Share price target for Corcept Therapeutics raised, buy recommendation based on Cushing's franchise growth. $CORT (+0.03%)

On Friday, HC Wainwright maintained its Buy rating on shares of Corcept Therapeutics (NASDAQ: CORT ) and raised its price target significantly from $45.00 to $80.00. The firm's decision reflects a positive outlook for the company's Cushing's syndrome treatment offering, including its flagship product Korlym.

The analyst at HC Wainwright pointed to the continued growth of Korlym sales in recent quarters, noting that the product appears to have been unaffected by generic competition from Teva Pharmaceuticals. The company's revised financial model now projects Korlym sales to reach nearly $531 million by 2030, a significant increase from the previously estimated $338 million for the same period

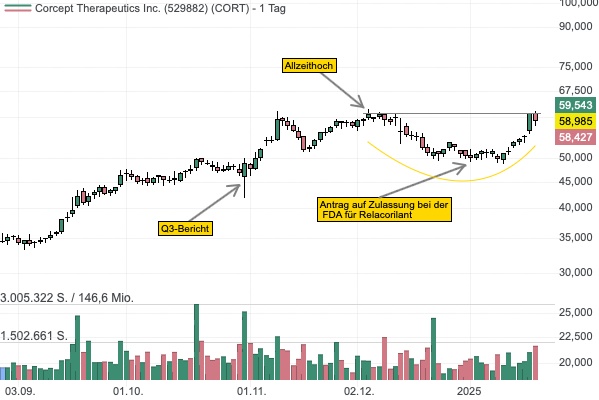

In addition to Korlym's strong performance, the analyst's optimism is also bolstered by expectations around Corcept's pipeline drug Relacorilant. The company is expected to submit a New Drug Application (NDA) by the end of 2024 and is expected to launch in the first quarter of 2026.

Assuming the drug is approved, HC Wainwright estimates the price of Relacorilant to be almost USD 378,000 per patient per year and forecasts that risk-adjusted revenues will start at USD 174 million in 2026 and eventually rise to USD 691 million by 2030.

The significant increase in the price target to $80 reflects the updated sales projections and the company's confidence in the future success of Corcept's Cushing's syndrome treatments. The analyst's comments and revised price target indicate the company's strong belief in capitalizing on the Cushing's syndrome market with its current and future product offerings.

In other recent news, Corcept Therapeutics has attracted significant attention due to its impressive financial performance and promising clinical developments. The company's second quarter revenues increased 39% year-over-year to $163.8 million, and net income reached $35.5 million. Following these strong results, Corcept's management has adjusted its revenue guidance for 2024 and now expects USD 640 to 670 million.

Analyst firms Truist Securities, Canaccord Genuity and Piper Sandler have maintained their positive ratings on Corcept shares, with Truist Securities raising its price target to USD 76. These firms cite the robust performance of Corcept's drug Korlym and the growth potential in the patient base as key factors.

The positive outlook is further supported by the progress of Corcept's Phase 3 program for Relacorilant, its next-generation treatment. The company is on track to file for regulatory approval of Relacorilant in the fourth quarter of 2024. In addition, upcoming trials and an upcoming litigation with TEVA are seen as potential catalysts for the company.

Corcept is also expanding into other therapeutic areas, including oncology and metabolic disorders, and is currently conducting trials for various diseases. These recent developments underscore Corcept Therapeutics' strong position and potential for future growth in the biotech sector.

InvestingPro Insights

HC Wainwright's bullish outlook is in line with several key metrics and InvestingPro insights. Corcept Therapeutics' current market capitalization is $4.93 billion, reflecting investor confidence in the company's growth potential. The company's revenue growth of 33.04% in the last twelve months and an impressive 39.15% in the last quarter underpin the analyst's positive view on Korlym's revenue performance.

InvestingPro Tips emphasizes that Corcept has been very profitable over the last twelve months and is expected to remain profitable this year. This profitability is further underlined by the company's strong gross profit margin of 98.49%, which indicates efficient cost management in its core businesses.

The share's recent performance has been remarkable, with a price return of 108.16% over the last six months and a return of 66.74% over the last year. This is in line with InvestingPro's tip that Corcept is trading near its 52-week high and is currently at 97.34% of that peak.

https://www.investing.com/news/company-news/corcept-therapeutics-stock-target-raised-buy-rating-on-cushings-franchise-growth-93CH-3670992