Dear investors,

Today I am back with a current analysis on $HUM (-4.1%) . However, this is a rough version of the analysis, which has not been revised or nicely formatted. Nevertheless, I believe that I can provide you with the most important information.

Humana Inc.

ISIN: US4448591028

Index: S&P500

Sector: Health Care

Chart analysis:

Since October 31, 2022, we have been in a long-term downtrend in which the price has already fallen by a good 50%. Commercials are more likely to go short but still with a lower volume, which is only moderately meaningful. Furthermore, we have been below the 200-week line below the 200-week linewhich suggests a strong, long-term downtrend. The current structure on the weekly chart is also giving a bearish signal. In addition, an M-pattern, which is further reinforced by an RSI divergence. This results in a clear bearish signal on the weekly chart. The next target could be the low at approx. 200$.

On the daily chart we are also below the 200 line. However, we had a short-term upward trend here, which caused the price to rise by 30% in around 40 days. There we then again into the weekly OBfrom which we rapidly plummeted downwards again. In the meantime, there has already been another break of structure to the downside. In the MACD, the blue line has now cut the orange line to the downside and as we are also below the 200 line, this is a bearish signal for me. The RSI is currently at a mediocre level. Profit-taking is possible at the green lines; the entire position should be sold at the latest at the blue line (weekly swing low at 200$).

Conclusion:

The chart gives a clear bearish signal. Both the present structure (Bearish Weekly OB + Retest) and the indicators (RSI Div; 200 line; MACD) signal a continuation of the downtrend.

Fundamental analysis:

Piotroski F-Score: 4 points

è Rather on the weak side -> indicates financial weakness/uncertainty

Weak bear market factor

è The price movements are almost independent of the SP500 à Not necessarily a good hedge for my portfolio

Strong bad news factor:

è Bad news can trigger stronger price movements

Sales and profit growth

- Good sales growth with an average of over 10% p.a. in the last 7 years

- Also good sales growth in the last few quarters

- Declining profit since 2021; profit fell by 50% in FY 2024

- Frequent losses in several of the last quarters

Sales growth remains in a mediocre range; however, profits are collapsing

CCA:

Humana has very high valuations compared to its peers, which cannot be explained by good margins and good growth. In terms of sales growth, Humana is in the lower midfield, and the same applies to margins. The implied share prices are largely below the current market price and therefore also give a bearish signal.

Addition: After the publication of the Q4 figures and an even lower than expected result in FY 2024, the valuation for Humana rises even further and the profit margin falls even lower. This further strengthens the bearish signal.

Historical multiple valuation:

All multiples have been on a downward trend for years.

No very strong correlations between certain multiple levels and the share price trend.

Only short-term correlation for EV/EBITDA:

Here we only recently came close to the upper barrier again and then fell again. This suggests a falling share price, at least in the short term, but is not particularly meaningful.

Conclusion:

All valuation multiples have been falling continuously for years; no long-term correlations between multiples levels and price performance can be identified, with the exception of a short-term time window à here a bearish signal is given.

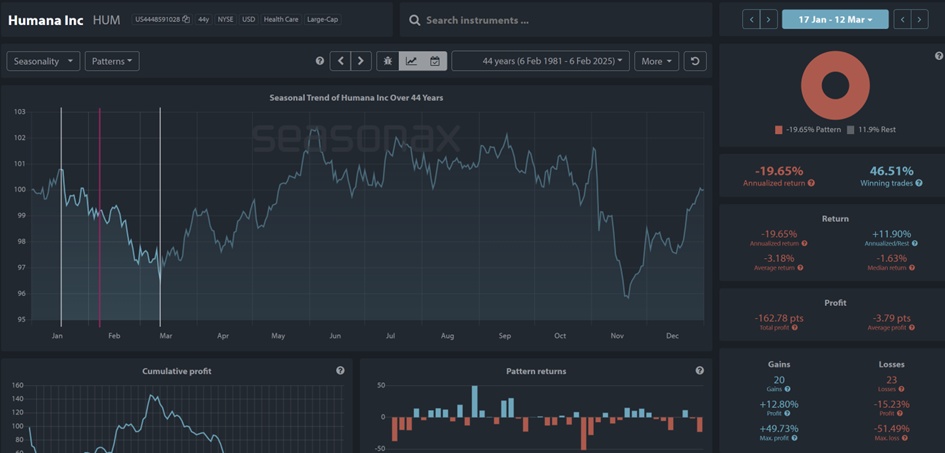

Seasonal tendency

No conspicuous time windows with high returns or win rates in the first quarter. In principle, however, we are in a time window in which the annualized return is negative over the long term (15,25,44 years). This means that the negative years usually lose more than the positive years gain.

Conclusion:

No particular anomalies; no decisive information to be recognized.

Conclusion:

The chart signals a steady downward trend and gives no indication of possible longer-term trend reversals. This is confirmed by the company's current financial situation. Profits have been falling for years and in the last FY 2024 profits even fell by 50% - with sales rising slightly. Valuation multiples are also falling steadily, but are still far too high compared to the industry as a whole. The higher valuations are in stark contrast to the poor margins and low or negative growth figures.

Overall, the downward trend is expected to continue, which is why we are planning to short the share.

The $200 mark can be taken as a medium-term price target. In the short term, profits can also be taken at the green levels of the chart analysis.

My previous position has already been liquidated with a 100% return. Nevertheless, I will keep my eyes open and short the stock again if the setup is good.

Due to its almost independent price movements compared to the index, this share is not suitable for a hedge for my portfolio.