2 weeks ago Deep Dive from @Derspekulant1 . I had already entered 3 days earlier, but today the derivative on $DDOG (-5.26%) has already reached the 100% mark.

Discussion about DDOG

Posts

44📊 Deep Dive: Datadog ($DDOG)

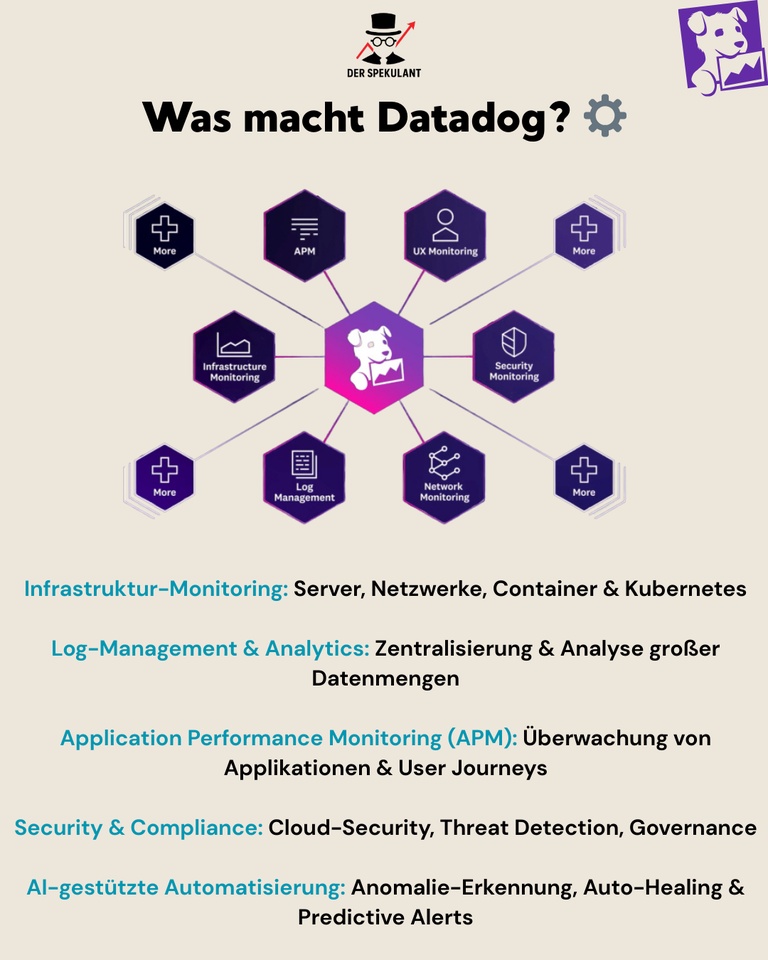

👉 Datadog is one of the leading providers in the field of monitoring, observability & security for cloud infrastructures. Founded in 2010, the US company has become an indispensable "operating system" for modern IT stacks - from servers and networks to applications and AI applications.

With a market share of ~20 % in the observability segment and a strong focus on upselling (security & AI modules), Datadog has established itself as a standard solution for hyperscalers, startups and Fortune 500 companies.

🚀 Growth driver

➡️ Cloud adoption & AI boom: Every company that uses the cloud needs monitoring - Datadog is one of the first port of call.

➡️ GLUE effect: Strong customer loyalty - once integrated, switching is extremely difficult (vendor lock-in).

➡️ UpsellingSecurity & AI modules drive margins up significantly.

➡️ Market potential: According to Gartner, the global observability market is growing at a double-digit rate and is expected to reach > USD 70 billion by 2030.

💰 Finances (Q2/2025)

📊 Sales: $720m (+23% YoY)

📊 ARR: ~$2.9bn

📊 Customers >100k ARR: ~3,200 (+18% YoY)

📊 Free cash flow margin: ~25 %

📊 Rule of 40: ~50 (top level for SaaS)

📊 NRR: >115 % → strong upselling

📊 Magic Number: ~0.8-0.9 (below ideal value >1, due to high AI investments)

⚖️ Valuation

➡️ EV/Sales 2025e: ~12x → high, but not unusual for market leaders in the SaaS sector

➡️ Comparison: Dynatrace ~8x, Splunk (before Cisco acquisition) ~5x → Datadog is clearly premium valued.

➡️ P/E ratio (2026e): ~45 → Profitability present, but growth story dominates.

🟢 Opportunities

🟢 Cloud & AI megatrend: Monitoring is mandatory infrastructure - whether for start-ups or Fortune 500.

🟢 Cross-selling: One customer → many modules (observability, security, APM, log management).

🟢 Scalability: SaaS model with high margins and enormous cash flow leverage.

🟢 First-mover advantage: Strong brand, community & developer ecosystem.

🔴 risks

🔴 Hyperscaler competition: AWS, Azure, GCP develop their own observability solutions.

🔴 High valuation: Execution risk - small disappointment = big price losses.

🔴 Dependence on IT budgets: Monitoring budgets are put on hold during recessions.

🔴 Competitive pressure: Dynatrace, Splunk, Elastic, New Relic - strong competition.

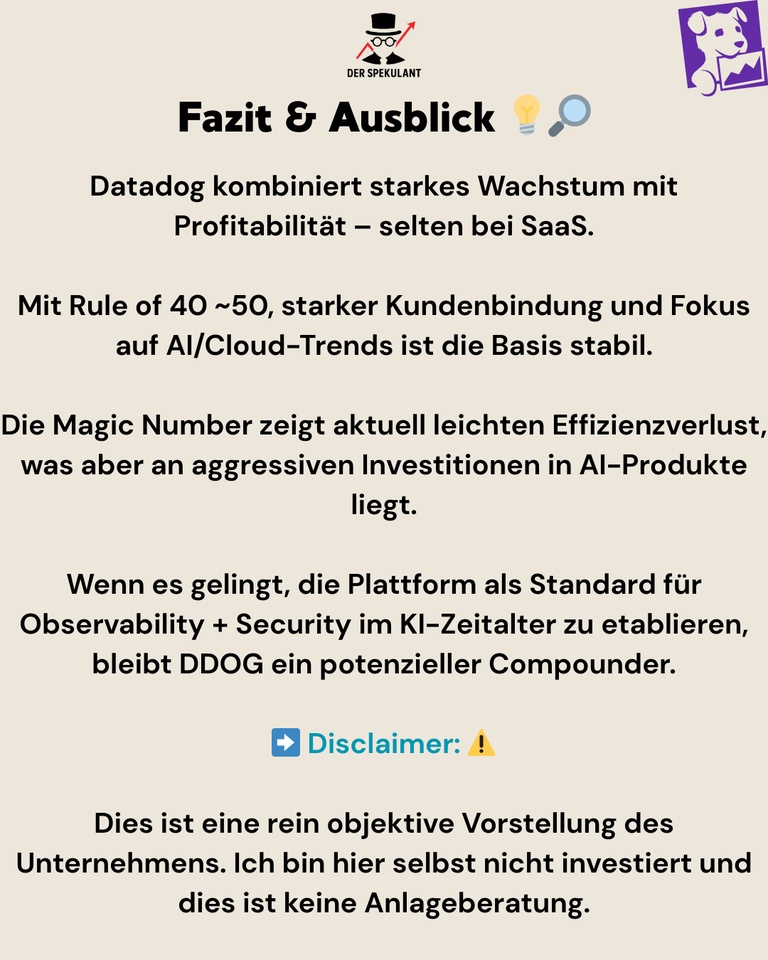

🧠 Conclusion

Datadog combines strong growth with profitability - a rarity in the SaaS sector. With a Rule of 40 of ~50 and >25 % FCF margin, the foundation is solid.

The high valuation remains the biggest risk - $DDOG (-5.26%) must continue to grow at double-digit rates to justify it.

👉 Will Datadog succeed in establishing itself in the AI age as the standard platform platform for monitoring + security in the AI age, it remains a potential compounder.

❓Question for the community:

Do you trust Datadog to maintain its premium multiple and overtake Splunk & Dynatrace in the long run - or is the stock currently too highly valued?

+ 2

Share analysis

Good evening,

I would like to take a closer look at various companies. To understand, is there potential, which figures are important, price/earnings ratio, profit growth... I find it a bit difficult. Is there something like a guide or something similar for stock analysis, so that I can simplify the procedure of how to approach a stock analysis? Can you recommend anything? I would be very grateful for any tips. 😊

I would currently like to take a closer look at these: $SOFI $BMNR (-10%)

$TEM (-5.83%)

$DDOG (-5.26%) ...

Greetings 👋🏽

2. profitability: profit growth, margins, return on equity and ROIC development

3. shareholder reward: dividends, buybacks, share price performance

4. security: debt history, interest coverage, book value and net asset value per share

5. current valuation and fair value

6. comparison of key figures with competitors in order to better classify the figures.

This is how I do it. On my YouTube channel Nicole's Stock Profiles you can see videos where I do this for various companies. However, your companies are not yet included.

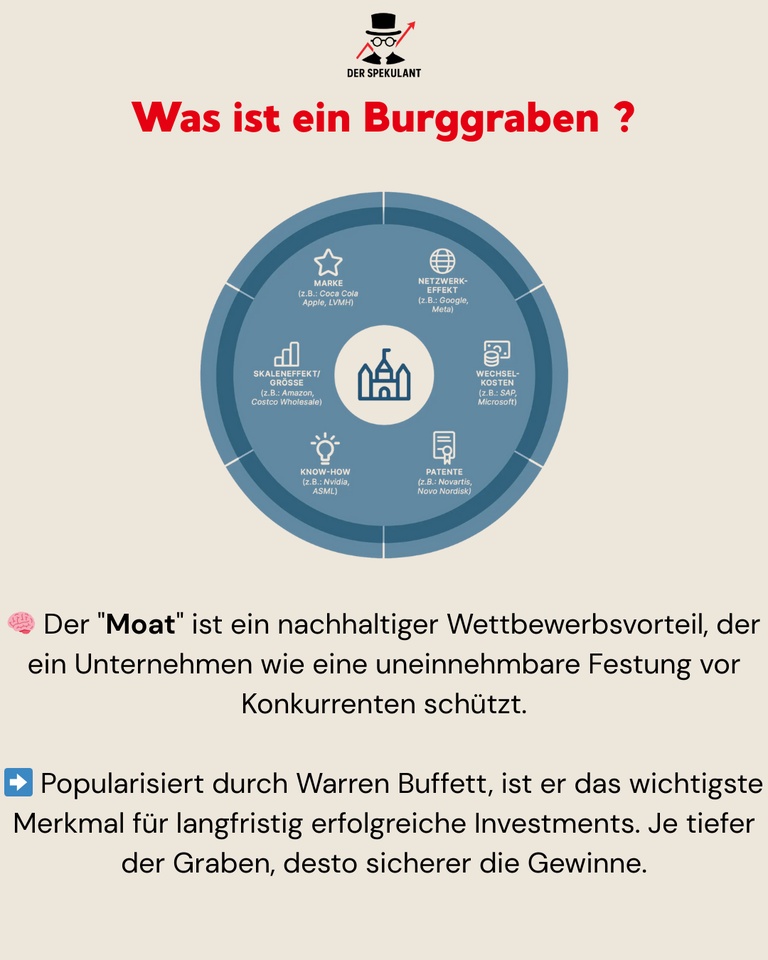

The moat: The most important concept every investor needs to understand 🏰

Hello Community,

Warren Buffett once said: "The key to investing is not assessing how much an industry will impact society or how much it will grow, but determining the competitive advantage of a particular company and, more importantly, the durability of that advantage."

