$ERIC A (+0.31%)

$DPZ (-1.21%)

$JNJ (-0.1%)

$JPM (+1.01%)

$WFC (+0.44%)

$BLK (-0.64%)

$GS (+0.78%)

$C (+2.09%)

$MC (-0.32%)

$ASML (+2.07%)

$BAC (+0.71%)

$MS (+1.1%)

$JBHT (+1.36%)

$EQT (-0.37%)

$SRT (-2.05%)

$NESNE

$TSM (+0.79%)

$ABBN (+0.56%)

$UAL (-0.52%)

$TOM (-1.54%)

$VOLV B (+0.34%)

$AXP (+1.02%)

$SLBG34

$STT (+1.31%)

- Markets

- Stocks

- Dominos Pizza

- Forum Discussion

Discussion about DPZ

Posts

30Quartalsberichte 13.10-17.10.25

The Humanoid 66 - The next industrial turning point

Good morning dear Getquin community 👋

Today I would like to introduce you to The Humanoid 66 and what it's all about. The market for humanoid robotics is just taking off and is facing one of the biggest upheavals since the advent of the automobile. Morgan Stanley and Goldman Sachs expect the market to be worth between 38 billion and three trillion US dollars by 2035. By 2050, over 60 million humanoid robots could be in use in the USA alone.

With The Humanoid 66, Morgan Stanley has compiled a list of 66 companies that are likely to benefit directly or indirectly from this development. These include not only the manufacturers themselves, but also suppliers and technology groups that provide the necessary infrastructure, from semiconductor and battery producers to sensor technology and software through to platform operators for artificial intelligence.

The leading players include $TSLA (+3.52%) Tesla with Optimus, Figure AI with Figure 02, Agility Robotics with Digit, Boston Dynamics with Atlas and Unitree with H1 and G1. Tesla is already planning to use more than a thousand Optimus robots in its own factories by 2024. The goal is clear: to make humanoid machines suitable for mass production at prices between 20,000 and 30,000 US dollars. Figure AI works closely with $MSFT (+1.37%) Microsoft, OpenAI and $BMW (+0.72%) BMW and was able to raise over 675 million US dollars in a financing round.

Technological progress is the key driver of this development. Multimodal generative AI enables humanoid robots to understand speech, communicate with humans and perform tasks autonomously. Advances in actuator technology, LiDAR systems, force sensors and battery technology are making the machines more efficient and more human-like. The energy density of modern lithium-ion cells is increasing by around 20 percent every two years, while the cost per kilowatt hour is expected to fall to 80 US dollars by 2030.

At the same time, wage costs for human labor are rising significantly. In the USA, they currently stand at just under 40 US dollars per hour, while in China they are around 6.50 US dollars and in India 4.45 US dollars. Studies show that automation can reduce labor costs in industrialized countries such as Germany, Japan and the USA by up to a third by 2025. Sectors such as agriculture, construction, care, logistics and manufacturing, where millions of jobs remain unfilled today, will be particularly affected.

The Humanoid 66 shows that this change goes far beyond individual companies. A new industrial ecosystem is emerging that links hardware, software, energy and data. Price reduction, scalability and integration into existing value chains will determine who will be among the winners.

Takeaway: Humanoid robotics is no longer a vision of the future, but the beginning of a structural reorganization of the global economy. Those who invest early in key areas such as AI chips, batteries, sensor technology and automation are positioning themselves in a sector that is likely to have a similarly profound impact as the invention of the car. The crucial question is just how far society is prepared to accept and integrate this new form of workforce.

For those who want to delve deeper: These are the companies featured in the Morgan Stanley report Humanoids @Tenbagger2024

