Hello my dears,

I would like to thank you very much for the 👍and great comments under my last company presentation. It means a lot to me.

With today's company presentation, I would also like to say a big thank you to our margin king @All-in-or-nothing 🙈.

Because you almost always have a 👍or comment for my ideas.

That's why I made sure that today's company has a double-digit EBIT margin, which will be increased.

My friends,

I still have the 🍊speech from Davos in my head. My takeaway from it is that we Europeans need to finally grow up. And become more independent. The world is not getting any better and dangers lurk everywhere.

That's why I've chosen Exosens $EXENS (+2.07%) for you today.

As always, I look forward to receiving plenty of comments.

Is the share an investment for you?

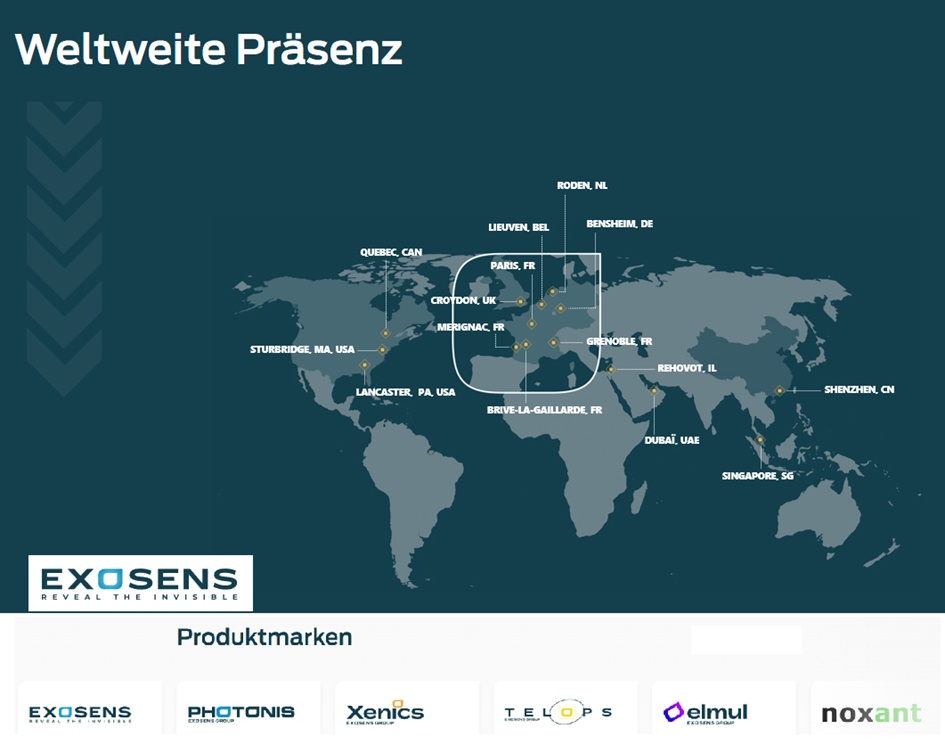

Exosens benefits from the global defense boom

Exosens (ISIN: FR001400Q9V2) is a French high-tech company that develops electro-optical systems. Its range includes sensors and high-precision detectors for defense, industrial and medical applications. Its specialized components address customers in extremely demanding environments. Exosens was founded in 1937. However, the share was only placed on Euronext Paris in 2024.

On October 27, 2025, the company published its Q3 2025 results, reporting a 23% increase in revenue to EUR 328 million in the first nine months. The company also stated that it had improved its adjusted gross margin year-on-year from 49% to over 51%. The management expressed its confidence in achieving the annual targets for 2025.

The continuous expansion through acquisitions and the high exposure to NATO defense programs have been driving Exosens' sales growth sustainably for several quarters. Rising defense budgets and continued innovation in photonics increase the likelihood that growth will continue in the future. FY 2025 results are expected at the end of February.

Conclusion: Exosens combines decades of technological expertise with structural tailwinds from rising defense spending. The strong sales growth combined with rising margins underlines the operational quality of the business model and the successful positioning in specialized niche markets. If the trends of rising defense budgets and innovation momentum continue, Exosens has good opportunities for growth beyond 2025.

Technologies

Exosens is a high-tech company with more than 85 years of experience in innovating, developing, manufacturing and selling high-quality electro-optical technologies in the field of amplification, detection and imaging.