It is precisely this competitive advantage that he called the "moat". In this article, we break down the most important concept for long-term stock market success in detail.

The 4 types of impregnable moats:

👑 1. intangible assets:

These are invisible but extremely powerful assets. They include brands that create an emotional bond and pricing power (as with $RACE (-3.78%) ), or patents that lock out competitors for years (as with $NOVO B (-3.44%) in the pharmaceutical sector). Companies with this moat can often charge higher prices and thus achieve higher margins.

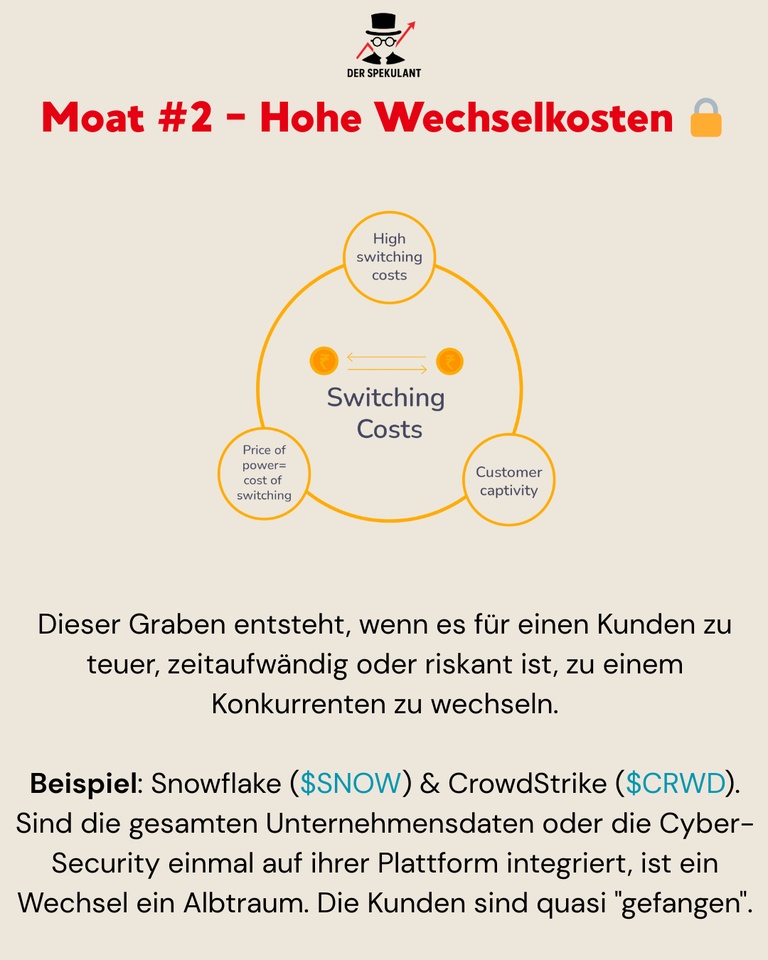

🔒 2. high switching costs:

Perhaps the most underestimated moat. A company has this moat if the customer would have to put up with massive disadvantages to switch providers. My AI infrastructure cluster is full of them: $SNOW (-4.44%) , $CRWD (-4.63%) and $DDOG (-5.26%) integrate themselves so deeply into their customers' IT systems that switching would be tantamount to operational hara-kiri. Customers stay, even if prices rise. The "net retention rate" is the key figure here.

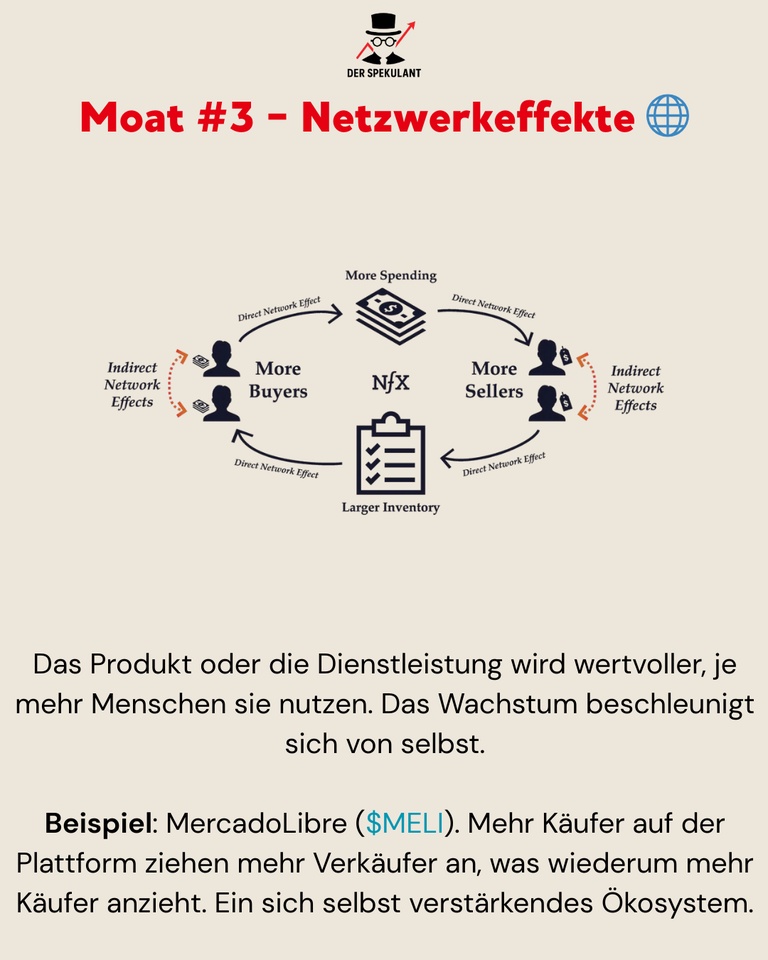

🌐 3. network effects:

The business model becomes exponentially stronger with each new user. My best example of this is $MELI (-6.22%) . Every new seller makes the platform more attractive for buyers, and every new buyer makes it more attractive for sellers. Mercado Pago, the payment system, amplifies this effect. This moat is extremely difficult to attack once a critical mass is reached.

📉 4. cost advantages:

The ability to consistently produce or deliver at a lower cost than the competition. This can be achieved through economies of scale or, as in the case of $1211 (-4.45%) through superior vertical integration. Because BYD manufactures its own batteries, the company can wage price wars that are ruinous for the competition.

Conclusion for your strategy:

Analyzing the moat should be the first step in any stock analysis. Before you look at quarterly figures or the P/E ratio, ask yourself the question:

"What's stopping a competitor from doing exactly the same thing tomorrow, only cheaper?"

If you can't find a good answer, the company probably doesn't have a moat.

#Burggraben

#Moat

#WarrenBuffett

#Investieren

#Aktienanalyse

#Qualitätsaktien

#Wettbewerbsvorteil

#DerSpekulant

#Ferrari

#Snowflake

#MercadoLibre

+ 3

Cyber security - the armor of the future

Hello dear Getquin Community,

Over the past few days, I have been working intensively on the topic of cyber security and its fundamental importance in various sectors such as healthcare, technology, energy, armaments & defense, e-commerce, software, insurance, industry, utilities, commodities, banks, fintech, holdings, crypto and blockchain. I took a closer look at the big players, the hidden champions and the essential blade manufacturers in the industry. My aim was to gain as comprehensive a picture as possible of the different levels of this industry.

If I have overlooked any important aspects or have not categorized something correctly, I look forward to your comments and interesting additions @Tenbagger2024

@Multibagger

@Simpson

@Vegasrobaina . Together we can understand the topic even better and learn from each other.

Feel free to leave a 👍. I wish you every success with your investments 🚀

At the request of @Multibagger I have subsequently added my personal favorites in each sector. I have an investment horizon of five to ten years. In addition to the quarterly figures, my main focus was on the long-term competitive advantages and the strength of the respective moat.

Contribution:

Cybersecurity is evolving from a peripheral topic to the foundation of global markets. Whether healthcare, banking, utilities, armaments & defense, energy, industry or the digital infrastructure for artificial intelligence and blockchain, the need for protection mechanisms is increasing everywhere. While the big players such as $PANW (-4.92%) Palo Alto Networks, $CRWD (-4.63%) CrowdStrike or $ZS (-2.54%) Zscaler are in the spotlight, more and more specialized providers are emerging that are essential in their niches and often have disproportionately high growth potential. Hidden champions such as $SECT B (-1.37%) Sectra in the healthcare sector, $NCNO (-2.71%) nCino in the banking sector or $ESTC (-4.39%) Elastic in the data center show that cyber security has long been a diversified ecosystem. In addition, we must not overlook the blade manufacturers, i.e. the companies that provide the technological basis. These include chip manufacturers such as $NVDA (-6.14%) , $INTC (-5.15%) Intel or $AMD (-10.01%) AMD, data center operators such as $EQIX (-1.43%) Equin$DLR (-3.41%) Digital Realty as well as software and infrastructure providers such as $ESTC (-4.39%) Elastic, $DDOG (-5.26%) Datadog or $ANET (-4.24%) Arista Networks, without whose technology the security providers' solutions would not be scalable. The capital markets are reacting to this with valuation premiums, as the dependence on secure infrastructures is comparable to electrification in the 20th century. Investors are now faced with the question of whether to favor the established market leaders or invest in smaller companies that fly under the radar but could potentially be the real winners of tomorrow.

🔑Takeaway:

Cybersecurity is not an isolated trend, but a key investment factor across all industries from hospitals to data centers from payments to crypto platforms.

Healthcare

Major players:

$PANW (-4.92%) Palo Alto Networks (PANW), $FTNT (-4.55%) Fortinet (FTNT), $CHKP (-1.42%) Check Point (CHKP), $CRWD (-4.63%) CrowdStrike (CRWD), $S (-4.35%) SentinelOne (S), $CYBR (-3.24%) CyberArk (CYBR), $ZS (-2.54%) Zscaler (ZS), $NET (-4.51%) Cloudflare (NET), $AKAM (-3.46%) Akamai Tech. (AKAM)

- Core provider for firewalls, zero trust, endpoint and web security

My top 2 recommendation in this sector are $ZS (-2.54%) Zscaler global Zero Trust Exchange, huge barrier to entry as infrastructure is built globally and $PANW (-4.92%) All-in-one platform, extremely high customer retention, hard to replace + acquisition of the company $CYBR (-3.24%)

Hidden champions:

$SECT B (-1.37%) Sectra (SECT-B.ST) - secure imaging & healthcare security

$VRNS (-3.95%) Varonis Systems (VRNS) - protection of sensitive patient data

Imprivata (private, partnerships with listed players) - identity management for clinics

My top recommendation

$SECT B (-1.37%) Niche leadership in healthcare security & medical technology

Blade manufacturer:

$NVDA (-6.14%) Nvidia (NVDA), $INTC (-5.15%) Intel (INTC), $AMD (-10.01%) AMD (AMD) - Chips & computing power for security appliances

$EQIX (-1.43%) Equinix (EQIX), $DLR (-3.41%) Digital Realty (DLR) - Data center infrastructure for clinical data

$ESTC (-4.39%) Elastic (ESTC), $DDOG (-5.26%) Datadog (DDOG) - basic software for monitoring & analytics

My top 2 recommendations are $NVDA (-6.14%) - GPUs, quasi-monopoly in high-end compute and $EQIX (-1.43%) - largest global colocation provider, enormous switching costs

🔑 Takeaway healthcare

Healthcare data is highly sensitive and clinics are at high risk of ransomware. In addition to large security providers, hidden champions such as Sectra and Varonis are gaining in importance as they secure directly at the interface between patient data and medical devices.