@Multibagger

1. Tesla - USA - $TSLA (+3.52%)

2. Toyota - Japan - $7203 (+1.96%)

3. Xpeng - China - $XPEV (+6.17%)

4. Naver - South Korea - (not listed)

5. CATL - China - $3750 (+0.98%)

6. LG Energy Solution - South Korea - $373220 Subsidiary of LG

7. Samsung / Samsung SDI - South Korea - $SMSN (+4.28%)

8. SK Innovation - South Korea - $096770

9. HD Hyundai Infracore / Doosan (component) - South Korea - $042670

10. Hengli Hydraulic - China - $601100

11. NTN - Japan - $6472 (+0%)

12. NSK - Japan - $6471 (+0%)

13. Sanhua - China - $002050

14. Siemens - Germany - $SIE (+1.52%)

15. Top Group ("Topu") - China - $601689

16. Ambarella - USA - $AMBA (+1.52%)

17. Synopsys - USA - $SNPS (-0.68%)

18. NXP - Netherlands / USA - $NXPI (+0.4%)

19. Qualcomm - USA - $QCOM (+10.43%)

20. TSMC - Taiwan - $TSM (+0.79%)

21. Wolfspeed - USA - $WOLF

22. ARM - UK - $ARM (+3.68%)

23. onsemi - USA - $ON (+3.47%)

24. cadence - USA - $CDNS (+1.01%)

25. STMicroelectronics - Netherlands - $STM (+1.87%)

26. NVIDIA - USA - $NVDA (+1.93%)

27. SK hynix - South Korea - $HY9H (+7.3%)

28. sociionext - Japan - $6526

29. SMIC - China - $0981

30. infineon - Germany - $IFX (+2.14%)

31. Renesas - Japan - $6723 (+1.34%)

32. Dassault Systèmes - France - $DSY (-0.7%)

33. Mobileye - Israel / Intel ecosystem - $MBLY

34. Hexagon - Sweden - $HEXA B (+0.16%)

35. Knight Transportation - USA - $KNX (-0.51%)

36. DSV - Denmark - $DSV (+2.21%)

37. Werner Enterprises - USA - $WERN (-0.42%)

38. DHL Group - Germany / international - $DHL (+1.62%)

39. Kuehne + Nagel - Switzerland - $KNIN (+1.42%)

40. Obayashi - Japan - $1802 (+0.34%)

41. China State Construction Engineering Corporation (CSCEC) - China - $601668

42. RBG (presumably an Asian construction company) - (not listed)

43. Shimizu - Japan - $1803 (+1.71%)

44. Taisei - Japan - $1801 (+1.2%)

45. Baker Hughes - USA - $BKR (-1.35%)

46th SLB (Schlumberger) - USA - $SLB

47. Tenaris - Luxembourg / multinational - $TEN (+3.1%)

48. Halliburton - USA - $HAL (+0.95%)

49. amazon - USA - $AMZN (+1.04%)

50th Coupang - South Korea $CPNG (+1.91%)

51. JD.com - China - $JD (+2.71%)

52. BMW - Germany - $BMW (+0.72%)

53rd Mercedes-Benz - Germany - $MBG (+0.81%)

54th General Motors - USA - $GM (-0.47%)

55. BYD - China - $1211 (+1.71%)

56. Stellantis - NL / multinational - $STLAM (+0.34%)

57. Ford - USA - $F (-4.22%)

58. McDonald's - USA - $MCD (+1.04%)

59th Domino's - USA - $DPZ (-1.21%)

60. BGF Retail - South Korea - $282330

61. GS Retail - South Korea - $007070

62nd Lotte - South Korea - $004990

63. Yum China - China - $YUMC (-0.49%)

Source: Morgan Stanley Research Bluepaper Humanoids Investment Implications of Embodied AI and Stock3 drumbeat of Germany's humanoid robot manufacturers The Humanoid 66, 05.10.2025

