$NDAQ (+0.46%)

$RTX (+0.15%)

$KO (-0.1%)

$MMM (-0.04%)

$NOC (+0.14%)

$LMTB34

$OR (-0.06%)

$TXN (-1.76%)

$NFLX (+0.12%)

$HEIA (-0.25%)

$SAAB B (+2.58%)

$UCG (+1.01%)

$BARC (-0.72%)

$GEV (+1.26%)

$TMO (+0%)

$T (-0.22%)

$MCO (-0.12%)

$IBM (-0.07%)

$SAP (+0.6%)

$TSLA (+0.95%)

$AAL (+0.16%)

$FCX (+1.33%)

$HON (-0.42%)

$DOW (+0.4%)

$NOKIA (-0.17%)

$TMUS (+0.07%)

$INTC (+1.12%)

$NEM (+1.22%)

$F (+0.03%)

$PG (+0.05%)

$GD (+0.11%)

Discussion about KO

Posts

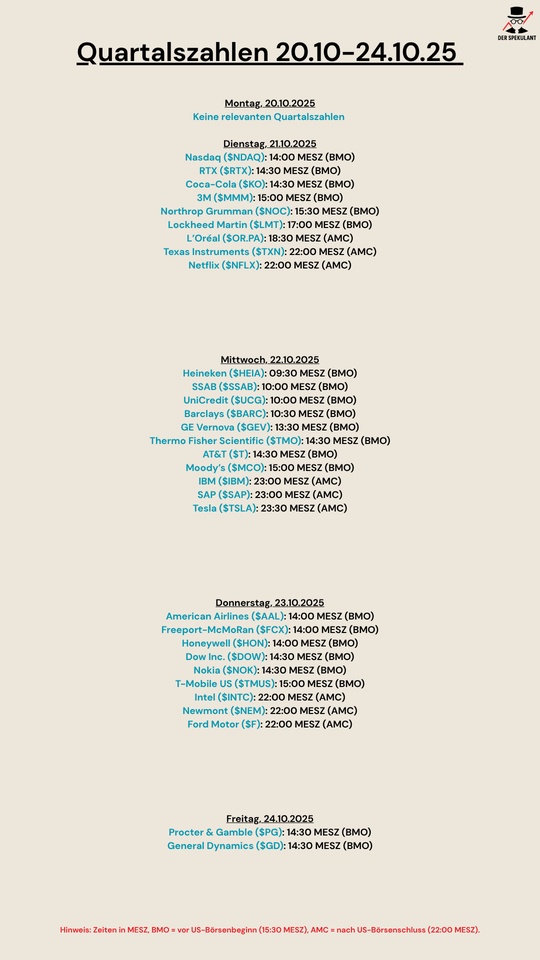

529Quartalsberichte 21.10-24.10.25

It's going to be expensive 🍺

A number of major beer manufacturers are raising their prices. Six of the ten most popular beer brands in Germany are currently affected by price increases from major breweries or will be in the coming months, according to an analysis by the specialist drinks market magazine "Inside".

In addition to several large breweries, many small breweries also increased their prices. However, it remains to be seen to what extent the breweries' customers will accept price increases and pass them on to consumers.

Not only the retail trade, but also the food service industry is confronted with price increases for beer in many cases. "Beer sales are actually under more pressure than ever before," emphasized "Inside" publisher Niklas Other. Less beer is being drunk in the restaurant trade in particular, and there is clearly not as much emphasis on socializing at the moment. "Then there's demographics: older people are drinking less."

The move away from alcohol is hitting other product categories such as spirits and wine even harder. Non-alcoholic drinks are also currently becoming more expensive. Other points to the market leader Coca-Cola $KO (-0.1%) which raised its prices on September 1. According to the group, the price increases to customers in the retail and out-of-home market are in the low single-digit percentage range on average for all products and packs.

Source text (excerpt) & image: Handelsblatt, 17.10.2025

Well then: cheers! 🍻

Inspiration needed

Hello everyone,

I have cleaned up my portfolio a bit and trimmed it to 30 positions (please ignore the very small positions, it is more expensive to sell them than to keep them). The different ETFs on msci, msci em, dax and NASDAQ are due to historical reasons (sub. Deposits, change from synth. To physical replication, too many taxes with complete change). At the end of the year I will sell the 2 DWS old funds and then have the tax refunded promptly --> grandfathering. I just don't know where to switch to.

I am currently saving:

$TDIV (-0.31%) 250/m

$IWDA (+0.21%) 600/m

$IEMA (+0.63%) 250/m

$EQAC (+0.27%) 250/m

$ALV (+0.33%) 50/w

$KO (-0.1%) 50/w

$PEP (-0.4%) 50/w

$UNH (+0.57%) 50/w

$V (+0.09%) 50/w

$ULVR (-0.28%) 50/w

And I reinvest the dividends from $O (-0.26%) and $MAIN (+1.12%) monthly

I try to have all positions that I want to hold long-term at 2-4 percent (exceptions: ETFs, $EWG2 (+0.75%) and $BRK.B (-0.11%) )

At the moment semiconductors ($AMD (+1.31%)

$PLTR (+0.78%)

$MU (+2.96%) and $MPWR (+0.28%) ) are my "yield positions", which I would like to sell if the price continues to rise.