Technology, Data centers & AI, Telecommunications

Major players:

$ZS (-2.54%) Zscaler (ZS), $S (-4.35%) SentinelOne (S), $CHKP (-1.42%) Check Point (CHKP)

- Protection for cloud and AI environments

My top recommendation $ZS (-2.54%) - Global Zero Trust Exchange, almost impossible to copy

Hidden champions:

$ESTC (-4.39%) Elastic (ESTC) - Security-Analytics

$ANET (-4.24%) Arista Networks (ANET)

- Network switches for data centers

My top recommendation $ANET (-4.24%) - High-end switches, hyperscaler customers

Shovel manufacturer:

$EQIX (-1.43%) Equinix (EQIX), $DLR (-3.41%) Digital Realty (DLR)

- Data center infrastructure

$NVDA (-6.14%) Nvidia (NVDA), $INTC (-5.15%) Intel (INTC), $MRVL (-5.93%) Marvell Tech. (MRVL)

- Chips & computing power for AI and security

My top 2 recommendation $NVDA (-6.14%) - GPUs, quasi-monopoly in high-end compute and $EQIX (-1.43%) - largest global colocation provider, enormous switching costs

Special players Telecommunications

$AKAM (-3.46%) Akamai Tech. (AKAM) & Cloudflare (NET) - secure traffic and mobile data

$RDWR (-4.29%) Radware (RDWR) - DDoS protection for telcos

$CSCO (-3.83%) Cisco (CSCO) - network security for carriers

$CLAV (+1.23%) Clavister Holding AB (CLAV) - through SD-WAN and carrier security

My top recommendation $AKAM (-3.46%) - Established CDN + Security

🔑 Takeaway technology, data centers & AI

Data centers and AI platforms are the backbone of the digital economy. Zero Trust and cloud security from Zscaler or SentinelOne meet shovel manufacturers such as Equinix or Nvidia, who are indispensable with infrastructure and chips.

Energy

Major players:

$FTNT (-4.55%) Fortinet (FTNT, NASDAQ) - OT/ICS security for power grids and power plants

$PANW (-4.92%) Palo Alto Networks (PANW, NASDAQ) - Zero Trust & network protection for energy suppliers

$CHKP (-1.42%) Check Point (CHKP, NASDAQ) - Critical infrastructure protection, gas and oil industry

My top recommendation $FTNT (-4.55%) - ASIC hardware + software, cost advantage

Hidden champions:

Dragos (private, IPO candidate) - leader in OT security, specialized in energy infrastructures

$RDWR (-4.29%) Radware (RDWR, NASDAQ) - DDoS defense for energy networks

$NCC (-0.3%) NCC Group (NCC.L, London) - penetration tests & audits for utilities

$CLAV (+1.23%) Clavister Holding AB (CLAV) - OT/ICS and infrastructure security

My top recommendation $CLAV (+1.23%) - small niche player (carrier security)

Shovel manufacturer:

$SBGSY (-2.31%) Schneider Electric (SBGSY, OTC) - OT/ICS hardware with security components

$ENR (-3.54%) Siemens Energy (ENR, Frankfurt) - Energy infrastructure with embedded security solutions

$AVGO (-7.17%) Broadcom (AVGO, NASDAQ) - Security chips for networks in energy environments

My top recommendation $AVGO (-7.17%) - Chip giant + Symantec Enterprise Security

E-Commerce

Major players:

$NET (-4.51%) Cloudflare (NET, NYSE) - DDoS and API protection for online stores & payment platforms

$AKAM (-3.46%) Akamai (AKAM, NASDAQ) - Application security & bot management in e-commerce

$FFIV (-3.6%) F5 Networks (FFIV, NASDAQ) - API & payment security for digital platforms

My top recommendation $NET (-4.51%) - worldwide network for DDoS/API, network effects

Hidden Champions:

$RSKD (-3.72%) Riskified (RSKD, NYSE) - Fraud prevention in online trading

$VRNS (-3.95%) Varonis Systems (VRNS, NASDAQ) - Protection of customer data

$CYBR (-3.24%) CyberArk (CYBR, NASDAQ) - Identity & access protection for payment processes

My top recommendation $CYBR (-3.24%) - Standard for Privileged Access

Shovel manufacturer:

$V (-2.33%) Visa (V, NYSE) & $MA (-2.02%) Mastercard (MA, NYSE) - not classic cybersecurity, but operators of secure payment networks

$ESTC (-4.39%) Elastic (ESTC, NYSE) - fraud analytics for e-commerce platforms

$DDOG (-5.26%) Datadog (DDOG, NASDAQ) - monitoring & security analytics for retail infrastructure

My top recommendation $V (-2.33%) - Global payment network, enormous network effect

🔑 Takeaway:

Energy is particularly vulnerable due to OT/ICS systems, specialists such as Dragos are emerging here.

E-commerce needs fraud prevention in addition to traditional web security, which is why players such as Riskified are occupying a niche.

Armaments & Defense

Major players:

$NOC (-2.31%) Northrop Grumman (NOC, NYSE) - leader in cyberdefense for military & intelligence agencies, also developing offensive cyber capabilities

$BAESY (+1.65%) BAE Systems (BAESY, OTC) - strong cyber intelligence division, protects critical military and government networks

$RTX (-3.57%) Raytheon Technologies (RTX, NYSE) - defense company with growing cybersecurity portfolio for military communications & satellites

My top recommendation $NOC (-2.31%) - Top defense contractor with cyber dominance

Hidden champions:

$PLTR (-7.09%) Palantir Technologies (PLTR, NYSE) - Data and analytics platform with strong cybersecurity component, often for defense contractors

$CACI (-2.05%) CACI International (CACI, NYSE) - specializes in cyber intelligence, network protection and military IT services

$LDOS (-3.56%) Leidos Holdings (LDOS, NYSE) - IT and cybersecurity service provider for US defense and NATO

$CLAV (+1.23%) Clavister Holding AB (CLAV) - used by government and military organizations

$ADVE Advenica (ADVE) - Specialized security, relevant for government agencies and national infrastructure

My top recommendation $CACI (-2.05%) - Cyber intelligence, deep roots in the defense sector

Shovel manufacturer:

$LHX (-2.48%) L3Harris Technologies (LHX, NYSE) - provides communications and cyber hardware for military networks

$GD (-3.41%) General Dynamics (GD, NYSE) - with its IT division GDIT also a provider of cyber defense infrastructure

$KTOS (-4.85%) Kratos Defense (KTOS, NASDAQ) - specializes in drones, satellite systems and cyber hardening of defense communications

My top recommendation $GD (-3.41%) - strong role in defense cyber with GDIT

🔑 Takeaway:

In the defence sector, the boundaries between traditional defense and cybersecurity are becoming blurred. Alongside the large defense contractors, hidden champions such as Palantir, CACI and Leidos are emerging to provide pure cyber and data expertise. Shovel manufacturers such as L3Harris and Kratos secure the technical infrastructure.

Software & insurance

Big players:

$OKTA (-5.44%) Okta (OKTA), $CYBR (-3.24%) CyberArk (CYBR), $CRWD (-4.63%) CrowdStrike (CRWD)

- Identity, endpoint and cloud security

My top recommendation $CRWD (-4.63%) - Network effect through Falcon & Threat Graph

Hidden champions:

$VRNS (-3.95%) Varonis (VRNS) - Data Security

SailPoint (private, formerly NYSE) - Identity Governance

$FROG (-0%) JFrog (FROG) - DevSecOps & Supply-Chain-Security

$CYBE (+0%) CyberCatch Holdings, Inc (CYBE) - Provides AI-based cybersecurity SaaS

$GEN (-1.72%) Gen Digital (GEN) - one of the largest consumer cybersecurity providers worldwide (Norton, Avast, LifeLock), strong in identity protection and data protection for consumers & small businesses

$RBRK (-4.71%) Rubrik (RBRK) - data compliance and security in the area of cloud data security

My top recommendation $GEN (-1.72%) - Consumer security giant (Norton, Avast, LifeLock), strong brand power

Shovel manufacturer:

$MSFT (-3.3%) (MSFT), $GOOG (-3.33%) Alphabet (GOOGL), $AMZN (-5.92%) Amazon (AMZN)

- Cloud security base

$FFIV (-3.6%) F5 Networks (FFIV) - API protection for SaaS & insurance platforms

My top recommendation $GOOG (-3.33%) - global cloud security + Mandiant, strong moat through infrastructure & Threat Intel

🔑 Takeaway Software & Insurance

Data and identity protection take center stage. Major players such as Okta and CyberArk secure access, while hidden champions such as Varonis and JFrog provide specialist solutions. Cloud providers such as Microsoft and Amazon are both platform operators and security suppliers.

Industry, supply & raw materials

Major players:

$FTNT (-4.55%) Fortinet (FTNT), $CSCO (-3.83%) Cisco (CSCO), $PANW (-4.92%) Palo Alto Networks (PANW)

- Network protection for critical infrastructures

My top recommendation $FTNT (-4.55%) - ASIC hardware + software, cost advantage

Hidden champions:

$RDWR (-4.29%) Radware (RDWR) - DDoS protection

$NCC (-0.3%) NCC Group (NCC.L) - OT-Security & Penetration Tests

$SECT B (-1.37%) Sectra (SECT-B.ST) - secure infrastructure in the OT/healthcare intersection

$CLAV (+1.23%) Holding AB CLAV) - OT/ICS and infrastructure security

$ADVE Advenica (ADVE) - Specialized security, relevant for public authorities and national infrastructure

My top recommendation $ADVE - Specialized Crypto/OT-Security for public authorities

Shovel manufacturer:

$AVGO (-7.17%) Broadcom (AVGO) - security chips

Juniper Networks (JNPR) - network backbones

$ANET (-4.24%) Arista Networks (ANET) - high-end switches

My top recommendation $AVGO (-7.17%) - Chip-Giant + Symantec Enterprise Security

🔑 Takeaway Industry, Utilities & Commodities

OT/ICS systems in production, energy and raw materials are attractive targets. Fortinet and Palo Alto dominate, but hidden champions such as Radware and the NCC Group offer special expertise for attacks on industrial control systems.