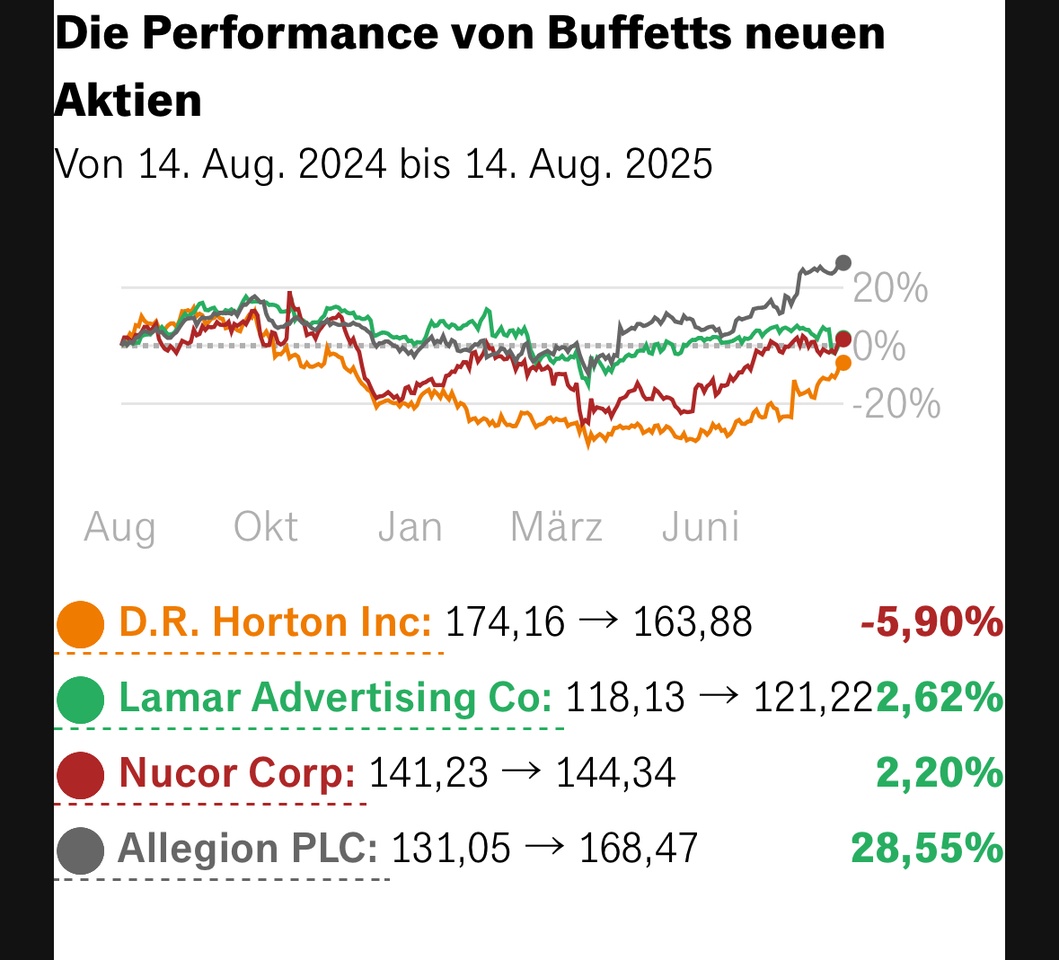

Buffett makes secret position public

The 94-year-old star investor is investing in new shares, according to data published by the US Securities and Exchange Commission (SEC) on Friday night. The document also reveals the identity of a position that was built up in secret.

Berkshire takes a stake in United Health

For two quarters, Berkshire had secretly built up a position in a share without having to disclose it. The process is not unusual. It typically happens when Berkshire builds up large positions and does not want copycats to drive up the price.

It is the US insurer United Health $UNH (-0.2%)

After Buffett's entry became known, the share price shot up by over eight percent in the aftermarket. Since the beginning of the year, however, it is still down around 45 percent.

The majority of analysts are confident that United Health will soon overcome its difficulties. According to the financial service LSEG, 19 out of 28 experts currently recommend buying the share. Their average target price of 313.50 dollars is a good 15 percent higher than Thursday's closing price.

Four more buys

At steel producer $NUE (+4.06%) Nucor, Berkshire held 6.6 million shares worth 857 million dollars as at June 30. At the house building company $DHI (+0.6%) DR Horton amounted to 191 million dollars, at the outdoor advertising company $US5128152007 Lamar Advertising to 142 million dollars and $ALLE (+1.72%) Allegion, a manufacturer of locking systems, to 112 million dollars.

All four shares are rather insignificant in Berkshire's portfolio. Together they are only worth 1.3 billion dollars - just 0.5 percent of the total portfolio.

The most important position that was increased, on the other hand, is the oil company $CVX (-0.34%) Chevron. Berkshire increased its position here for the first time since the fourth quarter of 2023. It grew by just under three percent.

Berkshire also increased its position in $POOL (-1.12%) Pool, which claims to be the world's leading distributor of swimming pool accessories (up 136 percent), as well as beverage manufacturer $STZ (-1.52%) Constellation Brands (up eleven percent), the aerospace company $HEI (-0.59%) Heico (up eleven percent) and the pizza chain $DPZ (-1.21%) Dominos Pizza (up 0.5 percent).

