Hi there,

in case you're interested 🤓, I've said goodbye to a few dividend stocks and am getting myself $EQAC (+1.02%) as a savings plan + addition to the $FWRG (+0.57%) into the portfolio.

I'm just feeling it!

Posts

107Hi there,

in case you're interested 🤓, I've said goodbye to a few dividend stocks and am getting myself $EQAC (+1.02%) as a savings plan + addition to the $FWRG (+0.57%) into the portfolio.

I'm just feeling it!

🔹 Revenue: $28.1B (Est. $27.59B) 🟢; UP +11% YoY

🔹 EPS: $1.06 (Est. $0.95) 🟢; UP +31% YoY

🔹 NII: $15.2B ($15.4B FTE) (Est. $15.03B) 🟢; UP +9% YoY

Guidance:

🔸 Q4 NII (FTE): $15.6B to $15.7B

Q3 Operating Metrics:

🔹 Provision for Credit Losses: $1.3B; DOWN -16% YoY

🔹 Net Charge-Offs: $1.37B (Est. $1.52B) 🟢; DOWN -11% YoY

🔹 Noninterest Expense: $17.3B; UP +5% YoY

🔹 Total Loans: $1.17T (Est. $1.16T) 🟢; UP +8% YoY

🔹 Total Deposits: $2.00T (Est. $2.02T) 🔴; UP +4% YoY

🔹 Average Deposits: $1.99T; UP +4% YoY

🔹 Average Loans and Leases: $1.15T; UP +9% YoY

🔹 Efficiency Ratio: 62%; DOWN -329 bps YoY

Consumer Banking:

🔹 Net Income: $3.4B; UP +28% YoY

🔹 Revenue: $11.2B; UP +7% YoY

🔹 Average Deposits: $947B; UP +1% YoY

🔹 Average Loans and Leases: $320B; UP +2% YoY

🔹 Combined Credit/Debit Card Spend: $245B; UP +6% YoY

🔹 Net Checking Accounts Added: ~212,000 (27th consecutive quarter of growth)

🔹 Consumer Investment Assets: $580B; UP +17% YoY

🔹 Active Mobile Banking Users: 41.3MM

🔹 Digital Sales: 66% of total sales

Global Wealth & Investment Management:

🔹 Net Income: $1.3B; UP +19% YoY

🔹 Revenue: $6.3B; UP +10% YoY

🔹 Client Balances: $4.6T; UP +11% YoY

🔹 AUM Balances: ~$2.1T; UP +13% YoY

🔹 Average Loans and Leases: $246B; UP +9% YoY

🔹 Average Deposits: $277B; DOWN -1% YoY

🔹 AUM Flows: $23.5B

🔹 Net New Relationships: ~5,400 (Merrill and Private Bank)

Global Banking:

🔹 Net Income: $2.1B; UP +12% YoY

🔹 Revenue: $6.2B; UP +7% YoY

🔹 Total Corporation Investment Banking Fees (excl. self-led): $2.0B; UP +43% YoY

🔹 Average Deposits: $632B; UP +15% YoY

🔹 Average Loans and Leases: $388B; UP +5% YoY

🔹 Treasury Service Charges: UP +12% YoY

🔹 Middle Market Average Loans: UP +6% YoY

🔹 #3 Investment Banking Fee Ranking; 136 bps market share gain

Global Markets:

🔹 Net Income: $1.6B; UP +6% YoY

🔹 Revenue:

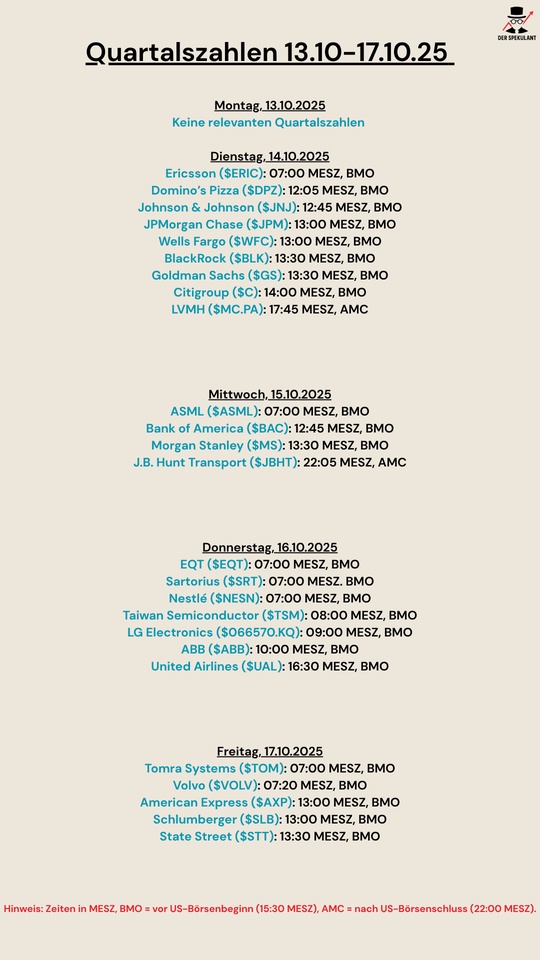

$ERIC A (-1.21%)