Banks, Fintech & Holdings

Big players:

$CRWD (-4.63%) CrowdStrike (CRWD), $PANW (-4.92%) Palo Alto Networks (PANW), $ZS (-2.54%) Zscaler (ZS)

- Core protection for banks & digital platforms

My top recommendation $ZS (-2.54%) - Global Zero Trust Exchange, almost impossible to copy

Hidden champions:

$NCNO (-2.71%) nCino (NCNO) - Cloud Banking Security

$NCC (-0.3%) NCC Group (NCC.L) - Audits & Compliance

$CYBE (+0%) CyberCatch Holdings, Inc (CYBE) - Provides AI-based cybersecurity SaaS

$GEN (-1.72%) Gen Digital (GEN) - through fraud prevention and identity topics

My top recommendation $GEN (-1.72%) - Consumer security giant (Norton, Avast, LifeLock), strong brand power

Shovel manufacturer:

$FFIV (-3.6%) F5 Networks (FFIV) - API security for payments

$AKAM (-3.46%) Akamai Tech. (AKAM) - Web & Payment Security

$ESTC (-4.39%) Elastic (ESTC) - Fraud Analytics

My top recommendation $FFIV (-3.6%) - Leader in Application & API Security

🔑 Takeaway Banks, Fintech & Holdings

High regulatory pressure makes cybersecurity a mandatory field. In addition to established providers, banks are relying on hidden champions such as nCino or Darktrace for cloud banking and anomaly detection. Shovel manufacturers such as F5 or Akamai secure payment APIs and banking portals.

Crypto & blockchain

Big players:

$PANW (-4.92%) Palo Alto Networks (PANW), $FTNT (-4.55%) Fortinet (FTNT), $CRWD (-4.63%) CrowdStrike (CRWD)

- Core protection for exchanges, wallets and blockchain infrastructure

My top recommendation $FTNT (-4.55%) - ASIC hardware + software, cost advantage

Hidden champions:

$BBAI (-4.05%) BigBear.ai (BBAI) - Blockchain Fraud Detection

$RIOT (-7.91%) Riot Platforms (RIOT) - Mining with a focus on security

$CHKP (-1.42%) Check Point - the new blockchain firewall initiative (Web3)

My top recommendation $CHKP (-1.42%) - Strong brand & existing customers, but limited innovative strength

Shovel manufacturer:

$NVDA (-6.14%) Nvidia (NVDA), AMD (AMD) - chips & mining hardware

$NET (-4.51%) Cloudflare (NET), $AKAM (-3.46%) Akamai Tech. (AKAM)

- Network protection for wallets & exchanges

My top recommendation $NVDA (-6.14%) - GPUs, quasi-monopoly in high-end compute

🔑 Takeaway crypto & blockchain

Crypto ecosystems are heavily affected by attacks on exchanges, wallets and smart contracts. While traditional security players provide protection, niche providers such as BigBear.ai and Riskified are emerging that specialize specifically in fraud and blockchain risks.

Source: Own analysis, image material: schwarz-digits

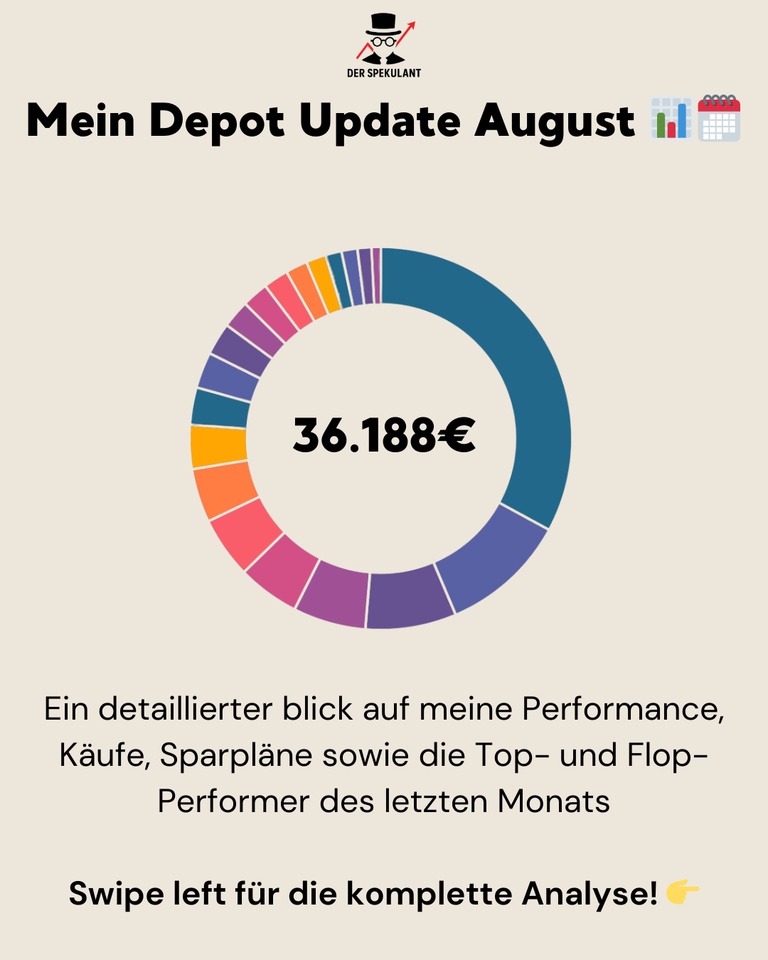

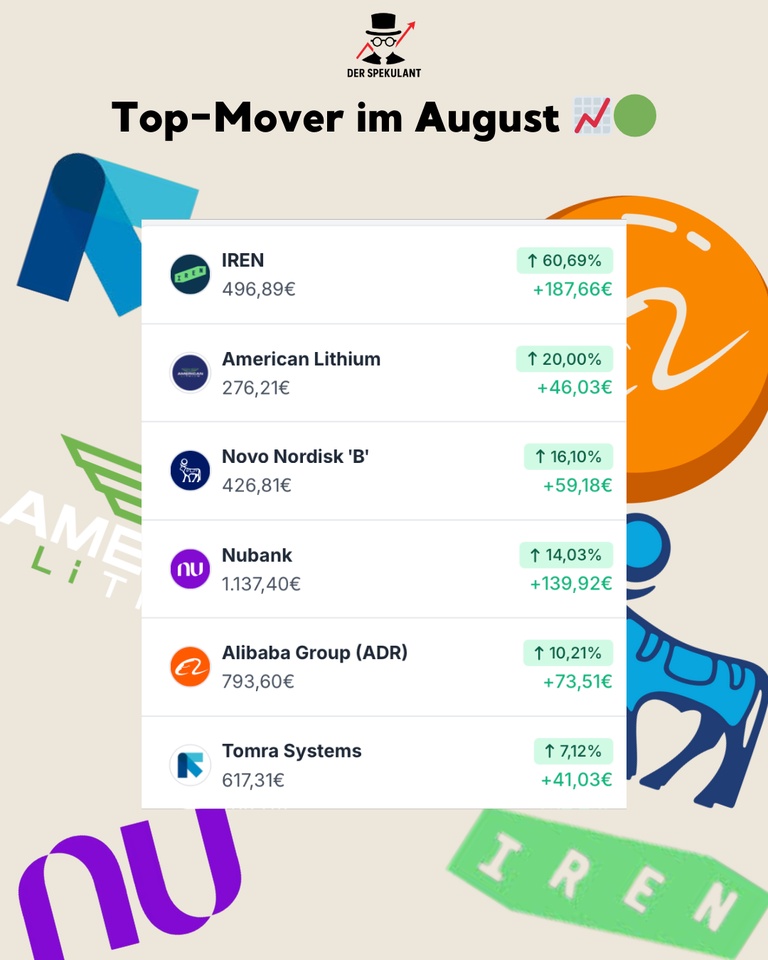

My portfolio update August 2025: Strength despite tech weakness & tactical realignment 📊🗓️

Hello Community,

August is over and it's time for the transparent monthly review. The portfolio has reached a new high of € 36,188. It was a month of contrasts, in which the strength of some satellites offset the weakness in the tech sector.

1. the performance: 🚀

Beating the market 📈

With a monthly performance of +0,94% I am very satisfied. As the chart shows, my portfolio clearly outperformed the broad market (FTSE All-World: -0.31%) and the major US indices (S&P 500: -1.11%, NASDAQ100: -2.23%). The result proves the strength of diversification: while my tech stocks corrected, other sectors carried the performance.

2. my buys & sells: 🛒

None ❌

In August, I deliberately kept my feet still and did not make any individual purchases or sales. My focus was on waiting for the important quarterly reports and preparing my tactical purchases for September.

3. my savings plans & purchases in September: Tactical allocation 💸

As you know, I take a flexible approach to my individual shares and adjust my purchases on a monthly basis. Only my ETF savings plans run consistently. My allocation for the start of September looks like this:

➡️ $ACWI

$WSML (-2.96%) (150 €): As always, the foundation is being consistently strengthened.

➡️ $MELI (-6.22%) (€150) & Datadog (€75): Here I continue to build on my core conviction positions.

➡️ $TEM (-5.83%) (125 €): This is my tactical pick for the month. I am opening a position in a highly potent and diversifying bet on the AI medical revolution.

➡️ $DDOG (-5.26%) (75 €): A core position in my cl infrastructure cluster. Digital transformation and the need for cloud monitoring and security are unwavering megatrends for me.

➡️ $NOVO B (-3.44%) (3 €): This is not an active allocation, but the automatic reinvestment of dividends received to maximize the compound interest effect for this quality position.

4. tops & flops: A reflection of the rotation 📉📈

Top mover: 🟢

The list was topped this month by the spectacular performance of $IREN (-9.15%) (+60.69%), which is benefiting from the continuing demand for energy for AI data centers. My speculative bet on American Lithium (+20.00%) also showed strength. The recovery in $BABA (-8.67%) (+10.21%) following good news on the cloud division and AI chip development.

Flop mover: 🔴

As expected, my tech stocks were hit here. $CRWD (-4.63%) (-11.16%) and $DDOG (-5.26%) (-5.45%) suffered and the weak market environment for growth stocks, although the quarterly figures were fundamentally good. Also $1211 (-4.45%) (-8.22%) also suffered after disappointing figures; the situation here remains tense.

Conclusion:

August was perfect proof of why broad diversification across different sectors and themes is so crucial. Weakness in one area (US tech) was more than compensated for by strength in others (energy, China recovery). My flexible approach to monthly purchases allows me to react specifically to such market phases.

How did your August❓ go?

Which shares did you buy tactically ❓

I look forward to the exchange in the comments!

+ 2

However, I'm surprised that, despite your speech, you don't diversify either in terms of asset classes or strategies. Why not? 🤔

Megatrend robotics, freshly updated, added value guaranteed!

After my first post on humanoid robots received a lot of positive feedback, I went into more detail. I have subsequently added my favorites in each sector.

Extended analysis of the value chain including shovel manufacturers and potential hidden champions

New categorySecondary key sectors (sales, marketing, financing)

In additionTop 25 companies worldwide, as well as Top 10 Europe and Top 10 Asia

I have also added a video link for beginners. This will give you an idea of how far the development of humanoid robotics has already progressed.