With their extensive range of cutting-edge technologies, they can offer detection components and solutions such as traveling wave tubes, advanced cameras, neutron and gamma detectors, instrument detectors and light amplification tubes. This enables them to respond to complex problems in highly demanding environments by offering customized solutions for their customers.

New applications in ion and electron, microwave amplifiers, gamma and neutron, X-ray, ultraviolet, visible and infrared technologies are being explored.

Exosen markets

Exosens is a leader in the defense and surveillance markets, offering innovative and high-quality products that meet the needs of its customers. In the defense market, Exosens' image intensifier tubes and hybrid power amplifiers give soldiers the tactical edge they need to operate in the darkest nights. In the surveillance market, Exosens' advanced imaging solutions offer a diverse range of imaging technologies covering a wide spectrum of light from below 300 nm violet (UV) to 12,000 nm in the Long Wave Infrared (LWIR) thermal spectral region. Exosens' low-light imaging products provide 24/7 day/night monitoring to ensure critical assets are protected.

Applications

- Soldiers' portable equipment

- Armored vehicles and platform sights

- Infrared signature and range

- Ballistics

- Missile warning and platform survivability

- Vision enhancement for any drone mission

- Police - law enforcement

- Border and infrastructure surveillance

- Maritime surveillance

- Search and rescue

- Life Sciences & Environment

Exosen's state-of-the-art detection technologies - including photon, ion and electron detection - provide the precision, speed and reliability essential for life sciences and environmental applications.

These capabilities enable researchers to observe molecular interactions with high sensitivity, supporting drug development, diagnostics and contaminant tracking. From vaccine validation and disease monitoring to environmental pollution control, Exosens' technology is driving advances that benefit health and sustainability.

Applications

- Cell analysis

- Biomedical

- Ophthalmology

- Agricultural monitoring

- Methane and gas detection

- Mineral detection and identification

- Waste Management

- Scientific cameras & instrumentation

- Space research

- Firefighting and fire research

- Atmospheric sounding

In the world of industry and transportation, precision and safety are of paramount importance. This is where Exosens Technology comes in, offering innovative solutions that take inspection and non-destructive testing to a whole new level.

Infrared (IR) imaging technology offers numerous advantages over visible imaging. A common application of IR imaging is its ability to photograph in low light conditions. IR imaging also improves vision in unfavorable weather conditions.

Applications

- Machine vision

- Semiconductor inspection

- Food sorting

- Additive manufacturing

- Thermography

- Beam profile analysis

- Non-destructive testing

- Combustion flow analysis

- Maintenance of the power grid

- Train and vehicle inspection

Nuclear energy

- Exosens has been a market leader in nuclear instrumentation for more than 50 years. The Exosens brand designs and manufactures neutron and gamma detectors for the nuclear industry, including applications in nuclear power plants, fuel processing plants, waste storage monitoring and nuclear research instrumentation.

Applications

- Nuclear power plants in the fuel cycle

- Nuclear power plants

- Nuclear research reactors

- SMR & advanced reactors

Investors

Investoren | Exosenen

January 14, 2026

Ultrahochauflösende Technologie

Exosens introduces ultra-high resolution, 80 lp/mm image intensification technology for scientific imaging

January 12, 2026

Exosens–ActInBlack-Vertrag

Exosens signs largest contract to date for its latest advanced 5G image intensifier tubes with ACTinBlack

December 17, 2025

EcoVadis Gold für Exosen

Exosens is awarded the EcoVadis Gold Medal, recognizing a commitment built up over several years.

December 10, 2025

Historischer Nachtsichtvertrag

Exosens and Theon International announce the signing of a contract with OCCAR for 100,000 MIKRON night vision binoculars.

December 03, 2025

Exosens–Theon erweiterte Vereinbarung

Exosens and Theon extend long-term commercial agreement until 2030 to secure image intensifier tube capacity in a market limited by growing demand

November 25, 2025

Neuer Hyper-Cam Airborne Nano

Exosens launches the Hyper-Cam Airborne Nano, redefining lightweight, long-wavelength hyperspectral infrared imaging

November 20, 2025

Exosen-Modelle wurden von MSCI für ESG mit "A" bewertet

Exosens received an "A" rating from MSCI for its ESG guidelines

November 17, 2025

Neuer intensivierter iLumos RED 5G

Exosens launches iLumos RED 5G, its most advanced intensified CMOS camera to date

October 27, 2025

Ergebnisse 9M 2025

Exosens achieves strong performance of 9 million in 2025, driven by sustained tailwinds of defense

October 09, 2025

Hochtemperaturdetektoren für Reaktoren der nächsten Generation

Proven reliability up to 800°C and beyond for SMR and AMR applications. Building on the joint heritage of Photonis and Centronic - 80+ years of excellence in neutron detection.

