Canadian and international dollarshop $DOL (+0.88%) is up today after exceeding estimates. Read more here:

https://finance.yahoo.com/news/dollarama-reports-fiscal-2026-first-110000145.html

Posts

4Canadian and international dollarshop $DOL (+0.88%) is up today after exceeding estimates. Read more here:

https://finance.yahoo.com/news/dollarama-reports-fiscal-2026-first-110000145.html

Here is the share price performance of the companies I track continuously. I focus on the period from 01.12.2024 - 15.01.2025

My portfolio currently contains shares in 3iGroup.

Action published its latest figures in November, which underline its strong growth in Europe. Action has achieved achieved net sales of 10.733 billion eurosaccompanied by an operating EBITDA of 1.532 billion euros - an impressive increase of 26 %. increase of 26 % compared to the previous year. What particularly impresses me is the like-for-like growth of 10.1%, driven entirely by volume increases. In a rising cost of living environment, Action shows how effective a strategy that passes on discounts directly to customers can be. Despite industry-wide price increases, Action remains a model of efficiency. In the first nine reporting periods of the year, 189 new stores were opened and 350 new stores were planned for the full year 2024. I assume that this target has been achieved. I find the rapid expansion in Italy, Portugal, Slovakia and Spain particularly exciting.

Basically, it can be said that US stocks (e.g. Dollar Tree and Dollar General) recorded high losses in 2024. Among other things, this was due to a lack of efficiency, but also to the threat of Trump's punitive tariffs on goods from China. Therefore, another exciting candidate for me is Dollarama, as they operate exclusively in Canada and Latin America.

Non-food discounters

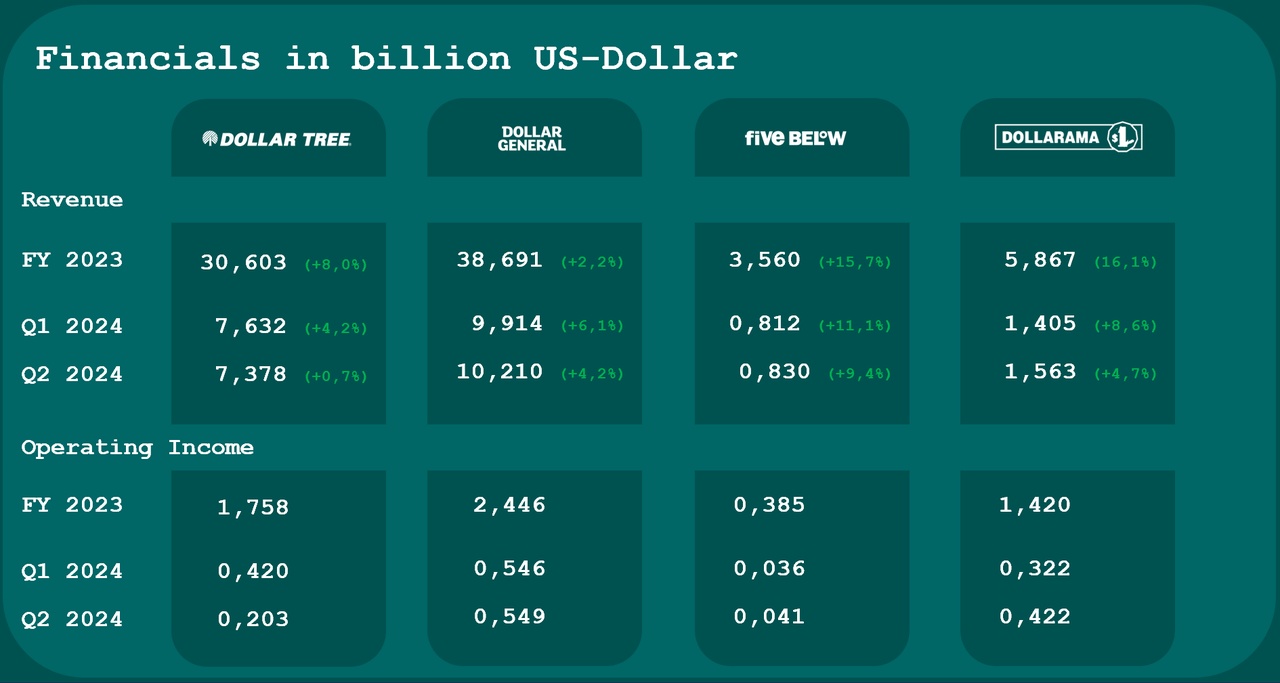

I am continuing to look at the non-food discounter sector and have carried out a small financial analysis in order to better assess the market situation.

Dollar General $DG (-0.6%) and Dollar Tree $DLTR (-1.91%) are clearly the heavyweights in the US market. Both have sales of over 30 billion dollars and are positive. However, compared to their competitors Dollarama $DOL (+0.88%) only have a tiny profit margin.

The share prices of US companies have also fallen sharply in recent months. The US market is struggling with problems. Inflation and high costs are leading to smaller profit margins and poor future forecasts. Another major issue is the threat of tariffs on China, which is depressing share prices.

Dollarama, on the other hand, is a Canadian company and has at least nothing to do with China tariffs. The majority of the stores are located in Canada and South America, here under the Dollercity brand. The profit margins are really impressive for a "1 dollar store" and that is why the share has performed so extremely in recent months. Over the year, the share price has risen by 48%.

In my opinion, there is potential for further growth as the company continues to expand, especially in South America. South America is an exciting market for me anyway.

Top creators this week