Finally a punctual dividend at TR.

The €45 will be reinvested in the share straight away.

One of my favorite German small caps🥰

Posts

8I can undercut with my div. growth values in the endowment account 🫡

The lion's share this year came from $BAS (-1.63%) which was then reallocated to $MBH3 (+0.31%) was reallocated.

@InvestmentPapa & @Howsy on.

+++ Small dividend +++

I can afford one yeast cube a day :)

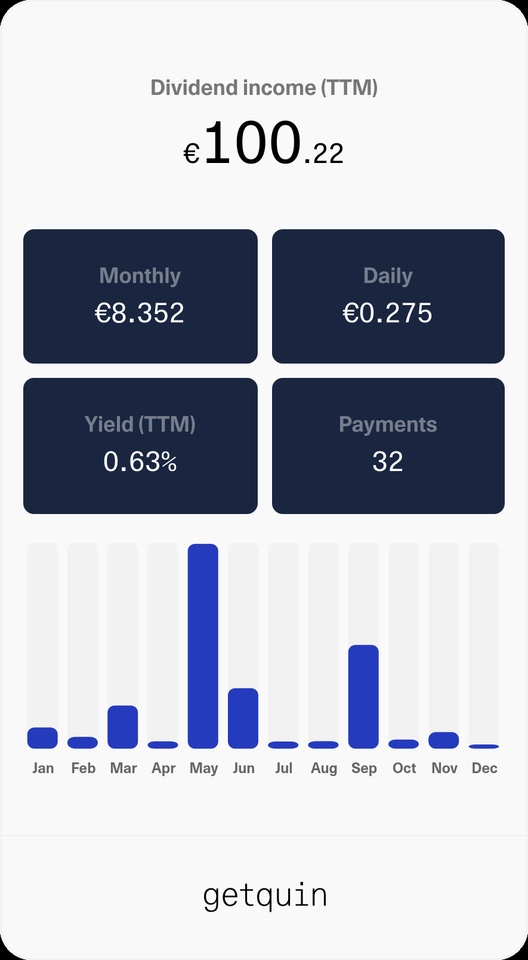

Typical growth portfolio, next year 300€ as target.

Nominate: @Der_Dividenden_Monteur

@Michael-official

@GoDividend

The first dividend of $MBH3 (+0.31%) directly reinvested

Slowly but surely my expenses are earning money.

And I am annoyed in retrospect that I have the last 6 years, these rather consumed, instead of investing them.

Greetings from Frankfurt Airport, now I'm off to Budapest with 3 good friends until Friday.

$BAS (-1.63%) Psoition dissolved in the donation depot.

Would really like to go more for dividend growth here,

for the remaining cash flow is $AFG (+0.91%) and later $HTGC (+0.14%) planned, both of which are healthier.

Reallocation will be made on Thursday in Hermle, ex-day of $MBH3 (+0.31%)

Purchase into the donation depository for April:

I know it's almost July but the buy order just hasn't been picked up😐

Initial purchase $MBH3 (+0.31%)

Hermle in a nutshell:

Turning and milling machines for the fields of

From small to large series with in-house automation and of course up to 5-axis machining.

I see more potential here than $GILV since one hangs here on the "Japanese" leash.

Back to the expenses:

Order was at Eldim in France, most will never have heard of, but just for the Apple fans interesting :)

Funfact: When asked why the picture with Tim Cook was not used for our advertising, the answer was: What for? The optics is a village and there knows us anyway already everyone 🤷♂️.

Greetings from 🏴

$First purchase

Hermle too $MBH3 (+0.31%) today published its figures for 2022.

Both sales and strong EBIT growth are boosting the Group. The company is now back at around the record level of 2018.

Dividend to be increased to €11.05 per preferred share.

The market position in 5-axis machining is becoming firmer.

The automation division in particular is benefiting strongly.

The order situation remains stable.

Great indications for a new startup. 🚀

Top creators this week