Last EPS 1.78$ ️ 7%

More details

AMETEK also completes the acquisition of FARO Technologies for $920 million.

Posts

9Interesting company and business, the value should increase in the long term through acquisitions and share buybacks. Also well suited for dividend growth.😊👍

Unfortunately not included in the Ultimate Homer ETF, as no savings plan is possible.

I just have to buy it this way. No. 37&38 😊👍

Here's a little introduction

https://investors.ametek.com/static-files/3160f46e-4ebc-4b2e-9aa7-41b99686a7a3

BofA highlights these stocks, which it sees as having potential despite the political uncertainty in the USA.

Yesterday, after a lot of research $AME (-2.71%) Ametek yesterday.

I was convinced by the broad structure and the numerous successful investments.

I also think the figures are quite solid 👍

Let's see what happens, but I'm very positive.

$AME (-2.71%) I find Ametek a very interesting company.

Has anyone had any experience with Ametek?

Thanks in advance 🤑💪

Beat the S&P500 Challenge

I have been thinking about which stocks I could use to beat the S&P500 index.

After a lot of research, I have now decided on 20 American shares, which I will save 100 euros/month each in savings plans from 01.04.2024. As I didn't want any overlaps/duplications with my ETFs (World and Consumer Staples), I chose companies from the second tier. Perhaps one or two of the stocks will also be of interest to you 😉

The portfolio will contain the following shares:

I know that it will be difficult to beat the S&P500, but I still want to try...

