Reading time: approx. 10min

1) INTRODUCTION

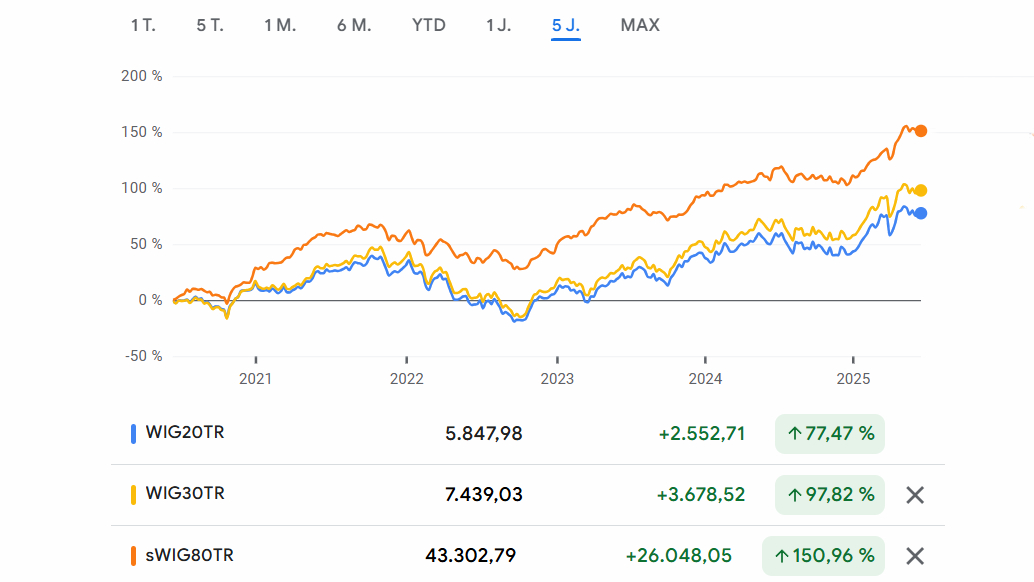

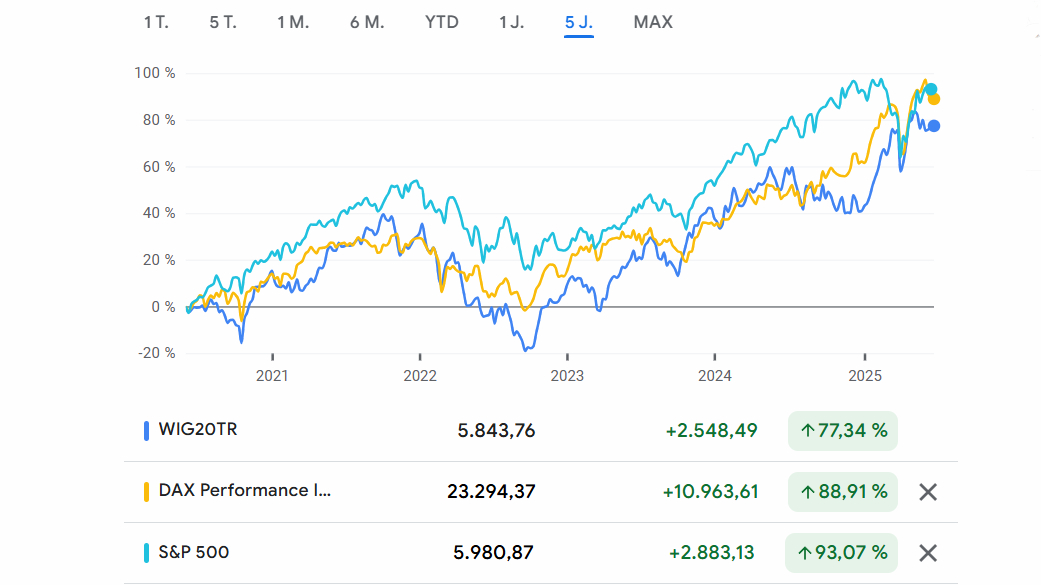

About 2-3 months ago, I decided to think outside the box, as they say. My aim was to look for promising companies away from the classic values and countries. I found what I was looking for in a neighboring country: Poland.

This article is about the Polish supermarket operator Dino Polska

$DNP (+0.72%) supermarket operator. I will present my analysis and my thoughts on the company. I was surprised by a few things myself. For example, I would not have thought it possible for a Polish supermarket chain to grow highly profitably and quickly at the pace of some tech stocks.

