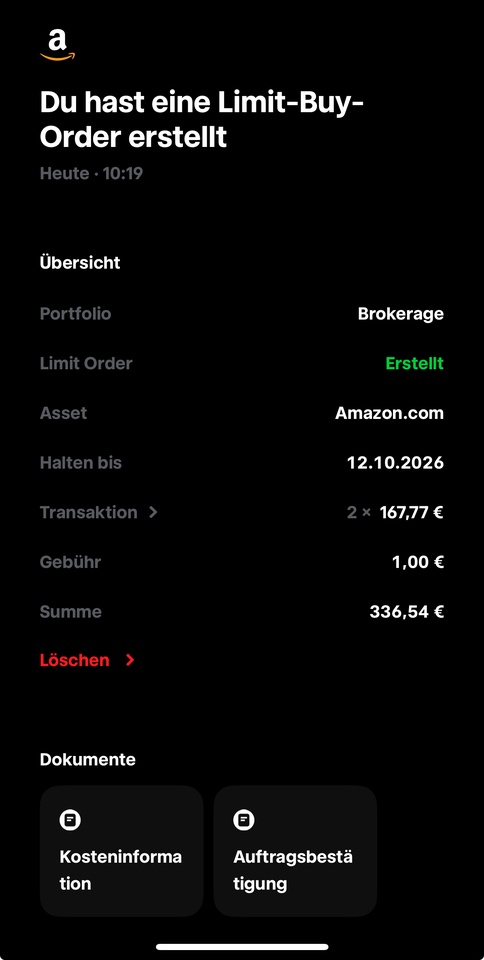

+ $1k added to $AMZN (-0.07%) today 🛍️ 🛒

Discussion about AMZN

Posts

1,042📊 Market Update (October 17, 2025)

🇺🇸 USA

$SPX500 — Futures are moving in a decisive drop, indicating a strong negative open due to renewed regional bank stress.

$DJ30 — Futures in a sharp decline, dragged down by financial and cyclical stocks.

$NSDQ100 — Futures are markedly lower, with weakness in tech stocks solidifying.

💻 Tech & Growth Snapshot

$NVDA (+1.31%) — Up in pre-market, holding strong against the general weakness thanks to robust AI demand.

$GOOGL (+1.36%) — Under strong pressure, aligned with the overall Nasdaq decline.

$AVGO (-0.43%) — Aggressive profit-taking in the semiconductor sector.

$META (+1.13%) — Stable in pre-market, showing relative strength against its peers.

$MSFT (+1%) — Slight dip, following the market's bearish trend.

$QBTS (-3.75%) — Down again, volatility remains extreme in this sector.

$RGTI (-2.47%) — Down, the quantum computing sector is highly sensitive to the risk-off mood.

🛍️ Retail & Commerce

$AMZN (-0.07%) — Down in pre-market, negative sentiment weighs on consumer confidence.

$BABA (+1.78%) — Stable, counter-trending thanks to Asian positive sentiment.

$CVNA (-3.1%) — Down, the stock struggles to find a stable support base.

$SHOP (+1.31%) — Correcting some of its recent gains.

⚕️ Health & Pharmaceutical

$LLY (+0.1%) — Stable/Up slightly, the defensive sector offers timid refuge.

$HIMS (-13.62%) — Profit-taking in pre-market despite recent catalysts.

$INSM (+1.43%) — Mixed, the biotech sector moves disconnectedly, but with caution.

🇪🇺 Europe

STOXX 600 — Opening solidly up, boosted by defensive sectors and positive earnings reports.

GER40 — Up slightly, showing resilience despite US banking worries.

$LDO.MI — Up, the defense sector continues to outperform.

$IBE.MC — Stable, utilities confirm their defensive asset status.

$OKLO — Stable, the nuclear tech stock awaits concrete catalysts.

