$CROX (-5.15%), is it a value bet?

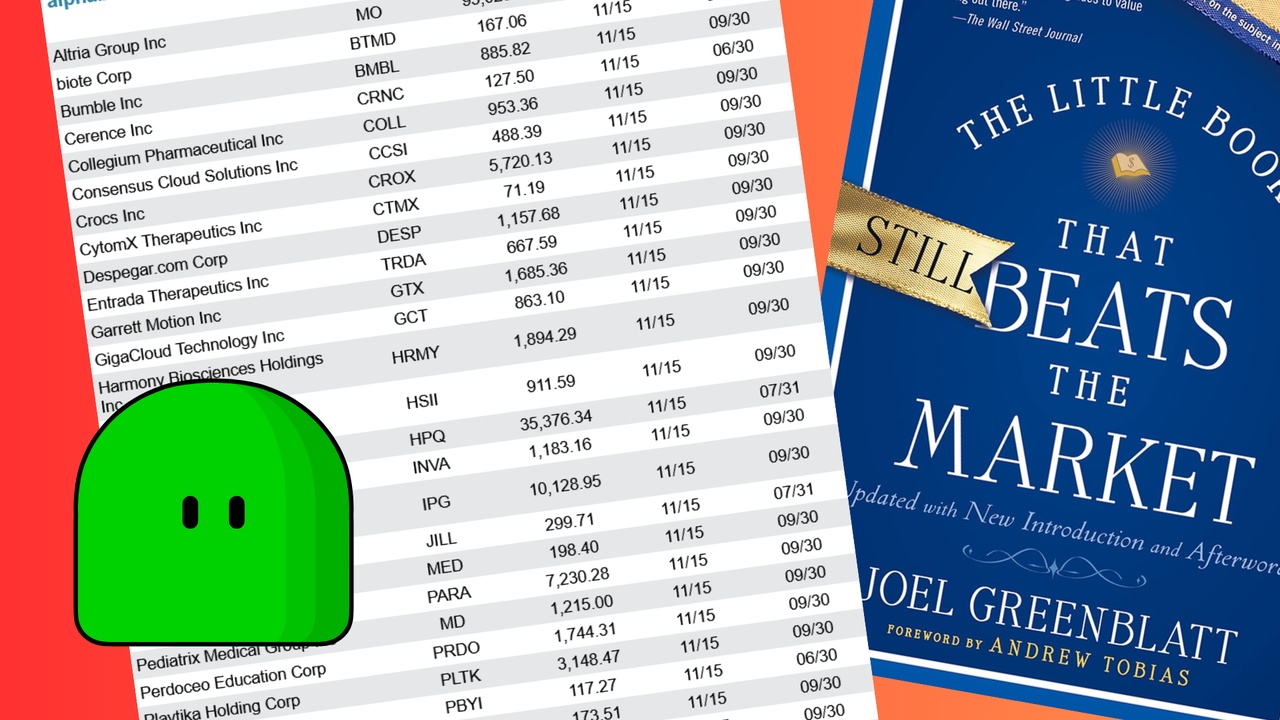

$CROX (-5.15%) is a notorious stock for Magic Formula investors. Year after year it comes back into the list (you can find the latest Magic formula list after the picture down below).

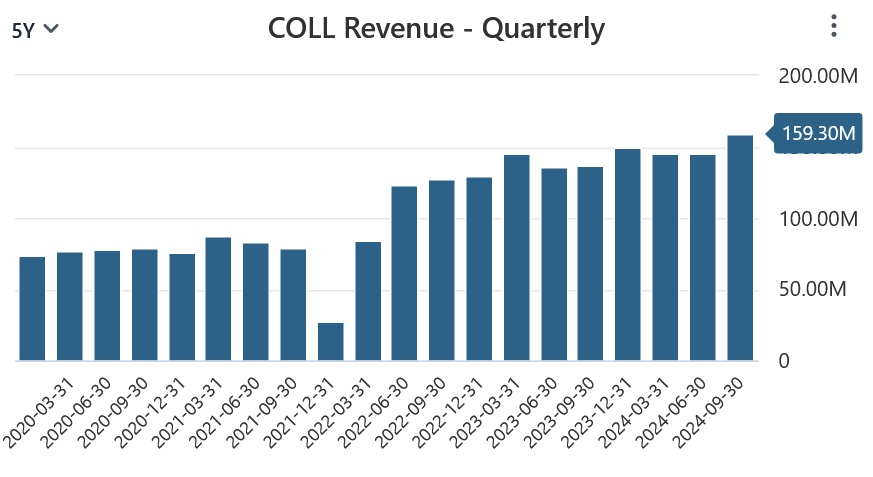

Both Revenue and Cash flow keep on growing quarter after quarter, but the stock price keeps on following a wavy pattern. It runs up for a while trying to close the valuation gap and then suddenly it pulls back. Let's try to understand the current situation.

------

$CROX (-5.15%) is currently trading at a notable low price-to-earnings (P/E) multiple, well below the averages of the Textile – Apparel industry and the broader Retail-Wholesale sector. With a forward 12-month P/E of 8x, the CROX stock reflects a discount to the industry average of 13.77x and the Consumer Discretionary sector’s average of 19.65x.

$CROX (-5.15%) Stock Looks Undervalued

This shows the CROX stock is undervalued relative to its industry peers, presenting an attractive opportunity for investors seeking exposure to the Consumer Discretionary sector.

Crocs stock price has surged 13.5% year to date, significantly outpacing the industry’s decline of 12.8%. This performance can be attributed to the company’s strategic initiatives, including robust market expansion and product diversification efforts.