As always with my deep divesI would like to take a closer and more detailed look at the business model before moving on to the financial situation. Finally, in the style of my article "My method for determining the fair price of a share", I will present my personal fair price for the share today.

Disclaimer: I opened a small position in Dino Polska on March 21 before the quarterly results. As a result, I am already invested in Dino Polska at the time of writing.

2.) BUSINESS MODEL

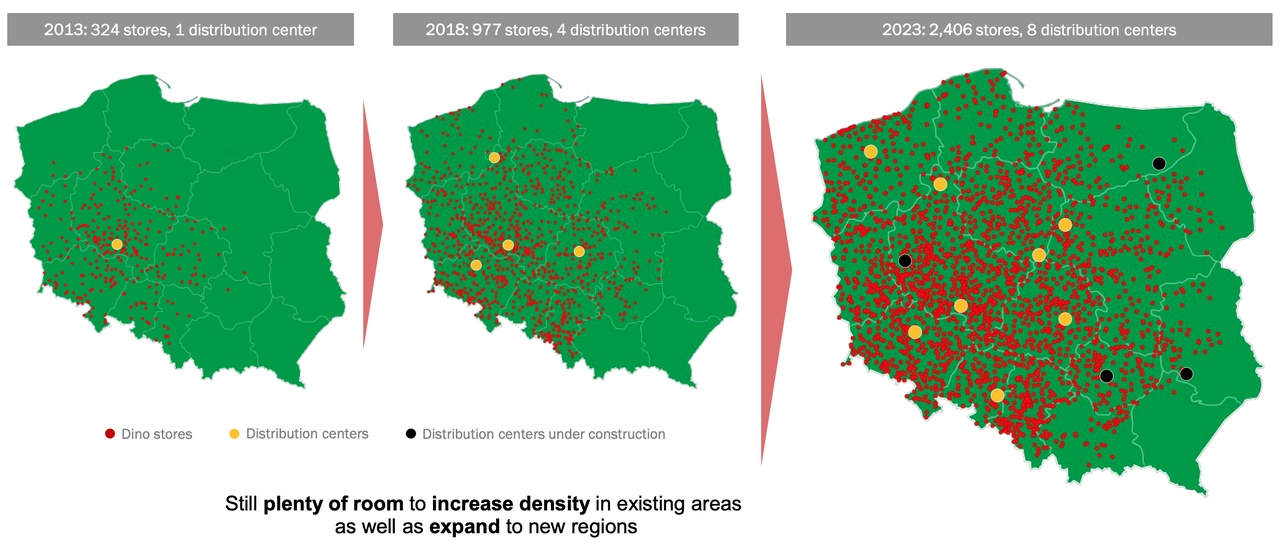

Dino Polska owns and operates supermarkets under the names "Dino" in Poland. Currently (as of 21.03.24), Dino operates 2406 supermarkets [1]. This number has increased enormously in recent years: in 2013, the company operated only 324 locations, which corresponds to an annual growth rate of around 22% since then [1].

The first supermarket was opened in 1999 by founder Tomasz Biernacki opened. By 2010, the number of supermarkets had risen to around 100. In the same year, a Polish private equity company acquired around 49% of the shares to finance further growth [3]. In 2017, the company finally went public at around €8 per share when the private equity company's shares were placed. The founder himself is still the majority shareholder and does not receive a salary or bonuses.

But what distinguishes Dino Polska? Is it just another supermarket chain? Similar to my article about Costco $COST (-0.62%) [4], the answer is Nobecause, as always, it's the details that count. So let's take a closer look at what sets Dino Polska apart:

Size and range: As the very first important difference to the competition in Poland, Dino focuses primarily on small supermarkets in smaller towns. The average retail space of a store is only around 400 square meters. An average Lidl store in Germany has around 900 square meters [3]. This is another reason why Dino only stocks around 5000 different products in its stores [1], which means a reduced degree of complexity in logistics and delivery and thus represents a cost advantage for Dino. In 2003, Dino Polska also acquired its own meat producer, which since then has exclusively supplied all stores with fresh and non-sealed meat and sausage products. This is a big difference to competing supermarkets, as they often only offer pre-packaged butcher's products. In addition, the focus is increasingly on inexpensive regional Polish products. There are often no or very few products from well-known brands on the shelves.

