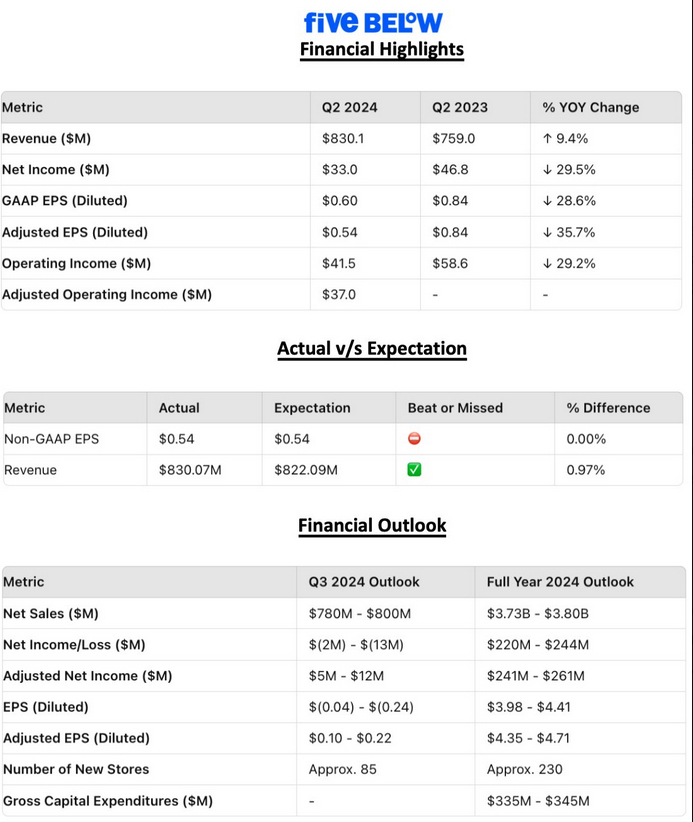

$FIVE (-0.57%) Below Q3 Earnings Highlights:

🔹 Adjusted EPS: $0.42 (Est. $0.17) 🟢

🔹 Revenue: $843.7M (Est. $801.5M) 🟢; UP +14.6% YoY

🔹 Comparable Sales: +0.6% (Est. -4.0%) 🟢

🔹 Gross Margin: 32.7% (Est. 32.2%) 🟢; UP +50 basis points YoY

🔸 Appointment of Winnie Park as CEO

Q4 Guidance:

🔹 Revenue: $1.35B-$1.38B (Est. $1.36B) 🟡

🔹 Comparable Sales: -3% to -5% (Est. -5.3%) 🟢

🔹 Adjusted EPS: $3.23-$3.41 (Est. $3.30) 🟡

FY24 Guidance:

🔹 Revenue: $3.84B-$3.87B (Est. $3.80B) 🟢

🔹 Comparable Sales: -3% (Est. -4.6%) 🟢

🔹 Adjusted EPS: $4.78-$4.96 (Est. $4.60) 🟢

Operational Highlights:

🔹 Opened 82 new stores, ending Q3 with 1,749 stores (+18.1% YoY).

🔹 Year-to-date, opened 205 new stores compared to 141 in FY2023.

🔹 Focused on enhancing product value, operational efficiency, and store experience.

Strategic Updates:

🔸 Record number of store openings during Q3, surpassing expectations.

🔸 Appointment of Winnie Park as CEO, effective December 16, 2024.

🔸 Focus on driving growth through product innovation, value, and store expansion.

CEO Commentary:

🔸 "Our Q3 results exceeded expectations, driven by improved performance across key merchandise categories and a record pace of new store openings. We are encouraged by solid Black Friday results and remain focused on delivering for customers in the critical holiday season ahead." – Ken Bull, Interim CEO