Thank you for your attention and your support 🙏

🌐 1. value chain of humanoid robots (with hidden champions)

1. research & chip design

$ARM (-10.82%) ARM (UK) - CPU-IP, energy-efficient processors

$SNPS (-12.42%) Synopsys (US) - EDA software, chip design

$CDNS (-9.81%) Cadence (US) - EDA & Simulation

$PTC PTC (US) - Engineering Software, CAD/PLM

$DSY (-2.25%) Dassault Systèmes (FR) - 3D Design & Digital Twin

$SIE (-2.34%) Siemens (DE) - Industrial Software & Lifecycle Mgmt

$ADBE (-3.29%) Adobe (US) - Design, AR/UX

ANSYS (US) - multiphysical simulation - acquisition by Synopsis

Altair (US) - CAE, simulation, digital twin - acquisition by Siemens

$HXGBY (-2.42%)

Hexagon (SE) - Metrology & Simulation

$AWE (-2.82%) Alphawave IP Group (UK) - High-speed chip IP for AI/robotics

1.Synopsis, 2.Siemens and 3.Adobe are my top 3 in this sector

2. manufacturing technology & equipment

$ASML (-5.06%) ASML (NL) - Lithography (EUV)

$AMAT (-6.65%) Applied Materials (US) - Semiconductor equipment

$8035 (-7.11%) Tokyo Electron (JP) - wafer fabrication

$KEYS (-7.24%) Keysight Technologies (US) - Metrology

$6857 (-6.61%) Advantest (JP) - Chip test systems

$TER (-9.45%) Teradyne (US) - test systems + cobots

$6954 (-1.33%) Fanuc (JP) - Industrial robots, CNC

$CAT (-2.48%) Caterpillar (US) - autonomous machines

$KU2G KUKA (DE) - industrial robots

Comau (IT) - automation - not listed on the stock exchange

$ROK Rockwell Automation (US) - industrial automation

$JBL (-5.69%) Jabil (US) - contract manufacturing (EMS/ODM)

$KIT (+2.23%) Kitron (NO) - European EMS/ODM manufacturer

$AIXA (-7.29%) Aixtron (DE) - deposition equipment for compound semiconductors

$LRCX (-8.15%)

Lam Research (US) - Etch/deposition systems

$MKSI (-10.1%)

MKS Instruments (US) - Plasma/vacuum technology

$ASM (-3.08%)

ASM International (NL) - Deposition systems

1.ASML, 2.Keysight Technologies, 3.Fanuc are my top 3 in this sector

3. chip manufacturing (foundries)

$TSM (-6.55%) TSMC (TW) - leading foundry

$SMSN Samsung Electronics (KR) - foundry + memory

$GFS (-7.55%) GlobalFoundries (US) - specialty chips

$INTC (-5.15%)

Intel Foundry Services (US) - new western foundry player

$981

SMIC (CN) - largest Chinese foundry

$UMC

UMC (TW) - Power/RF/Embedded chips

1.TSMC, 2.Intel, 3.Samsung Electronics are my top 3 in this sector

4. computing & control unit ("brain")

$NVDA (-6.14%) Nvidia (US) - GPUs, AI chips

$INTC (-5.15%) Intel (US) - CPUs, FPGAs

$AMD (-10.01%) AMD (US) - CPUs, GPUs

$MRVL (-5.93%) Marvell (US) - Network Chips

$MU (-6.96%) Micron (US) - Memory

$DELL (-4.8%) Dell Technologies (US) - Edge & Infrastructure

Graphcore (UK) - AI chips (IPU) - not a listed company

Cerebras (US) - Wafer-scale engine - not a listed company

SiPearl (FR) - European HPC chip - not a listed company

1.Nvidia, 2.Marvell, 3.Micron are my top 3 in this sector

5. sensors ("senses")

$6758 (-5.66%) Sony (JP) - image sensors

$6861 (-1.03%) Keyence (JP) - Industrial sensors

$STM (-5.65%) STMicroelectronics (FR/IT) - Sensors, MCUs

$TDY Teledyne (US) - optical/infrared sensors

$CGNX (-13.21%) Cognex (US) - Machine Vision

$HON (-2.58%) Honeywell (US) - sensor technology, security

ANYbotics (CH) - autonomous sensor fusion - not a listed company

$AMBA (-13.21%) Ambarella (US) - video & computer vision SoCs for real-time image recognition

$OUST

Velodyne Lidar (US) - Lidar sensors - acquisition by Ouster

$AMS (-5.97%)

OSRAM (AT/DE) - optical sensors

1.Teledyne, 2.Keyence, 3.Ouster are my top 3 in this sector

6. actuators & power electronics ("muscles")

$IFX (-4.21%) Infineon (DE) - Power Electronics

$ON (-7.46%) onsemi (US) - Power & Sensors

$TXN (-4.45%) Texas Instruments (US) - Mixed-Signal Chips

$ADI (-6.83%) Analog Devices (US) - Signal Processing

$PH Parker-Hannifin (US) - Hydraulics/Pneumatics

$MP (+8.11%) MP Materials (US) - Magnets

$APH (-3.8%) Amphenol (US) - Connectors

$6481 (-1.59%) THK (JP) - Linear guides & actuators

$6324 (-6.99%)

Harmonic Drive (JP) - Precision gears & servo drives for robotics

$6594 (-2.91%)

Nidec (JP) - Electric motors

$6506 (-1.37%)

Yaskawa (JP) - Drives & Robotics

$SU (-2.76%)

Schneider Electric (FR) - Energy & control solutions

$ZIL2 (+5.96%)

ElringKlinger (DE) - Battery & fuel cell technology, lightweight construction

1.Parker-Hannifin, 2.MP Materials, 3.Infinion are my top 3 in this sector

7. communication & networking ("nerves")

$QCOM (-8.32%) Qualcomm (US) - mobile communications, edge AI

$ANET (-4.24%) Arista Networks (US) - Networks

$CSCO (-3.83%) Cisco (US) - Networks, Security

$EQIX (-1.43%) Equinix (US) - Data centers

NTT Docomo (JP) - 5G/6G carrier - not a listed company

$VZ Verizon (US) - Telecommunications

$SFTBY SoftBank (JP) - Carrier + Robotics

$ERIC B (-0.31%)

Ericsson (SE) - 5G/IoT infrastructure

$NOKIA (+1.08%)

Nokia (FI) - 5G/6G for industry

$HPE (-7.48%)

Juniper Networks (US) - Network technology - acquisition by HP

1.Arista Networks, 2.SoftBank, 3.Cisco are my top 3 in this sector

8. energy supply

$3750 (-10.56%) CATL (CN) - Batteries

$6752 (-3.59%) Panasonic (JP) - Batteries

$373220 LG Energy (KR) - Batteries

$ALB (-7.74%) Albemarle (US) - Lithium

$LYC (+3.13%) Lynas (AU) - Rare earths

$UMICY (-0.49%) Umicore (BE) - recycling

WiTricity (US) - inductive charging - not a listed company

$ABBN (-0.59%) Charging (CH) - charging infrastructure

$SLDP

Solid Power (US) - Solid state batteries

Northvolt (SE) - European batteries - not a listed company

$PLUG

Plug Power (US) - fuel cells

$KULR (-6.68%)

KULR Technology (US) - Thermal management & battery safety for mobile systems

1.Albemarle, 2.CATL, 3.Panasonic are my top 3 in this sector

9. cloud & infrastructure

$AMZN (-5.92%) Amazon AWS (US) - Cloud, AI

$MSFT (-3.3%) Microsoft Azure (US) - Cloud, AI

$GOOG (-3.33%) Alphabet Google Cloud (US) - Cloud, ML

$VRT

Vertiv Holdings (US) - Data center infrastructure (UPS, cooling, edge)

$ORCL (-3.03%)

Oracle Cloud (US) - ERP + Cloud

$IBM (-4.51%)

IBM Cloud (US) - Hybrid cloud + AI

$OVH (-2.16%)

OVHcloud (FR) - European cloud

1.Alphabet, 2.Microsoft, 3.Oracle are my top 3 in this sector

10. software & data platforms

$PLTR (-7.09%) Palantir (US) - Data integration

$DDOG (-5.26%) Datadog (US) - Monitoring

$SNOW (-4.44%) Snowflake (US) - Data Cloud

$ORCL (-3.03%) Oracle (US) - Databases, ERP

$SAP (-3.86%) SAP (DE) - ERP systems

$SPGI S&P Global (US) - financial/market data

ROS2 Foundation - robotics middleware - not listed on the stock exchange

$NVDA (-6.14%) NVIDIA Isaac (US) - robotics development - part of Nvidia

$INOD (-11.68%) Innodata (US) - data annotation & AI training data

$PATH (-10.71%)

UiPath (RO/US) - Robotic process automation

$AI (-7.18%)

C3.ai (US) - AI platform

$ESTC (-4.39%)

(NL/US) - Search & data analysis

1.S&P Global, 2.Palantir, 3.Datadog are my top 3 in this sector

11. end applications / robots

$ABBN (-0.59%) ABB (CH/SE) - Industrial Robots

$6954 (-1.33%) Fanuc (JP) - Industrial robots

$TSLA (-6.86%) Tesla Optimus (US) - humanoid robot

$9618 (-5.5%) JD.com (CN) - logistics robot

$AAPL (-4.63%) Apple (US) - Platform & UX

$700 (-6.61%) Tencent (CN) - Platform & AI

$9988 (-8.32%) Alibaba (CN) - logistics & platform

PAL Robotics (ES) - humanoid robots - not a listed company

Neura Robotics (DE) - cognitive humanoid robots - not a listed company

$TER (-9.45%) Universal Robots (DK) - cobots - belongs to the Teradyne Corporation

Engineered Arts (UK) - humanoid robots - not a listed company

$ISRG (-4.16%) Intuitive Surgical (US) - surgical robotics

$GMED (-5.44%)

Globus Medical (US) - surgical robotics (ExcelsiusGPS platform)

$7012 (-7.11%) Kawasaki Heavy Industries (JP) - industrial robots, automation

$CPNG (-4.08%) Coupang (KR) - Logistics end user

$IRBT (-7.91%)

iRobot (US) - consumer robotics (e.g. Roomba), non-humanoid, but navigation/sensor fusion

Boston Dynamics (US) - humanoid & mobile robots-no listed company

Hanson Robotics (HK) - humanoid robots (Sophia) - not a listed company

Agility Robotics (US) - humanoid robot "Digit" - not a listed company

1.Apple, 2.Tencent, 3.Alibaba are my top 3 in this sector

🛠 2. cross enablers (shovel manufacturers) - with hidden champions

Raw materials & battery materials

Albemarle - Lynas - Umicore

$SQM

SQM (CL) - Lithium

$ILU (-2.29%)

Iluka Resources (AU) - Rare earths

$ARR (+44.81%)

American Rare Earths (US/AU) - New supply chains

my number 1 in the sector is Albemarle

manufacturing technology

ASML - Applied Materials - Tokyo Electron

$LRCX (-8.15%)

Lam Research (US) - Plasma/etching processes

$ASM (-3.08%)

ASM International (NL) - ALD equipment

$MKSI (-10.1%)

MKS Instruments (US) - Plasma/vacuum technology

my number 1 in the sector is ASML

Quality assurance

Keysight - Advantest - Teradyne

$EMR (-4.69%)

National Instruments (US) - Measurement technology - from Emerson Electric adopted

$300567

ATE Test Systems (CN) - test systems

$FORM (-1.8%)