Building: The second important difference to other supermarket chains is that Dino Polska has about 95% of its own stores, i.e. it owns both the buildings and the land of the supermarkets [1]. It is also interesting to note that Dino pays great attention to standardization here, so that new stores can be planned and built using quasi-existing blueprints. This also reduces complexity and saves costs, as not every single store has to be planned from scratch. The smaller stores also make it possible to build on smaller areas that are not accessible to competitors. In addition, Dino founder Tomasz Biernacki set up a construction company specifically for the purpose of building new stores. This ensures planning security and lower costs. Finally, it should be mentioned that almost 89% of all Dino stores have their own photovoltaic system, which now generates 66GWh of electricity per year [1]. For comparison: an average 2-person household consumes around 2500kWh of electricity per year, so 66GWh is roughly equivalent to the electricity consumption of 27,000 such households.

Price: Both points presented so far ensure high cost efficiency. This ensures that Dino Polska can offer the products in the supermarkets at very reasonable prices. In most cases, Dino is the cheapest supermarket in the area and its prices are often indexed to the prices of local competitors, so that Dino is guaranteed to be the cheapest supplier.

Focus: Dino deliberately specializes in smaller supermarkets in order to be able to operate profitably in smaller towns. They implement the concept, which has already been found to be good, in a 'hard-hitting' way. In Poland, a comparatively small proportion of the population lives in larger cities, so the focus on small to medium-sized towns offers an advantage over the competition. The food retail market in Poland is generally highly fragmented. As of 2021 [5], the market leader is Biedronka, which belongs to the Portuguese $JMT (+0.51%) group. Lidl & Kaufland (Schwarz Group) follow in 2nd place. Dino is in 6th place, but has the highest growth rate among its competitors.

3) GROWTH

As already mentioned, Dino Polska has enjoyed a high growth rate in its stores in recent years. The following overview is taken from the company's 2023 Report in [1]:

As can be seen, there is room for further store openings, especially in the eastern part of the country. In addition, the branch density can be further expanded. Dino Polska itself states in [1] that it currently sees room for around 7,000 of its stores in Poland. This means that only 34% of all potential supermarkets in the country have been developed. The company itself also states that it intends to continue opening supermarkets at a rapid pace. Interestingly, only one supermarket has been closed since 2007 [3].

The high store growth should of course also be reflected in rising sales. In the years 2015 to 2020, sales increased by an average of a good 36% annually between 2015 and 2020 [6]. These growth rates are a combination of the higher number of supermarkets and the sales growth of existing stores. In [1], Dino Polska himself calls same-store sales growth Like-for-Like-Sales Growth. In the last 10 years, LFL sales growth rates of over 10% have been the rule. Taking Polish food inflation into account, adjusted LFL growth rates of around 7-10% per annum can be achieved. The combination of store growth and LFL growth is then reflected in growth rates of over 30%.

According to [7], Poland has no longer been considered an emerging market since 2018 but a developed market, Poland still has a lot of prosperity growth ahead of it. Gross domestic product has been growing at stable rates of between 2-7% for 20 years. However, it should not go unmentioned that Poland is currently struggling with a high inflation rate in the region of 10%, which means that price pressure for Dino may intensify somewhat in the coming years.

4.) KEY FINANCIAL FIGURES

Let us now concentrate on the "hard facts". If the business model is working, we should be able to see this in the company figures. All of the following figures are taken from [1]:

Turnover (in PLN million):

2018 | 2019 | 2020 | 2021 | 2022 | 2023

5.838 | 7.647 | 10.126 | 13.362 | 19.802 | 25.666

This corresponds to a compound annual growth rate (CAGR) of over +34%. The gross margin, i.e. the gross profit, fluctuated slightly in the range of 22-24%which is already considered very good for a supermarket operator.

But will Dino Polska also manage to convert the rapidly rising sales into profits? The EBIT for the last few years looks like this:

EBIT (in PLN million):

2018 | 2019 | 2020 | 2021 | 2022 | 2023

429 | 562 | 838 | 1.024 | 1.538 | 1.876

The company has been highly profitable for years. We are seeing growth rates of +34% annually. Profits are therefore increasing at the same rate as sales, which indicates a functioning business model. The EBIT margin is stable at between 7.3% and 8.3%. For comparison: $WMT (-0.32%) currently stands at 4.2%, $TGT (+1.54%) 5.6% and $COST (-0.62%) 3.6%.