$DPZ (-1.23%)

$JNJ (-1.26%)

$JPM (+2.29%)

$WFC (+2.18%)

$BLK (+0.29%)

$GS (+3.38%)

$C (+2.07%)

$MC (-1.85%)

$ASML (+0.36%)

$BAC (+1.41%)

$MS (+2.5%)

$JBHT (-0.64%)

$EQT (-1.07%)

$SRT (+1.51%)

$NESNE

$TSM (+1.6%)

$ABBN (+0.44%)

$UAL (+3.2%)

$TOM (-1.82%)

$VOLV B (+0.21%)

$AXP (+1.25%)

$SLBG34

$STT (+1.05%)

September was the month in which my account shone like the last rays of summer sunshine! Why? The half-year bonus catapulted this month into the month with the highest income of all time. Of course, the money doesn't go into savings, but is put into the market the following month, because share price growth and dividends beat any consumption. There was also an unexpected refund from the dental supplement, which has already been reinvested. Who says that prophylaxis doesn't bring returns after all?

And what else? Business as usual: preparations for ice swimming started at the end of the month thanks to colder temperatures, daily sport and exercise, a nice community meeting of frugalists and investors. Yes, we talked about dividends rather than the latest fashion. Everything was rounded off with a donation. My portfolios went sideways, but did what they are supposed to do: Generate cash flow. And from this month onwards, there will be additional risk figures presented. A little growth and distribution. Time for a review!

Overall performance

This month was a typical month of consolidation for me. My investments moved sideways with only a very slight increase. Is this a good sign for a year-end rally? There was also an initial cut in the Fed's key interest rate. However, there were no major movements, and Q4 is more likely to be responsible for this. As always, income rained down on the account. My key performance indicators for my overall portfolio at a glance:

Performance & volume

The rise in the price of $AVGO (+2.19%) allows my largest single share position to grow further and strengthens its dominance. And the class leader has not spilled the beans in terms of performance since purchase either: +337%! After the $BAC (+1.41%) climbed into the top 5 by volume in the previous month, it remains in this group. The banks are currently doing well. Also$WMT (-0.42%) The retail giant is a reliable dividend payer and an important pillar among my individual stocks. The competitor$TGT (-0.11%) on the other hand, is the red lantern in my portfolio. Despite thefts and sales problems, I see a healthy business model. I am sure that this share will bounce back and continue to invest on a monthly basis.

Size of individual share positions by volume in the overall portfolio:

Share (%) of total portfolio and associated portfolio:

$AVGO (+2.19%) 3.30 % (main share portfolio)

$NFLX (-0.77%) 1.87 % (main share portfolio)

$WMT (-0.42%) 1.74 % (main share portfolio)

$FAST (+0.5%) 1.72 % (main share portfolio)

$BAC (+1.41%) 1.49 % (main share portfolio)

Smallest individual share positions by volume in the overall portfolio:

Share (%) of the total portfolio and associated securities account:

$SHEL (+0.28%) : 0.41 % (crypto follow-up portfolio)

$NOVO B (+0.14%) 0.50 % (main share portfolio)

$TGT (-0.11%) 0.55 % (crypto follow-on deposit)

$HSBA (+0.79%) 0.58 % (main share portfolio)

$GIS (-1.36%) 0.60 % (main share portfolio)

Top-performing individual stocks

Shares with performance since initial purchase (%) and the respective portfolio:

$AVGO (+2.19%) a: +337 % (main share portfolio)

$NFLX (-0.77%) : +153 % (main share portfolio)

$WMT (-0.42%) : +78 % (main share portfolio)

$FAST (+0.5%) +76 % (main share portfolio)

$SAP (-2.37%) +75 % (main share portfolio)

Flop performer individual stocks

Shares with performance since initial purchase (%) and the respective portfolio:

$TGT (-0.11%) : -38 % (main share portfolio)

$GIS (-1.36%) -31 % (main share portfolio)