FormFactor (US) - Wafer probing

my number 1 in the sector is Keysight

Motion & Drive

Parker-Hannifin

Festo (DE) - Pneumatics, Soft Robotics - not a listed company

Bosch Rexroth (DE) - Drives, Controls - not a listed company

$6481 (-1.59%)

THK (JP) - Linear guides

my number 1 in the sector is Parker-Hannifin

Sensors/Imaging

$TDY Teledyne

$BSL (-3.33%) Basler (DE) - Industrial cameras

FLIR (US) - Thermal imaging sensors - acquisition by Teledyne

ISRA Vision (DE) - Machine Vision - not a listed company

my number 1 in the sector is Teledyne

Magnets & Materials

MP Materials

$6501 (-7.57%)

Hitachi Metals (JP) - Magnetic materials

VacuumSchmelze (DE) - Magnetic materials - not a listed company

$4063 (-3.42%)

Shin-Etsu Chemical (JP) - Specialty materials

my number 1 in the sector is MP Materials

Chip Design & Simulation

Synopsys - Cadence - ARM

$SIE (-2.34%)

Siemens EDA (DE/US)-Mentor Graphics-strategic business unit of Siemens AG

Imagination Tech (UK) - GPU-IP - not a listed company

$CEVA (-12.41%)

CEVA (IL) - Signal Processor IP

my number 1 in the sector is Synopsys

Engineering & Lifecycle

PTC - Dassault - Siemens

Altair (US) - Simulation - no longer a listed company

$HXGBY (-2.42%)

Hexagon (SE) - Metrology

$SNPS (-12.42%)

ANSYS (US) - Simulation - takeover by Synopsys

my number 1 in the sector is Siemens

Networks & Data Centers

Arista - Cisco - Equinix

$HPE (-7.48%)

Juniper (US) - Networks - Acquisition of HPE

$DTE (+0.17%)

T-Systems (DE) - Industry cloud

$OVH (-2.16%)

OVHcloud (FR) - European cloud

my number 1 in the sector is Arista

Cloud infrastructure

AWS - Azure - Google Cloud

$ORCL (-3.03%)

Oracle Cloud (US) - ERP & databases

$IBM (-4.51%)

IBM Cloud (US) - Hybrid Cloud

$9988 (-8.32%)

Alibaba Cloud (CN) - Asian Cloud

$VRT

Vertiv Holdings (US) - Cloud/Infra

my number 1 in the sector is Alphabet (Google)

finance/information infra

S&P Global

$MCO (-2.16%)

Moody's (US) - Ratings

$MSCI (-2.55%)

MSCI (US) - Indices

$MORN

Morningstar (US) - Investment Research

my number 1 in the sector is S&P Global

Creative/Experience Infra

Adobe

$ADSK (-3.77%)

Autodesk (US) - CAD & Design

$U

Unity (US) - 3D/AR simulation

Epic Games (US) - Unreal Engine - not a listed company

my number 1 in the sector is Adobe

Platform & Ecosystem

Apple - Tencent - Alibaba

$META (-5.02%)

Meta (US) - AR/VR, Social Robotics

ByteDance (CN) - AI & platforms - not a listed company

$9888 (-8.29%)

Baidu (CN) - AI & Cloud

my number 1 in the sector is Tencent

Infrastructure/Edge

Dell

$HPE (-7.48%)

HPE (US) - Edge Computing

$SMCI

Supermicro (US) - AI servers

$6702 (-5.49%)

Fujitsu (JP) - Edge & HPC

my number 1 in the sector is Dell

storage solutions

Micron

$HY9H

SK Hynix (KR) - Memory

$285A (-4.8%)

Kioxia (JP) - NAND

$WDC

Western Digital (US) - Storage solutions

my number 1 in the sector is Micron

🏛 3. secondary key sectors with hidden champions

Financing & Capital

$GS (-2.43%) Goldman Sachs (US) - investment bank; ECM/DCM, M&A, growth financing

$MS Morgan Stanley (US) - investment bank; tech banking, capital markets

$BLK (-3.34%) BlackRock (US) - asset manager; capital allocation, ETFs/index funds

$9984 (-8.87%) SoftBank Vision Fund (JP) - mega VC; growth equity in robotics/AI

Sequoia Capital (US) - venture capital; early/growth in AI/robotics - this is a classic venture capital fund

DARPA (US) - government R&D funding (robotics/defense) - independent research and development agency

EU Horizon (EU) - research funding/grants for DeepTech - Innovative Europe pillar

China State Funds (CN) - state industry/technology fund

Lux Capital (US) - VC for DeepTech - Uptake (US) - AI-based predictive maintenance

DCVC (US) - Robotics & AI focus - investing exclusively via VC fund investments

Speedinvest (AT) - EU VC for robotics - access to investment only via fund investments

my number 1 in the sector is Softbank

Maintenance & Service

$SIE (-2.34%) Siemens (DE) - Industrial Service, Lifecycle & Retrofit

$ABBN (-0.59%) ABB (CH/SE) - Robotics Service, Spare Parts, Field Support

$GEHC (-4.73%) GE Healthcare (US) - Medtech service incl. robotic systems

Uptake (US) - AI-based predictive maintenance - not a listed company

Augury (US/IL) - condition monitoring, condition diagnostics - not a listed company

$KU2 KUKA Service (DE) - Robotics maintenance

$6954 (-1.33%) Fanuc Service (JP) - global service network

Boston Dynamics AI Institute (US) - Robotics longevity - funded by Hyundai Motor Group

my number 1 in the sector is Siemens

Marketing & Advertising

$WPP (-4.43%) WPP (UK) - global advertising group; branding/communications

$OMC Omnicom (US) - marketing/PR network

$PUB (-1.04%) Publicis (FR) - communications/advertising group

$META (-5.02%) Meta (US) - Digital Ads (Facebook/Instagram)

$GOOG (-3.33%) Google Ads (US) - search & display advertising

TikTok / ByteDance (CN) - social ads & distribution - not a listed company

$AAPL (-4.63%) Apple (US) - Branding/UX; Acceptance & Platform Marketing

$WPP (-4.43%)

AKQA (UK/US) - Tech branding - Since 2012 majority owned by the WPP Groupbut continues to operate as an autonomous operating unit

R/GA (US) - Innovation marketing - not a listed company

Serviceplan (DE) - largest independent EU agency - not a listed company

my number 1 in the sector is Meta

Law, Regulation & Ethics

ISO (CH) - international standards, robotics standards

TÜV (DE) - certification & safety tests

UL (US) - safety/conformity testing

EU AI Act (EU) - legal framework for AI & robotics

UNESCO AI Ethics (UN) - global ethics guidelines

Fraunhofer IPA (DE) - Robotics safety standards

ANSI (US) - standards

IEC (CH) - Electrical engineering standards

Training & Talent

MIT (US) - Robotics/AI Research & Education

ETH Zurich (CH) - autonomous systems & robotics

Stanford (US) - AI/Robotics labs & spin-offs

Tsinghua University (CN) - Robotics/AI in Asia

CMU (US) - Robotics Institute

EPFL (CH) - Robotics research

TU Munich (DE) - humanoid robot "Roboy"

🌍 Top 25 companies for humanoid robotics

These companies are central to the development & production of humanoid robotsbecause without them, crucial parts of the chain would be missing:

Chips & computing power (brain of the robots)

$NVDA (-6.14%) Nvidia (US) - AI GPUs & Isaac platform, foundation for robotic AI

$2330 TSMC (TW) - world's most important foundry, produces the AI chips

$ASML (-5.06%) ASML (NL) - EUV lithography, indispensable for chip production

$005930 Samsung Electronics (KR) - memory, logic, foundry

$HY9H SK Hynix (KR) - DRAM & NAND memory for AI

$MU (-6.96%) Micron (US) - Memory solutions for AI workloads

my number 1 in the sector is ASML

Sensors & perception (senses of robots)

$SONY Sony (JP) - image sensors, market leader

$6861 (-1.03%) Keyence (JP) - Industrial sensors & vision systems

$CGNX (-13.21%) Cognex (US) - Machine Vision, precise image processing

my number 1 in the sector is Keyence

Actuators & motion (muscles of robots)

$IFX (-4.21%) Infineon (DE) - power electronics, motor control

$6594 (-2.91%) Nidec (JP) - World market leader for electric motors

$PH Parker-Hannifin (US) - hydraulics/pneumatics, motion technology

$6481 (-1.59%) THK (JP) - Linear guides & actuators

my number 1 in the sector is Parker-Hannifin

Communication, cloud & infrastructure (nerves & data flow)

$QCOM (-8.32%) Qualcomm (US) - Mobile & Edge Chips

$AMZN (-5.92%) Amazon AWS (US) - Cloud & AI infrastructure

$MSFT (-3.3%) Microsoft Azure (US) - Cloud, AI services

$CSCO (-3.83%) Cisco (US) - Networks & Security

$VRT Vertiv Holdings (US) - Data Center Infrastructure

my number 1 in the sector is Microsoft

End Applications & Platforms (robots themselves)

$TSLA (-6.86%) Tesla (US) - humanoid robot Optimus

$ABBN (-0.59%) ABB (CH/SE) - Robotics & Automation

$6954 (-1.33%) Fanuc (JP) - industrial robots & CNC systems

$7012 (-7.11%) Kawasaki Heavy Industries (JP) - industrial robots

PAL Robotics (ES) - humanoid robots (TALOS, ARI, TIAGo) - not a listed company

Neura Robotics (DE) - cognitive humanoid robots - not a listed company

Universal Robots (DK) - cobots

my number 1 in the sector is Tesla

🇪🇺 Top 10 European key companies for humanoid robotics

$ASML (-5.06%)

ASML (NL)

World market leader in EUV lithography - no modern chips for AI & robotics without ASML.

$IFX (-4.21%) Infineon (DE)

Leading in power electronics & motor control - crucial for actuators of humanoid robots.

$STM (-5.65%)

STMicroelectronics (FR/IT)

Sensors, microcontrollers & power chips - the basis for control & perception.

$SAP (-3.86%)

SAP (DE)

ERP & data platforms, important for integrating humanoid robots into industrial processes.

$SIE (-2.34%)

Siemens (DE)

Industrial software, automation, digital twin - key for engineering & lifecycle management.

$KU2 KUKA (EN)

Robotics pioneer, industrial robots & automation - know-how for humanoid motion mechanics.

PAL Robotics (ES) - not a listed company

Specialist for humanoid robots (TALOS, ARI, TIAGo), internationally used in research & service.

Neura Robotics (DE) - Not a listed company

Young high-tech company, develops cognitive humanoid robots with advanced AI (4NE-1).

Universal Robots (DK) - Not a listed company

Market leader for cobots - platform for safe human-robot collaboration.

Engineered Arts (UK) - not a listed company

Develops humanoid robots such as Amecaknown for realistic facial expressions & gestures - important for HRI (Human-Robot Interaction)

🌏 Top 10 Asian key companies for humanoid robotics

$2330

TSMC (Taiwan)

World's largest semiconductor foundry, produces high-end chips (e.g. Nvidia, AMD, Apple) - no AI hardware without TSMC.

$005930

Samsung Electronics (South Korea)

Foundry, memory, logic chips, image sensors - extremely broadly positioned in robotics components.