Anyone familiar with my contributions knows that I attach great importance to the ROCE - i.e. the return on capital employed - is very important to me. The higher the ROCE, the more efficiently the available capital is used:

ROCE:

2018 | 2019 | 2020 | 2021 | 2022 | 2023

39,9% | 22,6% | 24,0% | 24,6% | 28,9% | 28,9%

Dino's ROCE is excellent. From PLN 1,000 of capital employed, we have consistently generated an operating profit of over PLN 200. We are currently even approaching the PLN 300 mark. In my article about $COST (-0.62%) I have already analyzed the ROCE of well-known supermarket chains. This comes $WMT (-0.32%) around 16%, $TGT (+1.54%) around 19% and $COST (-0.62%) around 22%. According to this, Dino Polska highly efficient - especially in comparison to other supermarket operators.

Despite the high growth rate and the speed of store expansion, Dino Polska is not overindebted. The net debt position is currently just 0.4 times of the EBITDA. Dino Polska finances the store expansion largely from operating cash flow, meaning that almost all operating cash flow is invested. As a result, the company currently generates hardly any free cash flow. The capital expenditures (capex) are around 7.3% of sales due to the rapid expansion. This is a comparatively high figure that reflects the rapid expansion of the store network, as $WMT (-0.32%) spends around 3.2% of its sales on capex and $COST (-0.62%) only 1.8%.

If Dino Polska were to reduce its capex to a value of 2.5%, it would already generate a free cash flow of PLN 1,129m today. This would correspond to a free cash flow yield of 4,7% would correspond. Nevertheless, this is still only a thought experiment to estimate future profitability. Only when Dino Polska decides to open fewer new stores will we approach the figure of 2-3% capex in the long term.

5.) VALUATION AND RISKS

The business model is simple, understandable and highly profitable. The growth rate is excellent and the company finances its growth with virtually no debt. In addition, the company operates with a great return on capital employed (ROCE). So now the big question is: what price am I prepared to pay for Dino Polska?

In my article "My method for determining the fair price of a share" [9], I presented a method that I personally use to get an impression of the fair value of a share. I will use this method here and estimate accordingly:

- future sales growth

- future EBITDA margin

- future capex ratio

Based on the current pace and the fact that at some point in the next few years the growth rate will slow down, I still expect Dino Polska to achieve annual sales growth of 22% over the next 10 years. In a detailed calculation, I have estimated the number of new stores in the coming years and the LFL growth.

The EBITDA margin has remained stable at 8-10% in recent years. I expect further efficiency gains in the coming years and believe that Dino will achieve an EBITDA margin of 11% in 10 years.

As mentioned in the last section, the capex ratio will fall over the next few years. I estimate the capex ratio in 10 years to be around 4%. That would still be higher than comparable supermarkets, but still only about half the size it is today.

Now that I have estimated the most important parameters for pricing, you should always think about possible risks in order to find a suitable margin of safety to determine.

Possible risks are, for example

- Increased or new competition: this would reduce growth and also margins

- geopolitical risks: Dino currently only operates its stores in Poland, which of course borders on Ukraine. A possible expansion of the war in Ukraine would of course have a massive impact on all of the above parameters.

- Currency risks: Dino is traded on the Warsaw Stock Exchange in Polish zloty (PLN). A possible devaluation of the Polish zloty against the euro would reduce the price in euros.

- Rising construction costs: Construction costs are likely to continue to rise, not only in Germany but also in Europe in general. This could result in Dino Polska being able to open fewer stores than currently forecast. This would of course be directly reflected in a lower growth rate.

All in all, an investment is certainly riskier than an investment in comparable supermarket chains in industrialized countries. I will therefore keep my margin of safety at 35% .

Furthermore, it should not go unmentioned that Polish shares are less liquid than shares from industrialized countries. At Lang & Schwarz, only a few shares are traded per day in some cases. This results in a comparatively high spread between the bid and ask price, which can be as high as 4-5% of the price. This also goes hand in hand with a higher volatility.

