Vår Energi $VAR (-0.13%) announces its financial results for the fourth quarter and full year 2025.

The company also holds its Capital Markets Update (CMU) and presents an updated strategy for increased production and value over time, with significant cash flow generation and attractive dividends.

"We are pleased to have achieved transformative growth in 2025, doubling our production in just two years. The company achieved record production, a high reserve replacement ratio, strong financial performance and significant value creation, while further de-risking the future through the completion and commissioning of nine projects, including Jotun FPSO in the Balder field and Johan Castberg."

"Vår Energi has never been in a stronger position for long-term value creation and continues to deliver attractive returns, reflected in distributions to shareholders for 2025 of US$1.2 billion, in line with guidance," said Nick Walker, CEO of Vår Energi.

Vår Energi forecasts production in the range of 390 to 410 thousand barrels of oil equivalent per day (kboepd) for the full year 2026 and increases the long-term production target to more than 400 kboepd.

"This is supported by a portfolio of 13 high quality projects under execution, a flexible pipeline of around 30 early stage projects in the maturing phase and a strengthened asset base with increased reserves and resources," Walker continued.

"Driven by an entrepreneurial, performance-driven organization, we continue to leverage incremental improvements across the Company, including enhanced recovery through infill drilling and targeted exploration, while becoming increasingly efficient and reducing costs."

"This continues to provide resilience in a volatile business environment, strong cash flow generation and attractive long-term returns for shareholders in line with our stated dividend policy of 25-30% of cash flow from operations after tax over the full cycle," Walker concluded.

A transformative 2025:

》Record high production《

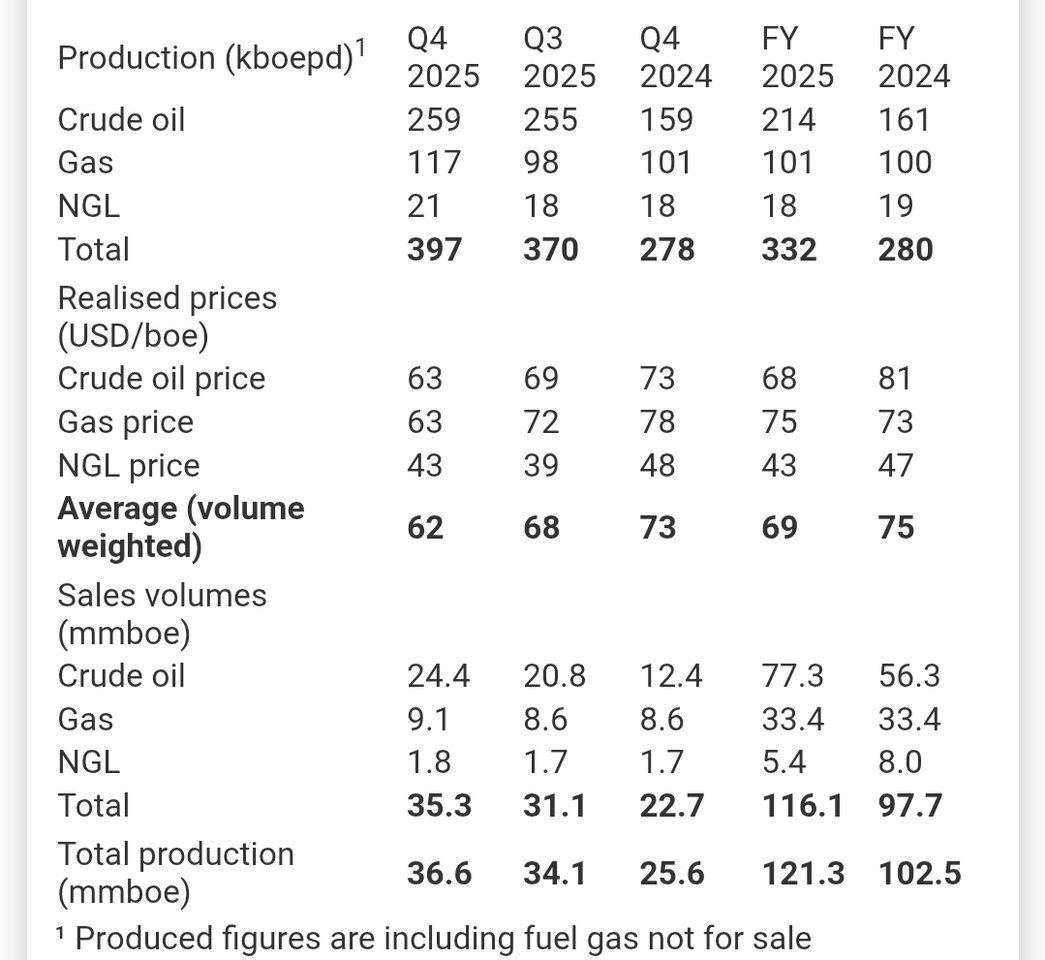

● Production of 397 kboepd per quarter and total annual production of 332 kboepd in 2025

● The outlook for the company is less risky following the completion of important projects

● Nine new growth projects were launched as planned during the year, adding around 180 kboepd to peak production

● Strong operational performance in 2025 with an average production efficiency of 92%

Strong financial performance

● Strong after-tax CFFO of USD 1.3 billion in the quarter and USD 4.6 billion for the full year 2025

● Available liquidity of USD 3.5 billion and leverage ratio of 0.8x at year-end 2025

● Production costs per unit at the lower end of the annual forecast at USD 11.1 per boe and USD 10.0 per boe for the quarter

》Development of long-term value creation for the future《

● 10 project approvals in 2025, development of 160 million barrels of oil equivalent (mmboe) net with an average break-even of USD 30 per boe

● High quality exploration activities with six commercial discoveries in 2025

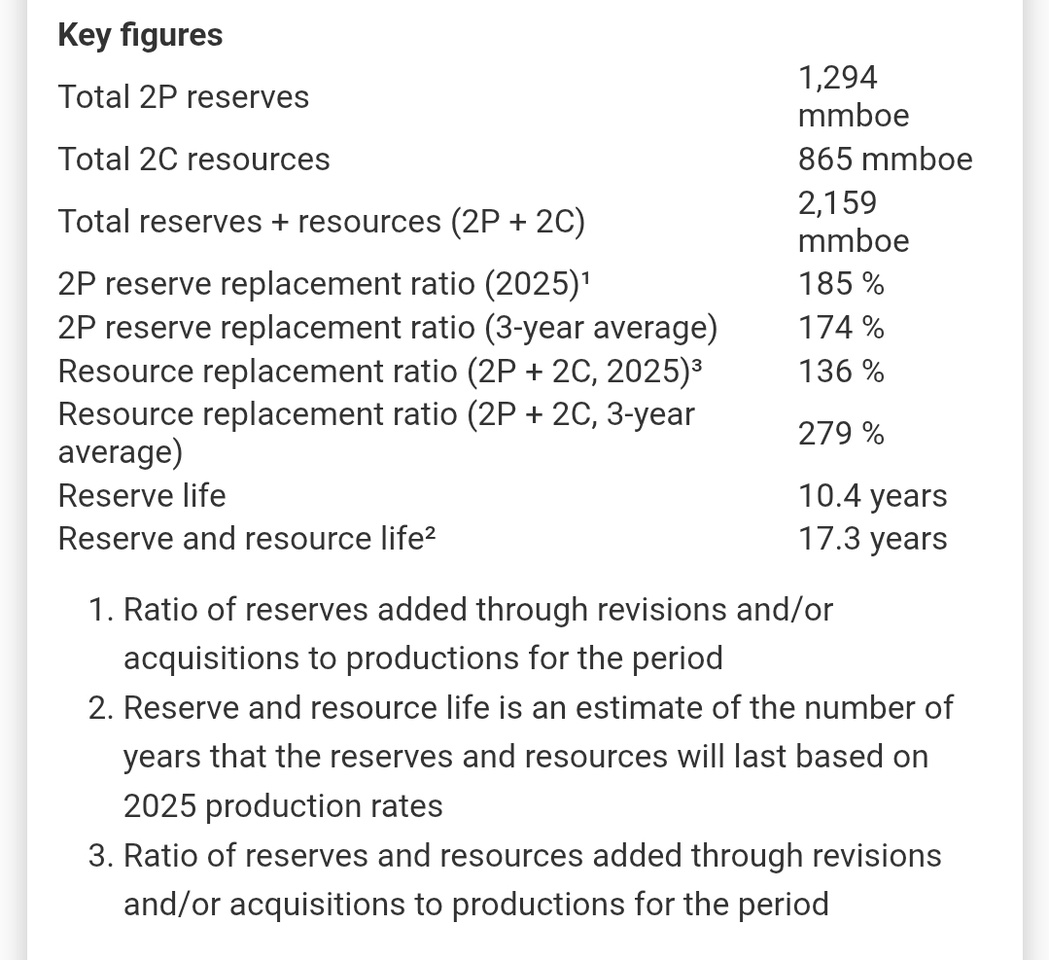

● Increase in reserves and resources2 by 2.2 billion boe by year-end 2025 with a 2P reserve replacement ratio of 185

