Hello my dears,

The CEO makes a major contribution to how successful a company is.

A CEO plays a crucial role in the success of a company. According to studies, a CEO's performance has a significant impact on company performance, with estimates ranging up to 45%. An effective CEO can increase company value through strategic direction, leadership and decision-making, while poor leadership can lead to stagnation or even decline.

Here are some aspects of how a CEO contributes to a company's success:

Strategic direction:

The CEO sets the long-term vision and strategy of the company and ensures that resources are utilized efficiently.

Leadership and motivation:

A good CEO motivates and leads employees, creates a positive corporate culture and promotes collaboration.

Decision-making:

The CEO makes important decisions that drive the company forward, whether in terms of products, markets or investments.

Communication:

The CEO is the mouthpiece of the company and communicates both internally and externally to create trust and transparency.

Crisis management:

A capable CEO can react quickly and effectively in crisis situations to avert damage to the company.

A CEO change can have a significant impact on a company, both positive and negative. If a new CEO comes in with a clear vision and effective leadership style, this can lead to a significant upturn, whereas a change to a less capable leader can lead to problems.

The role of the CEO is therefore of great importance for the success or failure of a company. A good CEO is more than just a manager; he or she is a visionary, a leader and a crisis manager who leads the company through all the ups and downs.

Dear ones, which are your favorite CEOs?

And do you even know the CEOs of your investments?

I have to admit I don't know all 59 🙈🙈

But maybe one of your CEOs is one of the 10 from 2024.

To determine the ten most successful CEOs of the year for shareholders, the business medium "The Economist" has compiled a list of CEOs whose total shareholder returns were particularly high compared to the average of listed companies in the S&P Global 1200. The S&P Global 1200 comprises the most valuable companies outside China and India. The information is based on data from "Bloomberg" and was collected between January and December 19, 2024.

10 John-Christophe Tellier (UCB) $UCB (-1.56%)

Jean-Christophe Tellier is the CEO of UCB, a global biopharmaceutical company based in Brussels. UCB specializes in the development of therapies for people with serious diseases, particularly in the fields of neurology and immunology.

In 2024, the launch of the anti-inflammatory drug Bimzelx in the US led to a sharp rise in the share price. UCB thus achieved a total shareholder return 133 percent higher than the average of the companies in the S&P 1200 over the period under review.