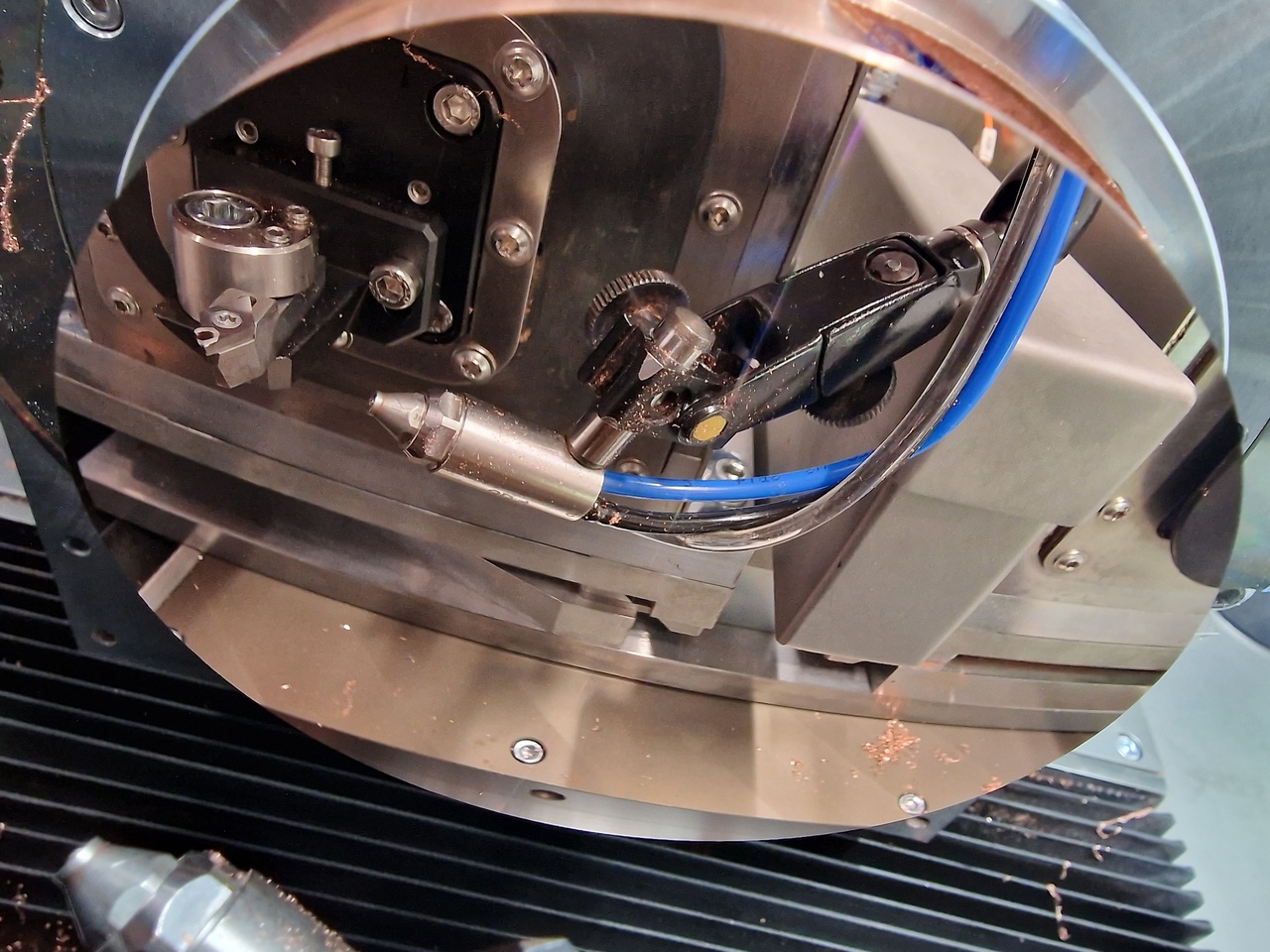

My little one today #boersengehandelteralltag

After 2 months, we were finally able to find and rectify a fault, and now the customer here in Ländle can once again produce mirrors for EUV lasers and thus $ASML (-5.06%) supply.

During the breaks, we had a look at the competitor machines from $AME (-2.71%) to see what they do better or worse.

I would like to take this opportunity to recommend the following article to you, somehow not everything is bad in our economy if you have a 15-year head start with the EUV system

$AME (-2.71%) the company has been lying dormant on my WL for half an eternity 😂.

Is anyone invested? I would be interested

Has developed very strongly judging by the chart

𝗠𝗮𝗿𝗸𝗲𝘁 𝗡𝗲𝘄𝘀 🗞️

𝗘𝗹𝗲𝗸𝘁𝗿𝗼𝗮𝘂𝘁𝗼𝘀 𝗮𝘂𝗳 𝗱𝗲𝗺 𝗩𝗼𝗿𝗺𝗮𝗿𝘀𝗰𝗵 / 𝗔𝗱𝗶𝗱𝗮𝘀 𝘂𝗻𝗱 𝗕𝗼𝗿𝗲𝗱 𝗔𝗽𝗲𝘀

𝗘𝘅-𝗗𝗮𝘁𝗲𝘀 📅

As of today, among others, Ametek ($AME (-2.71%)), Electronic Arts ($EA (-0.78%)) and HP ($HPQ (-5.92%)) are trading ex-dividend.

𝗤𝘂𝗮𝗿𝘁𝗮𝗹𝘀𝘇𝗮𝗵𝗹𝗲𝗻 📈

Today, among others, Ashtead Group ($AHT (-2.08%)), AutoZone ($AZO (+2.23%)) and Ferguson ($FERG) present their figures.

𝗠𝗮𝗿𝗸𝗲𝘁𝘀 🏛️

Heidelberger Druck ($HDD (-4.22%)) - Heidelberger Druckmaschinen AG is expanding its range of products and services in the field of electromobility by acquiring the charging column technology of EnBW ($EBK (+1.64%)). In addition to the range of charging devices on the wall at home (wallbox), corresponding products for public spaces are added. This is expected to attract new customers from the municipal utility, local authority or corporate sectors. The share was able to rise after this news and is currently at a level of 2.68 euros.

Tesla ($TSLA (-6.86%)) - Norway is the e-car front-runner. There are 81 e-cars per 1,000 inhabitants and 11,269 new electric vehicles were registered in November, most of which were Tesla models.

In Germany, the number of new registrations also increased, although there is still a lot of catching up to do in terms of network infrastructure.

𝗖𝗿𝘆𝗽𝘁𝗼 💎

Adidas ($ADS (-2.82%)) - Adidas dives into the metaverse. In early December, adidas Originals confirmed collaborations with Bored Ape Yacht Club (BAYC), NFT comics PUNKS Comic, and crypto investor and NFT collector gmoney. Alongside this, adidas Originals has changed its Twitter profile image to a Bored Ape cartoon with adidas Originals apparel, featuring the PUNKS Comic logo and gmoney's iconography alongside the adidas Originals logo.

Follow us for french content on @MarketNewsUpdateFR

Top creators this week