Berkshire's equity portfolio continues to shrink

Sold 20 million $AAPL (+1.68%) Apple shares and securities of $BAC (+0.71%) Bank of America and $DHI (+0.6%) D.R. Horton, and the company also completely divested itself of $TMUS (+1.58%) T-Mobile US.

In the second quarter, Berkshire also sold shares in the cable television company $CHTR (-0.06%) Charter Communications (down 46.5 percent), the healthcare group $DVA (+0.11%) Davita (down 3.8 percent) and the media company $FWONA (-0.1%) Liberty Media (2.5 percent).

Buffett also sold shares in Davita in the current quarter. Although Davita is still the tenth largest position in the Berkshire portfolio, it has shrunk by eight percent since March 31. Since the beginning of the year, it has even fallen by almost eleven percent.

Source: Text (excerpt) & graphics: Handelsblatt, 15.08.2025

Domino’s Q2’25 Earnings Highlights

🔹 Revenue: $1.145B (Est. $1.146B) 🟡; +4.3% YoY

🔹 EPS: $3.81 (Est. $3.36) 🟢; -5.5% YoY

Same-Store Sales

🔹 U.S. Same-Store Sales: +3.4% (Est. +2.0%) 🟢

🔹 U.S. Company-Owned Stores: +2.6%

🔹 International Same-Store Sales (Ex-FX): +2.4% (Est. +1.3%) 🟢

Store Growth

🔹 Net Global Store Adds: +178

↳ U.S.: +30

↳ International: +148

🔹 Total Store Count: 21,536

🔹 Trailing 12-month Net Store Growth: +606

Margin Trends

🔹 U.S. Company-Owned Store Gross Margin: 15.6% (-200 bps YoY) 🔴

🔹 Supply Chain Gross Margin: 11.8% (+50 bps YoY) 🟢

Other Q2 Metrics:

🔹 Income from Operations: $225M (+14.8% YoY)

🔹 Free Cash Flow: $331.7M (+43.9% YoY)

🔹 Operating Cash Flow: $366.9M (+33.8% YoY)

🔹 Net Income: $131.1M (Est. $135.7M) 🔴; -7.7% YoY

CEO Commentary

🔸 "We delivered strong Q2 results. Both delivery and carryout grew in the U.S., helping gain meaningful market share. We're now fully rolled out on the two largest aggregators and offer all major crusts, including stuffed crust. With best-in-class unit economics, the largest ad budget, and a rewards program that’s bigger than ever — we’re well-positioned to drive long-term value." – CEO Russell Weiner

🍟 Fries stable, fewer guests: McDonald's Q1 2025

McDonald's $MCD (+1.04%) is one of my top 3 positions in the portfolio and not without reason:

The Group has stood for stability, strong dividends and global brand power for decades.

But even McDonald's is not immune to inflation, consumer restraint and macroeconomic headwinds.

In the following article, I categorize the Q1 figures based on the official earnings release [1] and supplementary statements from the earnings call/webcast [2].

In addition to the pure figures, it's also about loyalty programs, margin development, new menu strategies and my personal conclusion on the share.

Have fun!

_______________

McDonald's is starting the new year with a decline in sales and profits, with business weakening in the USA in particular. Nevertheless, the company is showing global resilience, particularly through its licensed markets and the rapidly growing loyalty program.

