07.11.2024

iPhone sales boost revenue for chip designer Arm + Qualcomm beats expectations for fourth quarter + Novo Nordisk: weight loss and diabetes drugs flourish + Trump election victory sends bank shares sharply higher + Aurora Cannabis quarterly figures

The chip designer Arm Holdings $ARM (-10.82%) achieved higher sales in the second quarter than in the same period of the previous year. The company benefited from the sale of Apple's $AAPL (-4.63%) iPhones, Arm announced on Wednesday after the close of the US stock exchange. The British chip designer reported a profit of 30 US cents per share for the past quarter, adjusted for share-based payments and other factors. Analysts had expected a profit of 26 cents per share. Arm's turnover rose by five percent to 844 million dollars, compared to analysts' estimates of 808.4 million. However, the company forecast revenue for the current quarter to be only in the middle of estimates. Arm expects revenue to be between $920 million and $970 million, with a midpoint of $945 million, compared to the average analyst estimate of $944.3 million. The company expects third-quarter earnings of between 32 and 36 cents per share. Analysts had projected earnings of 34 cents per share for the third quarter. Arm collects a license fee for every chip sold that uses its technology. Arm's designs power almost every smartphone in the world.

The results of Qualcomm $QCOM (-8.32%) 's fourth-quarter results were better than expected as the chip supplier posted its fifth consecutive quarter of record automotive sales. Adjusted earnings per share rose to $2.69 from $2.02 a year ago, above the $2.57 consensus surveyed by Capital IQ. Non-GAAP revenue rose 18% year-over-year to $10.24 billion in the three months ended Sept. 29, beating Wall Street expectations of $9.93 billion. Qualcomm shares rose 7% in after-hours trading on Wednesday. Sales at Qualcomm's CDMA technology division, which represents its semiconductor business, rose 18% to $8.68 billion, driven by a 68% increase in the auto division to $899 million. Cell phone sales rose 12% to $6.1 billion, while the Internet of Things division increased 22% to $1.68 billion, the company said. Technology licensing revenue rose 21% to $1.52 billion. Qualcomm expects first-quarter adjusted earnings per share of $2.85 to $3.05 on revenue of between $10.5 billion and $11.3 billion.

The pharmaceutical company Novo Nordisk $NOVO B (-3.44%) continues to do good business with its top-selling diabetes and weight-loss drugs Ozempic and Wegovy. Group-wide sales of the Danish company increased by 21 percent to 71.3 billion Danish crowns (around 9.6 billion euros) in the third quarter, as the manufacturer announced in Baegsvaerd on Wednesday. The bottom line profit climbed by a good fifth to 27.3 billion Danish kroner. The Group thus performed better than analysts had expected. The management is now once again narrowing its sales and profit expectations for the year. An increase in revenue at constant exchange rates of 23 to 27 percent is now expected for the year as a whole. This is one percentage point more at the lower end, but also one percent less at the upper end than recently. The Danes are now predicting an increase in operating profit of 21 to 27 percent, excluding exchange rate effects. This means that the Group is also expecting slightly more at the lower end and slightly less at the upper end than before. In the summer, Novo Nordisk had already lowered its target for this key figure.