But at the moment I'm lacking inspiration. What is my portfolio missing in the long term? Which themes could I "play" to achieve short-term returns. Or just leave everything as it is.

I would be grateful for any opinions.

Greetings 👋

Why I keep buying KDP

I have increased my position in Keurig Dr Pepper (KDP $KDP (-0.82%) ) because I consider the company to be one of the best diversified beverage companies on the market.

Under the KDP umbrella, there are strong brands in coffee, tea, soft drinks, energy drinks, functional drinks and even cooperations in the alcohol sector.

I find the fast-growing area of energy and functional drinks particularly exciting, where KDP is building up market share with brands such as C4 Energy, Bai, Core Hydration and, more recently, Ghost.

The acquisition of Ghost shows that KDP is consistently investing in young, trend-conscious brands - an area with enormous growth potential.

Although KDP is ranked behind Pepsi $PEP (-0.4%) and Coke $KO (-0.1%) but with its coffee division $KDP (-0.82%) clear advantage.

The fall in the share price offers me an attractive buying opportunity. Cash flow and brand diversity clearly speak in favor of the company in the long term.

+ 1

📅 Transactions end of September - beginning of October 2025

💼 Equities & ETFs

- 🏭 R3N (French SME) → small caps reinforcement 🇫🇷 (PEA-PME)

- 🌍 Amundi EURO STOXX 50 II ETF → more exposure to European leaders $MSE (-0.07%)

💰 Vanguard FTSE All-World High Dividend ETF → total return boost $VHYL (-0.14%)

💻 iShares NASDAQ 100 ETF → tech remains my core 🔥 $CSNDX (+0.31%)

🔌 Cisco Systems → double entry on US tech $CSCO (+0.2%)

🧴 Coca-Cola → solid defensive value for dividends 🥤$KO (-0.1%)

🧬 Zoetis → addition in the animal health sector 💊 $ZTS (-0.07%)

🏦 S&P Global → diversification into premium finance 💼 $SPGI (+0.28%)

✈️ Booking Holdings → light position in high-end tourism 🌴 $BKNG (+0.24%)

🪙 Crypto & Metals

- ₿ Bitcoin → small, quiet DCA $BTC (+1.8%)

Ξ Ethereum → always faithful to the blockchain $BTC (+1.8%)

🪙 iShares Physical Gold ETC → a little gold for balance 💎 $IGLN (-0.83%)

💼 Sale

- ⚙️ Carpenter Tech → taking gains on beautiful perf 📈 $CRS (+0.49%)

Coca Cola

On the green line I want to increase my $KO (-0.1%) position but is it going to get on my green line or is it up and up from now on.

I have Coca Cola and Pepsico in my portfolio. Now I would like to invest another €1000, which would you recommend?

This question reached me.

However, I then also $KDP (-0.82%) next to $KO (-0.1%) and $PEP (-0.4%) ... How do you see it?

This is the short form of my answer:

- Coca-Cola: The defensive portfolio fundamental - ideal for dividend fans and stability lovers, but upside limited.

- PepsiCo: Currently attractively valued, with a strong global position and analyst support. If you are looking for a solid dividend + turnaround potential, this is the sweet spot.

- Keurig Dr Pepper: Highly speculative, but with greatest upside and strong earnings growth. If you believe in the new strategy and are not afraid of volatility, you could achieve higher returns here in the long term.

For an additional €1,000 investment, there is a lot to be said for PepsiCo as a "Goldilocks solution" - stable dividend, favorable valuation, good chances of positive surprises. Courageous investors with staying power can consider Keurig Dr Pepper as a turnaround.

A spontaneous video to go with it: https://youtu.be/F5Em1ePdMHE

Happy holidays to all.

Some shares may now also be added to my portfolio

... In my opinion, this is not the ideal time to buy, but some stocks, especially in the more defensive area, are comparatively attractive for me right now, especially as they can also be a defensive anchor if tech should correct again. As far as tech is concerned, I'm waiting for that.

Today I have:

$WM (-0.28%)

$RSG (+0.08%)

$PG (+0.05%)

$COKE (+0.89%)

$KO (-0.1%)

$LIN (-0.39%)

$CSL (+0.07%)

$NEE (+0.39%)

$DB1 (+0.13%)

$DTE (+1.42%)

$COST (-0.06%) bought

all about the same amount... Linde a little more, Carlisle a little less...

Trending Securities

Top creators this week