Oct 06, 2025

Neutronenradiographie

Exosens: On-site neutron imaging radiography becomes a reality

September 29, 2025

Großer Vertrag der spanischen Armee

Exosens secures a major contract with the Spanish army for 17,000 advanced night vision monoculars

September 09, 2025

Neues 5G-Bildverstärkerrohr

Exosens launches its new 5G image intensification tube, a game changer in terms of visual perception and night vision performance

September 04, 2025

Neue Wärmebildkameras Crius XP & Microcube XP

Exosens introduces new Crius XP and Microcube XP Series thermal imaging cameras.

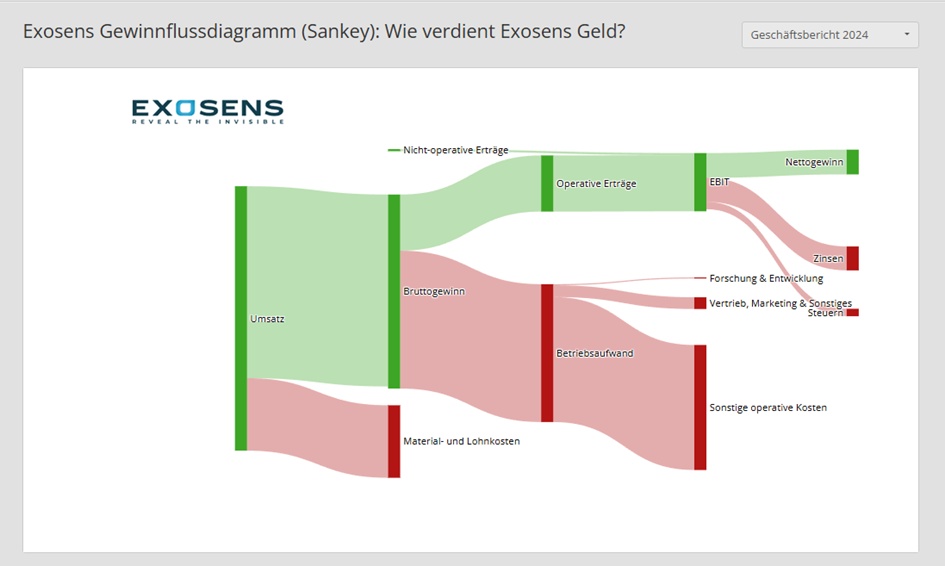

EUR in millions

Estimates

Year Sales Change

2024 394,1

2025 462 17,22 %

2026 528 14,29 %

2027 588,8 11,51 %

Year EBIT Change

2024 95,3

2025 118,5 24,33 %

2026 137 15,6 %

2027 155,9 13,82 %

Year Net result Change

2024 30,7 66,79 %

2025 67,01 118,27 %

2026 83,04 23,93 %

2027 97,07 16,89 %

Year Net debt CAPEX

2024 144 41,3

2025 159 59,51

2026 110 58,77

2027 55,9 56,52

Year Free cash flow Change

2024 55,4

2025 46,93 -15,29 %

2026 65,26 39,06 %

2027 85,19 30,54 %

Year EBITDA margin EBIT margin ROE

2024 30,07 % 24,18 % 11,72 %

2025 30,64 % 25,65 % 16,49 %

2026 31 % 25,94 % 17,84 %

2027 31,89 % 26,48 % 18,01 %

Year Earnings per share Change

2024 0,61 510 %

2025 1,415 131,96 %

2026 1,74 23 %

2027 2,037 17,01 %

Year Dividend Yield

2024 0,1 0,51 %

2025 0,3003 0,55 %

2026 0,3835 0,7 %

2027 0,471 0,86 %

Year P/E ratio PEG

2024 31.9x 0x

2025 38.7x 0x

2026 31.5x 1.4x

2027 26.9x 1.6x

Market value 2,782

Number of shares (in thousands) 50,762

Date of publication 03,03,2025

$EXENS (+2.07%)

I wish you every success in your trading on the capital markets!