🏦 Banking & Finance

$$UCG (-1.2%) — Under strong pressure, the financial sector is generally affected by contagion fears.

$$ISP (-1.43%) — Markedly lower, negative sentiment dominates.

$$BAMI (-0.21%)

$CE (+0.69%) , $BPE (-0.47%) — Widespread selling on Italian banks.

$$BBVA (+1.59%) — In strong increase, counter-trending the sector due to positive corporate news or insulation from US regional bank stress.

$AXP (+7.53%) — Down in pre-market, facing consumer slowdown concerns.

$V (+2.32%) — Essentially flat, confirms its more defensive status.

🌏 Asia

$JPN225 — Close down, weighed by Wall Street losses and trade uncertainty.

$KOSPI — Close flat/slightly down, the market remains in a holding pattern.

$HK50 — Sharp fall, due to regional bank pressures and China's plenum anticipation.

$CHINA50 — Weak, caution dominates.

💱 Forex

$EURUSD — Down, the Euro loses ground against the haven Dollar.

$GBPUSD — Down, the Pound is under pressure.

$USDJPY — Falling sharply, the Yen is rallying as the Dollar loses momentum on Fed rate-cut hopes.

$DXY — The Dollar Index is showing strength, acting as a safe haven.

💎 Commodities & Precious Metals

$GLD (-1.44%) — Strong rally, gold hits new record highs on strong safe-haven demand.

$CDE (-8.97%) — Up sharply, following the explosive trend of gold.

$BRENT — Down slightly, global demand fears persist.

$WTI — Losing ground, affected by negative macroeconomic sentiment.

📈 Benchmark ETFs

$VOO (+0.71%) — Tracks the negative S&P 500 futures.

$VGT (+0.5%) — Down, reflecting weakness in the technology sector.

$CSNDX (+1.07%) — Tracks Nasdaq futures in negative territory.

$VWCE (+0.6%) — Stable/Down, reflects the mixed global trend.

$BND (+0.06%) — Up, as bond yields fall due to safe-haven demand.

💰 Crypto

$BTC (-0.83%) — Down slightly, aligned with the general risk-off mood.

$ETH (-1.31%) — Following Bitcoin, showing broad weakness.

$CRO (+0.46%) — Flat/Down slightly, in line with the rest of the market.

$TRX (-7.46%) — Down slightly, the sector struggles to find significant support.

🚀 Space & New Tech

$RKLB (-0.44%) — Weak in pre-market, aligning with other growth stocks.

🔎 Deep Dive: Gold & Banking Stress

The day is polarized: the strong safe-haven demand for Gold ($GLD) is the dominant theme, hitting new all-time highs due to persistent US regional bank stress. While European markets, specifically $BBVA.MC, show resilience and an isolated uptrend, the US futures and Italian financial stocks are struggling. The overall takeaway is a heightened sense of systemic risk, forcing investors into traditional havens while penalizing US high-beta stocks. The strength of $NVDA remains a key structural theme resisting the general decline.

⚠️ Disclaimer: Past performance is not indicative of future results. Investing involves risks, including the loss of capital.

My eToro Portfolio vs. The Market: A 1-Year Review (+53.63% vs. S&P 500's +16.40%) 🚀

I'm excited to share an in-depth performance review of my eToro portfolio today. I've analyzed the last 12 months, and the results clearly show that a focused strategy can significantly beat the market.

Here are the final numbers, from October 2024 to today:

- 📈 My eToro Portfolio: +53.63%

- 💻 Nasdaq 100 ($NSDQ100): +24.40%

- 📊 S&P 500 ($SPX500): +16.40%

- 🏭 Dow Jones ($DJ30): +9.78%

As the chart shows, not only did I beat the market, I more than doubled the performance of the strongest benchmark index, the Nasdaq 100! This result is proof that a targeted, high-conviction strategy can make a huge difference.

So, how did this happen? Let's break down the key pillars of my winning strategy:

1. Going Beyond the Benchmark

This year, passively investing in a Nasdaq ETF would have been a great move. But my strategy aimed higher. I focused on specific disruptive stocks within the biggest tech megatrends—names with a higher potential for exponential growth than the giants that dominate the index. This active selection is what created the real performance gap.