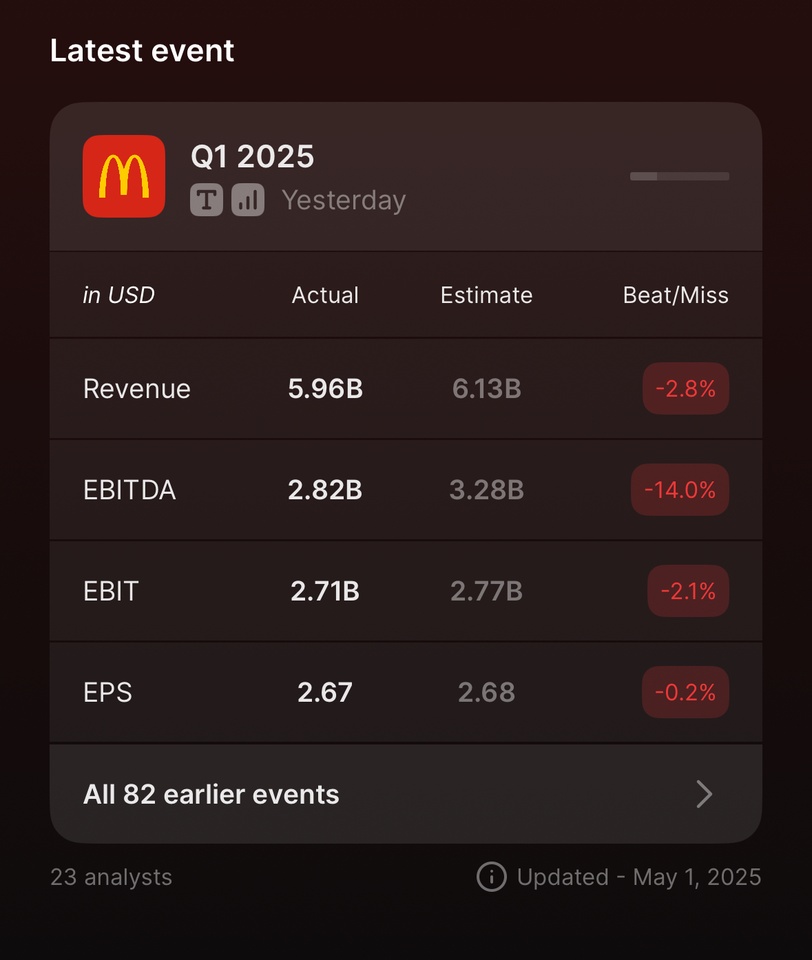

📊 ESTIMATES VS. REPORTED

*(According to the earnings report, operating profit (EBIT) amounted to $2.65 billion; the third-party provider Quartr states a slightly different figure of $2.71 billion, which may be due to rounding or other valuation measures).

📊 Results Q1 2025

- Turnover$5.96 billion (previous year: $6.17 billion) -> decline of 3%

- Operating profit (EBIT): $2.65 billion (previous year: $2.74 billion) -> decrease of 3%

- Earnings per share (EPS):

- GAAP (incl. special effects): $2.60 (previous year: $2.66) → -2%

- Non-GAAP (adjusted): $2.67 (previous year: $2.70) → -1 %

What is GAAP vs. non-GAAP?

- GAAP: official accounting in accordance with US accounting rules

- Non-GAAP: adjusted figures, e.g. without special effects such as restructuring costs, often better suited to evaluate the "operating business"

💰 Margin & result

"Our adjusted operating margin was around 45.5%, despite declining sales."

- Ian Borden, CFO

- Operating margin down slightly (vs. 46.3% in FY 2024), but remains very robust given the environment

- Restaurant margins above $3.3 billion in Q1

- Declines in company-operated margins, especially in Europe (see brief digression)

EXCURSUS: Company-operated margin: (operating margin from company-owned restaurants)

...refers to the profit margin that McDonald's generates from the restaurants it operates itself, as opposed to franchise or licensed operations.

McDonald's operates two types of restaurants worldwide:

1 . Franchise restaurants (around 95%)

- Operated by independent entrepreneurs.

- McDonald's earns from this through franchise fees, rent and revenue sharing.

2 . Company-operated restaurants (approx. 5 %)

- Belong directly to McDonald's

- Sales and costs run entirely through the consolidated balance sheet.

Why is this margin important?

- It shows how profitable McDonald's own stores are.

- If, for example, costs for staff, food or energy rise, this puts pressure on this margin.

- In the earnings call, it was emphasized that company-operated margins were under pressure in Q1, particularly in Europe:

- cost inflation

- weaker demand

- unfavorable exchange rates

🌍 Global comparative figures (Comparable Sales):

- These are sales from existing restaurants that have been open for at least 13 months. They show organic growth without the effect of new locations.

- Worldwide: -1.0 %

- USA: -3.6 %

- International Operated Markets (IOM): -1.0 %

- International Developmental Licensed Markets (IDL): +3.5 %

What are IOM and IDL markets?

