Automatic Data Processing (ADP) is the backbone of payroll and human capital management for over 40 million workers worldwide. Its business is essential, regulated, and deeply embedded—creating a moat that few can replicate.

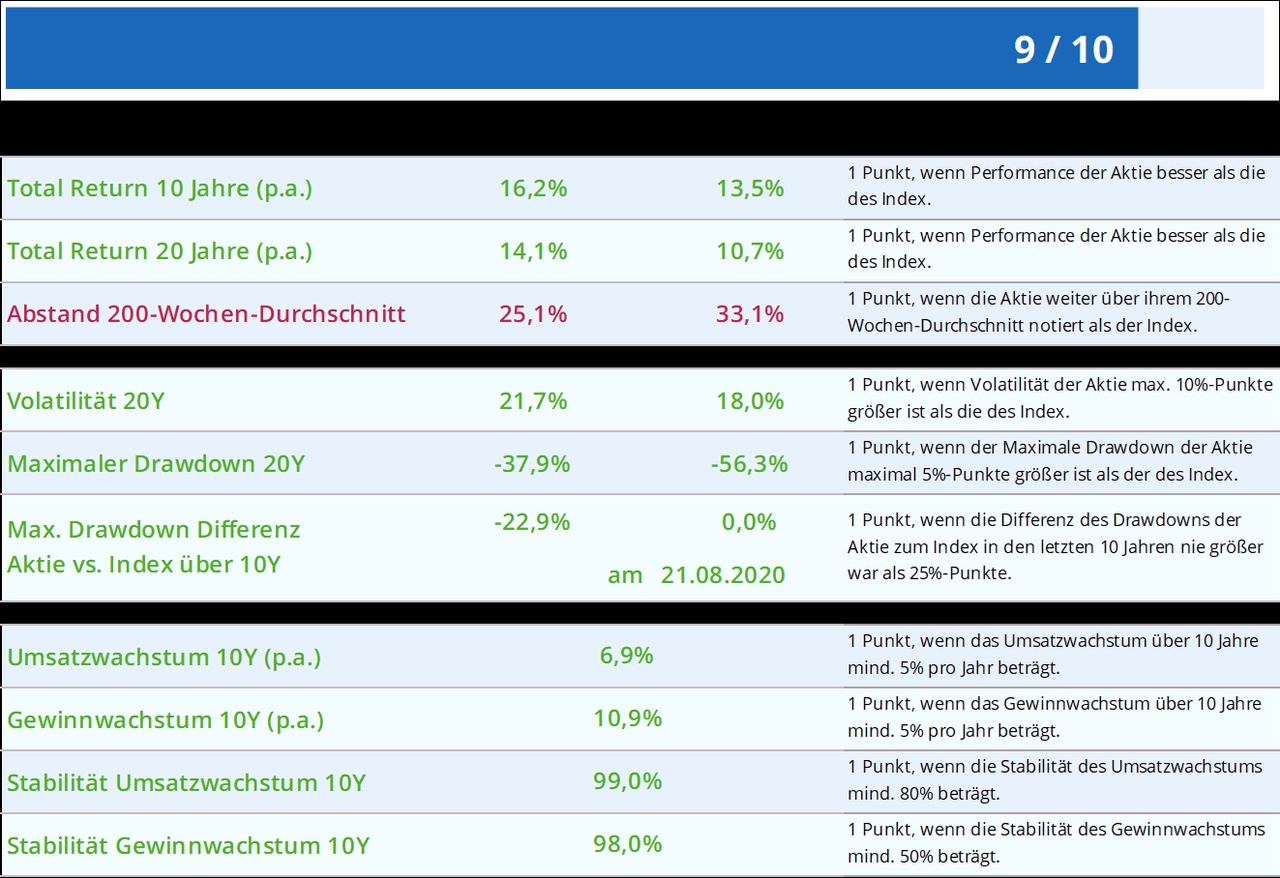

Financially, ADP is a model of consistency:

- Revenue CAGR: ~7% over the past decade

- EPS CAGR: ~12%

- Margins: 48% gross, 26% operating, 20% net

- Free Cash Flow Margin: 23%

- ROE: 80%, ROCE: 50%

- This combination of growth and efficiency is rare for a service company of its size.

The balance sheet is strong, with $7.8B in cash and only $1.4B in net debt. Dividend yield sits at 2.1%, with double-digit growth for over a decade.

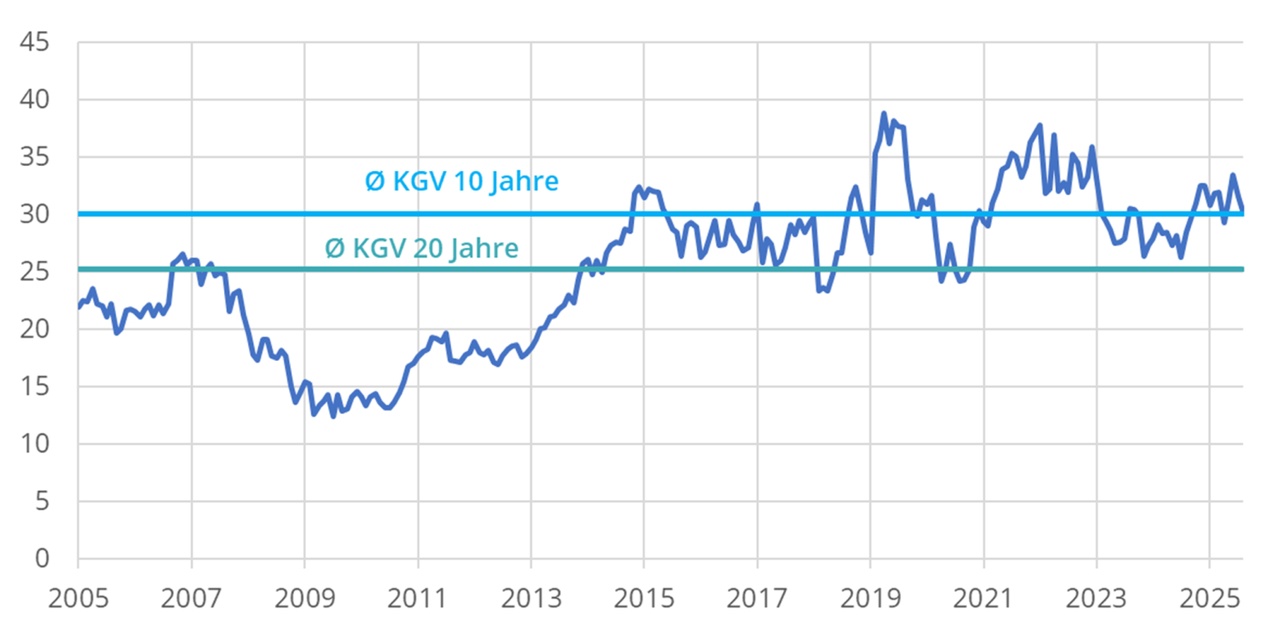

Valuation is rich (P/E 29×), but justified by resilience: ADP’s recurring revenue, switching costs, and regulatory embedding make its position nearly unassailable. Scale, trust, and data form a network effect that deters disruption.

Investment thesis: ADP is not a cyclical tech play; it’s labor infrastructure—cash-rich, globally entrenched, and built to endure. A compounder suited for long-term holders seeking reliability, dividends, and quiet dominance.