2. Using Volatility as Fuel

The chart is honest: during the market correction in April, my portfolio dipped lower than all the indices. That's the price of a concentrated growth portfolio. Many would have sold. I held firm, confident in my long-term thesis. The explosive recovery starting in May proved that patience and conviction were rewarded.

3. Active Selection, Not Passive Investing

These results don't come from just buying an ETF. They require active management: studying fundamentals, understanding the macro environment, and having the courage to invest in innovative companies like $RKLB, $OKLO, and $RGTI before they become mainstream.

4. Understanding the Market Narrative

The indices tell a clear story: tech ($NSDQ100) led the market, while industrial stocks ($DJ30) lagged. My strategy fully embraced this trend, concentrating capital where the real growth was happening.

Conclusion

Beating the market is tough. Beating its strongest sector is even tougher. This +53.63% return demonstrates the power of a focused strategy that accepts calculated risk to aim for extraordinary returns.

I'm proud of these results and will continue to share my journey and analysis with full transparency.

PS: The past is a lesson, not a guarantee. But the strategy remains the same: find the companies that will build our future and invest in them with conviction.

⚠️ Disclaimer: Past performance is not an indication of future results. Investing involves risks, including the loss of capital.

https://www.etoro.com/people/farlys

$SPX500 $NSDQ100 $DJ30

$AAPL (+2.46%)

$MSFT (+1%)

$GOOGL (+1.26%)

$AMZN (-0.07%)

$NVDA (+1.31%)

$TSLA (+2.92%)

$META (+1.13%)

$RKLB (-0.44%)

$OKLO

$RGTI (-2.47%)