9 Rick Smith (Axon Enterprise). $AXON (+2.45%)

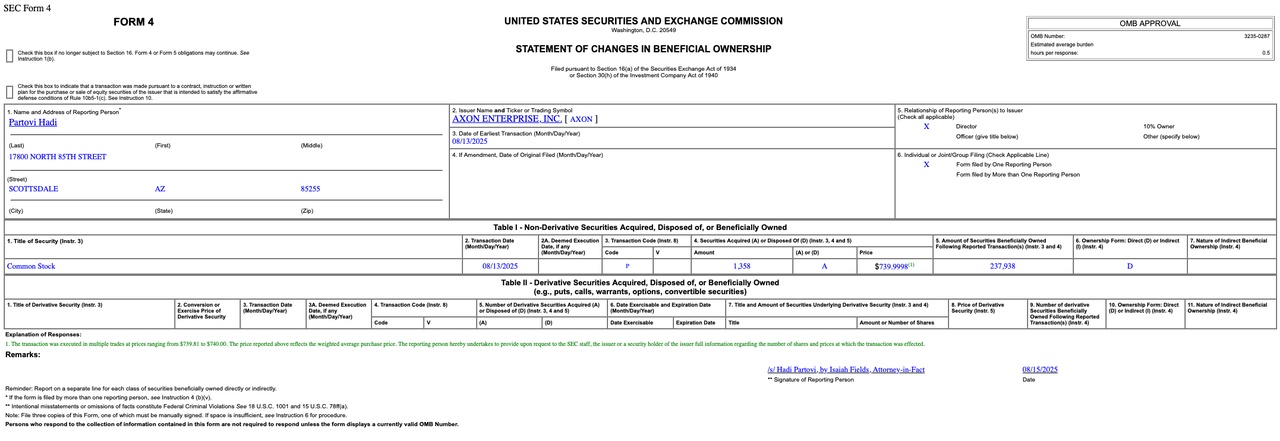

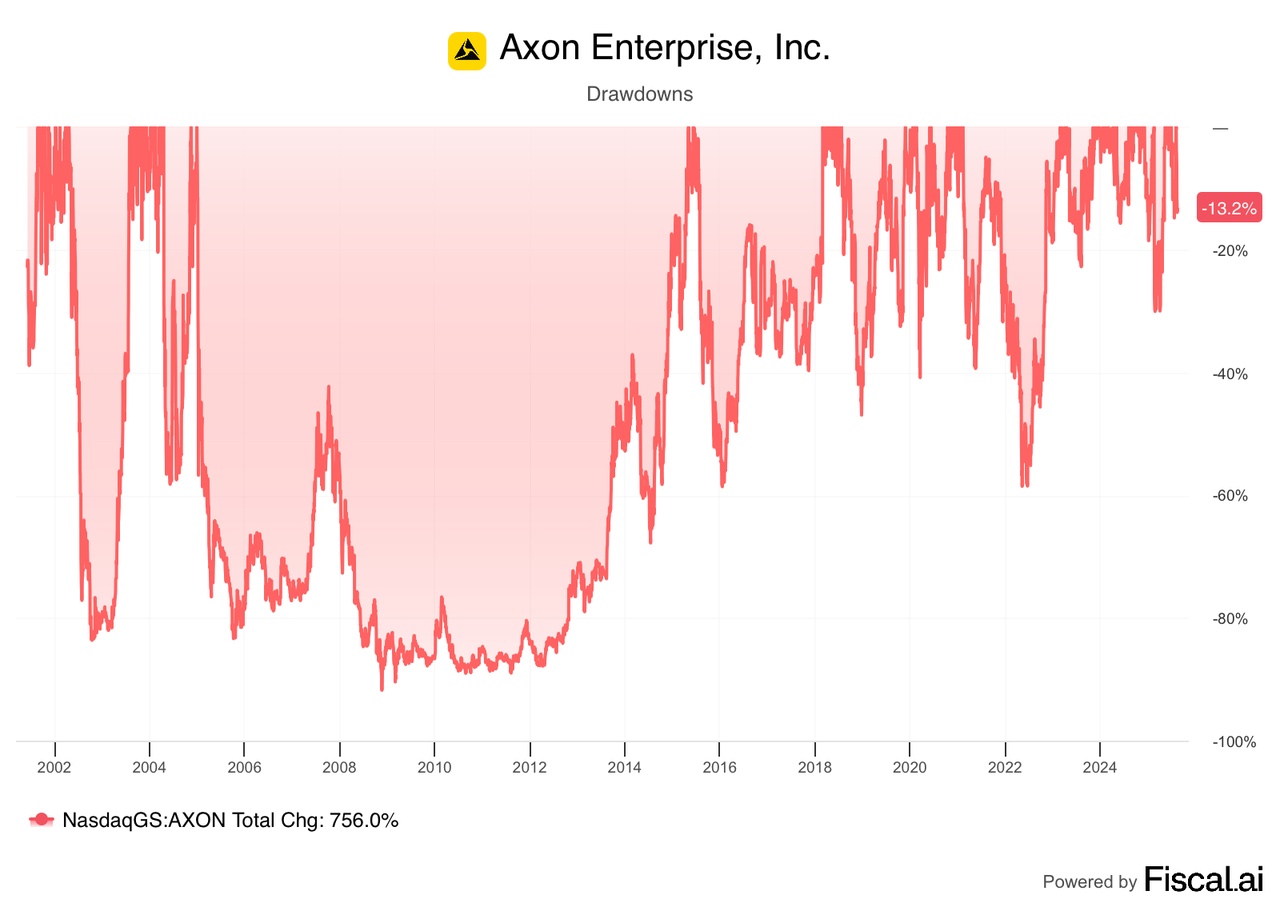

Rick Smith is the founder and CEO of Axon Enterprise, a technology company that develops public safety solutions. Originally founded in 1993 as Taser International, the company made a name for itself with the development of stun guns used by law enforcement agencies worldwide.

Despite repeated reports of a toxic workplace culture at Axon, the company has had a successful year. The rise in the share price was spurred on by the comments of the newly elected US President Donald Trump, who wants to further militarize the US federal police force. Axon Enterprise generated a 149% higher total shareholder return in 2024 than the average company in the S&P 1200.

8th Tyler Glover (Texas Pacific Land). $TPL (+0.34%)

Tyler Glover is the CEO of Texas Pacific Land Corporation (TPL), one of the largest private landowners in Texas and an influential company in the energy and real estate industries. TPL owns millions of acres of land in West Texas, particularly in the Permian Basin, one of the most productive oil and gas regions. In 2024, the company's share price rose on expectations that the high energy consumption of AI data centers will boost the business. Texas Pacific Land delivered a 158% higher total shareholder return than the average company in the S&P 1200 over the period.

7 Geir Haoy (Kongsberg). $KOG (+0.75%)

Geir Haoy is the CEO of Kongsberg Gruppen, a Norwegian technology company operating in various industries, including defense, space, shipping, oil and gas, and digital solutions. In 2024, the company benefited from increasing orders for weapon systems. CEO Haoy achieved a 174 percent higher total return for his shareholders in 2024. 174 percent higher total return than the S&P 1200 average.

