🌐 Stock exchange battle: Deutsche Börse, ICE, Euronext, NASDAQ - who dominates trading? 📊

Company presentation

Deutsche Börse AG

Deutsche Börse is one of the world's leading exchange operators and offers a wide range of services in the areas of trading, clearing and market infrastructure. In addition to the Frankfurt Stock Exchange, the company has particularly distinguished itself through its innovative strength in the field of electronic trading.

Euronext NV

Euronext is a pan-European exchange group that operates markets in Belgium, France, Ireland, Italy, the Netherlands, Norway and Portugal. It is the largest stock exchange in Europe and offers a platform for trading shares, bonds and derivatives.

Nasdaq

As the world's first electronic stock exchange, founded in 1971, Nasdaq has developed into the leading trading center for technology companies. It is known for its high liquidity and the immense trading volume that is handled daily.

Intercontinental Exchange (ICE)

ICE operates global financial and commodity markets and is best known for its acquisition of the New York Stock Exchange (NYSE). The company offers a wide range of services, including trading in energy, commodities and financial derivatives.

Historical development

- German Stock Exchange: Its origins date back to the 16th century. The modern Deutsche Börse was created in the 1990s through mergers of regional exchanges and has since undergone extensive digitization.

- Euronext: Founded in 2000 through the merger of several European exchanges, Euronext has become the leading European platform through acquisitions, such as Borsa Italiana 2021.

- Nasdaq: Since its inception, Nasdaq has revolutionized electronic trading. The launch of the Nasdaq 100 index in 1985 strengthened its position as the central trading platform for tech companies.

- ICE: ICE was founded in 2000 and has rapidly expanded its position as a global player through strategic acquisitions, including NYSE in 2013.

Business model

- Deutsche Börse: It offers a comprehensive range of securities and derivatives trading as well as clearing and settlement services via Clearstream. Its diversification strengthens its competitiveness.

- Euronext: As an integrated platform, Euronext covers trading in equities, bonds and derivatives and offers additional services in the areas of corporate services and technology.

- Nasdaq: Nasdaq focuses on electronic trading, particularly in the technology sector, and offers innovative products such as ETFs and indices.

- ICE: ICE combines trading in commodities and financial derivatives and also offers clearing services, which increases the efficiency and transparency of its platforms.

Core competencies

- Deutsche Börse: Excellent technical infrastructure and market knowledge.

- Euronext: Leader in European market infrastructure with a diversified service offering.

- Nasdaq: Innovative power in electronic trading and a strong presence in the technology sector.

- ICE: Expertise in commodities and derivatives trading as well as strong clearing capabilities.

Future prospects

- Deutsche Börse: Focus on digital transformation and entry into new markets.

- Euronext: Investing in sustainable financing and consolidating its market position in Europe.

- Nasdaq: Expansion of AI and blockchain-based technologies for trading optimization.

- ICE: Expanding its product portfolio with innovative trading solutions and technologies.

Strategic initiatives

- Deutsche Börse: Securing its market position through acquisitions and investments in new technologies.

- Euronext: Focuses on expansion through acquisitions of regional markets to create an integrated European trading platform.

- Nasdaq: Focuses on launching new products, especially to support growing technology companies.

- ICE: Strong integration of new technologies to optimize trading processes and expand its business model.

Market position and competition

German Stock Exchange

Strong in Europe

Euronext

Euronext

Leading in Europe

German Stock Exchange

Nasdaq

Leading in the USA

NYSE

ICE

Strong global position

CME Group

Total Addressable Market (TAM)

- German stock exchange: Coverage of the European market with a focus on equities and derivatives trading.

- Euronext: Coverage of the European market with a focus on equities and bonds.

- Nasdaq: Global technology market with a particular focus on the USA.

- ICE: Covers global commodities and financial derivatives markets.