$HY9H

SK Hynix (KR) - Memory

$SONY

Sony (Japan)

Market leader in CMOS image sensors, essential for robotic vision & perception.

$6861 (-1.03%)

Keyence (Japan)

Sensor technology & machine vision for industrial automation, widely used in robotics.

$6954 (-1.33%)

Fanuc (Japan)

Industrial robots & CNC systems, one of the most important manufacturers of robotics hardware worldwide.

$6506 (-1.37%)

Yaskawa Electric (Japan)

Drives, motion control & robot arms - relevant for humanoid motion control.

$6594 (-2.91%)

Nidec (Japan)

World market leader for electric motors (from mini motors to high-performance drives).

$7012 (-7.11%)

Kawasaki Heavy Industries (JP) - Industrial robots

$9618 (-5.5%)

JD.com (China)

Driver for robotics in e-commerce & logistics, invests in humanoid robotics applications

Build robots, earn shovels

The hype is all about humanoid robots, but the constant winners are in the background.

I have divided the analysis into two perspectives. 1. the complete value chain of humanoid robots, which shows all the players from the chip to the finished robot, and 2. the blade manufacturers in the background, who always earn money as enablers, regardless of which manufacturer wins the race.

ASML, Applied Materials and Tokyo Electron dominate in manufacturing technology. Quality assurance comes from Keysight, Advantest and Teradyne. Chip design is supported by Synopsys, Cadence and ARM. Data streams are secured by Arista Networks, Cisco and Equinix. The computing basis is created in the cloud by Amazon, Microsoft and Alphabet. Albemarle, Lynas and Umicore play a central role in raw materials and battery materials. These companies monetize their customers' investment waves, have high barriers to entry, service revenues and pricing power, but remain cyclical with risks from export rules, capex cuts and currency movements.

🌐 Value chain of humanoid robots Sector overview

1. research & chip design (IP / EDA)

$ARM (-10.82%)

ARM Holdings (ARM, UK/USA) - CPU architectures

$SNPS (-12.42%)

Synopsys (SNPS, USA) - Chip design software

$CDNS (-9.81%)

Cadence Design Systems (CDNS, USA) - EDA & Simulation

2. manufacturing technology & equipment

$ASML (-5.06%)

ASML (ASML, NL) - EUV lithography, key monopoly

$AMAT (-6.65%)

Applied Materials (AMAT, USA) - Process equipment

$8035 (-7.11%)

Tokyo Electron (8035.T, JP) - Wafer equipment

$KEYS (-7.24%)

Keysight Technologies (KEYS, USA) - Test & RF measurement technology

$6857 (-6.61%)

Advantest (6857.T, JP) - Semiconductor test systems

$TER (-9.45%)

Teradyne (TER, USA) - Test systems + robotics (Universal Robots)

3. chip production (Foundries)

$TSM (-6.55%)

TSMC (TSM, TW) - Largest contract manufacturer

$005930

Samsung Electronics (005930.KQ, KR) - Memory + Foundry

$GFS (-7.55%)

GlobalFoundries (GFS, USA) - Specialized production

4. computing & control unit ("brain")

$NVDA (-6.14%)

Nvidia (NVDA, USA) - GPUs, AI accelerators

$INTC (-5.15%)

Intel (INTC, USA) - CPUs, FPGAs

$AMD (-10.01%)

AMD (AMD, USA) - CPUs/GPUs

$MRVL (-5.93%)

Marvell Technology (MRVL, USA) - Network/data center chips

5. sensors ("senses")

$6758 (-5.66%)

Sony (6758.T, JP) - CMOS image sensors

$6861 (-1.03%)

Keyence (6861.T, JP) - Vision systems, sensors

$STM (-5.65%)

STMicroelectronics (STM, CH/FR) - MEMS sensors

6. actuators & power electronics ("muscles")

$IFX (-4.21%)

Infineon (IFX, DE) - Power semiconductors, SiC

$ON (-7.46%)

N Semiconductor (ON, USA) - SiC/Power Chips

$STM (-5.65%)

STMicroelectronics (STM, CH/FR) - Motor control & power

$TXN (-4.45%)

Texas Instruments (TXN, USA) - Motor control, power ICs

$ADI (-6.83%)

Analog Devices (ADI, USA) - Energy & BMS chips

7. communication & networking ("nerves")

$QCOM (-8.32%)

Qualcomm (QCOM, USA) - 5G/SoCs

$AVGO (-7.17%)

Broadcom (AVGO, USA) - Network & radio chips

$SWKS (-7%)

Skyworks Solutions (SWKS, USA) - RF components

8. energy supply

$300750

CATL (300750.SZ, CN) - Batteries

$6752 (-3.59%)

Panasonic (6752.T, JP) - Batteries for automotive/robotics

$373220

LG Energy Solution (373220.KQ, KR) - Batteries

9. cloud & infrastructure

$AMZN (-5.92%)

Amazon (AMZN, USA) - AWS

$MSFT (-3.3%)

Microsoft (MSFT, USA) - Azure

$GOOG (-3.33%)

Alphabet (GOOGL, USA) - Google Cloud

$EQIX (-1.43%)

Equinix (EQIX, USA) - Data center operator

$ANET (-4.24%)

Arista Networks (ANET, USA) - Network infrastructure

$CSCO (-3.83%)

Cisco Systems (CSCO, USA) - Edge & Data Center Networks

10. software & data platforms

$PLTR (-7.09%)

Palantir (PLTR, USA) - Data integration, decision software

$DDOG (-5.26%)

Datadog (DDOG, USA) - Cloud monitoring / observability

$SNOW (-4.44%)

Snowflake (SNOW, USA) - Cloud-native data platform

$ORCL (-3.03%)

Oracle (ORCL, USA) - Databases, ERP

$SAP (-3.86%)

SAP (SAP, DE) - ERP/cloud systems

$PATH (-10.71%)

UiPath (PATH, USA) - Automation software (RPA)

$AI (-7.18%)

C3.ai (AI, USA) - Enterprise AI platform

11. end applications / robots

$ABB

ABB (ABB, CH) - Industrial robots

$6954 (-1.33%)

Fanuc (6954.T, JP) - Industrial robots, CNC

$TSLA (-6.86%)

Tesla (TSLA, USA) - Optimus" humanoid robot

$9618 (-5.5%)

JD.com (JD, CN) - E-commerce & automated logistics

🛠️ Shovel manufacturer for humanoid robots

🔹 Hardtech (physical "shovels")

These companies provide the material basis: manufacturing machines, raw materials, semiconductor base.

Semiconductor Equipment & Manufacturing

$ASML (-5.06%)

ASML (ASML, NL) - EUV lithography (monopoly).

$AMAT (-6.65%)

Applied Materials (AMAT, USA) - Wafer equipment.

$8035 (-7.11%)

Tokyo Electron (8035.T, JP) - Process equipment.

Test systems (hardware-side)

$6857 (-6.61%)

Advantest (6857.T, JP) - Semiconductor test.

$TER (-9.45%)

Teradyne (TER, USA) - Test systems + industrial robots.

Materials & raw materials

$ALB (-7.74%)

Albemarle (ALB, USA) - Lithium (batteries).

$LYC (+3.13%)

Lynas Rare Earths (LYC.AX, AUS) - Rare earths for magnets.

$UMICY (-0.49%)

Umicore (UMI.BR, BE) - Cathode materials, recycling.

🔹 Soft/infra (digital "shovels")

These companies supply the infrastructure & toolswithout which development, training and operation would be impossible.

Design Software & IP

$SNPS (-12.42%)

Synopsys (SNPS, USA) - EDA software.

$CDNS (-9.81%)

Cadence Design Systems (CDNS, USA) - Chip design & simulation.

$ARM (-10.82%)

ARM Holdings (ARM, UK/USA) - CPU architectures (license model).

Test & Measurement (software/signal level)

$KEYS (-7.24%)

Keysight Technologies (KEYS, USA) - Electronics & RF test systems.

Network & data center backbone

$ANET (-4.24%)

Arista Networks (ANET, USA) - High-speed networks.

$CSCO (-3.83%)

Cisco Systems (CSCO, USA) - Data center/edge networks.

$EQIX (-1.43%)

Equinix (EQIX, USA) - Data centers (colocation).

Cloud infrastructure

$AMZN (-5.92%)

Amazon (AMZN, USA) - AWS (cloud, AI training).

$MSFT (-3.3%)

Microsoft (MSFT, USA) - Azure.

$GOOG (-3.33%)

Alphabet (GOOGL, USA) - Google Cloud.

Takeaway: Investing in the infrastructure stack allows you to participate in the robotics trend regardless of the subsequent product winner and reduces the individual product risk, but you have to live with cycles. In your opinion, which stage of the chain offers the best risk/return combination and fits into a disciplined portfolio?

Source: Own analysis based on publicly available company information and IR materials of the companies mentioned.

Image material: Techa Tungateja/iStockphoto

Build robots, earn shovels

The hype is all about humanoid robots, but the constant winners are in the background.

I have divided the analysis into two perspectives. 1. the complete value chain of humanoid robots, which shows all the players from the chip to the finished robot, and 2. the blade manufacturers in the background, who always earn money as enablers, regardless of which manufacturer wins the race.

ASML, Applied Materials and Tokyo Electron dominate in manufacturing technology. Quality assurance comes from Keysight, Advantest and Teradyne. Chip design is supported by Synopsys, Cadence and ARM. Data streams are secured by Arista Networks, Cisco and Equinix. The computing basis is created in the cloud by Amazon, Microsoft and Alphabet. Albemarle, Lynas and Umicore play a central role in raw materials and battery materials. These companies monetize their customers' investment waves, have high barriers to entry, service revenues and pricing power, but remain cyclical with risks from export rules, capex cuts and currency movements.