6. Yasuhito Hirota (Asics). $7936 (-1.23%)

Yasuhito Hirota is the CEO of Asics, one of the world's leading sportswear and footwear companies, which is particularly well known for its running and training shoes. This year, one model in particular has been a success for the company: Onitsuka Tiger.

The shoe is trending thanks to posts on social media and has recorded high sales figures. Asics thus achieved a 176% higher total shareholder return than the S&P 1200 average in the period under review.

5 Seiji Izumisawa (Mitsubishi Heavy Industries)

$$7011 (-0.83%)

Seiji Izumisawa is the CEO of Mitsubishi Heavy Industries (MHI), a Japanese industrial conglomerate that operates in a variety of sectors, including aerospace, power generation, shipbuilding, engineering and defense. Izumisawa has bundled the company's strengths - and focused primarily on the energy and defense sectors. This year, he delivered a 177 percent higher total return to shareholders than the average company in the S&P 1200.

4. Jensen Huang (Nvidia). $NVDA (+1.27%)

Jensen Huang is the co-founder and CEO of Nvidia, a leader in graphics processing units (GPUs) and artificial intelligence (AI). Under his leadership, Nvidia has evolved from a manufacturer of graphics chips for computers to a global technology giant that also offers solutions for AI, deep learning, cloud computing and self-driving cars.

The rapid growth resulting from the AI hype slowed down this year. The high expectations of analysts were not quite met. Nevertheless, Huang was able to achieve a 180% higher total return for its shareholders in 2024 than the S&P 1200 average.

3rd Jim Burke (Vistra). $VST (+4.78%)

Jim Burke is the CEO of Vistra, an energy supply company based in Irving, Texas. Vistra is engaged in the generation and distribution of electricity and operates a broad portfolio of energy assets, including gas, coal, wind and solar power plants.

Similar to Texas Pacific Land, his company benefited from increasing energy consumption due to AI data centers. In 2024, it generated a 288% higher total return than the S&P 1200 average.

2nd Christian Bruch (Siemens Energy). $ENR (+4.4%)

Christian Bruch is the CEO of Siemens Energy, a global company specializing in the development, manufacture and maintenance of technologies for power generation, transmission and distribution. Siemens Energy was created in 2020 as an independent company from the spin-off of the Siemens Energy Division.

In 2024, the company recovered after Siemens Energy posted a loss of more than 4.5 billion euros in 2023. The German government provided billions in guarantees for the troubled company. In 2024, Siemens Energy achieved a total return 312 percent higher than the S&P 1200 average due to the recovery of the share price.

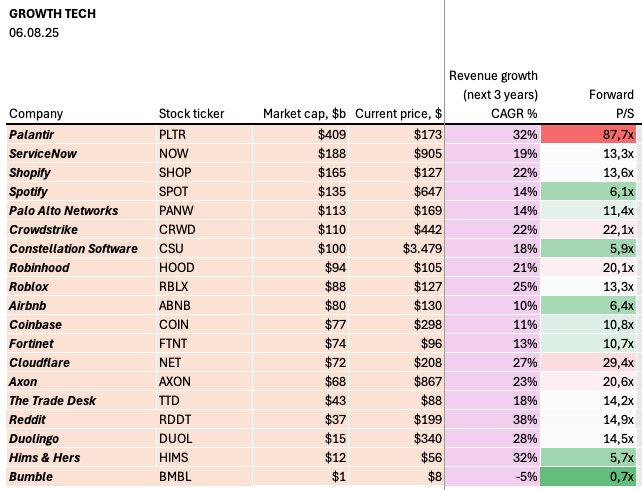

1 Alex Karp (Palantir). $PLTR (+2.23%)

Alex Karp is the co-founder and CEO of Palantir, a company specializing in data analytics and software solutions. Founded in 2003, Palantir provides big data analytics platforms that are mainly used by government agencies but also by companies in various sectors - and are controversial.

By 2024, the company's market capitalization had risen from USD 36 billion to over USD 180 billion. In September, Palantir was included in the S&P 500 Index of the most valuable companies in the USA. In 2024, Palantir thus achieved a total return 322 percent higher than the S&P 1200 average.

I would have expected some of the CEOs here, but there are also a few that I would not have expected.

I am invested in Siemens Energy, Vistra and NVIDIA

Unfortunately, UCB didn't make it from the Watch into my portfolio.

I hope you enjoyed the presentation of the CEOs.

Please let me know in the comments.

https://www.businessinsider.de/wirtschaft/ranking-die-besten-ceos-fuer-aktionaere-im-jahr-2024/