$NKE (-0.82%) -27 % (main share portfolio)

$CPB (-0.75%) -24 % (main share portfolio)

$UPS (+0.85%) -24 % (main share portfolio)

Asset allocation

My asset allocation is as follows:

ETFs: 39.1%

Equities: 58.6%

Crypto: 2.2 %

P2P: less than 0.01 %

Investments and subsequent purchases

I have invested the following amounts in savings plans:

Planned savings plan amount from the fixed net salary: € 1,030

Planned savings plan amount from the fixed net salary, incl. reinvested dividends according to plan size: € 1,140

Savings ratio of the savings plans to the fixed net salary: 49.75

In addition, the following additional investments were made from returns, refunds, cashback, etc. as one-off savings plans/repurchases:

Subsequent purchases/one-off savings plans as cashback annuities from refunds: € 73.00

Subsequent purchases/non-recurring savings plans as cashback annuities from bonuses/incentives from the KK: € 0.00

Subsequent purchases from other surpluses: € 31.00

Automatically reinvested dividends by the broker: € 5.03 (function is only activated for an old custody account, as I otherwise prefer to control the reinvestment myself)

Additional purchases were made:

Number of additional purchases: 2

73.00 € for $TDIV (+0.08%)

25.00 € for $ZPRG (+0.3%)

Passive income from dividends

My income from dividends amounted to € 139.14 (€ 128.42 in the same month of the previous year). This corresponds to a change of -1.36% compared to the same month last year. The slight decrease is due to the fact that my large Vanguard ETFs postponed the distribution to the following month. The following are further key data on the distributions:

Number of dividend payments: 34

Number of payment days: 17 days

Average dividend per payment: € 4.09

average dividend per payment day: € 8.18

The top three payers are:

My passive income from dividends (and some interest) mathematically covered 16.05% of my expenses in the month under review.

Crypto performance

My crypto portfolio ran sideways in September with highs and lows. The hope here lies more in the coming Q4. My key figures:

Performance in the reporting period: +8.66 %

Performance since inception: +135.10

Share of holdings for which the tax holding period has expired: 98.57 %.

Crypto share of the total portfolio: 2.20 %

I am vigilant with regard to crypto. The exit should continue. I don't want to provide the exit liquidity for the other market participants. There will be news in the following month.

Performance comparison: portfolio vs. benchmarks

A comparison of my portfolio with two important ETFs shows:

TTWROR (current month): +1,76 %

$VWRL (+0.58%) : +2,63 %

$VUSA (+0.8%) : +2,56 %

One possible explanation for the poorer performance compared to the index values could be a higher proportion of individual shares,

New: Risk indicators

Here are my key risk figures for the month under review (and in brackets YTD)

Maximum drawdown: 0.94% (17.17%)

Maximum drawdown duration: 19+ days (231+ days)

Volatility: 1.68% (11.51%)

Sharpe Ratio: 5.73 (0.29)

Semi-volatility: 1.21% (9.04%)

An extremely low drawdown of only 0.94% shows that your portfolio had hardly any fluctuations during the month. This is typical for a sideways phase or stable markets.

The YTD drawdown of 17.17% is no coincidence: Trump's tariffs have mainly affected consumer-related stocks such as $TGT (-0.11%) have been hit. However, my focus on stable dividend payers and broad-based ETFs has limited the losses. The fact is, however, that Trump has put a dent in my figures.

Outlook

As you can see from the introduction, there were no highlights, but there were also no disasters for me to report on. So we're done for this month. Thanks for reading!

However, I still have some questions for you to improve my review:

Are you also interested in the performance and top/flop5 of my ETFs or cryptos? Then let me know in the comments and I'll include it in the coming months.

In my posts on Instagram and also here, I keep talking about my cashback pension. Would you like to know more about the concept, what's behind it for me and how it will supplement my "share and ETF pension"?

My review here on getquin includes additional key figures as well as those from my Instagram reviews. Would you also like to see more from the budget review of my private finances included here as a little extra?

👉 Would you like to view my review as an Instagram Carousel post?

Then follow me on Instagram:

📲 There's also 3 posts a week in addition to the portfolio and budget review: @frugalfreisein

Please pay close attention to the spelling, unfortunately there are too many fake and phishing accounts on social media. I have also been "copied" several times now.

👉 How was your month in the portfolio? Do you have any tops and flops to report?

Leave your thoughts in the comments!

US companies plan share buybacks on a historic scalewhich is a sign of the American economy's confidence in the economy. Nvidia Corp is the latest company to join the long list of buyback plans.