- Equity performance

- $DB1 (+0.83%)

: TR over 10 years is 366% - $ENX (+0.74%)

: TR is 620% over 10 years - $NDAQ (-0.62%)

: TR is 503% for 10 years - $ICE (+1.27%)

: TR is on 10 years is 343,1%

For the development (company figures), better view and more check out the free blog:https://topicswithhead.beehiiv.com/p/b-rsen-battle-deutsche-b-rse-ice-euronext-nasdaq-wer-dominiert-den-handel

Conclusion

Stock market shares are always interesting because they benefit disproportionately from good stock market years due to their relatively fixed costs. In addition, these companies are increasingly developing into data managers, which promises further growth and efficiency gains. There is still plenty of potential for consolidation and growth in the European stock exchanges in particular, especially due to the dynamic market activities.

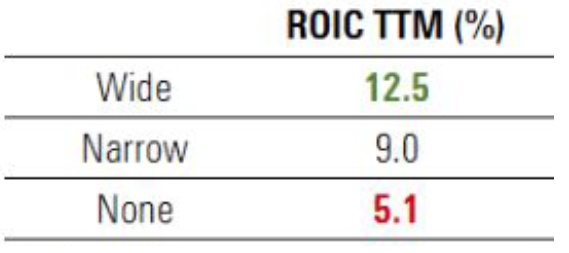

When looking at capital efficiency, Euronext and Deutsche Börse stand out, either as top performers or as only slightly worse alternatives. Therefore, they are my preferred candidates if I had to make a decision. Despite everything, all the stocks mentioned have performed impressively, which is why I hold all but ICE and regularly buy more.

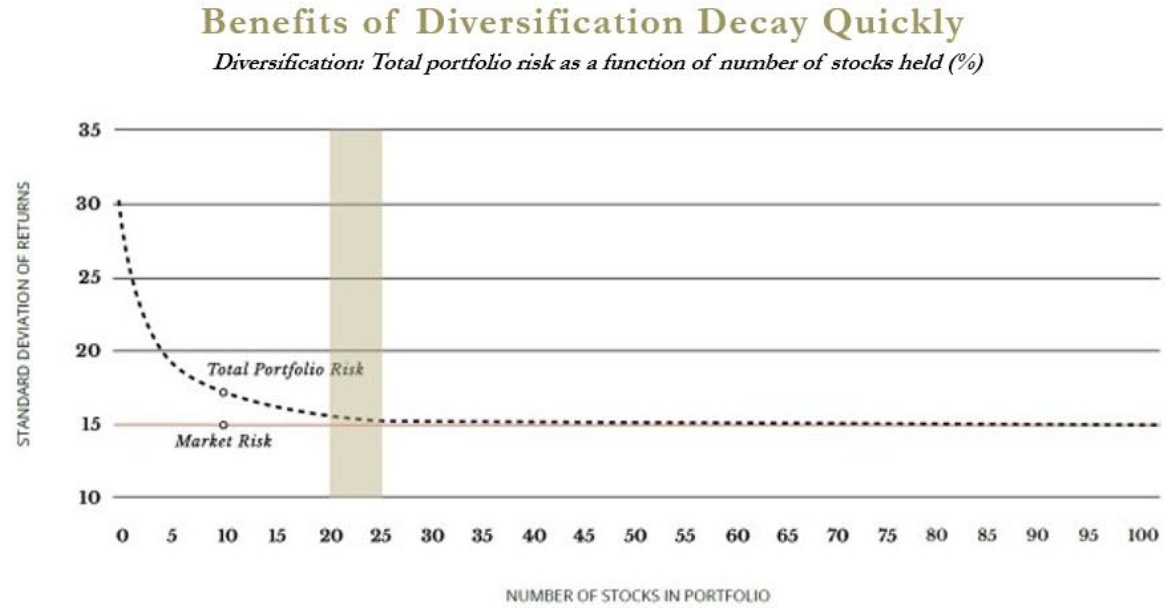

If you are active on the stock market and want to participate, you can hardly go wrong with these stocks. My three stocks in particular offer excellent diversification, as each of the exchanges has its own advantages and disadvantages.

It should be particularly emphasized that the Nasdaq also includes Scandinavian stock exchange operators, which also contributes to diversification and offers interesting growth opportunities.

If you look at historical performance, Euronext would be the clear outperformer and therefore the best choice over the last 10 years.