🌐 Value chain of humanoid robots Sector overview

1. research & chip design (IP / EDA)

$ARM (-10.82%)

ARM Holdings (ARM, UK/USA) - CPU architectures

$SNPS (-12.42%)

Synopsys (SNPS, USA) - Chip design software

$CDNS (-9.81%)

Cadence Design Systems (CDNS, USA) - EDA & Simulation

2. manufacturing technology & equipment

$ASML (-5.06%)

ASML (ASML, NL) - EUV lithography, key monopoly

$AMAT (-6.65%)

Applied Materials (AMAT, USA) - Process equipment

$8035 (-7.11%)

Tokyo Electron (8035.T, JP) - Wafer equipment

$KEYS (-7.24%)

Keysight Technologies (KEYS, USA) - Test & RF measurement technology

$6857 (-6.61%)

Advantest (6857.T, JP) - Semiconductor test systems

$TER (-9.45%)

Teradyne (TER, USA) - Test systems + robotics (Universal Robots)

3. chip production (Foundries)

$TSM (-6.55%)

TSMC (TSM, TW) - Largest contract manufacturer

$005930

Samsung Electronics (005930.KQ, KR) - Memory + Foundry

$GFS (-7.55%)

GlobalFoundries (GFS, USA) - Specialized production

4. computing & control unit ("brain")

$NVDA (-6.14%)

Nvidia (NVDA, USA) - GPUs, AI accelerators

$INTC (-5.15%)

Intel (INTC, USA) - CPUs, FPGAs

$AMD (-10.01%)

AMD (AMD, USA) - CPUs/GPUs

$MRVL (-5.93%)

Marvell Technology (MRVL, USA) - Network/data center chips

5. sensors ("senses")

$6758 (-5.66%)

Sony (6758.T, JP) - CMOS image sensors

$6861 (-1.03%)

Keyence (6861.T, JP) - Vision systems, sensors

$STM (-5.65%)

STMicroelectronics (STM, CH/FR) - MEMS sensors

6. actuators & power electronics ("muscles")

$IFX (-4.21%)

Infineon (IFX, DE) - Power semiconductors, SiC

$ON (-7.46%)

N Semiconductor (ON, USA) - SiC/Power Chips

$STM (-5.65%)

STMicroelectronics (STM, CH/FR) - Motor control & power

$TXN (-4.45%)

Texas Instruments (TXN, USA) - Motor control, power ICs

$ADI (-6.83%)

Analog Devices (ADI, USA) - Energy & BMS chips

7. communication & networking ("nerves")

$QCOM (-8.32%)

Qualcomm (QCOM, USA) - 5G/SoCs

$AVGO (-7.17%)

Broadcom (AVGO, USA) - Network & radio chips

$SWKS (-7%)

Skyworks Solutions (SWKS, USA) - RF components

8. energy supply

$300750

CATL (300750.SZ, CN) - Batteries

$6752 (-3.59%)

Panasonic (6752.T, JP) - Batteries for automotive/robotics

$373220

LG Energy Solution (373220.KQ, KR) - Batteries

9. cloud & infrastructure

$AMZN (-5.92%)

Amazon (AMZN, USA) - AWS

$MSFT (-3.3%)

Microsoft (MSFT, USA) - Azure

$GOOG (-3.33%)

Alphabet (GOOGL, USA) - Google Cloud

$EQIX (-1.43%)

Equinix (EQIX, USA) - Data center operator

$ANET (-4.24%)

Arista Networks (ANET, USA) - Network infrastructure

$CSCO (-3.83%)

Cisco Systems (CSCO, USA) - Edge & Data Center Networks

10. software & data platforms

$PLTR (-7.09%)

Palantir (PLTR, USA) - Data integration, decision software

$DDOG (-5.26%)

Datadog (DDOG, USA) - Cloud monitoring / observability

$SNOW (-4.44%)

Snowflake (SNOW, USA) - Cloud-native data platform

$ORCL (-3.03%)

Oracle (ORCL, USA) - Databases, ERP

$SAP (-3.86%)

SAP (SAP, DE) - ERP/cloud systems

$PATH (-10.71%)

UiPath (PATH, USA) - Automation software (RPA)

$AI (-7.18%)

C3.ai (AI, USA) - Enterprise AI platform

11. end applications / robots

$ABB

ABB (ABB, CH) - Industrial robots

$6954 (-1.33%)

Fanuc (6954.T, JP) - Industrial robots, CNC

$TSLA (-6.86%)

Tesla (TSLA, USA) - Optimus" humanoid robot

$9618 (-5.5%)

JD.com (JD, CN) - E-commerce & automated logistics

🛠️ Shovel manufacturer for humanoid robots

🔹 Hardtech (physical "shovels")

These companies provide the material basis: manufacturing machines, raw materials, semiconductor base.

Semiconductor Equipment & Manufacturing

$ASML (-5.06%)

ASML (ASML, NL) - EUV lithography (monopoly).

$AMAT (-6.65%)

Applied Materials (AMAT, USA) - Wafer equipment.

$8035 (-7.11%)

Tokyo Electron (8035.T, JP) - Process equipment.

Test systems (hardware-side)

$6857 (-6.61%)

Advantest (6857.T, JP) - Semiconductor test.

$TER (-9.45%)

Teradyne (TER, USA) - Test systems + industrial robots.

Materials & raw materials

$ALB (-7.74%)

Albemarle (ALB, USA) - Lithium (batteries).

$LYC (+3.13%)

Lynas Rare Earths (LYC.AX, AUS) - Rare earths for magnets.

$UMICY (-0.49%)

Umicore (UMI.BR, BE) - Cathode materials, recycling.

🔹 Soft/infra (digital "shovels")

These companies supply the infrastructure & toolswithout which development, training and operation would be impossible.

Design Software & IP

$SNPS (-12.42%)

Synopsys (SNPS, USA) - EDA software.

$CDNS (-9.81%)

Cadence Design Systems (CDNS, USA) - Chip design & simulation.

$ARM (-10.82%)

ARM Holdings (ARM, UK/USA) - CPU architectures (license model).

Test & Measurement (software/signal level)

$KEYS (-7.24%)

Keysight Technologies (KEYS, USA) - Electronics & RF test systems.

Network & data center backbone

$ANET (-4.24%)

Arista Networks (ANET, USA) - High-speed networks.

$CSCO (-3.83%)

Cisco Systems (CSCO, USA) - Data center/edge networks.

$EQIX (-1.43%)

Equinix (EQIX, USA) - Data centers (colocation).

Cloud infrastructure

$AMZN (-5.92%)

Amazon (AMZN, USA) - AWS (cloud, AI training).

$MSFT (-3.3%)

Microsoft (MSFT, USA) - Azure.

$GOOG (-3.33%)

Alphabet (GOOGL, USA) - Google Cloud.

Takeaway: Investing in the infrastructure stack allows you to participate in the robotics trend regardless of the subsequent product winner and reduces the individual product risk, but you have to live with cycles. In your opinion, which stage of the chain offers the best risk/return combination and fits into a disciplined portfolio?

Source: Own analysis based on publicly available company information and IR materials of the companies mentioned.

Image material: Techa Tungateja/iStockphoto

My depot for discussion: Looking for honest feedback!

Hello community,

I would like to present my revised portfolio strategy to you today and am looking forward to your opinions and constructive feedback. I am pursuing a core-satellite approach.

The core (approx. 40%):

My foundation for long-term and stable asset accumulation. Here I rely on the MSCI World and the Nasdaq 100 in order to participate in global economic growth in a broadly diversified manner. Simple, cost-effective and proven.

The satellites (approx. 60%):

Here I pursue clear, thesis-based investments in individual stocks. These can be divided into six thematic clusters:

1. the AI infrastructure (cloud, data & security):

My biggest bet. I believe that the real winners of the AI revolution are the companies that provide the foundation.

Positions:

Cloudflare, CrowdStrike, Snowflake, Datadog.

2. the fintech revolution in emerging markets:

The disruption of traditional banking in populous and digitally savvy regions.

Positions:

MercadoLibre, Nu Holdings.

3. global champions & turnarounds:

Here I bundle global market leaders that I consider undervalued or that are on the verge of a comeback.

Positions:

Alibaba, BYD. For me, these are not speculative gambles, but counter-cyclical bets on dominance in their respective markets.

4. industrial excellence & luxury brands:

A bet on undisputed market leaders in highly profitable niches with strong moats - from armor to high-tech automation to luxury sports cars and one of the best investors of all time.

Positions: Rheinmetall, Ferrari, Berkshire Hathaway, Keyence.

5. future technologies & energy:

The thesis here is clear: more AI and more data centers require massively more energy.

Positions:

The Uranium ETF, Iris Energy, American Lithium.

6. megatrends: health & sustainability:

Investments in global market leaders that benefit from two unstoppable social developments: demographic change and the need for a circular economy.

PositionsNovo Nordisk, Tomra Systems.

My question to the Getquin community:

What is your opinion on this strategy and allocation?

#DepotCheck #PortfolioReview #Feedback #CoreSatellite #Strategy

$NET (-4.51%)

$CRWD (-4.63%)

$NOVO B (-3.44%)

$1211 (-4.45%)

$BABA (-8.67%)

$IREN (-9.15%)

$NLR (-0.73%)

$ACWI

$WSML (-2.96%)

$RACE (-3.78%)

$BRK.B (-2.44%)

$RHM (-2.26%)

$6861 (-1.03%)

$DDOG (-5.26%)

$MELI (-6.22%)

$SNOW (-4.44%)

$NU (-3.45%)

$TOM (-2.03%)

Cathie Woods ARK ETFs make large purchases at The Trade Desk and sell block position

Cathie Wood's ARK ETFs once again saw significant transactions on Tuesday, August 12, 2025, with a focus on technology and biotech stocks. The largest transaction of the day was the purchase of 738,367 shares of The Trade Desk Inc ( $TTD (-5.03%) ) with a total value of $39,266,357. This move underscores ARK's continued confidence in the digital advertising platform, where the fund had already significantly increased its positions in recent days.

Another notable transaction involved Block Inc ( $SQ (-8.11%) ), formerly known as Square. Here ARK sold 215,543 shares, representing a sizable value of $15,741,105. This sale represents one of the larger divestitures of the day and could indicate a strategic realignment of ARK's position towards the financial services and digital payments company.

ARK also made a significant purchase of 643,406 shares of Pinterest Inc ( $PINS ) worth $21,998,051. The social media company has repeatedly been in ARK's focus in the past, as evidenced by the continuous purchases over the past week. This trend points to a bullish assessment of Pinterest's growth prospects on the part of ARK.

In the biotech sector, ARK's ARK ETF purchased 128,896 shares of CRISPR Therapeutics AG ( $CRSP (-3.49%) ) for a total value of $714,567, continuing its investment in the gene-editing company. On the flip side, various ARK ETFs divested shares of DraftKings Inc ( $DKNG (-7.73%) ), Guardant Health Inc ( $GH (-1.74%) ), Robinhood Markets Inc ($HOOD (-9.88%) ), Palantir Technologies Inc ($PLTR (-7.09%) ), Roblox Corp ( $RBLX ) and Shopify Inc ($SHOP (-9.54%) ). The largest sell-off was DraftKings, with 221,203 shares worth $9,452,004 sold.

Other notable buys included Exact Sciences Corp ( $EXAS (-2.45%) ) and Personalis Inc ( $PSNL (-6.98%) ). ARK bought 93,753 and 134,035 shares worth $3,835,435 and $603,157 respectively. The continued purchases in these stocks could indicate a focused strategy targeting innovative healthcare companies.

Smaller transactions were also part of the day's activity. ARK bought shares in Compass Pathways PLC ( $CMPS (-4.46%) ) and 10X Genomics Inc ( $TXG (-2.95%) ). Despite the smaller dollar amounts, these purchases could be part of a long-term strategy that focuses on up-and-coming companies in the respective sectors.

Some of dear Cathie's transactions don't need to be understood but well, the young lady's returns speak for themselves.

$ARKK (-5.94%) and $ARKF (-6.33%) over 70% return since 365 days, I can only shine with +27% with my portfolio.

I will remain invested in $TTD (-5.03%) My current portfolio has a lot of risk, as I have generated some cash.

At the moment I'm considering whether I should possibly $HMWO (-3.69%) and $EQQQ (-4.82%) or just the $VUSA (-3.84%) into the portfolio.

Temporarily sold $AMD (-10.01%) +35%, $HIMS (-8.47%) +15%, $DOCN (-5.38%) +9%.

I would re-enter Hims and AMD at certain prices and possibly add other companies to the portfolio if they fit my selection.

My positions:

On the watchlist

Trending Securities

Top creators this week