As every Sunday, the most important news of the last week and the dates of the coming week.

Here are the dates of the coming week:

https://youtube.com/shorts/xwA7DCnogM4?si=VWzzbPzr4BMTQGHj

Monday:

#china Lowers interest rates on one of the central bank's interest rate lines. The one-year loan now costs 3.45% interest instead of 3.55%. China is trying to stimulate the economy with this. The real estate sector in particular is expected to benefit from lower interest rates.

https://www.bbc.com/news/business-66567085.amp

$PANW (-4.92%) Palo Alto Networks can surprise the stock market with strong figures. The cybersecurity provider increased sales by 26%. In addition, there was a positive outlook for the full year.

https://www.deraktionaer.de/artikel/aktien/an-diesem-aktionaer-cybersecurity-tipp-fuehrt-kein-weg-vorbei-20337977.html

Good omen for #inflation producer prices fall for the first time since 2020. Producer prices are seen as a harbinger of actual inflation; if producers produce more cheaply, this also depresses the inflation rate in the future. Compared with the previous year, producer prices have fallen by 6.0%, significantly more than the assumed 5.1%.

https://www.handelsblatt.com/politik/konjunktur/nachrichten/konjunktur-erzeugerpreise-fallen-erstmals-seit-ende-2020/29343326.html

According to a Bundesbank report, the economic situation in Germany remains tense. There will probably be a 0 round in the 3rd quarter as well, meaning no growth.

https://app.handelsblatt.com/finanzen/geldpolitik/monatsbericht-deutsche-wirtschaft-wird-im-sommer-wohl-ebenfalls-nur-stagnieren/29344192.html

Tuesday:

$F3C (-2.55%) SFC Energy remains the big hope in our moonshot portfolio. The figures were above expectations. Second quarter sales grew 46%. The guidance for the full year is increased.

https://www.finanzen.net/nachricht/aktien/gute-geschaefte-sfc-energy-aktie-gibt-vorboerslich-gas-sfc-energy-nach-umsatzsprung-optimistischer-12757967

$COTY (-5.51%) Coty, which produces, among other things, perfumes for luxury labels, reports significant growth. Sales increased by 16%. However, profit was below expectations due to higher costs.

$9888 (-8.29%) Baidu performs better than expected. The Chinese equivalent of Google increases advertising revenues by 15%.

The construction manufacturer $STO3 (-4.94%) Sto lowers its forecast. Due to poor weather conditions, among other things, full-year sales will probably be slightly lower.

Monday evening $ZM (-3.74%) Zoom still presented figures above analysts' expectations.

https://app.handelsblatt.com/unternehmen/industrie/-geschaeftszahlen-im-newsblog-rabatte-lassen-macys-gewinn-einbrechen/24098412.html

Wednesday:

On average, a bank account in Germany costs 100 euros per year, according to a study. Although there is interest again almost everywhere, but not on the current account.

https://app.handelsblatt.com/finanzen/banken-versicherungen/banken/banken-banken-erhoehen-gebuehren-weniger-gratiskonten/29348194.html

Poor purchasing managers' index figures, a clear signal of recession. The index plummeted to 44.7 points. Expected was only a decline to 48.3 points. In particular, the service sector sags more than expected, so far poor industrial data could be compensated here.

https://deutsche-wirtschafts-nachrichten.de/705530/deutsche-wirtschaft-im-august-auf-rasanter-talfahrt

