$GRAB (-5.81%) "super-app" Grab 🚀🚀🚀🌕

Grab Hldg

Price

Discussion about GRAB

Posts

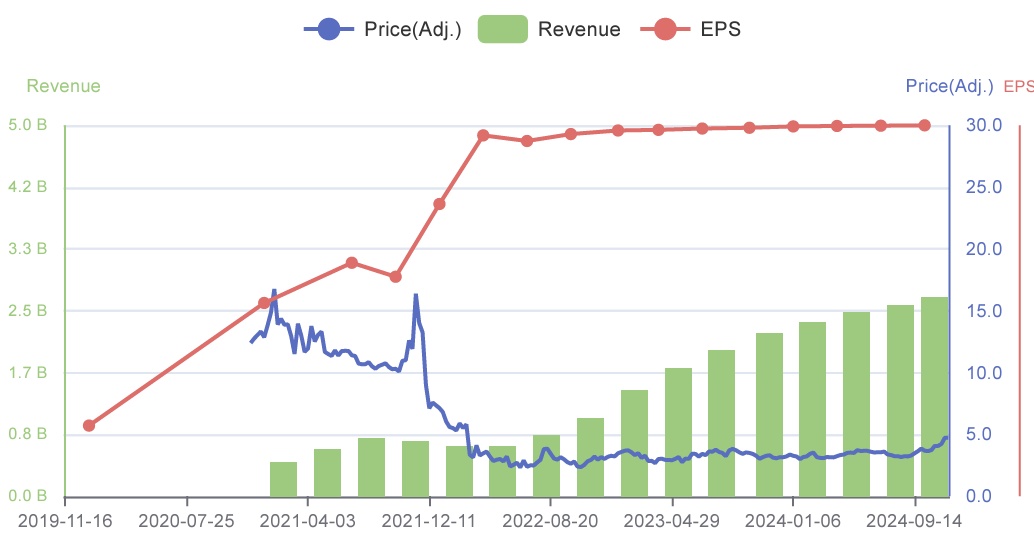

11$GRAB (-5.81%) A very positive day today for GRAB, which breaks through the 5 barrier. Below is a chart showing the company's turnover versus share price.

The continuing run of $GRAB (-5.81%)

Grab Holdings reported solid results in the third quarter of 2024 with sales up 17 percent year-on-year to $716 million . GMV on-demand increased 15 percent to 4.7 billion $ , while monthly transactional users reached 42 million . The company achieved a profit of $15 million and a record adjusted EBITDA of 90 million $ , marking the 11th consecutive quarter of improvement. Operating cash flow was of $338 million , with adjusted free cash flow of 76 million $ on a year-over-year basis. Based on solid performance, Grab raised its full-year 2024 revenue guidance to $2.76-2.78 billion and adjusted EBITDA outlook to $308-313 million.

Positive

- Achieved quarterly profit of $15 million.

- Revenues grew 17% year-on-year to $716 million

- Record adjusted EBITDA of $90 million, up 224% year over year

- Users making monthly transactions increased 16% to 41.9 million

- Cash on hand improved to $6.1 billion from $5.6 billion on a quarterly basis

- Customer deposits in digital banking tripled year-on-year to $1.1 billion

- Raised full-year 2024 forecast for revenue and adjusted EBITDA

Negative

- Operating loss of $38 million in the third quarter

- Total incentives increased to $462 million

- GMV on-demand for MTU decreased by 3 percent year-on-year.

Earnings next week (11.11 - 15.11)

High-Risk-High-Growth Small Cap Update :)

At $RKLB (+3.76%) everything is going in the right direction at the moment. Up almost 200% since initial investment about half a year ago. And the future promises much more.

$QBTS (+1.26%) Although a leading provider of quantum computing is considerably riskier and very far from profitability, it has finally been posting share price gains for a month now and is recovering.

