Battle for the bean - High costs and their consequences: How Nestlé, Hershey & Co. fight

Last year was a challenge for the food and consumer goods industry like never before. The sharp rise in input costs - particularly for raw materials such as cocoa, sugar and milk - hit even industry giants such as $NESN (+1.09%), $MDLZ (-0.02%)

$HSY (+1.4%) and

Meiji ($2269) (+4.23%) - Asia's largest chocolate producer from Japan - were hit hard. These companies have had to deal with exploding costs that have put massive pressure on both margins and share prices. At the same time, they have developed various strategies to counter this pressure - with mixed success, as their latest quarterly reports show.

A look at the past year

2024 was characterized by exceptionally high commodity prices. Cocoa reached record highs. Due to droughts and weather disasters, the price of a tonne of beans doubled to around 8,700 euros. And transportation costs also rose due to global supply chain problems. These developments were directly reflected in the margins.

At #hershey for example, the gross margin fell by 3.6 percentage points in the third quarter of 2024, despite significant price adjustments. Nestlé fared similarly, with its operating margin shrinking to around 17%, which is below previous peak values.

Meiji, achieved sales growth of 4.2% in the first half of 2024, but operating profit in the food segment fell by 6.9%.

Attempts to curb costs

The companies have responded to the challenges with various measures:

Price adjustments

- Nestlé implemented price adjustments of 1.6% in the first nine months of 2024. However, these were not enough to compensate for the increase in input costs.

- Mondelēz increased prices by 5.1% in the third quarter of 2024. While this supported sales growth of 5.4%, the success was largely based on the price increases and not on increased sales volumes.

- Hershey was able to stabilize in the short term with price adjustments, but recorded a 1.4% decline in sales in the third quarter of 2024.

Efficiency gains

- Nestlé and Hershey invested in automation and digital transformation to reduce costs in the long term.

- Meiji implemented optimizations in production and focused on higher-margin products.

Portfolio optimization

- Mondelēz expanded its portfolio in high-margin segments, which contributed to an improvement in the gross margin. It acquired the Chinese cookie manufacturer Evirth in order to gain a foothold in the Asian market.

- Meiji restructured its sales organization in Asia to focus on profitable markets.

Despite these efforts, most companies were only able to partially offset the increased costs. Consumers react sensitively to price adjustments, and inflation puts additional pressure on purchasing power. This limits the scope for further price increases.

Analysis: Which shares are still worth buying?

Despite the challenges, there are differences between the four companies that are crucial for investors. In order to make the best choice, we look at the most important key figures such as dividend growth, valuation and undervaluation.

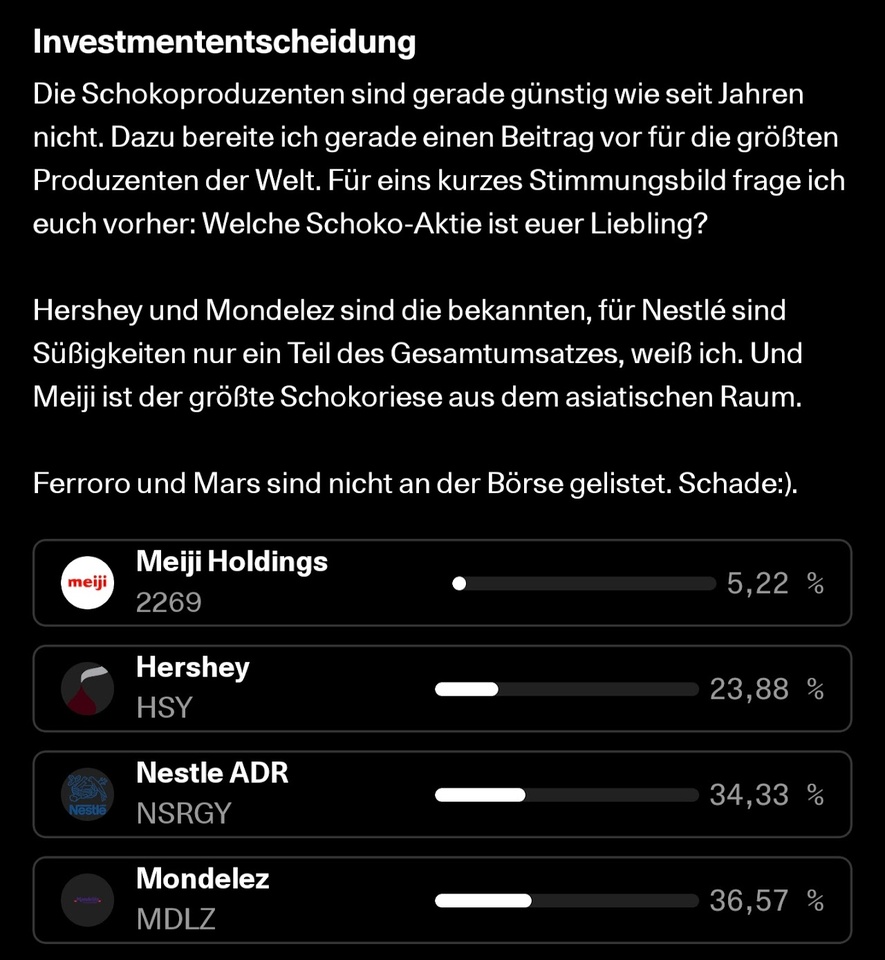

On 'getquin' I asked the community, Which chocolate stock is your favorite?