- IOM: Countries and regions in which McDonalds itself is more heavily involved (e.g. Germany, UK, France)

- IDL: Countries in which McDonald's does not operate its restaurants itself, but licenses them to local franchise partners. These partners pay fees to McDonald's but run the business independently. Examples: Japan, Middle East, parts of Asia and Africa.

📉 Why did things go worse in the USA?

The decline in sales in the USA (-3.6 % comparable sales) was mainly due to:

- Fewer guests (falling visitor numbers)

- Consumer restraint among lower income groups

- Price increases in the previous year, which are now increasingly deterring customers

- Fewer orders per visit & fewer premium products in the shopping basket (weaker product mix)

🌐 System-wide sales (system-wide sales):

- This comprises the total sales of all McDonald's restaurants, i.e. both existing and new locations, regardless of whether they are operated by McDonald's itself or by franchise partners.

- Q1 2025: -1 %

- but: +1 % at constant exchange rates

What does this mean?

Without the influence of fluctuating exchange rates, sales would have increased by 1 %. Calculated in US dollars, for example, a weak euro has a negative impact, even though the local business is stable.

🔁 Leap Day distorts comparison:

2024 was a leap year with February 29 (Leap Day), which means one more day of sales compared to 2025, making the previous year's base appear artificially higher. This makes the decline in sales appear larger than it actually is.

🎯 Loyalty program, McDonald's digital joker

Via the app or with a customer account, users receive loyalty points for their orders, which they can exchange for free products or discounts, similar to Payback but with burgers.

- $8 billion in sales in Q1 2025 with loyalty members

- $31 billion in the last 12 months

- 175 million active users (in the last 90 days), measured on a rolling basis

Why is the revenue from loyalty members higher than the Group revenue of $5.96 bn?

- The $8 billion are system sales (Systemwide Sales see above, i.e. the total sales of all McDonald's restaurants worldwide, including franchise operations.

- McDonald's Group revenue ($5.96 billion) only includes the revenue of the company itself (e.g. franchise fees & revenue from own stores).

➡ The high loyalty revenue shows how strong customer loyalty and app usage have become and how important this digital strategy is for McDonald's future.

➡️ Loyalty customers order more frequently, spend more and are less price-sensitive. The program helps McDonald's to stabilize sales and retain customers, especially in difficult economic times.

💳 Consumer climate & customer behavior

"In contrast to a few months ago, spending by middle-class consumers has now fallen almost as sharply as that of low-income households."

- Christopher Kempczinski, CEO

- Macroeconomic pressure & geopolitical uncertainty are impacting the QSR environment more than expected.

- Low- and middle-income customers are spending significantly less - especially in the USA.

- High-income customers remain relatively stable.

UnderstandingWhat is the QSR environment?

QSR = Quick Service Restaurant

This refers to the quick service restaurant sector, e.g. McDonald's, Burger King, Subway, KFC, etc.

When the "QSR industry" is mentioned in the earnings call, this refers to the competition and demand in the global fast food sector.

The "QSR environment" includes:

- Consumer behavior (how often do people go out to eat?)

- competitive pressure

- pricing strategies

- Costs (e.g. for raw materials, wages, rents)

🔎 Interim conclusion so far:

As expected, the figures show a challenging quarter with declines in sales and earnings in almost all core markets.

The USA in particular suffered from inflation, price pressure and weaker demand.

At the same time, McDonald's remains remarkably profitable with an operating margin of 45.5 %, which speaks for the resilience of the business model.

Growth in the licensed markets (IDL) and the strong loyalty program provide clear rays of hope.

For me, these are the first signs that McDonald's is structurally well positioned, even if the short-term momentum is currently slowing.

⚙️ Further initiatives & Strategy 2025:

Value-oriented menu strategy & McValue platform

"Leadership in price-performance is crucial in this environment."

- Kempczinski, CEO

- $5 Meal Deal in the USA

- EDAP menus (Every Day Affordable Price) in all 5 most important international markets

- Example France: Happy Meal for €4, menu cooperation with Ligue 1

- Example Germany: new McSmart Snacks program for price-conscious customers

Customer loyalty & marketing offensives

"Our Minecraft campaign is our biggest global campaign to date - with over 100 participating markets."