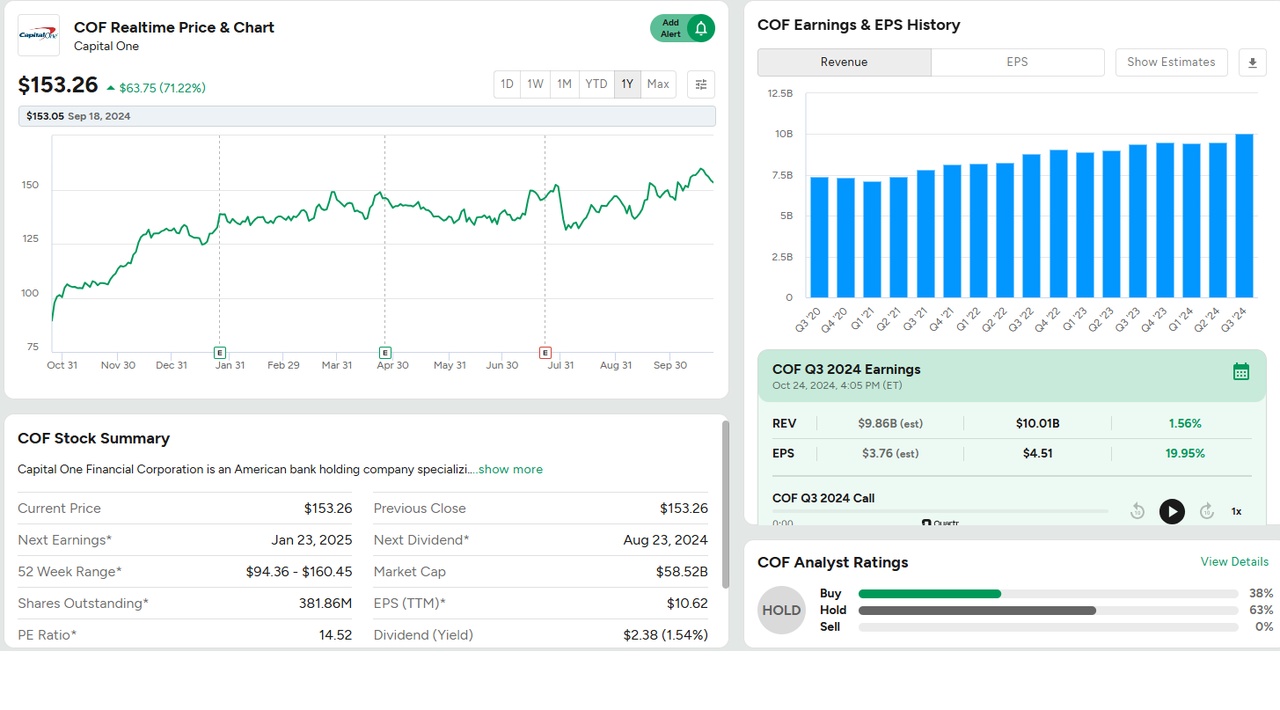

Donald Trump's clear victory in the US presidential election catapulted the share prices of US banks and financial services providers higher on Wednesday. Goldman Sachs and JPMorgan climbed to record highs in the Dow Jones Industrial benchmark index. Goldman $GS (-2.43%) recently gained around 12 percent, while JPMorgan $JPM (-2.22%) the gain amounted to more than 9 percent. In the S&P 500 Citigroup $C (-3.2%), Wells Fargo $WFC (-3.48%) and Morgan Stanley $MS (-3.39%) were similarly strong. Capital One Financial $COF (-3.86%)gained over 13 percent. A more protectionist trade policy is emerging in the USA under Trump. There is a threat of high import duties and corporate taxes could be lowered. However, debt could also increase. Bank shares benefited on Wednesday from the prospect of looser financial market regulation. In addition, interest rates could rise in view of a possible increase in debt - this would also be to the benefit of banks, for example in the lending business.

Aurora Cannabis figures $ACB (-13.35%)

- Record adjusted EBITDA1 of USD 10.1 million, an increase of 210% year-on-year

- Quarterly net revenue1 increased 29% to $81.1 million, with 41% growth in Global Medical Cannabis

- Reaffirms target of positive free cash flow1 in the quarter ending December 31, 2024

- Maintains a strong balance sheet with ~$152 million in cash and a debt-free cannabis business2

Thursday: Stock market dates, economic data, quarterly figures

ex-dividend of individual stocks

H & M Hennes & Mauritz (B) 3.25 SE

BP 0.08 USD

Ford Motor 0.15 USD

Unilever 0.37 GBP

Quarterly figures / company dates USA / Asia

12:30 Moderna quarterly figures

12:55 Under Armour quarterly figures

22:00 Expedia | News Quarterly figures

Quarterly figures / Company dates Europe

06:45 Adtran Networks | Zurich Insurance | Basler Quarterly figures

07:00 Daimler Truck | Heidelberg Materials | Lanxess | Nemetschek | Nordex | Rational | Arcelormittal | AMS-Osram | Aareal | Hamborner Reit | Knaus Tabbert quarterly figures

07:15 Air France-KLM quarterly figures

07:30 Compugroup | Delivery Hero | Munich Re | Rheinmetall | Telefonica | Adyen | Deutz quarterly figures

07:30 Dürr | Instone | Koenig & Bauer | Mutares | SGL Carbon | SNP Schneider quarterly figures

07:50 Suss Microtec quarterly figures

08:00 Verbund AG | PNE | BT Group | National Grid | CRH Quarterly Figures | Rolls-Royce Trading Update 3Q

10:00 Qiagen quarterly figures

14:30 Hochtief quarterly figures

17:50 Pirelli quarterly figures

18:00 Freenet quarterly figures

Economic data

- 08:00 DE: Trade balance September trade balance calendar and seasonally adjusted FORECAST: +19.0 bn Euro previous: +22.5 bn Euro Exports FORECAST: -2.8% yoy previous: +1.3% yoy Imports FORECAST: -0.2% yoy previous: -3.4% yoy

- 08:00 DE: Production in the manufacturing sector September seasonally adjusted FORECAST: -0.9% yoy previous: +2.9% yoy | Turnover in the service sector October

- 11:00 EU: Retail Sales September Eurozone PROGNOSE: +0.5% yoy previous: +0.2% yoy

- 13:00 UK: BoE, outcome and minutes of the Monetary Policy Council meeting and Monetary Policy Report October Bank Rate FORECAST: 4.75% previously: 5.00%

- 14:30 US: Initial jobless claims (week) FORECAST: 220,000 PREVIOUS: 216,000

- 14:30 US: Productivity ex Agriculture (1st release) 3Q annualized PROGNOSE: +2.5% yoy 2Q: +2.5% yoy Unit labor costs PROGNOSE: +1.1% yoy 2Q: +0.4% yoy

- 20:00 US: Fed, outcome of FOMC meeting Fed funds target rate FORECAST: 4.50% to 4.75% Previous: 4.75% to 5.00%