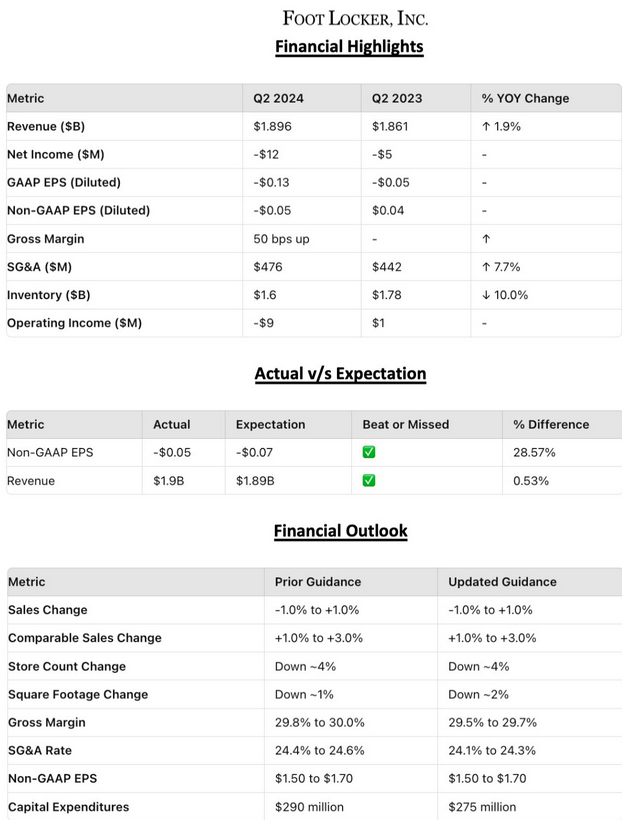

At $FL Foot Locker is currently not doing so well. Dividend and outlook are being lowered.

https://www.t-online.de/finanzen/boerse/ticker/aktien-im-fokus-foot-locker-belastet-kurse-von-adidas-puma-und-nike/0DAE2E00BA467D5B/

$NVDA (-6.14%) Nvidia does not disappoint, figures and outlook are above expectations. Sales increased year-on-year from USD 6.7 billion to USD 13.5 billion.

https://www.finanzen.net/nachricht/aktien/bilanz-vorgelegt-nvidia-aktie-zuendet-an-der-nasdaq-nachboerslich-erneut-den-turbo-nvidia-mit-gewinnsprung-erwartungen-uebertroffen-12757955

Thursday:

The BRICS states expand by 6 countries. This also increases the economic power and global influence, the declared goal is to form a counterpole to the G7. Through the merger, the interests of the member countries should be better enforced. Brazil, Russia, India, China and South Africa are now joined by Iran, Saudi Arabia, the UAE, Egypt, Ethiopia and Argentina.

https://www.handelsblatt.com/politik/international/staatenbund-brics-staaten-beschliessen-erweiterung-um-sechs-laender/29351372.html

$CEVMY (-0.25%) CTS Eventim is benefiting from the event boom. The ticket marketer broke the billion mark in the first half of the year and reported a 39% increase in sales.

https://app.handelsblatt.com/unternehmen/industrie/-geschaeftszahlen-im-newsblog-gewinnsprung-bei-cts-eventim/24098412.html

Friday:

Inflation is also coming back in Japan 🇯🇵. The increase was still at 2.8% year-on-year. The expected figure was 2.9%. The whole thing is remarkable, because the Japanese central bank has changed virtually nothing in the interest rate level.

https://www.n-tv.de/wirtschaft/der_boersen_tag/Inflation-in-Japan-verlangsamt-sich-weiter-article24349602.html

According to new figures, Germany's GDP neither grew nor shrank in the second quarter. Economic output stagnated. This means that we have experienced three quarters in a row without growth.

https://www.handelsblatt.com/politik/konjunktur/nachrichten/konjunktur-keine-rezession-mehr-aber-die-euro-zone-haengt-deutschland-ab/29349782.html

Short squeeze at $VFS (-3.8%) Vinfast, the manufacturer from Vietnam 🇻🇳 is trying its hand as an electric car manufacturer and is considered an industrial hope in the country.

https://www.deraktionaer.de/artikel/mobilitaet-oel-energie/stellt-dieses-e-auto-start-up-bald-alle-in-den-schatten-20338318.html

Powell emphasizes at the Jackson Hole meeting that there could be another interest rate hike, but that they want to proceed 'cautiously'. Basically, nothing new in the communication. The market is sold off a bit, it was probably hoped that interest rate cuts would also be discussed.

https://stock3.com/news/fed-chef-powell-sind-vorsichtig-bei-weiteren-zin-12954987

These are the most important dates of the coming week:

Monday: 03:30 Retail Sales (AUS)

Tuesday: 15:00 Housing Price Index (USA)

Wednesday: 14:00 Inflation data (DE)

Thursday: 11:00 Inflation data (EU)

Friday: 03:45 Caixin Production (China)