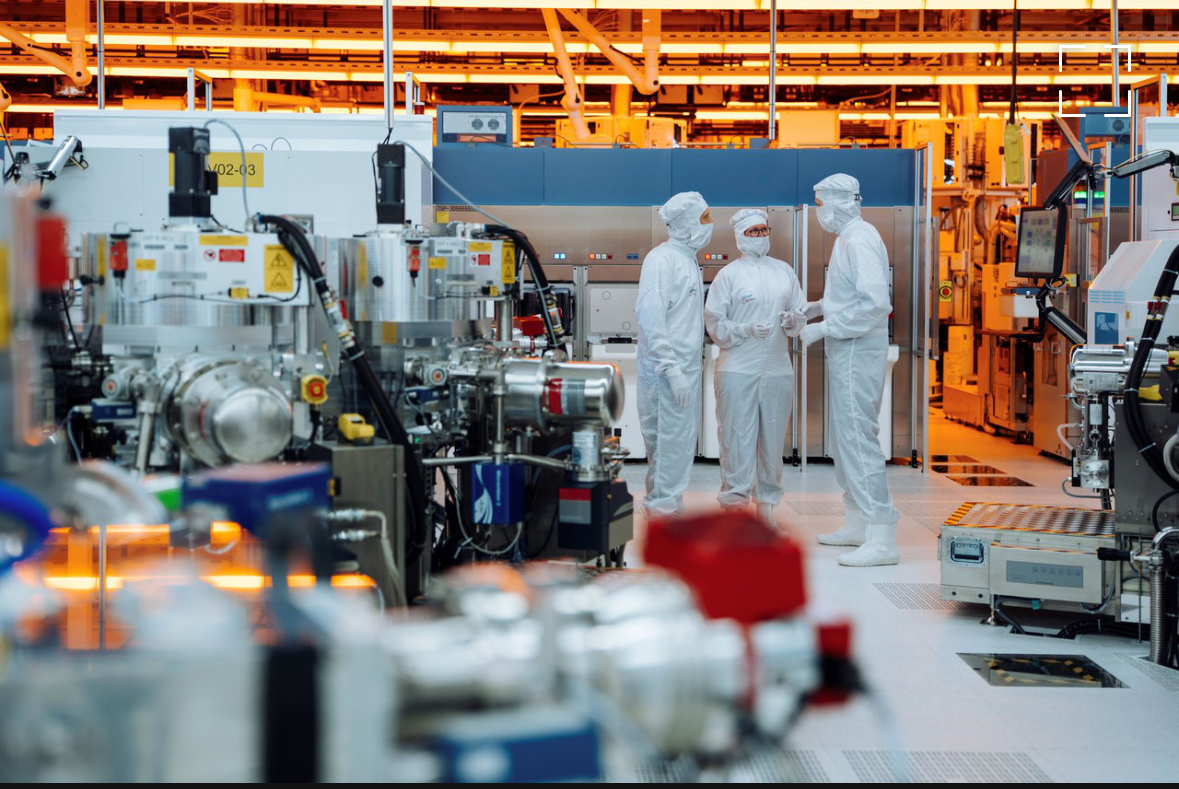

The secret profiteer of the AI hype

Infineon $IFX (-0.34%) is the global market leader in power semiconductors, i.e. the chips that are essential for powering data factories. Business is going better than ever before - but this is probably just the beginning. "The demand for power semiconductors for AI data centers is increasing massively," Infineon top manager Richard Kuncic told Handelsblatt.

The high investments are a blessing for Infineon in two respects.

Firstly, the company is benefiting from the sheer number of new server farms. In recent weeks, OpenAI has signed contracts worth billions with Oracle, Nvidia and AMD. "There is huge demand," said founder Sam Altman last week, but "we are so constrained by computing power."

Other companies are also investing unprecedented sums in data centers. Analysts at Jefferies speak of more than 300 major projects in the United States alone. The four largest hyperscalers, i.e. providers of computing power, would spend 90 billion dollars on new facilities every quarter.

Secondly, more and more power semiconductors are required to supply computers with energy. According to Kuncic, a server cabinet today contains such chips worth between 12,000 and 14,000 euros. This covers the energy requirements of 128 graphics processors, so-called GPUs. GPUs are supplied by companies such as NVIDIA $NVDA (+1.31%) and AMD $AMD (+0.35%) They are the core of AI computers.

According to Kuncic, engineers will accommodate 576 GPUs in the next generation of server racks. This will increase the value of the power semiconductors to more than 100,000 euros.

But that's not all. Kuncic: "More and more fields of application are emerging for AI. This is also increasing the demand for power semiconductors." Until now, companies such as OpenAI have mainly used the computers to train AI models at great expense. In the future, however, AI will be used much more frequently.

Europe's largest semiconductor manufacturer promised its investors sales of AI power semiconductors of 600 million euros for the past financial year, which ended on September 30. At the beginning of August, CEO Jochen Hanebeck said that this figure is set to rise to one billion euros in the new financial year.

It is possible that the CEO will increase this forecast in mid-November when he presents the latest results and ventures an outlook for the new financial year.

Infineon supplies the entire value chain with its power semiconductors, from the producers of transformers to computer manufacturers such as $DELL (-0.46%) Dell , $DELTA (+0%) Delta and $HPE (+2.77%) HP, to operators such as $AMZN (-0.07%) Amazon and $GOOGL (+1.26%) Google.

Together with Nvidia, the world's most valuable corporation, the Munich-based company is developing the next generation of power supply systems for AI data centers. The company made the announcement this spring.

With a market share of just under 18 percent, Infineon is the world's top-selling supplier of power semiconductors. The number two, US competitor Onsemi $ON (+0.15%)has around nine percent. Infineon is far ahead of its competitors in terms of technology and production, according to Deutsche Bank analyst Johannes Schaller last week.

Source text (excerpt) & graphic: Handelsblatt, 15.10.25

📊 Market Update (October 15, 2025)

🇺🇸 USA

U.S. markets closed yesterday's session with mixed and predominantly negative sentiment as traders wait to see which direction the market will take next.

- $SPX500 — Closed slightly down (-0.15%), showing uncertainty after a volatile day.