The announced buybacks exceeded the 1 trillion US dollars reaching this level in a very short time, according to data from Birinyi Associates. The previous record was set in October last year.

In recent months, corporate giants - particularly in the areas of finance and technology - have given the green light for extensive share buyback programs.

Source: https://www.moneyweb.co.za/news/markets/us-firms-racing-through-1trn-buyback-spree-in-record-time/

Investing is not an option, it is a necessity that goes beyond speculation and the search for immediate wealth. ✔️

It should not be seen as an option restricted to the few, but rather as a necessity for anyone who wants to preserve and expand their assets over time. In a dynamic economic scenario, in which inflation reduces the purchasing power of the currency and uncertainties require financial planning, investing becomes a fundamental pillar for financial stability and growth.

📌 Protection against inflation

Leaving money idle means losing purchasing power. Investing increases the chances of your assets rising above inflation.

📌 Compound interest

The earlier you start, the greater the impact of compound interest, accelerating capital growth.

📌 Diversification and risk reduction

Strategic investing minimizes risks and protects against market fluctuations.

Financial independence

Investments create sources of passive income, providing long-term security and stability.

The question is not whether to invest, but which assets to invest in and how to do so strategically. 💡

We'll cover this topic in our next post.

$UNH (+0.74%)

$TSM (+1.6%)

$GOOGL (+1.99%)

$META (+0.04%)

$TMO (+1.03%)

$TXN (-1.27%)

$AMAT (+1.61%)

$ICON

$ADBE (+0%)

$BAC (+1.41%)

$WBD (-0.86%)

$AVGO (+2.19%)

$MCHP (-1.98%)

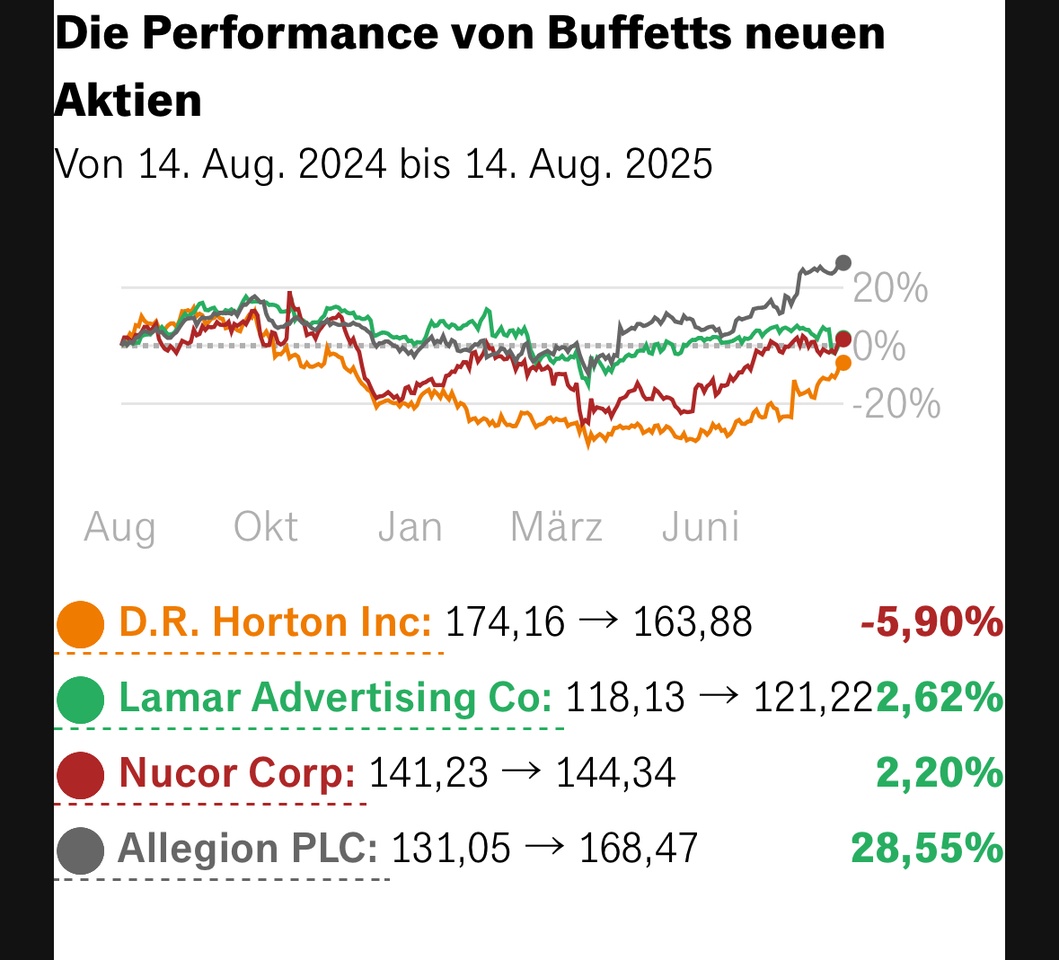

The 94-year-old star investor is investing in new shares, according to data published by the US Securities and Exchange Commission (SEC) on Friday night. The document also reveals the identity of a position that was built up in secret.