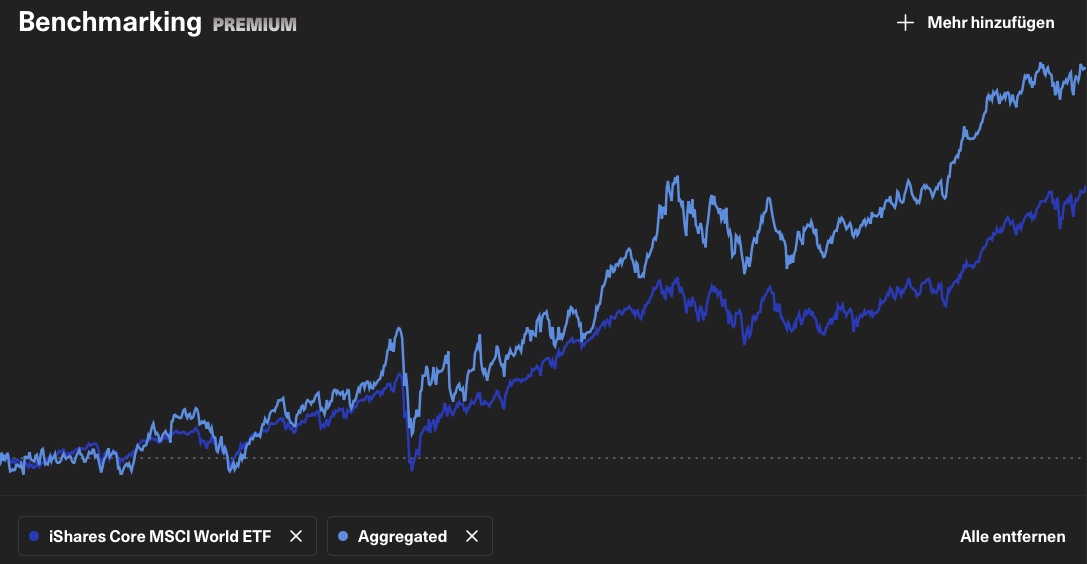

Based on my assumptions and estimates, I currently arrive at a fair price of around 700 to 1000 PLN per share. The share is currently trading at around PLN 380 per share. I therefore decided to open a small position in Dino Polska on March 21. My buy price - including the spread - at that time was around PLN 415 (approx. 96€) per share and I am therefore already 8% in the red.

The difference to today's price is due to the spread and the fact that the Dino share fell by around 10% after the publication of the annual report for 2023. For me, however, this is just a snapshot and I think the share price will be higher in 2-3 years than it is today. Since the IPO in 2017, the share price has already increased more than tenfold, which corresponds to a CAGR of a good 45%.

6.) SUMMARY AND CONCLUSION

In my opinion, Dino Polska is a model company that combines dynamic growth with good management and a good strategy. The company has been profitable for a long time and is currently investing a large part of its cash flow in expansion. The company will continue to grow and will probably generate more cash flow in future than can be reinvested profitably.

As already mentioned, I have built up a small position in Dino Polska myself. Nevertheless, it is definitely an investment of the riskier riskier type, as the share is not very liquid and has a comparatively high volatility. I will now leave the shares in my portfolio and hopefully look forward to a good share price performance over the next few years.

Stay tuned,

Yours Michael Scott

@Kundenservice please add the logo ;)

#stockanalysis

#analyse

#growth

Sources:

[1] Dino Polsa Investor Relations: https://grupadino.pl/en/wse/

[2] SeekingAlpha: https://seekingalpha.com

[3] Podcast "Companies of this world": https://open.spotify.com/episode/04zVqjLjnrlmz4eHnQD5Zl?si=k5RdmFF7Q3eN9W8Lz7h_jg

[4] Geqtuin post about Costco: https://getqu.in/Ajc51E/

[5] ESM Magazine: https://www.esmmagazine.com/retail/top-10-supermarket-retail-chains-in-poland-237524

[6] Statista: https://de.statista.com/statistik/daten/studie/1224907/umfrage/umsatz-von-dino-polska-in-polen/

[7] Emerging Europe: https://emerging-europe.com/news/poland-switch-emerging-developed-market-september-2018/#:~:text=Emerging%20Europe%20Staff%20Share%20This%21%20By%20September%202018%2C,other%20nations%20including%20Germany%2C%20France%2C%20Japan%20and%20Australia.

[8] The World Bank: https://data.worldbank.org/indicator/NY.GDP.MKTP.KD.ZG?end=2022&locations=PL&start=1991&view=chart

[9] Getquin contribution: https://getqu.in/rl57Yp/