- $DJ30 — The only index showing strength, it closed in positive territory (+0.45%), supported by industrial stocks.

- $NSDQ100 — Experienced a sharper decline (-0.76%), with tech stocks facing profit-taking.

💻 Tech Snapshot

- $AVGO (-0.43%) — In a clear downturn (-3.52%), the semiconductor sector appears to be under pressure.

- $AMZN (-0.07%) — Down (-1.66%), the stock is affected by the risk-averse climate in the tech sector.

- $META (+1.13%) — Closed essentially flat (+0.02%), showing relative strength compared to the sector.

- $MSFT (+1%) — Slight decline (-0.09%), in line with the general uncertainty in the tech space.

- $BABA (+1.78%) — In negative territory (-2.37%), hit by the sell-off in Chinese stocks listed on Wall Street.

🇪🇺 Europe (Closing data from 10/14 and today's open)

European stock exchanges closed weak yesterday, but today's futures point to a recovery at the open, following the positive wave from Asia.

- STOXX 600 — Finished yesterday down (-0.37%) with widespread selling.

- GER40 futures — Are moving in negative territory today (-1.05% in the last 24h), still reflecting yesterday's weakness but with potential for recovery at the open.

🏦 European & Italian Banks (Closing data from 10/14)

The banking sector showed weakness in the previous session.

- $$ISP (-1.43%) — Closed lower (-0.18%).

- $$BAMI (-0.21%) — In decline (-0.24%).

- $$BPE (-0.47%) — Negative performance (-0.27%).

- $$CE (+0.69%) — Was up on Friday, but today's data is awaited.

- $$BBVA (+1.59%) — Closed positive (+0.44%), bucking the trend seen in the Italian sector.

🌏 Asia (Today's closing data)

Asia is the true engine of the day, with a strong wave of buying improving global sentiment.

- $JPN225 — Closed with a strong gain (+1.82%), leading the region's optimism.

- $HK50 — Excellent performance, closing with a gain of +1.78%, driven by local tech stocks.

💱 Forex

- $965275 (-0.17%) — Stable around the 1.1620 area, with the dollar waiting for the next moves after yesterday's mixed data.

💰 Crypto (Today's data) The crypto sector is showing signs of weakness in the early hours of the day, moving against the trend of Asian equities.

- $BTC (-0.83%) — Trending down, trading below €97,000 after starting the day above this level. The performance in the last few hours is approximately -1.02%.

- $ETH (-1.31%) — Following Bitcoin's weakness with a similar trend.

🔎 Deep Dive: Asia Leads, the West Waits

Today's session is marked by a clear divergence between Asia and the West. While Asian markets, particularly Japan ($JPN225) and Hong Kong ($HK50), posted strong gains and fueled a positive global sentiment, European and American markets are coming off a session of weakness and uncertainty.

- Stock Markets: The optimism from Asia is positively influencing the European open. The real question is whether this momentum will be enough to reverse the negative trend seen on Wall Street yesterday, especially in the tech sector ($NSDQ100). All eyes are on the U.S. market open to see if the Asian risk-on sentiment will be sustained.

- Crypto Market: The crypto world seems disconnected from the positive equity sentiment today. The decline in Bitcoin and Ethereum suggests that crypto investors are proceeding with more caution, perhaps waiting for confirmation from Western markets before pushing higher. This period of weakness could present an interesting accumulation zone if the global sentiment continues to improve.

PS: The strong push from Asia is an encouraging sign. I am closely monitoring the European open to see if the rebound materializes. If Europe follows Asia, we could see a return of confidence in the U.S. as well. I'm holding my positions but remain ready to manage volatility.

⚠️ Disclaimer: Past performance is not an indication of future results. Investing involves risks, including the loss of capital.

Stocking up on Amazon

I see great potential in $AMZN (-0.07%) in the coming years, therefore I decided to buy some more :)

Happy investing ppl

Trending Securities

Top creators this week