Berkshire takes a stake in United Health

For two quarters, Berkshire had secretly built up a position in a share without having to disclose it. The process is not unusual. It typically happens when Berkshire builds up large positions and does not want copycats to drive up the price.

It is the US insurer United Health $UNH (+0.74%)

After Buffett's entry became known, the share price shot up by over eight percent in the aftermarket. Since the beginning of the year, however, it is still down around 45 percent.

The majority of analysts are confident that United Health will soon overcome its difficulties. According to the financial service LSEG, 19 out of 28 experts currently recommend buying the share. Their average target price of 313.50 dollars is a good 15 percent higher than Thursday's closing price.

Four more buys

At steel producer $NUE (+0.33%) Nucor, Berkshire held 6.6 million shares worth 857 million dollars as at June 30. At the house building company $DHI (+0.77%) DR Horton amounted to 191 million dollars, at the outdoor advertising company $US5128152007 Lamar Advertising to 142 million dollars and $ALLE (-2.03%) Allegion, a manufacturer of locking systems, to 112 million dollars.

All four shares are rather insignificant in Berkshire's portfolio. Together they are only worth 1.3 billion dollars - just 0.5 percent of the total portfolio.

The most important position that was increased, on the other hand, is the oil company $CVX (-0.43%) Chevron. Berkshire increased its position here for the first time since the fourth quarter of 2023. It grew by just under three percent.

Berkshire also increased its position in $POOL (-1.63%) Pool, which claims to be the world's leading distributor of swimming pool accessories (up 136 percent), as well as beverage manufacturer $STZ (-0.04%) Constellation Brands (up eleven percent), the aerospace company $HEI (-0.29%) Heico (up eleven percent) and the pizza chain $DPZ (-1.23%) Dominos Pizza (up 0.5 percent).

Berkshire's equity portfolio continues to shrink

Sold 20 million $AAPL (+1.3%) Apple shares and securities of $BAC (+1.41%) Bank of America and $DHI (+0.77%) D.R. Horton, and the company also completely divested itself of $TMUS (-1.21%) T-Mobile US.

In the second quarter, Berkshire also sold shares in the cable television company $CHTR (+0.36%) Charter Communications (down 46.5 percent), the healthcare group $DVA (+1.07%) Davita (down 3.8 percent) and the media company $FWONA (-0.23%) Liberty Media (2.5 percent).

Buffett also sold shares in Davita in the current quarter. Although Davita is still the tenth largest position in the Berkshire portfolio, it has shrunk by eight percent since March 31. Since the beginning of the year, it has even fallen by almost eleven percent.

Source: Text (excerpt) & graphics: Handelsblatt, 15.08.2025

In the second quarter UnitedHealth Group ($UNH (+0.74%) ) was the stock most bought by hedge funds!

Insiders, regulators, hedge funds, etc., are apparently all buying.

However, the stock is still at an all-time low, having corrected 57% in 1 year. Could this be an opportunity?

$UNH

$UNH

$TSM (+1.6%)

$GOOGL (+1.99%)

$META (+0.04%)

$TMO (+1.03%)

$TXN (-1.27%)

$AMAT (+1.61%)

$ICON

$ADBE (+0%)

$BAC (+1.41%)

$WBD (-0.86%)

$AVGO (+2.19%)

$MCHP (-1.98%)

🚀 Bank of America’s Q2 2025 earnings reveal a bold shift to digital banking & stablecoins! 💰 Q2 net income hit $7.1B (+3% YoY), revenue up 4% to $26.5B, driven by 7% NII growth to $14.8B. CEO Moynihan announced plans to use stablecoins for transactions, eyeing partnerships with JPMorgan & Citigroup to move trillions in client assets via blockchain. With 47M mobile users & $1T in CashPro payments, BofA is set to lead in digital finance. The GENIUS Act could unlock this potential, pending regulatory clarity. CET1 ratio at 11.5% & $13.7B in capital returns signal strength. #Banking #Crypto $BAC (+1.41%)

$XRP (+3.15%)

Top creators this week