- Kempczinski, CEO

- Minecraft movie campaign with digital experience & in-store promos

- 50 years of breakfast in the US with McMuffin Day & bagel return

- In Canada: $1 coffee & field hockey promo with 50 million impressions

Innovation & new structure

"We are creating burger, chicken & beverage specialists as we compete more and more against specialized players (e.g. chains that focus only on chicken or beverages, such as Chick-fil-A or Starbucks) to develop targeted products and better compete in these segments."

- New Restaurant Experience Team

- Faster implementation thanks to integrated product/tech/supply approach

- CosMc's insights flow into new beverage tests in US stores

- New category managers for Beef, Chicken & Beverages

GBS = Global Business Services:

- McDonald's centralizes areas such as accounting, IT & controlling to save costs and work faster.

More focus on mobile orders & digitalization

- Mobile orders via app & kiosks make the ordering process more efficient, collect data and increase basket value

Investments:

- +$300-500 million CapEx planned annually until 2027

- Focus on new restaurants, modernization & technology

📉 Challenges:

- Inflation & reluctance to spend, especially in the USA & Europe

- Currency risks: Weak foreign currencies depress sales in US dollars

- Operating margin pressure: Rising costs coupled with falling visitor numbers

📌 Personal conclusion

In the first quarter, McDonald's showed that even a giant can come under pressure, especially in a weak economic environment with declining visitor numbers in the US and Europe.

Nevertheless, the share price has remained relatively stable.

At the same time, I am convinced by the long-term levers:

the strong loyalty program, targeted pricing models and the international expansion in licensed markets (IDL), which are growing solidly.

I am continuing to hold my position, as McDonald's remains a robust basic investment for me.

However, there will be no further acquisitions at the moment, as I would first like to see margins and customer numbers stabilize in the long term.

_____________

Thank you for reading! 🤝

_____________

Sources:

[1] https://corporate.mcdonalds.com/content/dam/sites/corp/nfl/pdf/Q1_25_Earnings_Release.pdf

[2] https://web.quartr.com/link/companies/5595/events/314423?targetTime=0.0

______________

$MCD (+1.04%)

$YUM (-0.24%)

$QSR (-0.26%)

$WEN (-0.91%)

$CMG (-0.18%)

$SBUX (+1.24%)

$DPZ (-1.21%)

$JACK (-3.25%)

Domino’s Pizza reported earnings Q1 FY2025 results ended on Mar 23, 2025

- Revenue: $1.11B, +2.5% Y/Y

- Net Income: $149.7M, +18.9% Y/Y

- Free Cash Flow: $164.4M, +59.1% Y/Y

CEO Russell Weiner: "Our Hungry for MORE strategy continues to drive market share growth in QSR Pizza across both our US and international businesses."

🌱Revenue & Growth

- US retail sales: $2.24B, +1.3% Y/Y

- International retail sales: $2.22B, +8.2% Y/Y

- Global retail sales: $4.46B, +4.7% Y/Y

- US same store sales: -0.5% Y/Y

- International same store sales (ex-FX): +3.7% Y/Y

💰Profits & Health

- Gross Margin: 39.8% vs 38.9% in Q1 2024

- U.S. Company-owned store gross margin: 16.0%, down 1.5pp Y/Y

- Supply chain gross margin: 11.6%, up 0.5pp Y/Y

- Income from Operations: $210.1M, -0.2% Y/Y

- Diluted EPS: $4.33, +20.9% Y/Y

- Leverage Ratio: 4.9x vs 5.0x Q1 2024

- Net Cash from Ops: $179.1M, +45.0% Y/Y

- Capital Expenditures: $14.7M, -26.9% Y/Y

📌Business Highlights

- 17 net new stores in US; 25 net closures internationally

- Declared $1.74/share dividend (payable Jun 30, 2025)

- Repurchased 115,280 shares for $50M

- Food basket pricing to stores increased +4.8% Y/Y

🔮Future Outlook

- Focus on Hungry for MORE strategy: MORE sales, MORE stores, MORE profits

- Emphasis on growing US and international market share despite macroeconomic challenges

- Share repurchase authorization remaining: $764.3M

A steak always works 🤤

With $TXRH (+0%)

$CMG (-0.18%)

$MCD (+1.04%)

$DRI (-0.71%)

$DPZ (-1.21%) I have a few restaurants in my savings plan portfolio 😁

Last earnings Texas Roadhouse

- Dividend will increase by 11 % to 0.68$ increased

- Share buyback program of 500 million$

4Q 2024 4Q2023

Turnover 1.437 bn.$ 1,164 billion dollars

Net profit 115 million dollars 72 million dollars

EPS 1.73$ 1.08$

Source

Are you in the industry and what do you have in your portfolio?