$AWE (+5.69%) has presented very good figures and is also well equipped for the future. It is a technological niche, but one that it is nevertheless occupying quite successfully.

For more inspiration:

$GRAB (-5.81%) ,$TMDX (-6.57%) ,$LNTH (+2.1%) ,$GRA (+0.98%) ,$6871 (+0.85%) ,$4480 (-1.46%) ,$ACMR (-0.21%) ,$HIMS (-1.89%) ,$IONQ ,$ASTS

My favorite company $GRAB (-5.81%)

This month it finally grew by 20 percent.

EBITDA of deliveries was set by the company's management at over 4%. After a period when margins hovered around 1.5-1.6 percent.

We hope for its expansion throughout Southeast Asia.

What do you think of Grab ? It is used a lot in Malaysia, including for food delivery. It is a mix between Uber and Deliveroo.

It seems underpriced to me, despite the growth trend. I have used it in both Malaysia and Brazil and it seemed very good.

Grab is in a growth phase, as Amazon once was. It is not yet profitable, but for now their goal is to grow. It is a Grab ecosystem," which includes all of the company's products: GrabCar (personal cars), GrabBike (motorcycle cabs), GrabHitch (carsharing), GrabExpress (last-mile delivery) and "GrabChat," to enable easy communication between users and drivers. GrabChat translates messages in real time when driver and passenger use different languages. Most recently, Grabpay also came out to enable payment outside of Grab services.

$GRAB (-5.81%) continues its run, we are close to the 3.8...

Benchmark has reaffirmed its Buy rating and $6.00 target price for Grab's stock.

Despite paying no dividend, Grab's revenues have grown 30.77 percent over the past twelve months. This indicates a robust expansion of its business activities.

A Growing Company GRAB HOLDING $GRAB (-5.81%)

This is a company that I really like especially because of the long-term growth potential.

The company, for those who are not familiar with it, is basically a platform with a superapp for: mobility (similar to UBER), food delivery (similar to Deliveroo), parcel delivery (Fedex), Payments (Paypal) and other new services...

It is active in Cambodia, Indonesia, Malaysia, Myanmar, the Philippines, Singapore, Thailand, and Vietnam.

It is a company whose services I have used and been very comfortable with.

It is a company that is not yet making a profit but the prospects are interesting.

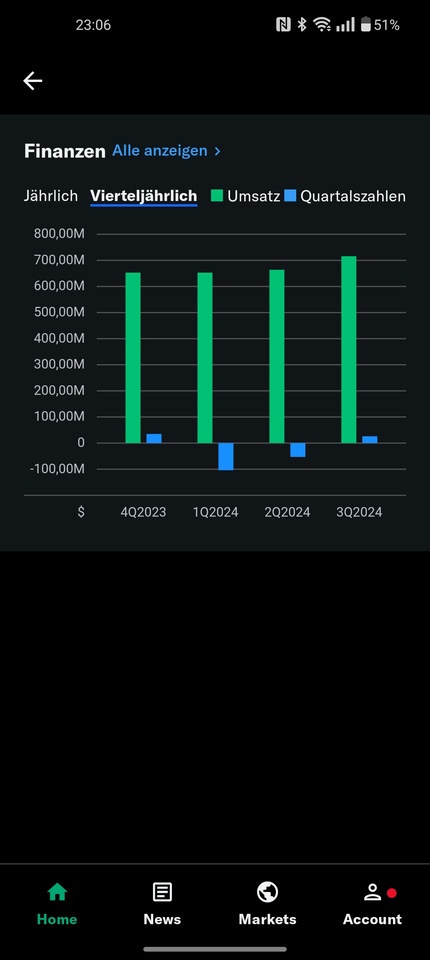

Here is a summary of the financial aspects

- Revenues grew 17% year over year to $664 million

- Operating loss improved by $121 million year-over-year to $(56) million

- Adjusted EBITDA improved by $81 million year-on-year to $64 million

- Net cash flow from operating activities was $272 million in the second quarter of 2024, an improvement of $323 million year-on-year

- It is also worth noting that Grab holds more cash than debt on its balance sheet .

