰𝗹𝗮𝗶𝗺𝗲𝗿: This is my personal opinion and is for informational purposes only. You should not interpret this information as financial or investment advice