Domino's share under pressure after disappointing quarterly figures

Have you heard the latest news about Domino's Pizza $DPZ (-1.21%) have you heard? The stock is down more than 3% in pre-market trading after fourth quarter results failed to meet Wall Street expectations.

Domino's reported that revenue rose 2.9% year-over-year to $1.44 billion. This was supported by higher order volumes and increased food and box prices. However, same-store sales were below the forecast 1.72% with an increase of 0.4%.

Adjusted earnings came in at $4.89 per share, also below expectations of $4.93. The annual figures were also disappointing, although the company's international sales performance was slightly above expectations.

Domino's strategy, "Hungry for MORE", has led to an increase in orders, but CEO Russell Weiner admits that competition in the quick service restaurant sector is strong. Despite the challenges, he remains optimistic that the company can gain market share.

How do you see the future of Domino's? Will the shares recover?

Domino's Pizza Q4 Earnings Highlights

🔹 EPS: $4.89 (Est. $4.91) 😐; UP +9.2% YoY

🔹 Revenue: $1.44B (Est. $1.47B) 😐; UP +2.9% YoY

🔹 Net Income: $169.4M (Est. $172.25M) 🔴; UP +7.7% YoY

Q4 Segment Performance:

🔹 U.S. Same-Store Sales Growth: +0.4% YoY

🔹 International Same-Store Sales Growth (Ex-FX): +2.7% YoY

🔹 U.S. Company-Owned Store Gross Margin: 15.5% (UP +0.8pp YoY)

🔹 Supply Chain Gross Margin: 11.3% (UP +0.4pp YoY)

Geographic Breakdown:

🔹 Global Net Store Growth: +364 stores in Q4

🔹 U.S. Store Count: 7,014 (UP +84 net new stores)

🔹 International Store Count: 14,352 (UP +280 net new stores)

🔹 Total Store Count: 21,366

Operational & Other Metrics:

🔹 Income from Operations: $273.7M (UP +6.4% YoY)

🔹 Free Cash Flow: $512M (UP +5.5% YoY)

🔹 Leverage Ratio: 4.9x (vs. 5.2x in 2023)

Strategic & Shareholder Updates:

🔹 Quarterly Dividend Increased by 15% to $1.74/share

🔹 Share Buyback: Repurchased $112M worth of shares in Q4; $327M for FY24

🔹 Total Authorized Buyback Remaining: $814.3M

CEO Russell Weiner’s Commentary:

🔸 "Domino's 2024 results demonstrated that our Hungry for MORE strategy drives strong order growth despite macroeconomic challenges. Our international business marked 31 consecutive years of same-store sales growth, while our U.S. market share expanded in QSR Pizza. We remain confident in continued market leadership and long-term value creation for franchisees and shareholders."

Update 01/25

As announced, here's a little update on January today, nothing long, don't want to bore you

Yield

Yield: 6.82% (FTSE All World: 4.23%)

TTWROR: 7.29%

Thus slightly outperformed, hopefully I can extend this lead further

transactions

Sales:

- Shimano $7309 (-1.41%)

Medpace $MEDP (-1.58%)

Apple $AAPL (+1.68%)

Domino's Pizza $DPZ (-1.21%)

McDonald's $MCD (+1.04%)

Purchases

- Norbit $NORBT (+3.6%) (subsequent purchase)

- Frosta $NLM (+4.44%) (initial purchase)

- RCS Mediagroup $RCS (-0.29%) (initial purchase)

- Uber Technologies $UBER (+2.13%) (initial purchase)

- Sanlorenzo $SL (+0.72%) (initial purchase)

- Charles River Labs $CRL (-1.15%) (subsequent purchase)

- Simply Better Brands $SBBC (-4.23%) (initial purchase)

Looks like a lot of back and forth for now, but with this my portfolio conversion continues and will soon be completed

Trending Securities

Top creators this week