》Attractive dividend payout《

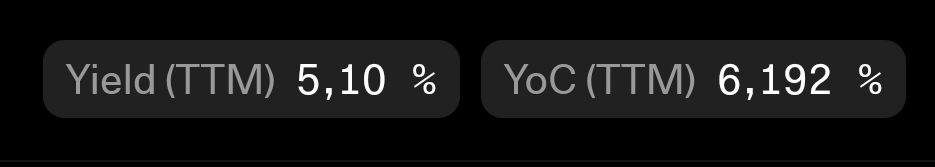

● The dividend for the fourth quarter of USD 300 million (NOK 1.209 per share) will be paid on February 12

● Dividend guidance of USD 300 million for Q1 2026 in line with dividend policy of 25-30% of CFFO after tax over the cycles

CMU highlights - More value for longer:

》Targeting higher production and value creation for a longer period《

● Low-risk company with completed major projects, whose production forecast for the full year 2026 is in line with the previous forecast with a record value of 390-410 kboepd

● High quality barrels with full year 2026 production cost guidance of around USD 10 per boe, reiterating the aim to maintain this level in the long term

● Longer-term higher production, raising the production target to over 400 kboepd in the long term

● A significant resource base of around 2.2 billion boe of proven and probable (2P) reserves, as well as 2C contingent resources, provides a solid foundation for long-term value creation

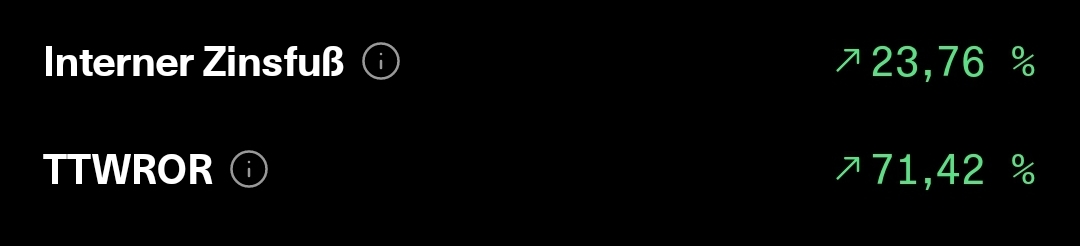

● 13 projects under implementation unlock 210 mmboe of net 2P reserves with low operating costs, a break-even point at around USD 30 per boe and an IRR of over 30%

● Progress on around 30 high quality early stage projects with a target of around 550 mmboe of net 2C resources with attractive economics

● Up to 8 new project approvals in 2026

● Investments of USD 2.5 to 2.7 billion expected for 2026, with average annual investments of USD 2.5 billion in the period 2027-2032

》Creating more value《

● Continued high exploration activity with 12 planned wells in 2026 targeting approximately 75 million boe of net risked reserves

● Exploration expenditure for 2026 of USD 250 to 300 million

● A significant, diversified exploration portfolio with over 1 billion boe of net risked reserves

》Safe and responsible《

● Upper quartile emissions intensity in the industry of around 9 kg CO2e/boe

● Strong ESG ratings, among the top 15% of the oil and gas industry worldwide

》Securing long-term returns《

● Gradual improvement for greater resilience and flexibility

● Delivery of high-quality barrels with a free cash flow break-even of around USD 40 per boe in the period 2026-2032

● Strong free cash flow generation of USD 5 to 10 billion in the period 2026-2032 and a flexible capital expenditure program with around 60% uncommitted capital expenditure

● Robust project portfolio, balanced commodity mix and significant uncommitted capital support resilience, flexibility and long-term dividend policy

》FINANCIAL SUMMARY《

Vår Energi has delivered and the outlook remains rosy with consistently good dividends 💪🏻