More than a third chose Mondelez.

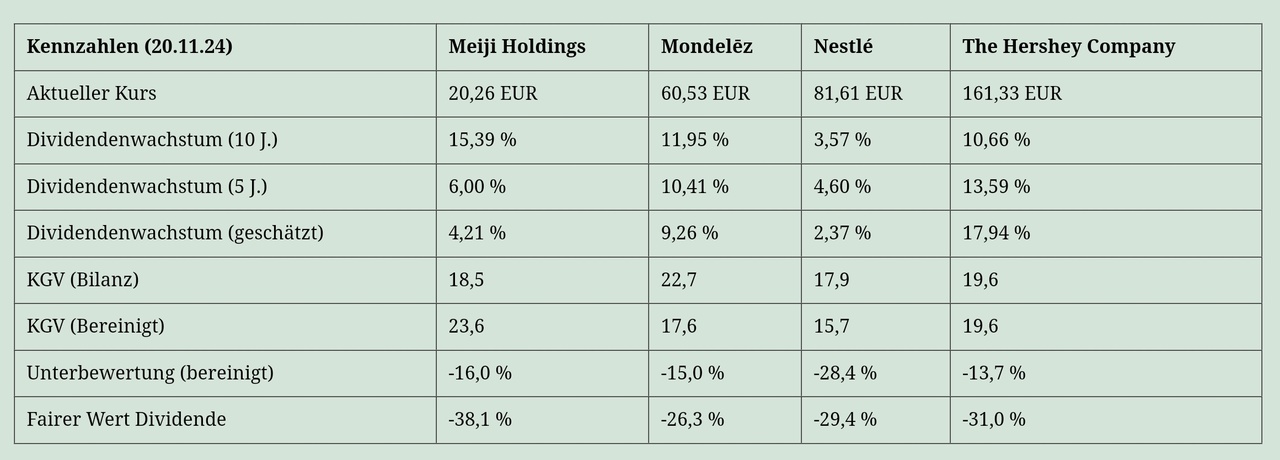

Let's take a look at the most important fundamental data. Basically, all valuations look very good right now. But as investors, we now want to separate the wheat from the chaff - or the beans from the fruit.

Valuation of the shares

Meiji Holdings: Strong growth, but expensive

Meiji boasts impressive dividend growth of 15.39% over the last ten years - a top figure in this comparison. The last five years have also been positive at 6.00%. However, the pace could slow down, as the estimated dividend increases are now only 4.21%.

One catch is the valuation: with an adjusted price/earnings ratio (P/E) of 23.6, Meiji is rather expensive compared to its competitors. The moderate undervaluation (-16%) leaves room for price fantasies. Meiji remains an interesting option for long-term dividend hunters.

Mondelēz: The balanced choice

Mondelēz presents itself as the all-rounder in this comparison. With an adjusted P/E ratio of 17.6, the share is fairly valued. In addition, there is reliable dividend growth of 11.95% over ten years and estimated increases of 9.26%. The moderate undervaluation (-15%) also suggests further potential.

This makes Mondelēz the ideal choice for investors looking for a mix of stability, growth and a fair valuation.

Nestlé: plenty of upside potential, but low growth

Nestlé impresses with an undervaluation of -28.4% - the highest discount in the comparison. However, growth leaves a lot to be desired: dividend increases are a meagre 3.57% (ten years) and an estimated 2.37%.

One plus point is the favorable adjusted P/E ratio of 15.7. Anyone looking for stability and not expecting rapid increases could hope for a good recovery from Nestlé. However, this may take time.

The Hershey Company: High growth rates, high price

Hershey impresses with estimated dividend growth of 17.94 % - the clear frontrunner. The last five years were also strong at 13.59 %. However, this comes at a price: an adjusted P/E ratio of 19.6 and an undervaluation of only -13.7% make the share more expensive than Nestlé or Mondelēz and therefore not a bargain choice.

Long-term investors might still like Hershey - especially because of the high dividend increases.

Mondelēz ahead

Of the four stocks, in our opinion Mondelēz currently offers the best combination of dividend growth, fair valuation and potential. Nestlé is a solid defensive alternative, while Hershey and Meiji remain exciting for growth-oriented dividend hunters. The decision ultimately depends on your investment horizon - but for a balanced overall package, Mondelēz is the most attractive investment idea of the four. No investment advice.

No investment advice. Follow with pleasure Instagram. More on https://www.dividenden-rechner.de/aktien-analysen/teurer-kakao