Factors Driving the Brand

Crocs is advancing its long-term strategy with key initiatives focused on sustainable growth. The company’s approach centers on three main pillars. These include elevating iconic products across brands to boost awareness and relevance, marketing, digital and retail expansion, and diversifying its product range to appeal to a broader consumer base.

Crocs has strategically expanded its product range, leveraging diversification to attract a broader consumer base. The Crocs brand’s remarkable growth in global awareness and desirability has been fueled by innovative collaborations and unique product offerings.

Current Pressures on CROX

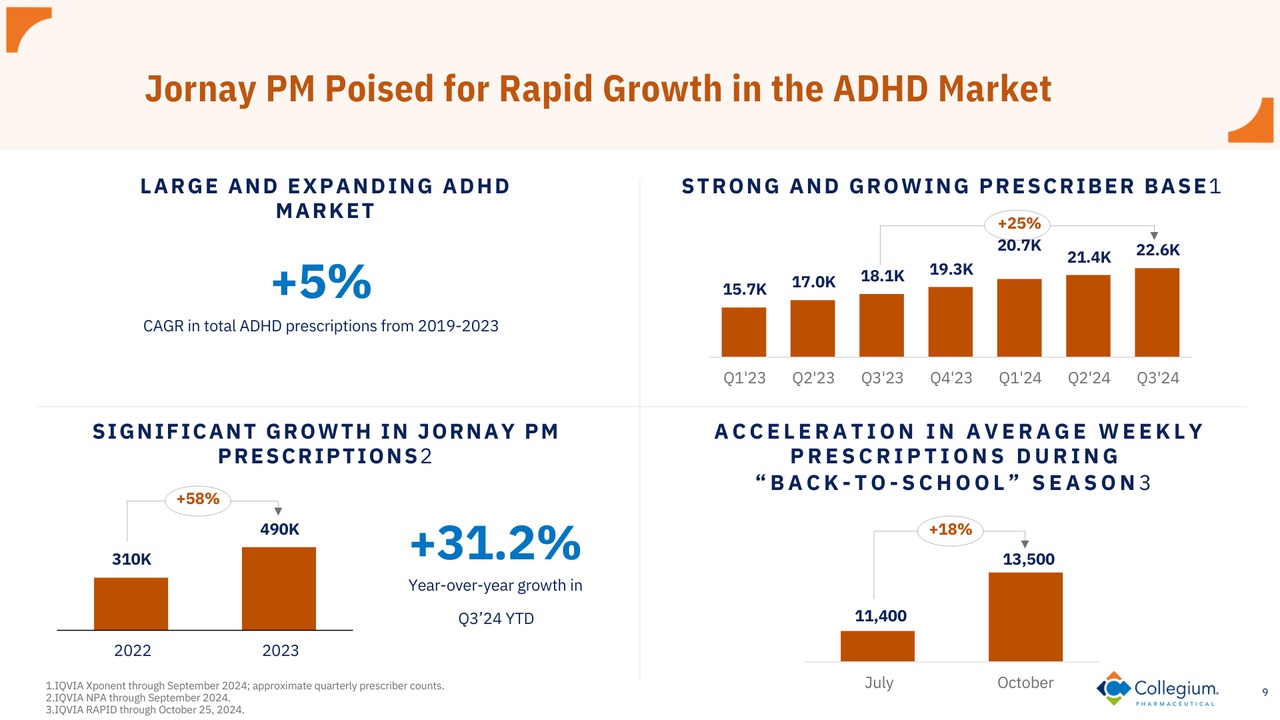

Despite all the positives, Crocs' HEYDUDE brand underperformed, with revenues dropping 17.4% year over year in the third quarter. This decline was led by a 22.9% fall in wholesale revenues and a 9.3% drop in direct-to-consumer (DTC) revenues. Comparable DTC sales for the HEYDUDE brand also decreased by 22.2%.

Looking ahead, Crocs anticipates a relatively subdued consumer environment in the United States until the Black Friday/Cyber Monday holiday period. Per the company, the industry saw heightened promotional activities in China during the mid-season festival, reflecting a more conservative approach by China consumers. As a result, the company expects to see a greater pullback in major cities like Shanghai and Beijing.

Given the challenging macroeconomic conditions, Crocs has issued a cautious outlook for the fourth quarter and 2024, anticipating flat-to-slight revenue growth year over year, in constant currency. The Crocs brand is expected to grow 2% in the fourth quarter, while HEYDUDE revenues may decline 4-6%. International growth is projected to slow due to regulatory challenges in India, and North America faces consumer selectivity and wholesale timing pressures, though DTC revenues remain positive.

For 2024, enterprise revenues are projected to increase 3% year over year in constant currency, which is at the lower end of the previously guided 3-5% growth. Revenues for the Crocs brand are expected to grow 8%, while HEYDUDE brand revenues are anticipated to decline 14.5% due to weaker-than-expected sellouts in both wholesale and digital channels. Previously, management had estimated the Crocs brand’s revenues to grow 7-9% and HEYDUDE’s revenues to decrease 8-10%.

Investment Opinion on CROX

You may find Crocs stock attractive for its undervaluation compared to industry peers, with a lower price-to-earnings ratio. Given strategic initiatives, margin improvements, successful partnerships and a focus on sustainability, the stock presents a compelling investment opportunity for those looking to capitalize on the company’s growth trajectory.

However, CROX faces challenges, including soft revenue expectations, struggles with the HEYDUDE brand and headwinds in China, which could impact its near-term performance. These factors introduce some uncertainty, suggesting a more cautious approach to investing in Crocs at this stage.

Magic Formula's list (01/12/2024)

#magicformula

#multibagger

#tenbagger

#joelgreenblatt

#greenblatt