Is it worth it at this price ?

It certainly weighs the fact that it has not yet turned a profit, however Citi analysts have reiterated a Buy rating and a $5.00 price target for Grab Holdings Inc. (GRAB).

Analysts at Bernstein SocGen Group reiterated an Outperform rating and a $4.10 price target on Grab Holdings Inc.

In my opinion as soon as it goes into profit (a matter of time) we will see some good things....

$GRAB (-5.81%) announcing their earnings tonight, high/low? https://www.stockmoo.com/stock/nasdaq-grab_531085/

getquin Daily Summary 05.07.2022

Hello getquin,

how was/is your day on the stock market? For me it was a bit more relaxed than the last weeks. Today: Dax companies raise salaries, Nexo wants to buy Vauld and Zimbabwe wants to introduce gold coins. In the special it is about the revaluation of Klarna!

Europe🌍:

1. DAX corporations increase salaries due to inflation

The first Dax companies are increasing their salary budgets because of increased inflation. This is the result of a survey conducted by Handelsblatt among the nation's 40 largest listed companies.

According to the survey, the latest budgets for pay increases at semiconductor manufacturer Infineon and chemicals trader Brenntag are above expectations. According to the survey, companies such as Adidas, Merck, Deutsche Telekom and Vonovia are increasingly factoring inflation into their pay calculations.

The corporations are responding to protracted, significant price increases with their unanticipated raises. The inflation rate in the euro zone rose to a new high of 8.6% in June. In Germany, the rate fell slightly to 7.6 percent from 7.9 percent in May.

Well, have you already been stocked up? https://bit.ly/3urXO9v

🟥 $BNR (+3.68%) (🔽 -3,25%)

🟥 $IFX (+1.74%) (🔽 -2,91%)

America🌏:

2. nexo offers purchase of Vauld

Crypto lender Nexo has signed a term sheet with rival, Vauld, giving the company 60 days for exclusive talks on a full takeover of the company. If the acquisition is successful, Nexo plans to restructure the company and seek expansion in Southeast Asia and India. Vauld had ceased operations on Monday, saying it was exploring restructuring options due to "financial challenges."

More on the purchase: https://cnb.cx/3bKBt0p

Africa 🌍:

3rd Zimbabwe to introduce gold coins as local currency crashes

Zimbabwe's central bank has announced it will begin selling gold coins as a store of value this month in a bid to curb runaway inflation that has significantly weakened the local currency.

Central Bank Governor John Mangudya said in a statement Monday that the coins will be sold in local currency, U.S. dollars and other foreign currencies starting July 25 at a price based on the current international gold price and production costs.

Special:

4. new valuation of Klarna

Swedish payment services company Klarna was once considered the most valuable startup in Europe, with a valuation of over $45.6 billion. Sebastian Siemiatkowski, the company's founder, is currently negotiating with investors for a new round of funding of around $650 million, at a valuation now of just $6.5 billion.

Read more here: https://bit.ly/3acbZJa

Stocks of the day:

🟩 TOP $GRAB (-5.81%) 2,60€ (🔼 +14,58%)

🟥 FLOP $NEX , 8,22 € (🔽 -9,12%)

🟩Most searched $NVDA (-0.31%) , 142,42 € (🔼 +3,81%)

🟩 Most traded $AMZN (+0.78%) , 107,47 € (🔼 +3,08%)

🟥 S&P500, 3,746.54 (🔽 -2.06%)

🟥 DAX, 12,484.49 (🔽 -2.26%)

🟥 bitcoin ₿, €18,985.70 (🔽 -1.99%)

Time: 17:00 CEST

Fun Fact:

Did you know that only 8% of all the money in the world is actually tangible? The rest is only digital.

Trending Securities

Top creators this week